Section 15 of the CGST Act: Valuation ( updated till on October 2023)

Section 15 of the CGST Act

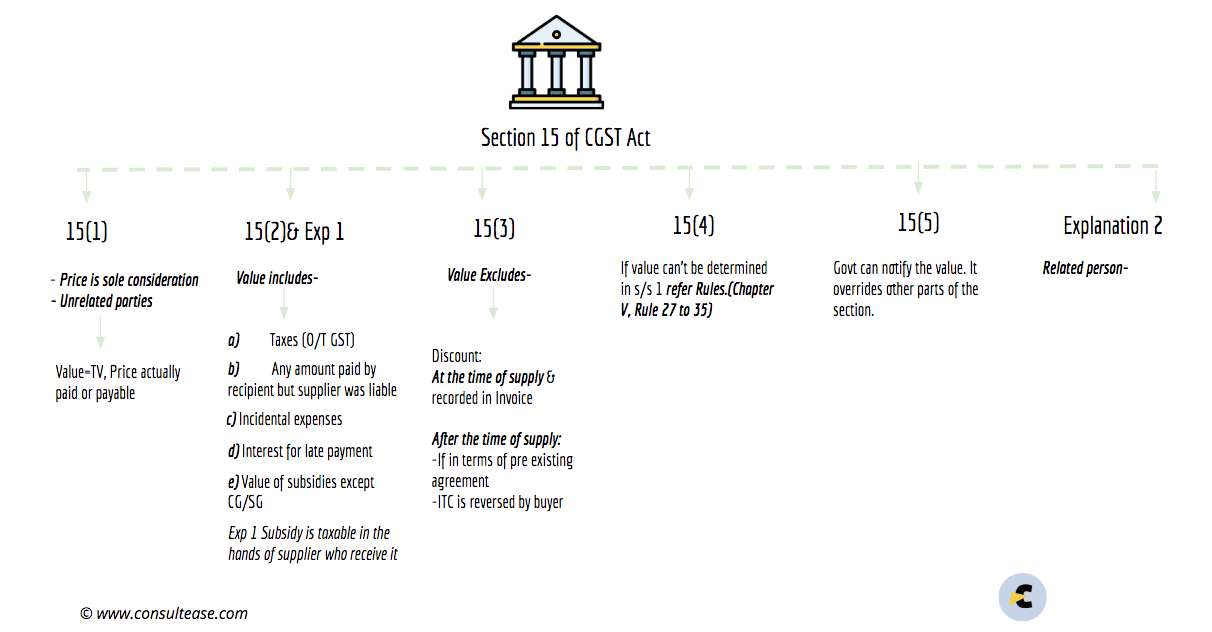

Section 15 of the CGST Act provides for the valuation in GST. Although the transaction value is value in most of the cases. There are some exceptions also. It provides for the treatment of discounts and subsidy. When a transaction is between two unrelated persons and money is the only consideration, the Transaction value is taxable value for GST. Section 15 of the CGST Act also provides for the definition of related person.

Summary of section 15 of the CGST Act:

Text of section 15 of the CGST Act as given in Bare Act:

(1) The value of a supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.

(2) The value of supply shall include–––

(a) any taxes, duties, cesses, fees and charges levied under any law for the time being in force other than this Act, the State Goods and Services Tax Act, the Union Territory Goods and Services Tax Act and the Goods and Services Tax (Compensation to States) Act, if charged separately by the supplier;

(b) any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods or services or both;

(c) incidental expenses, including commission and packing, charged by the supplier to the recipient of a supply and any amount charged for anything done by the supplier in respect of the supply of goods or services or both at the time of, or before delivery of goods or supply of services;

(d) interest or late fee or penalty for delayed payment of any consideration for any supply; and

(e) subsidies directly linked to the price excluding subsidies provided by the

Central Government and State Governments.

Explanation.––For the purposes of this sub-section, the amount of subsidy shall be included in the value of supply of the supplier who receives the subsidy.

(3) The value of the supply shall not include any discount which is given––

(a) before or at the time of the supply if such discount has been duly recorded in the invoice issued in respect of such supply; and

(b) after the supply has been effected, if—

(i) such discount is established in terms of an agreement entered into at or before the time of such supply and specifically linked to relevant invoices; and

(ii) input tax credit as is attributable to the discount on the basis of document issued by the supplier has been reversed by the recipient of the supply

(4) Where the value of the supply of goods or services or both cannot be determined under sub-section (1), the same shall be determined in such manner as may be prescribed.

(5) Notwithstanding anything contained in sub-section (1) or sub-section (4), the value of such supplies as may be notified by the Government on the recommendations of the Council shall be determined in such manner as may be prescribed.

Explanation.—For the purposes of this Act,––

(a) persons shall be deemed to be “related persons” if––

(i) such persons are officers or directors of one another’s businesses;

(ii) such persons are legally recognised partners in business;

(iii) such persons are employer and employee;

(iv) any person directly or indirectly owns, controls or holds twenty-five per cent or more of the outstanding voting stock or shares of both of them;

(v) one of them directly or indirectly controls the other;

(vi) both of them are directly or indirectly controlled by a third person;

(vii) together they directly or indirectly control a third person; or they are members of the same family;

(b) the term “person” also includes legal persons;

(c) persons who are associated in the business of one another in that one is the sole agent or sole distributor or sole concessionaire, howsoever described, of the other, shall be deemed to be related.

Rules relevant for section 15 of the CGST Act, Valuation Rules:

| 1. | Rule 27 | Value of supply of goods or services where the consideration is not wholly in money |

| 2. | Rule 28 | Value of supply of goods or services or both between distinct or related persons, other than through an agent |

| 3. | Rule 29 | Value of supply of goods made or received through an agent |

| 4. | Rule 30 | Value of supply of goods or services or both based on cost |

| 5. | Rule 31 | Residual method for determination of the value of supply of goods or services or both |

| 6. | Rule 31A | Value of supply in case of lottery, betting, gambling and horse racing |

| 7. | Rule 32 | Determination of value in respect of certain supplies |

| 8. | Rule 32A | Value of supply in cases where Kerala Flood Cess is applicable |

| 9. | Rule 33 | Value of supply of services in case of pure agent |

| 10. | Rule 34 | Rate of exchange of currency, other than Indian rupees, for determination of value |

| 11. | Rule 35 | Value of supply inclusive of integrated tax, central tax, State tax, Union territory tax |

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.