What is CMP 08 ? How to handle negative liability and format of letter to deptt.

Table of Contents

CMP 08 for composition dealers:

This new form is introduced for composition dealers. Both composition dealers and taxpayers under 02/2019 CT are required to file it. They are filing GSTR 4 till now. But they need to file CMP 08 quarterly. GSTR 4A is still required to be filed but only once a year. This form is a challan cum return. Its due date is extended to 31st July 2019. But form is still not live.

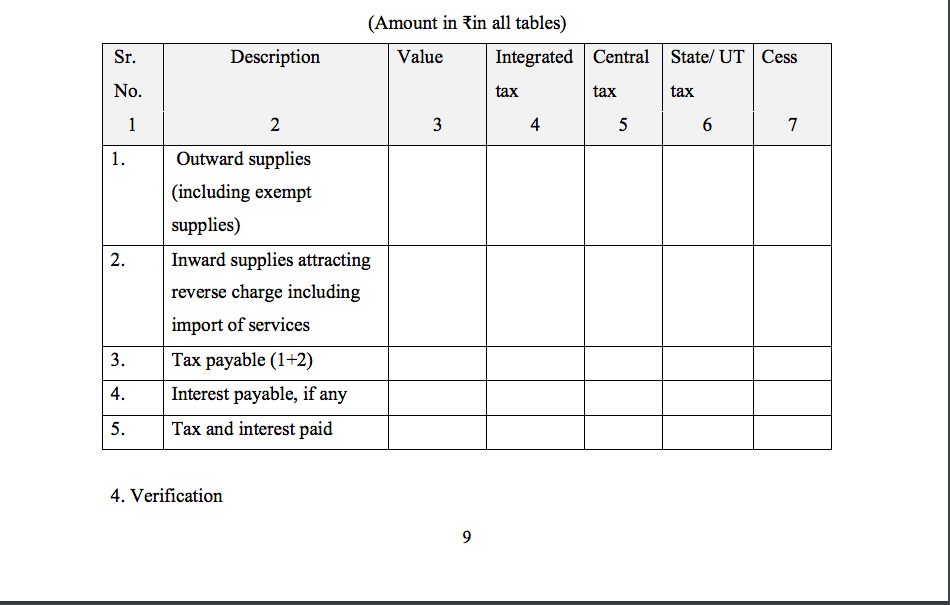

- Outward supplies (including exempt supplies)

- Inward supplies attracting reverse charge including import of services.

- Interest payable, if any

- Tax and interest paid

Details of purchase other than RCM purchase is not required. In GSTR 4A purchase not attracting RCM is also required.

Taxpayers adopting the services composition levy are also required to fill this form.

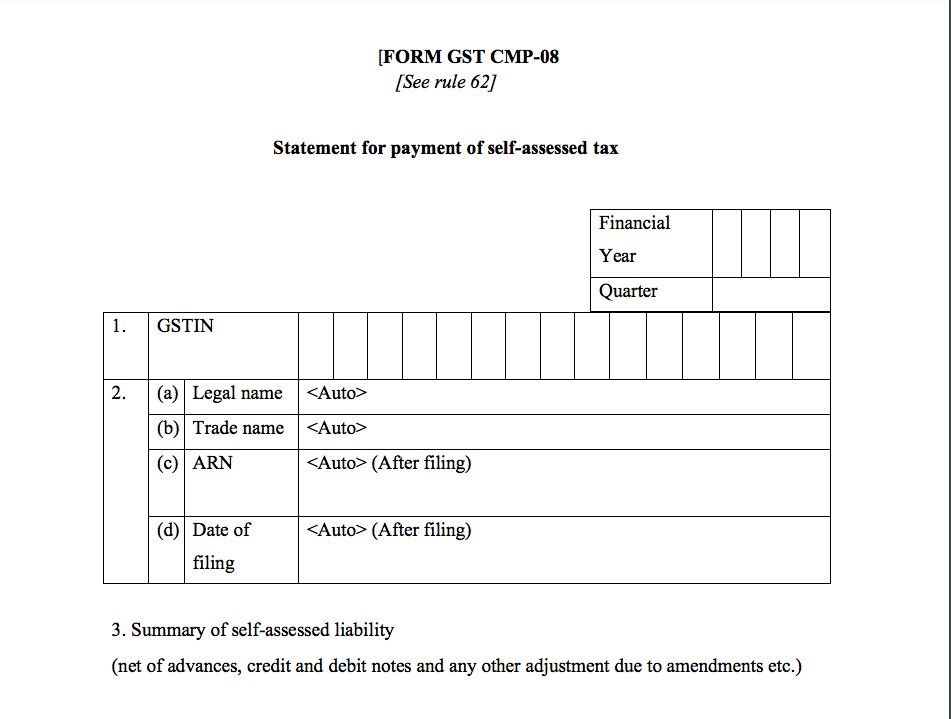

What is the format of CMP 08?

This challan has details of outward supply of a composition dealer. Summary of self-assessed liabilities is required here. This summary is net of advances, credit and debit notes and any other adjustment due to amendments etc.

