Updated provisions of Registration under GST

Table of Contents

- Registration under GST

- Persons not liable to registration (Section 23):

- Procedure for registration (Section 25):

- Voluntary Registration:

- Other relevant points:-

- Registration procedure for Casual taxable person and Nonresident taxable person (Section 27):

- Amendment of registration (Section 28):

- Cancellation of registration (Section 29):

- Revocation on cancellation (Section 30):

- Download the copy:

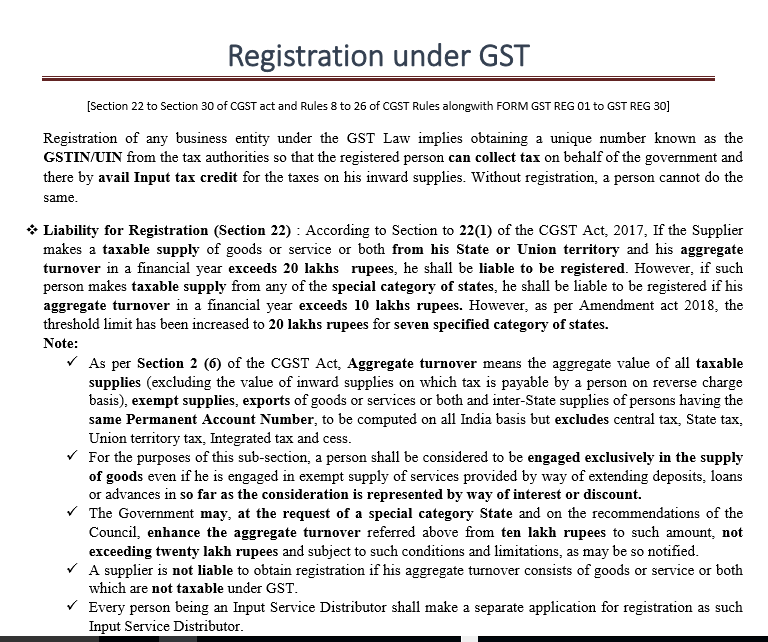

Registration under GST

[Section 22 to Section 30 of CGST Act and Rules 8 to 26 of CGST Rules along with FORM GST REG 01 to GST REG 30]

Registration of any business entity under the GST Law implies obtaining a unique number known as the GSTIN/UIN from the tax authorities so that the registered person can collect tax on behalf of the government and thereby avail Input tax credit for the taxes on his inward supplies. Without registration, a person cannot do the same.

Related Topic:

GST provisions applicable from 1st April 2021

- Liability for Registration (Section 22): According to Section to 22(1) of the CGST Act, 2017, If the Supplier makes a taxable supply of goods or service or both from his State or Union territory and his aggregate turnover in a financial year exceeds 20 lakhs rupees, he shall be liable to be registered. However, if such a person makes a taxable supply from any of the special categories of states, he shall be liable to be registered if his aggregate turnover in a financial year exceeds 10 lakhs rupees. However, as per Amendment act 2018, the threshold limit has been increased to 20 lakhs rupees for seven specified categories of states.

Related Topic:

List for state-wise threshold for registration in GST

Note:

- As per Section 2 (6) of the CGST Act, Aggregate turnover means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, Integrated tax, and cess.

- For the purposes of this subsection, a person shall be considered to be engaged exclusively in the supply of goods even if he is engaged in the exempt supply of services provided by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount.

- The Government may, at the request of a special category State and on the recommendations of the Council, enhance the aggregate turnover referred above from ten lakh rupees to such amount, not exceeding twenty lakh rupees and subject to such conditions and limitations, as may be so notified.

- A supplier is not liable to obtain registration if his aggregate turnover consists of goods or services or both which are not taxable under GST.

- Every person being an Input Service Distributor shall make a separate application for registration as such an Input Service Distributor.

- Aggregate turnover should include all supplies whether made on his own account or behalf of the principal.

- The supply of goods by a registered job worker after completion of job work shall be treated as the supply of goods by the principal referred to in section 143, and the value of such goods shall not be included in the aggregate turnover of the registered job worker.

