Updated provisions of Valuation under GST

Valuation under GST

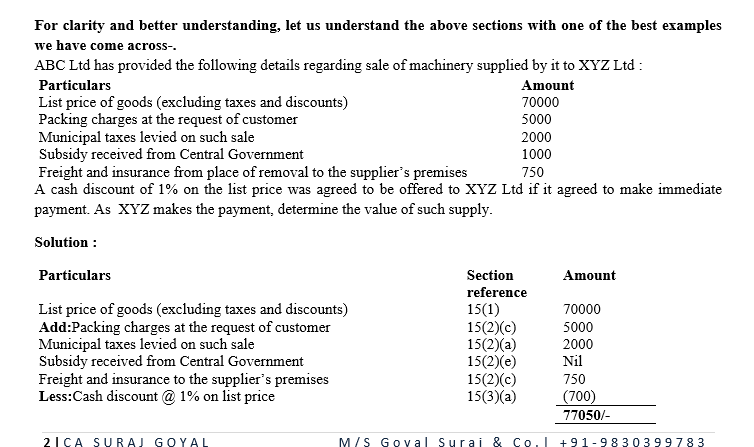

SECTION 15: VALUE OF TAXABLE SUPPLY[RULE 27 TO RULE 35]

As GST is payable as a percentage of the value of supply, it is thereby important to determine the value of taxable supply as per the GST Law. Section 15 of the CGST act deals with the same along with several inclusions and deductions. However, when the same cannot be determined by section 15, Rules of Chapter IV i.e. Rules 27 to 35 of the CGST act is used for such valuation.

| Section reference | Condition | Value of supply |

| 15(1) |

Where the Supplier and the Recipient Of the Supply are

|

Transaction value i.e. the price actually paid or payable for the said supply |

Note:

- The term related person would include the following:-

- Such persons are officers or directors of one another’s businesses;

- Persons legally recognized as partners in business;

- Such persons are employer and employee;

- Any person directly or indirectly owns, controls, or holds twenty-five percent. or more of the outstanding voting stock or shares of both of them;

- One of them directly or indirectly controls the other;

- A third person directly or indirectly controls both of them;

- Together they directly or indirectly control a third person;

- They are members of the same family;

- The term person includes a legal person

- Persons who are associated with the business of one another would also deem to be related

| Section reference | Additions to the value determined as per section 15(1) |

| 15(2) |

(a) Any taxes, duties, cesses, fees, and charges levied under any statute except GST, if they have been separately charged (b) Any amount which the supplier is liable to pay but the same has been incurred by the recipient. (c) Any incidental expenses, such as commission and packing and any other amount charged by the supplier at or before such supply is rendered (d) interest or late fee or penalty for delayed payment of a consideration (e) Any subsidies directly linked to the price excluding subsidies provided by the Government |

Note :

- Any incidental expenses, such as commission and packing and any other amount charged by the supplier after such supply is rendered is not to be included. The same is to dealt with separately through a separate tax invoice. In case of a debit note, the same is to be treated as a separate transaction.

- A subsidy not linked to price is not to be added to the value of supply.

| Section reference | Deductions to the value determined as per section 15(1) |

| 15(3) |

(a) Any discount is given before or at the time of supply duly identified in the Invoice. (b) Any discount is given after the time of supply only if the same was agreed upon anytime before such supply and ITC on the same has been reversed by the recipient |

Assessable value = Transaction value + Adjustment of 15(2) – Deduction of 15(3)

- Section 15(4) of the CGST act talks about the case where the value of supply of goods or services cannot be determined under Section 15(1) – the same shall be determined as per Chapter IV of CGST Rules,2017

In case of a supply notified under section 15(5), the value of the same shall be determined as per Chapter IV of CGST Rules,2017 [Refer Rule 32 below]

