Reverse charge in GST: List updated 03.10.2019

- Updated list for the reverse charge in GST updated till date

- What is the meaning of RCM?

- Who is liable for payment of tax in Reverse charge mechanism?

- Which notifications provide for the reverse charge in GST?

- What are the RCM provisions for a Goods Transport Agency

- What are the provisions related to RCM on Services of advocates:

- 3.Services by an arbitral tribunal

- 4.Services provided by way of sponsorship to any body corporate or partnership firm

- 5. Services supplied by the Central Government, State Government, Union territory or local authority

- 5A. Supply by CG,SG,UT,LA by way of renting of immovable property

- 5B. Transfer of development rights of FSI for construction of a project

- 5C. Long-term lease of land (30 years or more)

- 6.Services by a Director of a company or body corporate to such company or body corporate

- 7.Service by an insurance agent to any person carrying on insurance business

- 8. Services supplied by a recovery agent to a banking company or a financial institution or a non-banking financial company

- 9. transfer or permitting the use or enjoyment of a copyright

- 9A. Services by an author by way of transfer or permitting the use or enjoyment of a copyright

- 10. Supply of services by the members of Overseeing Committee to Reserve Bank of India

- 11. Services by individual Direct Selling Agents (DSAs)

- 12. Services provided by business facilitator (BF) to a banking company

- 13. Services provided by an agent of business correspondent (BC) to business correspondent (BC

- 14. Reverse charge in GST for Security Services Provided to a registered person

- 15.2 Supplier Covered:

- 15.3 Recipient of service:

- 16.Services of lending of securities under Securities Lending Scheme, 1997

- 17. Reverse charge in GST on Import of services:

- 18. Ocean Freight:

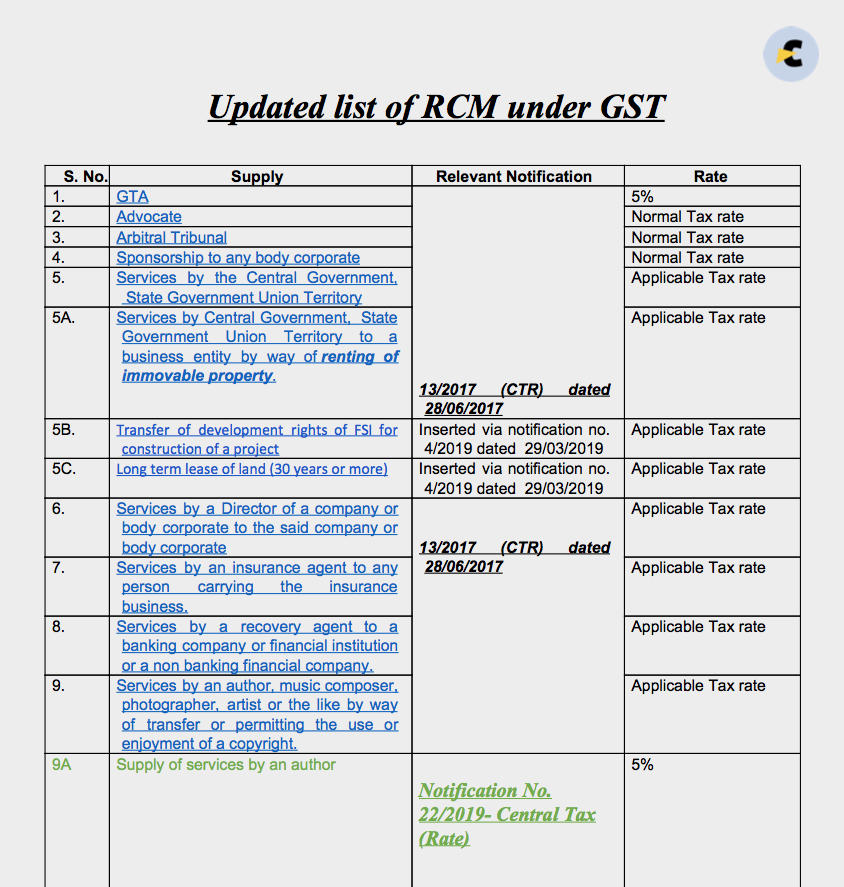

Updated list for the reverse charge in GST updated till date

Reverse charge updated list. This list contains all the services liable for payment in reverse charge. It simply means that the recipient will pay the tax directly. Generally, the supplier collects the tax from the recipient and pays but in this case recipient deposit tax to the government.