For the purpose of this section, special category states mean states defined in article 279A of the constitution. The same has been summarised below:-

| Special category of states having threshold limit of 10 Lakh | Special category of states having a threshold limit of 20 Lakh (After amendment )[Section22] |

|

|

*Kerela and Telangana have maintained status quo and have kept their threshold for GST Registration in case of goods at Rs. 20 Lakhs.

- As per N.N. 10/2019- C.T. dt. 7th March 2019, the threshold limit for registration for those engaged in the exclusive supply of goods has been enhanced to 40 lakh rupees. However, such persons who would not be granted the threshold limit of 40 lakhs includes such persons engaged in making intra-State supplies in the States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura, Uttarakhand, any Person who is required to take compulsory registration under section 24, Suppliers of Ice cream and other edible ice, whether or not containing cocoa, Pan masala, and Tobacco and manufactured tobacco substitutes.

Related Topic:

Post sale discount under GST: Facile View

According to Section 22 (2), every person who is registered or holds a license or registration under any existing indirect tax law on the day immediately preceding the appointed day i.e. date on which the GST Act came into force, shall be liable to be registered under this Act with effect from the appointed day. According to Section 22 (3), if a business carried on by a taxable person registered under this Act is transferred, whether on account of succession or otherwise, to another person as a going concern, the successor shall be liable to be registered with effect from the date of such transfer or succession. However, according to Section 22(4), in case of transfer, amalgamation, the demerger of two or more companies by order of the court, the transferee shall be liable to be registered, only from the date on which the Registrar of Companies issues the certificate of incorporation giving effect to such Order.

Thus, a summary on the various threshold limits have been given below:-

| Supply | Threshold up to 10 lacs | Threshold up to 20 lacs | Threshold up to 40 lacs |

| Supply of goods | Special Category of states as specified above | Seven Special Category of states as specified above | All other States |

| Supply of service | Special Category of states as specified above | All other states and Union territories | Not applicable |

| Supply of goods and of service | Special Category of states as specified above | All other states and Union territories | Not applicable |

Persons not liable to registration (Section 23):

According to Section 23(1), the following persons are not liable to register under the Act:-

- Any person engaged exclusively in a supply that is not liable to tax or is wholly exempt from tax under the GST Act

- An agriculturist, who is supplying produce out of cultivation of land. According to Section 23 (2), The Government may, on the recommendations of the Council, by notification, specify the category of persons who may be exempted from obtaining registration under this Act. Note:

- As per N.N. 5/2017-C.T. dt. 19th June 2017 the Government has exempt such persons who are only engaged in making supplies of taxable goods wherein the total tax is payable by the recipient under reverse charge mechanism under section 9(3).

Compulsory registration (Section 24):

Notwithstanding anything contained in sub-section (1) of section 22, the following categories of persons shall be required to be registered under this Act:-

- Persons making any inter-State taxable supply

- Casual taxable persons making taxable supply

- Persons who are required to pay tax under reverse charge,

- Persons who are required to pay tax under sub-section (5) of section 9, i.e. e-commerce operator where services of transportation of passengers by Cabs, Accommodation in commercial places (except where the person is already liable for registration) and that of housekeeping, etc are provided through them.

- Non-resident taxable persons making taxable supply

- Persons who are required to deduct tax i.e. TDS under section 51, whether or not separately registered under this Act

- Persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise

- Input Service Distributor, whether or not separately registered under this Act

- Persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator, who is required to collect tax at source under section 52

- Every electronic commerce operator who is required to collect TCS u/s 52

- Every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person

- Such other persons or class of persons as may be notified by the Government on the recommendations of the Council. Note:

- As per N.N. 10/2017- C.T. dt. 28th June 2017, Any person making an interstate taxable supply of service and having an aggregate turnover not exceeding 20 Lakhs, 10 lakhs for special category states, shall not be liable to compulsory registration under Section 24.

- As per N.N. 08/2017- Integrated Tax dt. 14th September 2017, In case of inter-state supply of handicraft goods, where the aggregate turnover of such person does not exceed the threshold limit, they would not be liable to compulsory registration under Section 24. The same would also be applicable in case of a casual taxable person supplying handicraft goods as per N.N. 32/2017- C.T. dt. 15th September 2017.