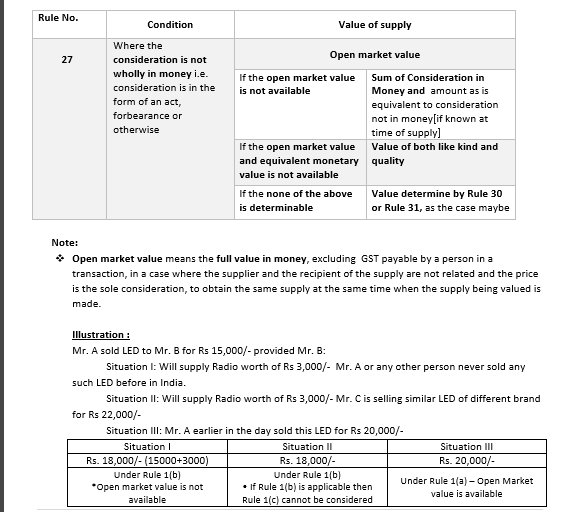

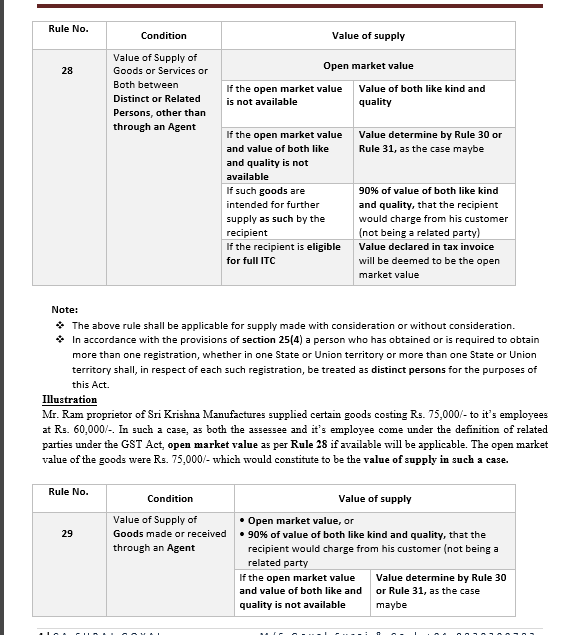

Now let’s discuss the rules that are prescribed to be followed u/s 15(4) & 15(5) as referred above –

Download the copy:

