Revised GST return rules issued by CBEC

Revised GST return rules issued by CBEC

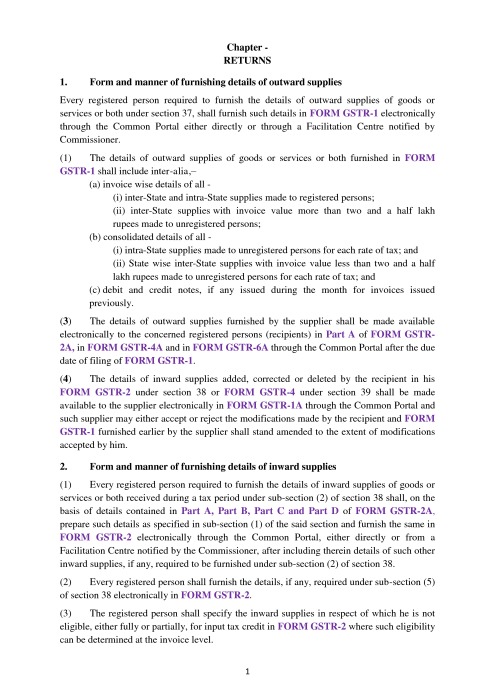

Revised GST return rules issued by CBEC. These rules contains the important provisions related to returns in GST. Returns are one of the most important compliance in GST. Thus to comprehend in GST detail knowledge of return provisions is required.There are three basic returns in GST. GSTR1 is the return of supplier. GSTR2 is the return of recipient. GSTR3 is the consolidated return.In case of non resident, ISD, tax deductor in section 51 and 52 the return forms are different.

Main provisions covered in rules are:

Form and manner of:

- Furnishing details of outward supplies

- Furnishing details of inward supplies

- Submissionof monthly return

- submission of quarterly return by the composition supplier

- Submissionof return by non-resident taxable person

- submission of return by an Input Service Distributor

- submissionof return by a person required to deduct tax at source

- submission of statement of supplies by an e-commerce operator

- Notice to non-filers of returns

- Matching of claim of input tax credit

- Final acceptance of input tax credit and communication thereof

- Communication and rectification of discrepancy in claim of input tax credit and reversal of claim of input tax credit

- Claim of input tax credit on the same invoice more than once

- Matching of claim of reduction in the output tax liability

- Final acceptance of reduction in output tax liability and communication thereof

- Communication and rectification of discrepancy in reduction in output tax liability and reversal of claim of reduction

- Claim of reduction in output tax liability more than once

- Refund of interest paid on reclaim of reversals

- Matching of details furnished by the e-Commerce operator with the details furnished by the supplier

- Communication and rectification of discrepancy in details furnished by the e-commerce operator and the supplier

- Annual return

- Final return

- Details of inward supplies of persons having Unique Identity Number

- Provisions relating to a goods and services tax practitioner

- Conditions for purposes of appearance

These are the main headings covered in these rules. In case you need detailed insites you can download these rules.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.