| S. No. | Supply | Relevant Notification | Rate |

| 1. | GTA |

13/2017 (CTR) dated 28/06/2017 |

5% |

| 2. | Advocate | Normal Tax rate | |

| 3. | Arbitral Tribunal | Normal Tax rate | |

| 4. | Sponsorship to any body corporate | Normal Tax rate | |

| 5. | Services by the Central Government, State Government Union Territory | Applicable Tax rate | |

| 5A. | Services by Central Government, State Government Union Territory to a business entity by way of renting of immovable property. | Applicable Tax rate | |

| 5B. | Transfer of development rights of FSI for construction of a project | Inserted via notification no. 4/2019 dated 29/03/2019 | Applicable Tax rate |

| 5C. | Long term lease of land (30 years or more) | Inserted via notification no. 4/2019 dated 29/03/2019 | Applicable Tax rate |

| 6. | Services by a Director of a company or body corporate to the said company or body corporate |

13/2017 (CTR) dated 28/06/2017 |

Applicable Tax rate |

| 7. | Services by an insurance agent to any person carrying the insurance business. | Applicable Tax rate | |

| 8. | Services by a recovery agent to a banking company or financial institution or a non banking financial company. | Applicable Tax rate | |

| 9. | Services by an author, music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright. | Applicable Tax rate | |

| 9A | Supply of services by an author | Notification No. 22/2019- Central Tax (Rate) | 5% |

| 10. | Supply of services by the members of Overseeing committee t Reserve Bank of India. | 33/2017(CTR) Dt. 13.10.2017 | Applicable Tax rate |

| 11. | Services supplied by individual DSA to bank or NBFC. | 15/2018 (CTR) Dt. 26.07.2018 | Applicable Tax rate |

| 12. | Services provided by business facilitator (BF) to a banking company. | 29/2018(CTR) Dt. 31.12.2018 | Applicable Tax rate |

| 13. | Services provided by an agent of business correspondent to business correspondent | 29/2018(CTR) Dt. 31.12.2018 | Applicable Tax rate |

| 14. | Security services provided to a registered person. | 29/2018(CTR) Dt. 31.12.2018 | Applicable Tax rate |

| 15. | Renting of a motor vehicle

|

Notification No. 22/2019- Central Tax (Rate)

|

|

| 16. | The lending of securities under Securities Lending Scheme, | Notification No. 22/2019- Central Tax (Rate)

|

|

| 15. | Import of service | Entry No. 1 of Notification No. 10/2017- Integrated Tax (Rate) dated 28 June 2017. | Applicable Tax rate |

| 16. | Ocean Freight | Entry No. 10 of Notification No. 10/2017- Integrated Tax (Rate) dated 28 June 2017 | Applicable Tax rate |

What is the meaning of RCM?

The reverse charge mechanism in GST means the instances where the recipient of the supply is liable to pay tax to the government. Generally, the tax is collected by the supplier and then deposited to the government. In the case of RCM, the tax is directly deposited by the recipient. There are two types of RCM in GST. First is covered by section 9(3) and other is covered by section 9(4).

Related Topic:

GST on Corporate Guarantees

Who is liable for payment of tax in Reverse charge mechanism?

The person receiving the supply is liable to pay tax in RCM. e.g, A supplied GTA services to B. In this case B will be liable to pay tax in reverse charge in GST.

Which notifications provide for the reverse charge in GST?

The following are the relevant notifications in GST covering the list of reverse charges.

- Notification no. 13/2017 (CTR) as updated. This notification covers the services covered in reverse charge in GST.

- Notification no. 4/2017 (CTR) as updated. This notification provides for the services covered in reverse charge.

- Notification no. 7/2019 (CTR) covering the reverse charge provisions for purchase from unregistered suppliers.

What are the RCM provisions for a Goods Transport Agency

A good transport agency means a Transporter of Goods.

1.1 Supply Covered:

The supply of goods transport agencies is covered under this entry.

The term GTA is defined in explanation to entry no 9(iii) of Notification No.11/2017 (CTR)

[Explanation.- “goods transport agency” means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called.]

1.2 Suppliers Covered:

Good transport agency not making payment in forward charge @6%.

Earlier GTA was not allowed to pay tax in forward charged but via Notification No. 20/2017- Central Tax (Rate) New Delhi, dated 22nd August 2017 it was allowed to pay tax in forward charge @6%(plus 6% for SGST).