- As per Section 2(20) of the CGST Act, Casual taxable person means a person who occasionally undertakes transactions involving the supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he has no fixed place of business.

- As per Section 2(77) of the CGST Act, a Non-resident taxable person means any person who occasionally undertakes transactions involving the supply of goods or services or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India.

- As per N.N. 65/2017- C.T. dt. 15th November 2017 and N.N. 6/2019- C.T. dt. 29th January 2019, any person supplying service through an e-commerce operator who is required to collect TCS under section 52 would only be liable to compulsory registration only if his aggregate turnover exceeds the threshold limit.

Procedure for registration (Section 25):

The procedure for Registration under GST as prescribed from Rule 8 of the CGST act requires the applicant to file Form GST REG-01(Part A) declaring his PAN (which would be validated by CBDT database), mobile number and e-mail address(verified through OTPs). On success, a TRN will be generated post which Part B needs to be filled and verified. An acknowledgment through GST REG 02 would be generated.

As prescribed under Rule 9, after proper examination, if the records are found to be correct, the proper officer may grant the registration within 3 working days from date of application or else issue a notice in GST REG 03.

The applicant needs to reply to the notice in FORM GST REG-04, within a period of seven working days from the date of the receipt of such notice. Where the proper officer is satisfied with the clarification, he may approve the grant of registration to the applicant within seven working days from the date of the receipt of such clarification. If no reply is furnished or where the proper officer is not satisfied, he shall, after recording his reasons writing, reject such application and inform the applicant electronically in FORM GST REG-05.

If the proper officer fails to take any action within a period of three/seven working days as mentioned above, the application for grant of registration shall be deemed to have been approved.

A certificate of registration in FORM GST REG-06 showing the principal and additional (if any) place of business shall be made available to the applicant and a Goods and Services Tax Identification Number shall be assigned.

| Particulars | Where | When |

| A person who is liable to be registered under section 22 or section 24 | Shall apply for registration in every such State or Union territory in which he is so liable | Within thirty days from the date on which he becomes liable to registration |

| A casual taxable person or a non-resident taxable person | Place of commencement of business | At least five days prior to the commencement of business |

According to Section 25 (2), every person seeking registration under this Act shall be granted a single registration in a State or Union territory. However, as per N.N. 03/2019 – C.T. dt. 29th January 2019, any person having multiple places of business in a State or Union territory may be granted a separate registration for each such place of business in FORM REG-01 subject to the following conditions as prescribed in Rule 11:-

- such person has more than one place of business

- such person shall not pay tax under section 10 i.e. composition scheme for any of his places of business if he is paying tax under section 9 for any other place of business

- all separately registered places of business of such person shall pay tax under the Act on such supply made to another registered place of business of such person and issue a tax invoice or a bill of supply, as the case may be, for such supply

Every person acquiring separate registration would be treated as a distinct person.

Voluntary Registration:

As per section 25(3), Any person even though not liable to be registered under section 22 or section 24 may get himself registered voluntarily, and all provisions of this Act shall apply to such person.

| Procedure for registration | Cases |

| General procedure: FORM REG-01 |

|

| Special procedure |

|

Other relevant points:-

- As per Rule 10, if the applicant applies for registration within 30 days of becoming liable for registration, the Effective date of registration shall be the date on which he becomes liable to registration. However, in any other case, it shall be the date of the grant of the registration certificate.

- As per Rule 12, Any person required to deduct tax u/s 51 or required to collect tax at source u/s 52 shall electronically submit an application, duly signed or verified in FORM GST REG-07 for the grant of registration.

- As per Rule 14, Any person supplying online information and database access or retrieval services from a place outside India to a non-taxable online recipient shall submit an application for registration, in FORM GST REG-10, at the common portal.

