Section 41 of CGST Act:provisional Claim of ITC (Updated till July 2024 )

Table of Contents

Section 41 of CGST Act of the CGST Act as amended by the Finance Act 2023

Note: Section 41 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

Section 41 of CGST Act provide for the claim of ITC and provisional matching thereof. This matching is subject to finalization. Once the GSTR-3 is filed there will be a matching on back end. A mismatch report will be generated and made available to taxpayer.

Text On Section:

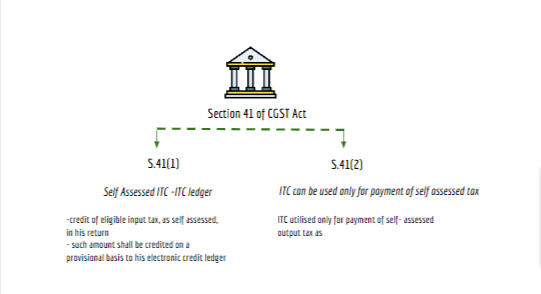

“(1) Every registered person shall, subject to such conditions and restrictions as may be prescribed, be entitled to take the credit of eligible input tax, as self-assessed, in his return and such amount shall be credited on a provisional basis to his electronic credit ledger.

(2) The credit referred to in sub-section (1) shall be utilised only for payment of selfassessed output tax as per the return referred to in the said sub-section.”

Provided that where the said supplier makes payment of the tax payable in respect of the aforesaid supplies, the said registered person may re-avail the amount of credit reversed by him in such manner as may be prescribed

Chart of the Section:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.