1.3 Recipient Covered:

We can divide the recipients covered in this entry into two parts. One which is covered even if they are not registered. This recipient will even become liable to registered under the provisions of section 24 of the CGST Act. Second, are the recipient who will be liable for this RCM only when they are already registered. It means that if they are not already registered they will not be liable to take registration due to RCM.

i) Recipient covered in this RCM even if they are not registered

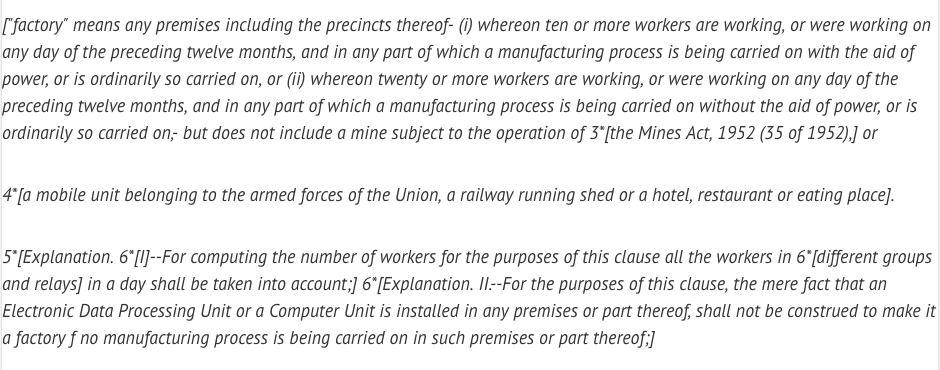

(i) Any factory registered under or governed by the Factories Act, 1948(63 of 1948).

As per Section 2(m) of Factory Act 1948 a Factory is defined as follows.

ii) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India

iii) anyco-operative society established by or under any law.

iv) anybody corporate established, by or under any law.

Meaning of body corporate under section 2(11) of Companies Act 2013.

[“body corporate” or “corporation” includes a company incorporated outside India, but does not include—

(i) a co-operative society registered under any law relating to co-operative societies; and

(ii) any other body corporate (not being a company as defined in this Act), which the Central Government may, by notification, specify in this behalf.]

Further section 2(20) of COmpanies Act 2013 defined a company as

[“company” means a company incorporated under this Act or under any previous company law]

v) any partnership firm whether registered or not under any law including association of persons. Please pay attention to the fact that an LLP is also considered as partnership for this provision. This clarification was inserted by Notification No. 22/2017- Central Tax (Rate) New Delhi, the 22nd August, 2017.

ii) Recipient covered in this RCM only if they are registered:

- Casual Taxable Person.

- Individual /HUF

1.4 Exceptions:

- GTA Making payment of tax in forward charge @6% (and 6% SGST).

- Entry no. 21B of notification no. 12/2017(CTR) dated 28th June 2017. services provided by a goods transport agency, by way of transport of goods in a goods carriage by road, to, –

- a Department or Establishment of the Central Government or State Government or Union territory; or

- local authority; or

- Governmental agencies, which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under section 51 and not for making a taxable supply of goods or services.

3. An Individual or HUF including a casual taxable person who is not registered. (URD Individual or HUF). Further this supply is exempted by entry no. 21A of Notification no. 12/2017 dated 28th June 2017. Thus even the GTA is not required to pay tax in forward charge in this case.

4. Entry No.21 of Notification no. 12/2017 dated 28th June 2017 covers following services as exempt supply. Services provided by a goods transport agency, by way of transport in a goods carriage of –

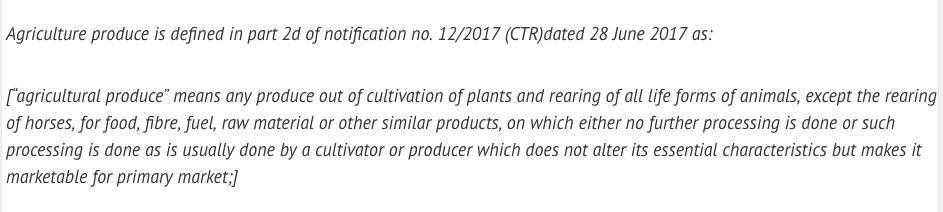

agricultural produce;

5. goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage does not exceed one thousand five hundred rupees;

6. goods, where consideration charged for transportation of all such goods for a single consignee does not exceed rupees seven hundred and fifty;

7. Transportation of

- milk, salt and food grain including flour, pulses, and rice;

- organic manure;

- newspaper or magazines registered with the Registrar of Newspapers;

- relief materials meant for victims of natural or man-made disasters, calamities, accidents or mishap; or

- defense or military equipment.

