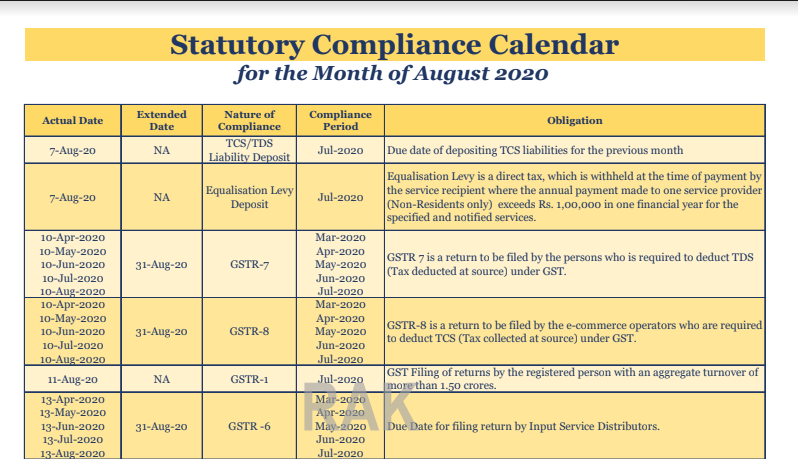

Statutory Compliance Calendar for the Month of August 2020

Statutory Compliance Calendar for the Month of August 2020

| Actual Date | Extended Date |

Nature of Compliance |

Compliance Period |

Obligation |

| 7-Aug-20 | NA | TCS/TDS Liability Deposit | Jul-2020 | Due date of depositing TCS liabilities for the previous month |

| 7-Aug-20 | NA | Equalisation Levy Deposit | Jul-2020 | Equalisation Levy is a direct tax, which is withheld at the time of payment by the service recipient where the annual payment made to one service provider (Non-Residents only) exceeds Rs. 1,00,000 in one financial year for the specified and notified services. |

| 10-Apr-2020 10-May-2020 10-Jun-2020 10-Jul-2020 10-Aug-2020 |

31-Aug-20 | GSTR-7 | Mar-2020 Apr-2020 May-2020 Jun-2020 Jul-2020 |

GSTR 7 is a return to be filed by the persons who is required to deduct TDS (Tax deducted at source) under GST. |

| 10-Apr-2020 10-May-2020 10-Jun-2020 10-Jul-2020 10-Aug-2020 |

31-Aug-20 | GSTR-8 | Mar-2020 Apr-2020 May-2020 Jun-2020 Jul-2020 |

GSTR-8 is a return to be filed by the e-commerce operators who are required to deduct TCS (Tax collected at source) under GST. |

| 11-Aug-20 | NA | GSTR-1 | Jul-2020 | GST Filing of returns by the registered person with an aggregate turnover of more than 1.50 crores. |

| 13-Apr-2020 13-May-2020 13-Jun-2020 13-Jul-2020 13-Aug-2020 |

31-Aug-20 | GSTR -6 | Mar-2020 Apr-2020 May-2020 Jun-2020 Jul-2020 |

Due Date for filing return by Input Service Distributors. |

| 15-Aug-20 | NA | Provident Fund | Jul-2020 | Due Date for payment of Provident fund contribution for the previous month. |

| 15-Aug-20 | NA | ESI | Jul-2020 |

Due Date for payment of Provident fund and ESI contribution for the previous month. |

| 20-Apr-2020 20-May-2020 20-Jun-2020 20-Jul-2020 20-Aug-2020 |

31-Aug-20 | GSTR -5 | Mar-2020 Apr-2020 May-2020 Jun-2020 Jul-2020 |

GSTR-5 to be filed by Non-Resident Taxable Person for the previous month. |

| 20-Apr-2020 20-May-2020 20-Jun-2020 20-Jul-2020 20-Aug-2020 |

31-Aug-20 | GSTR -5A | Jul-2020 | GSTR-5A to be filed by OIDAR Service Providers for the previous month. |

| 20-Aug-20 | NA | GSTR – 3B | Jul-2020 | Due Date for filing GSTR – 3B which aggregate turnover More than 5 Crores in the previous year |

| 22-Aug-20 | 27-Sep-2020 and 30-Sep-2020 |

GSTR – 3B | Jul-2020 | Due Date for filing GSTR – 3B which aggregate turnover Less than 5 Crores in the previous year which states is Chhattisgarh, Madhya Pradesh, Maharashtra, Gujarat, Daman and Diu, Dadra & Nagar Haveli, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman, and the Nicobar Islands, Telangana and Andhra Pradesh |

| 24-Aug-20 | 29-Sep-2020 and 30-Sep-2020 |

GSTR – 3B | Jul-2020 | Due Date for filing GSTR – 3B which aggregate turnover less than 5 Crores in the previous year which states are Jammu and Kashmir, Laddakh, Arunachal Pradesh, Punjab, Himachal Pradesh, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha. |

| 31-Jul-20 | 3-Aug-20 | GSTR-1 | Apr-2020 to Jun- 2020 |

GST Filing of returns by a registered person with aggregate turnover up to 1.50 crores |

| 11-Jul-20 | 5-Aug-20 | GSTR-1 | Jun-2020 | GST Filing of returns by a registered person with aggregate turnover up to 1.50 crores |

| 30-Apr-20 | 31-Aug-20 | GSTR-4 | FY 2019-20 | Return filed by Composition Dealers on annual Basis |

Related Topic:

Due Date Compliance Calendar JULY 2021

Read the Copy:

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

CA Rohit Kapoor

CA Rohit Kapoor

Delhi, India

CA Rohit Kapoor is a member of the Institute of Chartered Accountants of India (ICAI) and has vast experience in Direct Taxes with the working experience of 8+ Years. Rohit has also delivered Sessions in the Workshops, Training Session, etc. organized by RSMS, RAK, BCI, PSF, etc. He is also on the Board of Various Public Companies and National Level NGOs.