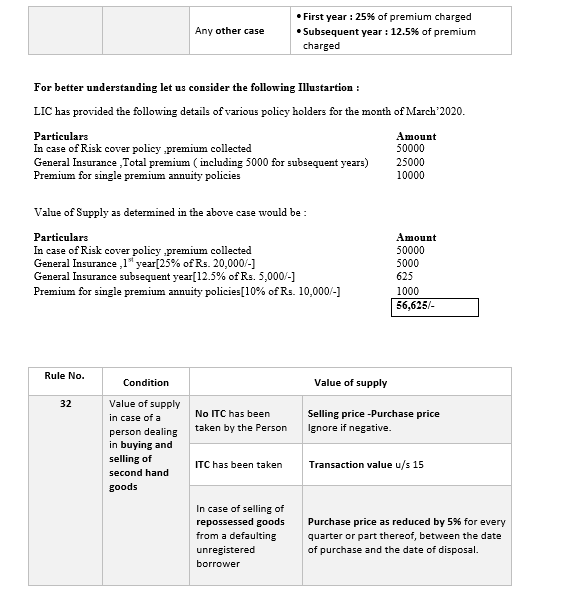

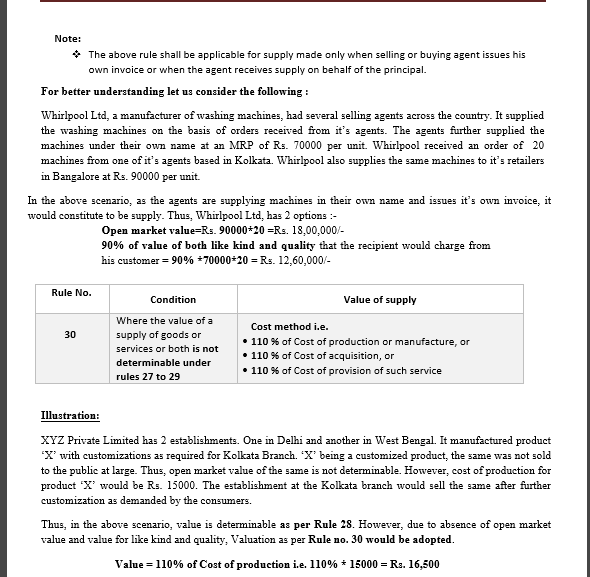

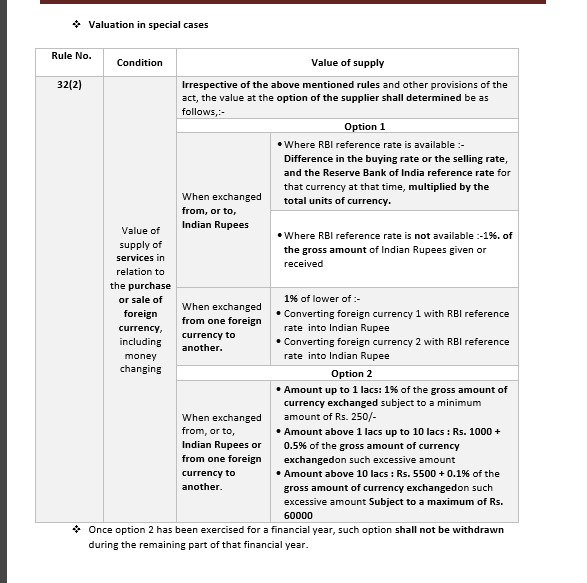

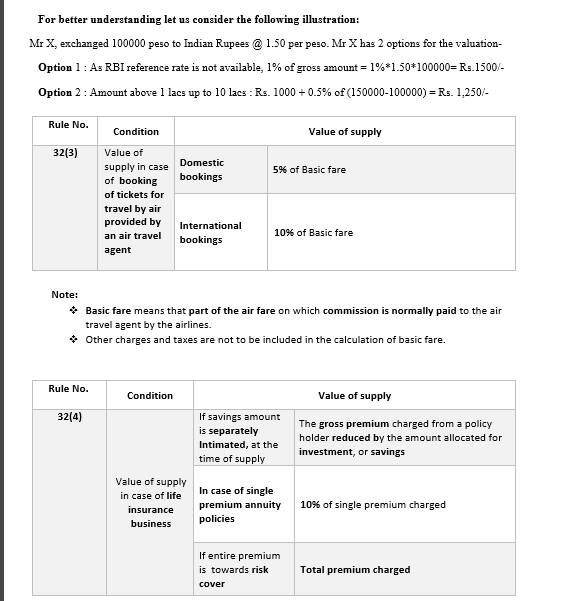

For better understanding let us consider the following :

Mr. Honey a dealer in second-hand cars purchases the cars and sells them after painting and some repair. He does not take credit for any of the purchases. He told one car at Rs. 90000 which was purchased by him at Rs. 85000.

In the above scenario, the value of supply would be Rs. 90000-85000 = Rs. 5000/-. However if in the above scenario, the purchase price would have been Rs. Above 90000, the value of supply would be Nil.

| Rule No. | Condition | Value of supply |

| 32 | Value of supply in case of a value of a token, or a voucher, or a coupon, or a stamp (other than a postage stamp) which is redeemable | The money value of the goods or services or both redeemable against such token, voucher, etc |

|

Value of taxable services, where the input tax credit is available provided

|

NIL |

- As per Rule 33, Irrespective of any provisions of this Chapter, the expenditure or costs incurred by a supplier as a pure agent of the recipient of supply will be excluded from the value of supply, if all the following conditions are satisfied:-

- the supplier acts as a pure agent of the recipient of the supply when he makes the payment to the third party on authorization by such recipient;

- the payment made by the pure agent on behalf of the recipient of supply has been separately indicated in the invoice issued by the pure agent to the recipient of service, and

- the supplies procured by the pure agent from the third party as a pure agent of the recipient of supply are in addition to the services he supplies on his own account.

Meaning of Pure Agent

(a) enters into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or costs in the course of supply of goods or services or both;

(b) neither intends to hold nor holds any title to the goods or services or both so procured or supplied as a pure agent of the recipient of supply;

(c) does not use for his own interest such goods or services so procured, and

(d) receives only the actual amount incurred to procure such goods or services in addition to the amount received for supply he provides on his own account.

For better understanding let us consider the following :

Mr. Ram (a CA) makes payment of GST, TDS, and ROC on behalf of its clients. He later recovers the same from his client in addition to these service charges. Accordingly, as Mr. Ram is acting as a pure agent, the same would not be added to the value of supply in the invoice made by Mr. Ram.

| Rule No. | Condition | Value of supply |

| 34 | Rate of Exchange of Currency, other than Indian Rupees |

Supply of Goods:

Supply of Service:

|

- As per Rule 35, Where the value of supply is inclusive of integrated tax or, as the case may be, central tax, State tax, Union territory tax, the tax amount shall be determined in the following manner :

Tax amount = (Value inclusive of taxes X tax rate in % of such Tax) ÷ (100+ sum of tax rates, as applicable, in %)

Declaimer: The contents of this document are solely for informational purposes. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. The author does not accept any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied without express written permission of the author.

If you already have a premium membership, Sign In.

CA Suraj Goyal

CA Suraj Goyal

SME & Speaker, Business Advisor on Indian GST Add profile section

Kolkata, India

SME & Speaker, Business Advisor on Indian GST