1.5 Practical Issues:

Issue 1: In some cases, the GTA is charging in forward charge but not at 6%(+6%). In this case, the recipient will still be liable to pay RCM @5%. Because the entry in 13/2017 mentions that if the supplier is paying tax at 6%(+6%) only then the recipient will not be liable for RCM.

Issue 2: In the case of transportation of exempted goods does the supplier of goods is liable for RCM on freight paid to GTA for transportation of such exempted goods.

Resolution: Yes, He will be liable. The supply of GTA is taxable irrespective of the nature of goods except for entry no. 21 of notification no. 12/2017 (CTR) dated 28th June 2017.

What are the provisions related to RCM on Services of advocates:

Advocates are also covered for reverse charge. Further, the person covered in RCM is also exempted from taking registration in GST. The outward supply of advocates is covered in RCM except when it is provided to a person using it personally and not for business. In that case, these services are exempted via notification number 12/2017 (CTR) as updated to date. (See entry no. 45(b)(ii)(iii))

2.1 Supply Covered:

Legal services are covered under this entry. As provided in explanation in the entry itself( substituted vide corrigendum to notification 13/2017- CTR, dated 25.09.2017, legal services means:

Explanation.- “legal service” means any service provided in relation to advice, consultancy or assistance in any branch of law, in any manner and includes representational services before any court, tribunal or authority.

2.2 Supplier Covered:

Legal services provided by the following are covered in this entry.

- Individual advocate

- Senior advocate

- Firm of advocates

2.3 Recipient Covered:

Any business entity located in the taxable territory. Explanation to notification no 13/2017 (CTR) provides that a business entity located in the taxable territory who is litigant, applicant or petitioner, as the case may be, shall be treated as the person who receives the legal services for the purpose of this notification.

3.Services by an arbitral tribunal

3.1 Supply Covered:

Any service supplied by an arbitral tribunal.

3.2 Supplier Covered:

Arbitral Tribunal

3.3 Recipient Covered:

Any business entity located in the taxable territory.

4.Services provided by way of sponsorship to any body corporate or partnership firm

This is another important entry. Services provided by way of sponsorship to any body corporate or a partnership firm. In this case, the recipient of sponsorship services will be liable to pay GST in reverse charge.

e.g. Indian medical association organized an event for the doctors. They provided the banners of the doctors who paid a fixed sum for the event. In this case, the services by IMA is sponsorship service. But RCM will not be applicable because for sponsorship RCM is applicable only when it is provided to a body corporate or a partnership firm.

4.1 Supply Covered:

Sponsorship services

4.2 Supplier Covered:

Any person

4.3 Recipient Covered:

Body Corporate or Partnership Firm (Including LLP) located in the taxable territory.

5. Services supplied by the Central Government, State Government, Union territory or local authority

This is a very important entry. Services supplied by CG, SG, UT or LA is covered in this entry. Many of these services are exempted by notification no. 12/2017(CTR). We need to see if supply is exempt or covered in exception then Reverse charge in GST is not applicable. In all other cases, Revere charge is applicable.

15.1 Supply Covered:

All services except the following are covered under this entry.

- Renting of immovable property.

- Services by the department of post by way of

- Speed Post,

- express parcel post,

- life insurance and

- agency services

Provided to a person Other than CG,SG,UT,LA.

- Services in relation to an aircraft or a vessel,inside or outside the precincts of a port or an airport.

- Transport of goods or passenger.

5.2 Supplier Covered:

CG,SG,UT,LA

5.3 Recipient Covered:

Any business entity located in taxable territory. (Registered or unregistered, doesn’t matter)

5A. Supply by CG,SG,UT,LA by way of renting of immovable property

5A.1 Supply Covered:

Renting of immovable property

5A.2 Supplier Covered:

CG,SG,UT,LA

5A.3 Recipient Covered:

Any person registered under GST.

5B. Transfer of development rights of FSI for construction of a project

This entry is inserted via notification no. 4/2019 dated 29.03.2019.

5B.1 Supply Covered: Transfer of development rights or floor space index including the additional FSI. This transfer should be for the purpose of construction. The construction shall be of a project of promoter.

5B.2 Supplier Covered: Any person

5B.3 Recipient Covered: Promoter.