- Rule 18 talks about Display of registration certificate and GSTIN on the name board exhibited at the entry of his principal place of business and at every additional place or places of business

Registration procedure for Casual taxable person and Nonresident taxable person (Section 27):

Every Casual taxable person and Nonresident taxable person will have to compulsorily get registered under GST at least 5 days prior to commencement of business irrespective of the threshold limit by submitting as an application in FORM GST REG-09(Rule 13). For a Nonresident taxable person, a valid passport instead of a PAN would suffice. At the time of submission of such an application, such a person is required to pay an amount equal to the Estimated Net tax liability as advance. The registration certificate issued to them would be valid for the period specified in the registration application or 90 days from the effective date of registration (which can be further extended up to 90days in FORM GST REG -11 under Rule 15) [Provisions of rule 9 and rule 10 relating to the verification and the grant of registration shall apply, mutatis mutandis]

- Suo moto registration shall be granted by the proper officer finds that a person liable to registration under the Act has failed to apply for such registration, such officer may register the said person on a temporary basis and issue an order in FORM GST REG-12. [The person shall submit an application for registration in the form and manner provided in rule 8 or rule 12. Provisions of rule 9 and rule 10 relating to the verification and the grant of registration shall apply, mutatis mutandis]

- As per u/s 25(9), the following person shall submit an application electronically in FORM GST REG- 13 –

- any specialized agency of the UN or any Multilateral Financial Institution and Organization as notified under the United Nations (Privileges and Immunities) Act, 1947, Consulate or Embassy of foreign countries

- any other person or class of persons, as may be notified by the Commissioner.

The above-mentioned persons shall be assigned a Unique Identification Number under Rule 17.

Amendment of registration (Section 28):

As prescribed under Rule 19, In case of any change in particulars furnished while registration, the registered person will be required to furnish details in FORM GST REG14 within 15 days of such change along with all the relevant documents as may be required by the proper officer for approval of such change. Once the officer is satisfied regarding such an amendment, he shall grant an order in FORM REG-15 electronically. In case of amendment of noncore field, the registration certificate would stand amended upon submission of application i.e. FORM GST REG-14.

Cancellation of registration (Section 29):

As per section 29(1), the proper officer may, either on his own motion or on an application filed by the registered person under Rule 20 in FORM GST REG 16 or by his legal heirs, in case of death of such person, cancel the registration. The same can be cancelled in the following cases:

- Business discontinued

- Transferred fully for any reason including death of the proprietor

- Amalgamation or demerger or disposal of the business entity

- Change in the constitution of the business

- A taxable person who is no longer liable to be registered under section 22 or section 24.

Cancellation by the proper officer can be done in the following cases:

- Contravention of Rule 21 i.e. conduct of business from a place which is not his place of business as declared, issue of invoices in contravention of the rules and provisions, violation of section 171 i.e. adoption of anti-profiteering measures and violation of Rule 10A

- Non-filing of return for6 consecutive months or 3 consecutive tax periods in case of a composition dealer

- Non-commencement of business within 6 months from date of registration in case of a voluntary registration

- Registration obtained by fraud.

As per Rule 22, Where the proper officer has reasons to believe that the registration of a person is liable to be cancelled under section 29, he shall issue a notice to such person in FORM GST REG-17, requiring him to show cause, within a period of seven working days from the date of the service of such notice, as to why his registration shall not be cancelled. The reply to the same has to be filed in FORM GST REG -18 and the cancellation order shall be issued under FORM GST REG-19/REG-20 as the case may be.

Revocation on cancellation (Section 30):

As per Rule 23, A registered person, whose registration is cancelled by the proper officer on his own motion, may submit an application for revocation of cancellation of registration, in FORM GST REG-21. The proper officer may, by order, either revoke the cancellation of the registration or reject the application. Provided that the application for revocation of cancellation of registration shall not be rejected unless the applicant has been given an opportunity of being heard. He would first issue a Show cause notice for such rejection to the applicant seeking clarification within 7 working days. Where the proper officer is satisfied, that there are sufficient grounds for revocation he shall revoke the cancellation of registration by an order in FORM GST REG-22 within a period of thirty days from the date of the receipt of the application.

Declaimer: The contents of this document are solely for informational purposes. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. The author does not accept any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied without express written permission of the author.

Download the copy:

CA Suraj Goyal

CA Suraj Goyal

SME & Speaker, Business Advisor on Indian GST Add profile section

Kolkata, India

SME & Speaker, Business Advisor on Indian GST