Reporting of data in annual return

Introduction:

Reporting of data in annual return is discussed in this article in detail. Annual return is required to be filed by every registered taxpayer. Various informations are required to be provided in annual return. Majorly following information is required:

- Supply

- Input tax credit

- Demand and refund

- HSN wise summary

- tax payable and paid

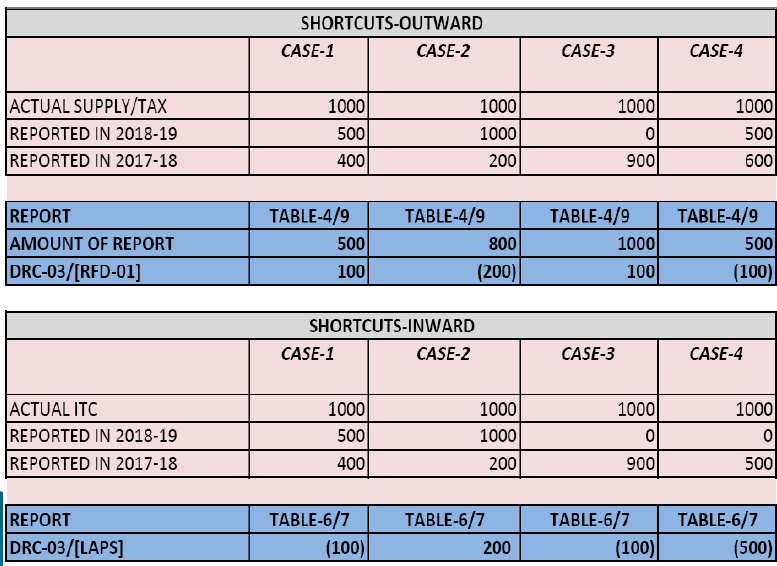

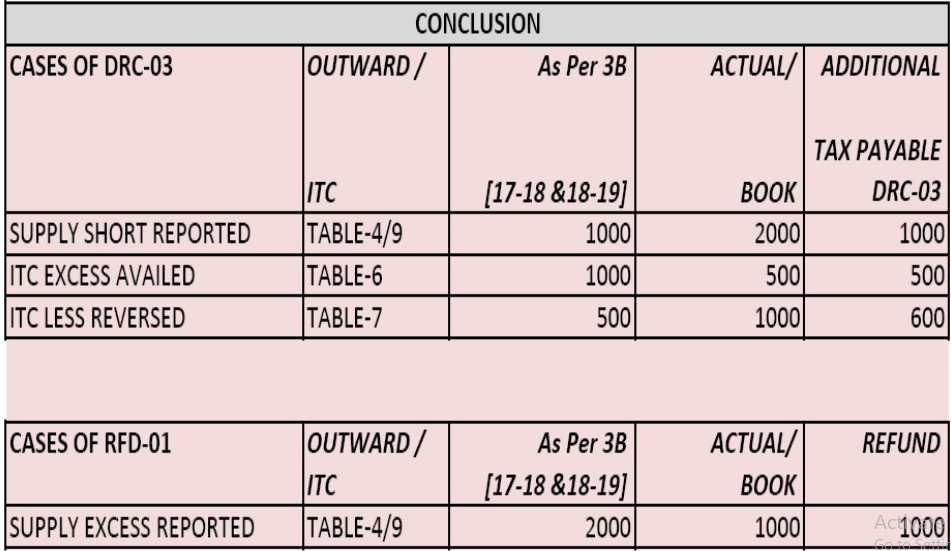

Various issues related to outward supply in annual return:

In this article various issues related to the reporting of supply in annual return is discussed. Their possible treatment is given.

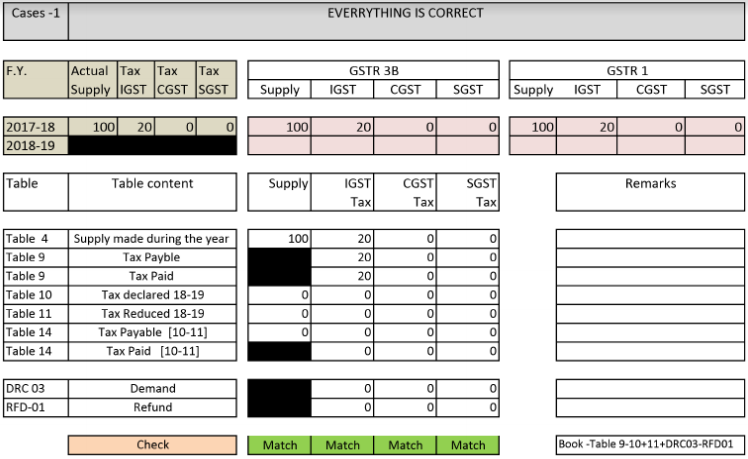

Case-1: When everything is reported correctly, How to report supply in annual return?

Reporting of data in annual return related to supply is discussed here.