5C. Long-term lease of land (30 years or more)

5C.1 Supply Covered: Long term lease of land (30 years or more) by any person against consideration in the form of upfront amount (called as premium, salami, cost, price, development charges or by any other name) and/or periodic rent for construction of a project by a promoter

5C.2 Supplier Covered: Any Person

5C.3 Promoter.

6.Services by a Director of a company or body corporate to such company or body corporate

This entry was in service tax also. Any services provided by a director to its company is covered here. In this reverse charge in GST tax is payable by the company. It is important that any service by a director is covered and not only the services provided in the capacity of a director.

e.g. If a director let out his shop to the company. The reverse charge will be paid by the company even for the rent amount. It covers any service.

6.1 Supply Covered:

Any supply of services by a Director to the company in which he is a director.

6.2: Supplier Covered:

Director of a company or body corporate.

6.3: Recipient Covered:

Any company or body corporate.

6.4: Issues:

- a) whether the Bank (shareholder of ABC Ltd) who has appointed Nominee Director to represent on its behalf on the board of ABC Ltd is liable to pay GST on RCM basis on sitting fees paid to such nominee director?

b) Whether the bank guarantee by a director for a loan to a company is also covered for RCM.

2. Whether the salary paid to a director is also liable for RCM?

This is a very important issue. A whole time director or managing director also get a salary from the company. In this case, the relation of employer and employee exist. In this case, RCM is not applicable. Schedule III of CGST Act covers any supply by an employee to the employer in the course of employment. The amount of salary and any reimbursement because of employment is out of RCM liability.

7.Service by an insurance agent to any person carrying on insurance business

Supply made by an insurance agent to the insurance company is covered here. Insurance agent solicits the customers on behalf of an Insurance company.

7.1 Supply Covered:

Any services by an insurance agent.

Clause (f) of notification no. 13/2017 defines the Insurance agent as:

“insurance agent” shall have the same meaning as assigned to it in clause (10) of section 2 of the Insurance Act, 1938 (4 of 1938).

Section 2(10) of Insurance Act defines an agent as:

“insurance agent” means an insurance agent licensed under Sec. 42 who receives agrees to receive payment by way of commission or other remuneration in consideration of his soliciting or procuring insurance business including business relating to the continuance, renewal or revival of policies of insurance”

7.2 Supplier Covered:

Insurance Agent.

7.3 Recipient Covered:

Any person carrying on insurance business.

8. Services supplied by a recovery agent to a banking company or a financial institution or a non-banking financial company

Banks hire recovery agents. These agents do the proceedings of recovery on behalf of banks. In this services bank is liable to pay GST in reverse charge.

8.1 Supply Covered:

All services by a recovery agent to a banking company or a financial institution or an NBFC.

8.2 Supplier Covered:

Recovery Agent

Generally these recovery agents are appointed by the banks themselves.

8.3 Recipient Covered:

Banking company or a financial institution or a Non -banking financial company.

9. transfer or permitting the use or enjoyment of a copyright

Transfer of copyright is covered here. The transfer of copyright by an author is excluded from this entry and has been inserted via new entry, no. 9A.

9.1 Supply Covered:

transfer or permitting the use or enjoyment of a copyright-covered under clause (a) of sub-section (1) of section 13 of the Copyright Act, 1957 relating to original literary, dramatic, musical or artistic works.

9.2 Supplier Covered:

author, music composer, photographer, artist or the like.

9.3 Recipient Covered:

Publisher, music company, producer or the like, located in the taxable territory.

9A. Services by an author by way of transfer or permitting the use or enjoyment of a copyright

Introduced by notification no. 22/2019 dated 30th Sept 2019. It covers the transfer of copyright by an author.

9A.1: Supply covered:

Transfer of Copyright.

9A.2: Supplier covered:

Author, who has transferred the copyright relating to original literary work to a publisher.

9A.3: Recipient covered:

Publisher located in the taxable territory.

9A.4: Exceptions:

There the following two exceptions to this RCM entry.

- When the author is ready to pay in forward charge and make a declaration in this regard in form Annexure I. (Provided at the end of documents)

- When the makes a declaration, as prescribed in Annexure II on the invoice issued by him in Form GST Inv-I to the publisher. (Provided at the end of the document)

10. Supply of services by the members of Overseeing Committee to Reserve Bank of India

This is a very specific entry covering the services by the members of the overseeing committee to reserve bank of India.

