Revised GST registration rules released

GST registration rules

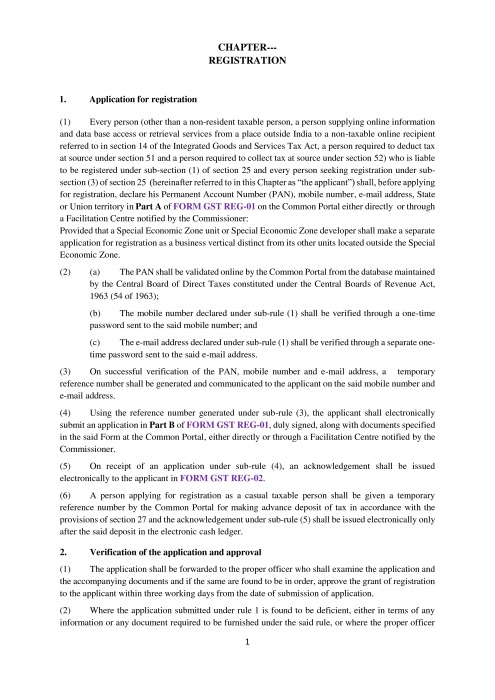

Revised registration rules are released by the GSTIN. These rules to be read with the relevant provisions given in GST Act.

Major provisions given here are:

- Application for registration

- Verification of the application and approval

- Issue of registration certificate

- Separate registration for multiple business verticals within a State or a Union territory

- Grant of registration to persons required to deduct tax at source or to collect tax at source

- Grant of registration to non-resident taxable person

- Grant of registration to a person supplying online information and data base access or retrieval services from a place outside India to a non-taxable online recipient

- Extension in period of operation by casual taxable person and non-resident taxable person

- Suo moto registration

- Assignment of unique identity number to certain special entities

- Display of registration certificate and GSTIN on the name board

- Amendment of registration

- Registration to be cancelled in certain cases

- Cancellation of registration

- Revocation of cancellation of registration

- Migration of persons registered under the existing law

- Physical verification of business premises in certain cases

- Method of authentication

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.