State and Central Jurisdiction for GST enrolment

As we are aware that GST enrolment has already started. This enrolment is first step towards the GST migration of existing taxpayers .You need to check GST enrolment schedule in your state to find the date when your process of migration will start.

This GST enrolment is just a starting to ease the process of migration. You will have to fill it to get the provisional registration in GST. This provisional registration certificate will be made available online on appointed date. Provisional registration certificate will be valid for six months. Taxpayer is required to fill the necessary documents online and get their provisional registration final.

In case the taxpayer fails to get the final registration his input tax credit in books as on date immediately preceding the appointed date will lapse. This will cause a huge loss as he will not be able to utilize his carry forward credit in GST.

In the enrolment application there is a requirement to fill the State Jurisdiction, Ward, Circle, Sector No. and Center Jurisdiction. Some taxpayer may find it hard to get their jurisdiction. Here we will help you in finding your State Jurisdiction, Ward, Circle, Sector No. and Center Jurisdiction easily.

- If you are a VAT dealer check your registration certificate in existing VAT law. It should include the details of State Jurisdiction, Ward, Circle, Sector No.

- If you are also registered in central excise you can refer your excise registration for central jurisdiction.

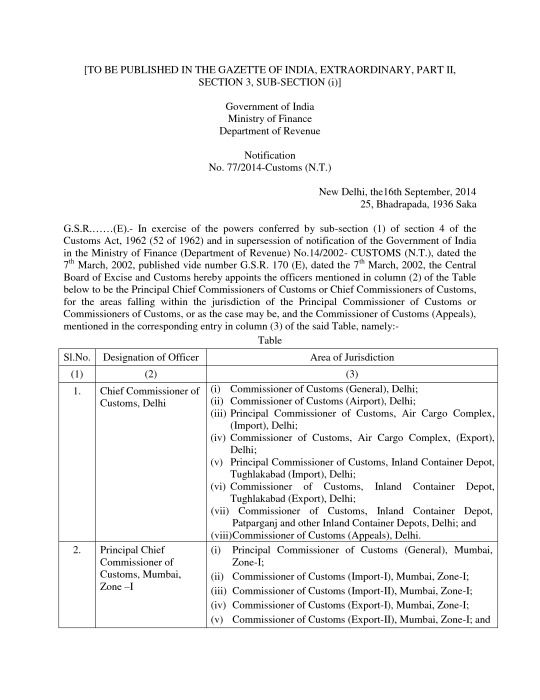

- If you are only a VAT registered dealer, you need to find your Central Jurisdiction based on the address of your Principal place of Business. List of all central jurisdiction are given below. You can download it from here and find your central jurisdiction.

This PDF contains the list of all jurisdiction for cental zone. You need to fill same in your GST enrolment application.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.