10.1 Supply Covered:

All services by members of the overseeing the committee

10.2 Supplier Covered:

Members of the overseeing committee constituted by Reserve bank of India.

10.3 Recipient Covered:

Reserve Bank of India.

10.4 Date of applicability:

This provision was made applicable vide notification No. 33/2017 – Central Tax (Rate) dt 13.10.2017.

11. Services by individual Direct Selling Agents (DSAs)

Services provided by DSA is covered here.

11.1 Supply Covered:

All services by an individual Direct Selling Agent.

11.2 Supplier Covered:

Direct selling agent other than a body corporate, partnership or limited liability partnership firm.It is important to note here that the DSA providing services to NBFC or bank are only covered in this part. DSA of other entities are not covered.

11.3 Recipient Covered:

A Banking company or non-banking financial company (NBFCs) located in the taxable territory.

11.4 Date of applicability:

This provision is applicable vide notification No. 15/2018 – Central Tax (Rate) dt 26.07.2018.

12. Services provided by business facilitator (BF) to a banking company

Supply of services by a business facilitator is covered in this entry. The services provided to a banking company is covered here.

12.1 Supply Covered:

All services of a business facilitator.

12.2 Supplier Covered:

Business Facilitator.

12.3 Recipient Covered:

A banking company, located in the taxable territory.

12.4 Date of applicability:

This provision was made applicable from 31st December 2018 via Notification No. 29/2018- Central Tax (Rate) dated 31st December 2018.

13. Services provided by an agent of business correspondent (BC) to business correspondent (BC

Supply by an agent of BC is covered in this entry. It has a narrow coverage.

13.1 Supply Covered:

All services by an agent of a Business correspondent.

13.2 Supplier Covered:

An agent of the business correspondent.

13.3 Recipient Covered:

A Business Correspondent located in the taxable territory.

13.4 Date of applicability:

This provision was made applicable from 31st December 2018 via Notification No. 29/2018- Central Tax (Rate) dated 31st December 2018

14. Reverse charge in GST for Security Services Provided to a registered person

This is the latest entry in the list of RCM. The security personnel provided to a registered person will be covered here. In this case, tax will be paid by the recipient.

14.1 Supply Covered:

Security services i.e.services provided by way of supply of security personnel.

14.2 Supplier Covered:

Any person is other than a body corporate.

14.3 Recipient Covered:

A registered person located in taxable territory Except

(i) (a) a Department or Establishment of the Central Government or State Government or Union territory; or

(b) local authority; or

(c) Governmental agencies;

which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under section 51 of the said Act and not for making a taxable supply of goods or services; or

(ii) a registered person paying tax under section 10 of the said Act.

14.4 Issues:

Whether the supply made before 1st January 2019 but billed after that will be liable for this RCM or not. Time of supply provision provide a time limit of 30 days for raising an invoice for a service. In that case the time of supply is deemed to be the date of invoice. If we take a literal interpretation of this provision it will result in levy of RCM. Even when the service was actually provided before date of its applicability.

14.5 Date of applicability:

This provision is applicable from 31st December 2018 via Notification No. 29/2018- Central Tax (Rate) dated 31st December 2018.

