Rule 36(4) and other issues in claiming ITC under the GST Act

Rule 36(4) and other issues in claiming ITC under the GST Act

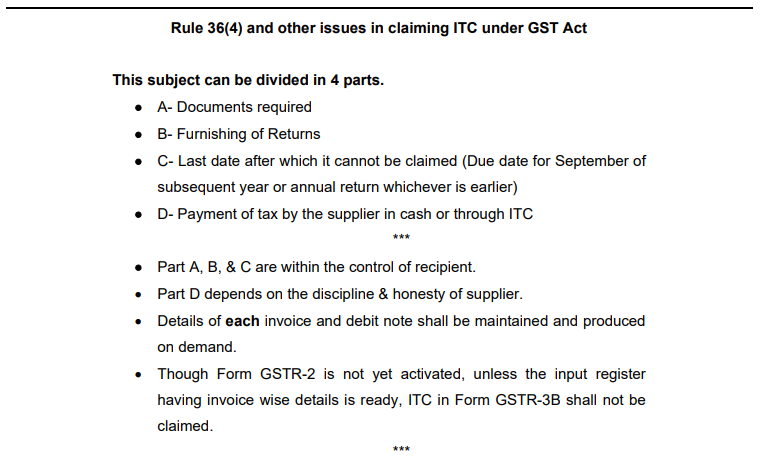

This subject can be divided into 4 parts.

- A- Documents required

- B- Furnishing of Returns

- C- Last date after which it cannot be claimed (Due date for September of the subsequent year or annual return whichever is earlier)

- D- Payment of tax by the supplier in cash or through ITC

- Part A, B, & C are within the control of recipient.

- Part D depends on the discipline & honesty of supplier.

- Details of each invoice and debit note shall be maintained and produced on demand.

- Though Form GSTR-2 is not yet activated, unless the input register having invoice wise details is ready, ITC in Form GSTR-3B shall not be claimed.

How to ascertain the payment of tax by the supplier in cash or through ITC?

- Fortunately, in MVAT Act and under GST Act, payment of tax by the supplier in cash or through ITC is not literally taken by the authorities.

- Therefore uploading Annexure J-1 and GSTR-1 by suppliers is being taken as tax actually paid.

- Otherwise, in a case where supplier’s ITC is disallowed u/s 48(5) of MVAT Act or u/s 16(2)(c) of CGST Act would have made recipient’s life miserable in establishing his ITC as well as of all suppliers in the chain.

- Therefore filing of GSTR-1 by suppliers is enough.

- Download 2A of supplier and match with ITC register.

- In case of matched – full ITC.

- In the case of mismatched – Rule 36(4) provides to claim an additional 20/10 percent of matched ITC.

- Rule 36(4) amended after Notification No.49 of 2019 dated 09.10.2019 is reproduced below.

- Rule 36(4): Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the supplier under sub-section (1) of Section 37, shall not exceed ten percent of the eligible credit available in respect of invoices or debit notes, the details of which have been uploaded by the supplier under section 37(1).

- See Circular No.123/42/2019-GST dated 11.11.2019 clarifying the subrule (4).

Issue:

The concept of granting an additional 20/10 percent of matched ITC is provided vide sub-section (4) of Section 43A, which is not yet brought into force. Therefore the question is, whether the introduction of Rule 36(4) is valid?

Answer:

- The entire Rule 36 has been prescribed to provide for “documentary requirements and conditions for claiming ITC”.

- The power to prescribe the aforesaid entire rule is derived from Section 16(2), 37 or 38.

- Therefore, Rule 43A commences with the words “notwithstanding anything contained in Section 16(2), 37 or 38”.

- In view of the above, it cannot be said that sub-rule (4) of Rule 36 has been introduced only for the purpose of sub-section (4) to Section 43A.

- Section 43A is to lay down the “procedure for furnishing return and availing ITC.”

- It is not for the grant of ITC.

- The parent provisions for availing ITC are under Section 16 to 21 of Chapter-V.

Section 43A(1):

- Notwithstanding anything contained in Section 16(2), 37 or 38

- Every registered person shall, in the returns furnished under Section 39(1),

- Verify, validate, modify or delete the details of supplies furnished by the suppliers.

Section 43A(2):

- Notwithstanding anything contained in Section 41, 42 or 43,

- the procedure for availing ITC by the recipient and verification thereof shall be such as may be prescribed.

Section 43A(3):

- The procedure for furnishing the details of outward supplies by the supplier on the common portal,

- for the purpose of availing ITC by the recipient shall be such as may be prescribed.

Section 43A(4):

- The procedure for availing ITC in respect of outward supplies not furnished under sub-section (3),

- shall be such as may be prescribed, and,

- such procedure may include the maximum amount of the ITC which can be so availed, not exceeding twenty/ten percent of the ITC, on the basis of details furnished by the suppliers under said sub-section.

- For the aforesaid purpose Rule 36(4) is introduced.

- Circular No.123/42/2019-GST dated 11.11.2019 has been issued by the Principal Commissioner (GST) to clarify various issues regarding Rule 36(4).

Section 43A(5):

- The amount of tax specified in the outward supplies for which the details have been furnished by the supplier under sub-section (3),

- shall be deemed to be the tax payable by him.

Download the copy:

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

Adv. Deepak Bapat

Adv. Deepak Bapat