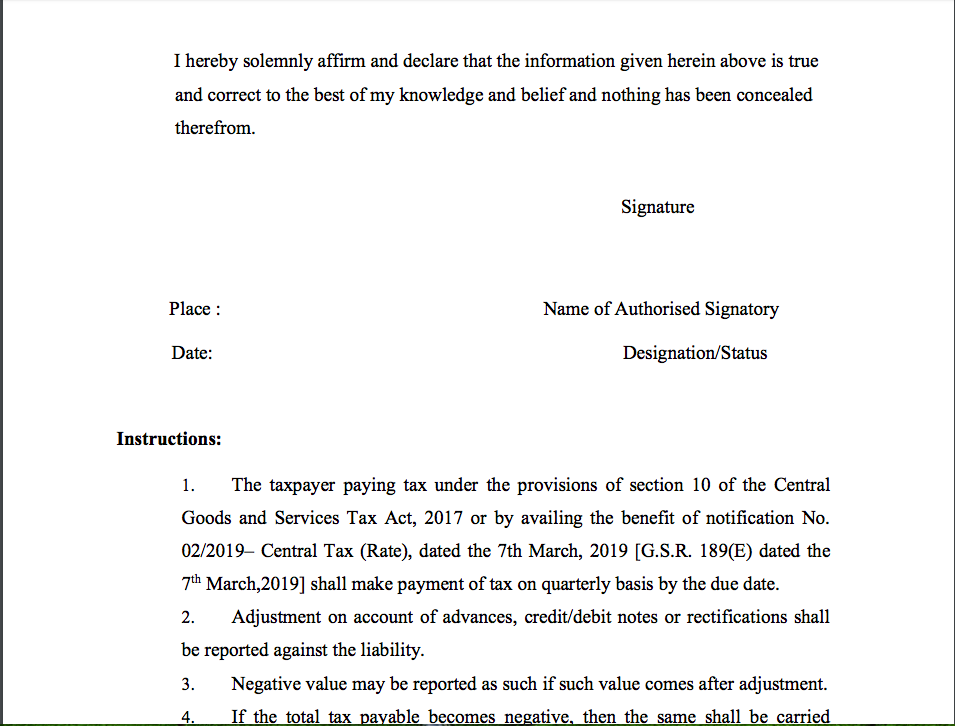

Instructions for filing CMP08:

Following instructions are important for CMP08.

- These two types of taxpayers can file a CMP 08

- Normal composition dealer registered in composition levy of section.

- Taxpayers who have opted for composition under notification no. 2/2019

- Adjustment on account of advances, credit/debit notes or rectifications shall be reported against the liability.

- If the value after the adjustment is a negative value it can also be shown.

- If the tax payable is negative. It will be carried forward to next month for adjustment.

- In case there is no tax liability in FCM or in RCM, nil return can also be filed.

- Interest is also leviable for payments after the due date.

This form is not live at the portal yet. Thus we can’t show you a real demo or image. Taxpayers are waiting for this as the date of filing of return is near. I Hope GSTIN will look into this matter.

How to handle the Negative liability in CMP 08?

Another miss linking by the GSTIN. Table no. 6 of GSTR 4 was left blank by many composition dealers. It is taken as Nil turnover by GSTIN. They adjusted it and created a negative liability. Now at the time of filing CMP 08 portal is not letting the taxpayers pay the tax. This is causing a lot of problems. Composition dealers are unable to file their returns with correct figures.

Now the question is how to resolve it. There is no fixed solution. But yes some Jugaad techniques are available. Through these techniques, the taxpayer can relieve from their liability. They can also save any future penalty or action from the department.

Solution 1- They can write a letter to the jurisdictional officer. Pay the tax in a cash ledger. But the adjustment is not possible due to negative liability. They can mention all these facts in a letter.

Solution 2- Make the payment via DRC 03. Even in this case, I will suggest you write a letter to the jurisdictional officer.

Solution 3- Increase the amount of turnover or tax payable so much that it can reflect the actual tax payable. Thus you can make the payment of tax and file the return. Even in this case information to the department is a must.

Format of letter to Jurisdictional officer for negative adjustment issue

Sir,

I am a composition dealer registered under GSTIN -XXXXXXXXX. While filing our GSTR 4 of PFY we skipped reporting of turnover and tax paid in Table no. 6. We were not informed of its consequences. The portal has created a negative liability. Now, for the current quarter, we are unable to file our return. We want to declare our correct turnover and deposit the amount of tax. But the portal is not allowing it.

Thus to prevent revenue loss to the government we have deposited the tax amount in our cash ledger. (or for solution 2- We have deposited the correct tax amount using DRC 03). (For solution 3- We have increased the turnover and tax payable to create the liability of tax payable. SO that we can pay the tax and file the return.) Please allow the manual adjustment of the same. You may also do the adjustment from your side. Details of our turnover and tax liability for the current quarter are given here.

Turnover- XXXX

Tax payable- XXXX

The amount deposited in cash ledger- XXXX

I hope this is enough and hope that no late fees or penal action will be taken against us.

Thanking you

Name(prop/partner/auth signatory)

GSTIN-

Date

Sign.

Whether the taxpayers who already filed their returns using negative liability need to pay the tax?

In my opinion yes they should. Negative liability is not a valid source to pay tax. It is just an incorrect linking by GSTIN.

Watch video on Where is CMP 08?

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.