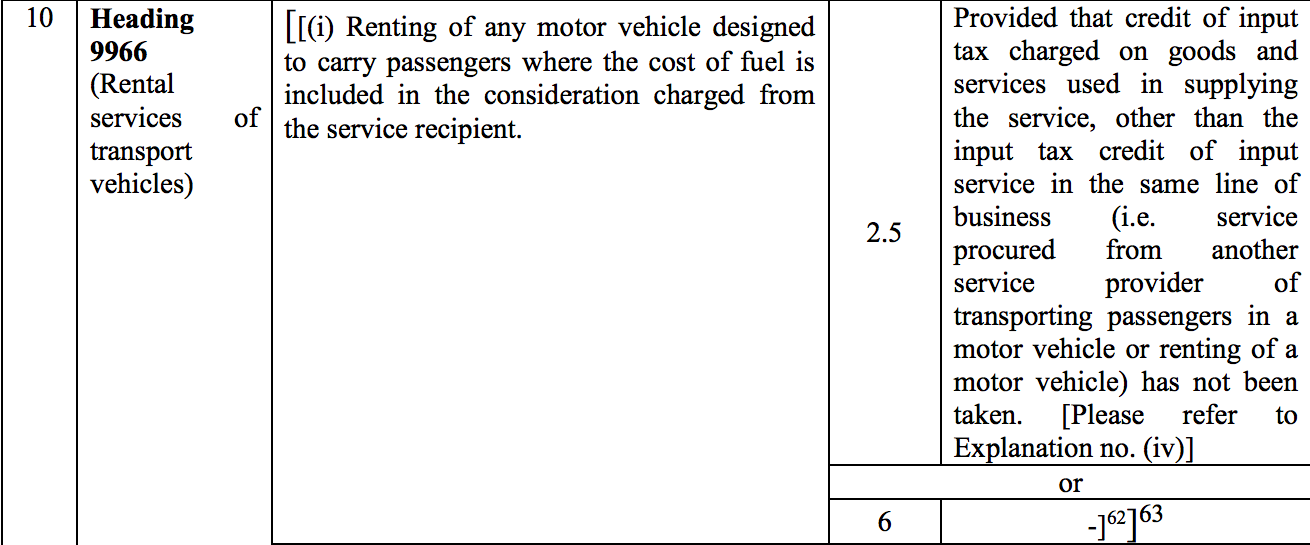

15. Renting of a Motor Vehicle:

15.1 Supply Covered:

Services provided by way of renting of a motor vehicle

15.2 Supplier Covered:

Any person other than a body corporate, paying central tax at the rate of 2.5% on renting of motor vehicles with input tax credit only of input service in the same line of business.

15.3 Recipient of service:

Any body corporate located in the taxable territory.

Let us simplify. The following table can summaries all the scenarios.

| Sl. No. | Supplier | Recipient | Applicability of RCM |

| 1. | Body Corporate | Body corporate | NA |

| 2. | Body Corporate | Other than body corporate | NA |

| 3. | Other than body corporate | Body corporate | Applicable |

| 4. | Other than body corporate | Other than body corporate | NA |

Also, the RCM is applicable only in those cases where the supplier is paying tax @5% with ITC of similar services. In case they are paying tax at 12 %, This RCM is not applicable. We need to understand this better. We should have a look at the tax rate of motor vehicle renting.

As you can see there are two options. The first is to pay at 5% and take limited ITC and the other is normal 12%. So the RCM will be applicable only on the first one.

16.Services of lending of securities under Securities Lending Scheme, 1997

16.1 Supply Covered

Services of lending of securities under Securities Lending Scheme, 1997 (“Scheme”) of Securities and Exchange Board of India (“SEBI”), as amended.

16.2 Supplier Covered:

Lender i.e. a person who deposits the securities registered in his name or in the name of any other person duly authorised on his behalf with an approved intermediary for the purpose of lending under the Scheme of SEBI.

16.3 Recipient of service:

Borrower i.e. a person who borrows the securities under the Scheme through an approved intermediary of SEBI.”

17. Reverse charge in GST on Import of services:

Import of services by a registered person or for business purpose are covered in this entry. The supply in GST also includes the import of services with consideration even if it is not for business.

17.1 Supply Covered:

Import of services from outside India. Services can be said to be imported when all of the following three conditions will be satisfied.

- The supplier of services is located outside India.

- The recipient of the services is located in India.

- The place of supply is located in India.

If all of these conditions are satisfied then it will be called an import of services. It can be of two types.

- OIDAR services.

- Other than OIDAR services.

