SABKA VISHWAS (LEGACY DISPUTE RESOLUTION) SCHEME, 2019

SABKA VISHWAS (LEGACY DISPUTE RESOLUTION) SCHEME, 2019:

- This scheme is for settling all past disputes of Central Excise, Service Tax and 26 other indirect taxes.

- It shall come into force on such date when notified in the official gazette.

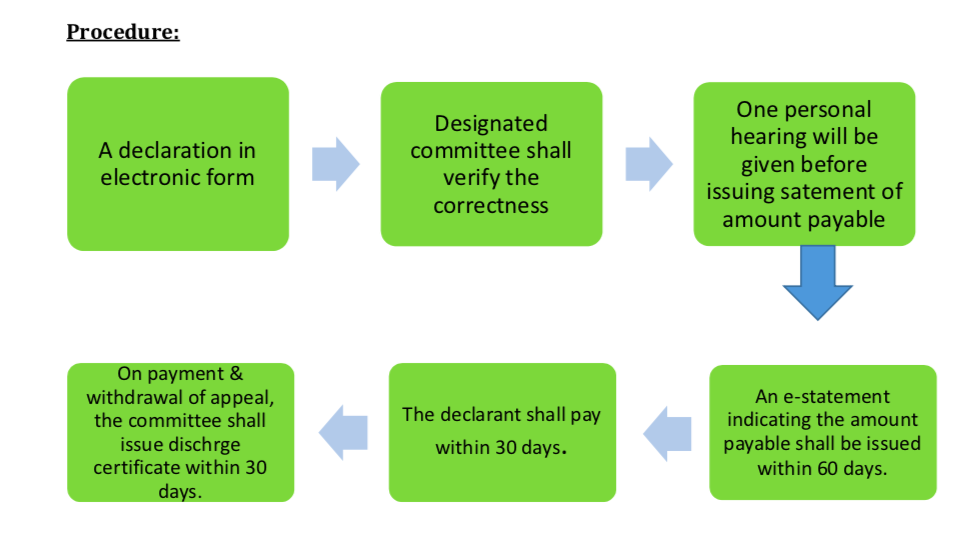

- Under this scheme, the eligible persons shall declare the unpaid tax dues and pay the same in accordance with the provisions of the scheme. There is immunity of interest, penalty and any other proceedings/prosecution under this scheme.

|

Description |

Relief Available |

|

|

Amount of duty Rs.50 lacs or less |

Amount of duty more than Rs.50 lacs |

|

|

Show cause notice issued and case is pending for hearing as on 30.06.2019 |

70% |

50% |

|

Appeal is filed and case is pending for hearing as on 30.06.2019 |

70% |

50% |

|

Enquiry/Investigation/Audit conducted with tax demand quantified upto 30.06.2019 |

70% | 50% |

|

Tax dues are related to “Amount in arrears” |

60% | 40% |

|

Tax dues are on account of voluntary disclosure |

NIL | NIL |

|

Show cause notice issued for late fee or penalty only, and the amount of duty in the said notice has been paid or is nil |

100% of (Penalty/late fee) |

100% of (Penalty/late fee) |

Conditions for availing the benefit of the scheme:

- Any amount paid as pre-deposit shall be deducted when issuing the statement indicating the amount payable by the declarant.

- If the amount pre-deposit is more than the amount payable under this scheme, the declarant shall not be entitled for any refund.

- The amount payable under this scheme cannot be paid through ITC account.

- The amount paid under this scheme shall not be refundable under any circumstances.

- A person cannot make a voluntary disclosure after an enquiry or investigation or audit or for an amount declared as payable in a return filed consequent to such proceedings.

Certain Meanings for this scheme:

- Amount payable means the final amount payable by the declarant as determined by the designated committee and as indicated in the statement issued by it and shall be calculated as the amount of tax dues less tax relief.

- Amount in arrears means the amount of duty which is recoverable as arrears of duty.

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

CA Vipul Khandhar

CA Vipul Khandhar