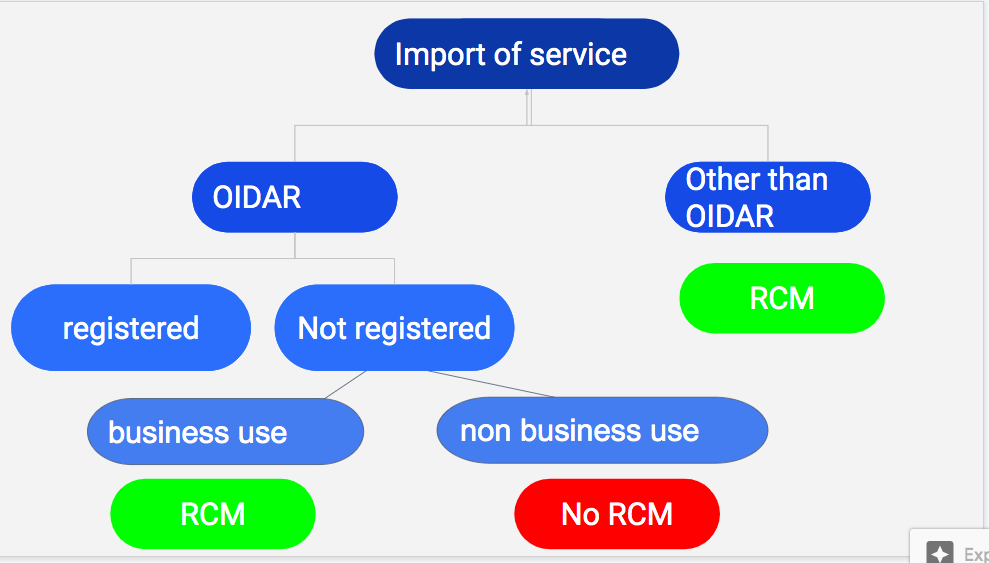

In case of OIDAR services the services will be covered in RCM only if it is imported by a non registered person for personal use. Non OIDAR services will always be covered in reverse charge. We can summarise this entire concept in following image.

17.2 Supplier Covered:

Supplier is a person located outside India. It is applicable for import of service.

17.3 Recipient covered:

The recipient is a person located in taxable territory. Although non taxable online recipient is exempted.This exemption is only when it is imported for personal use. In case of a registered entity it is covered in RCM even if it is without consideration.

18. Ocean Freight:

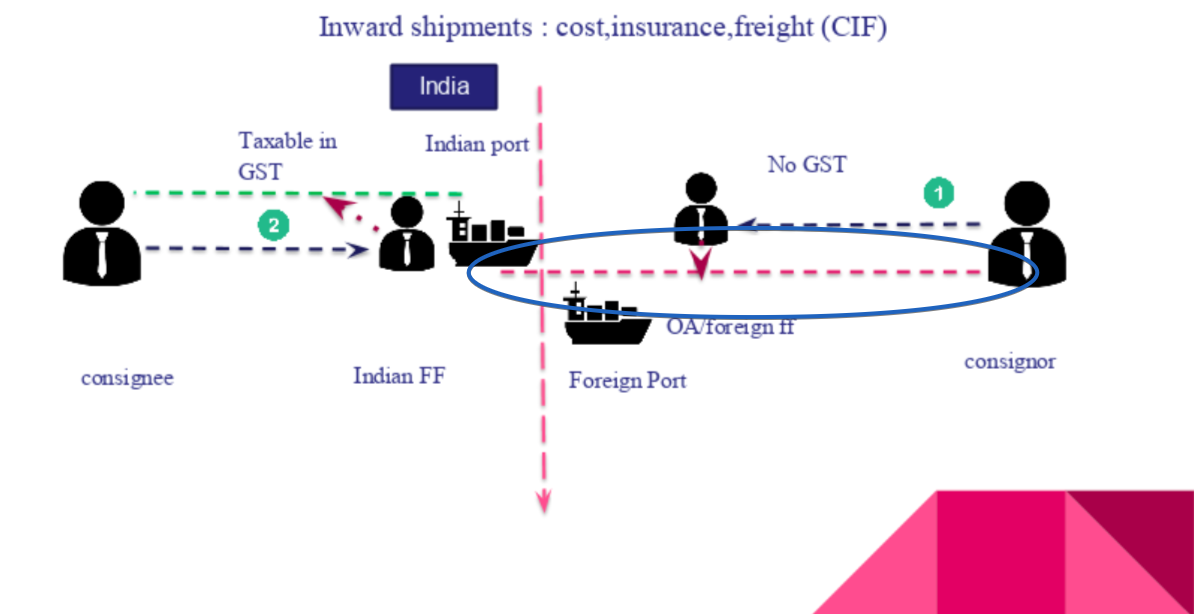

This is the most controversial entry in the RCM list. This entry covers the freight paid on import of goods by a person located outside India to a person located outside India. The constitutional validity of this entry is under challenge. In the case of Mohit minerals, this entry is challenged. Section 9(3) empowers the government to notify the recipient of services. Although the person notified here is not the recipient of service. Also, the tax payable at import is on total value including the value of freight. It is also double taxation.

18.1: Supply Covered:

Ocean freight is liable for RCM in this entry. You can better understand it via the image below.

18.2: Supplier Covered:

Here the supplier has no direct nexus with the recipient. The transportation of goods is outside India.

18.3: Supplier Covered:

Here the recipient covered is the person who has imported the Goods. The entry covers the importer. This term is defined in the Customs Act. In customs Act “importer” means

This is a comprehensive discussion on reverse charge in GST.

Download the pdf on RCM updated till 03 Oct 2019.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.