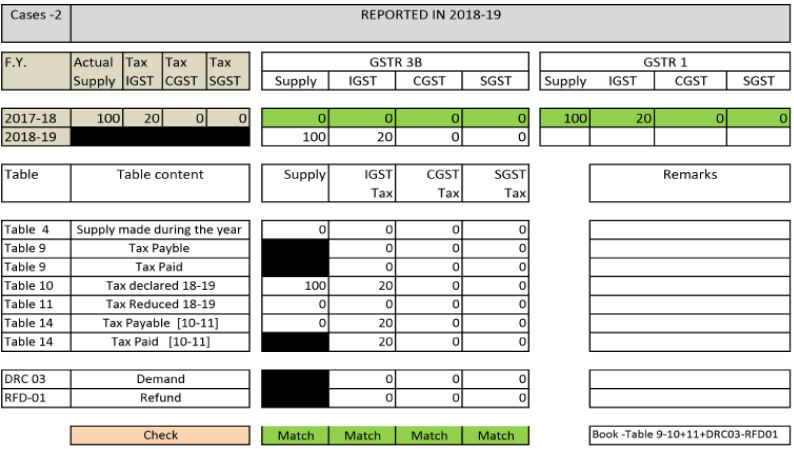

Case-2: How to report a supply in annual return when it is reported in next year?

Case-2: How to report a supply in annual return when it is reported in next year?

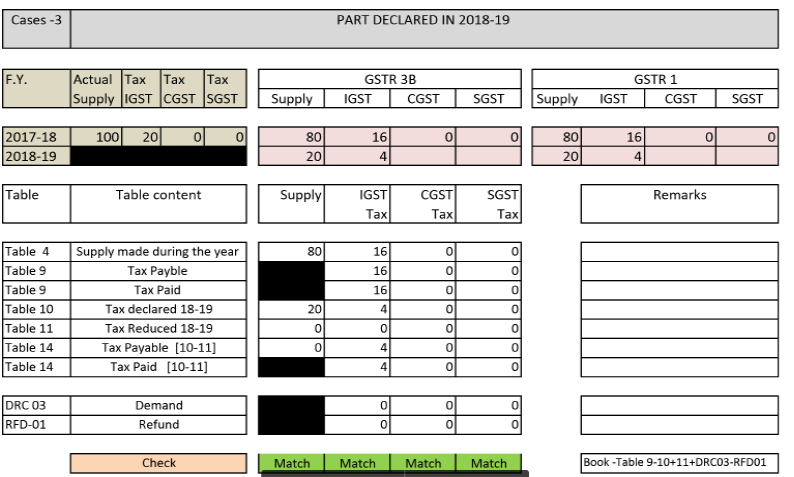

Case-3: How to report a supply in annual return when it is partly declared in 18-19?

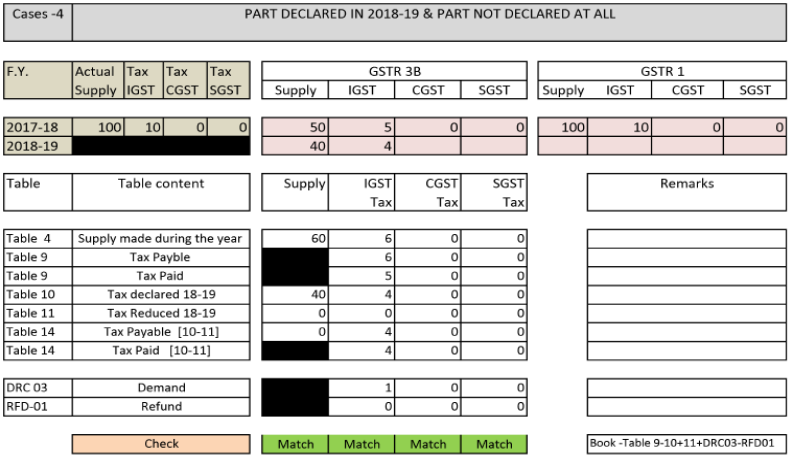

Case 4: How to report a supply in annual return when it is not declared at all:

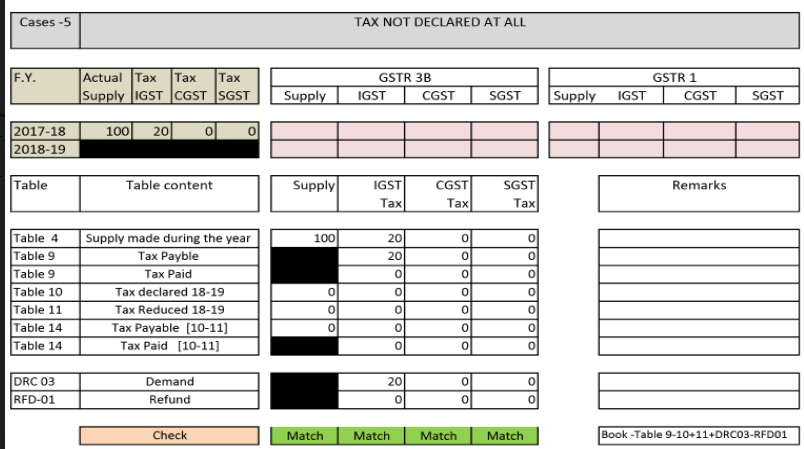

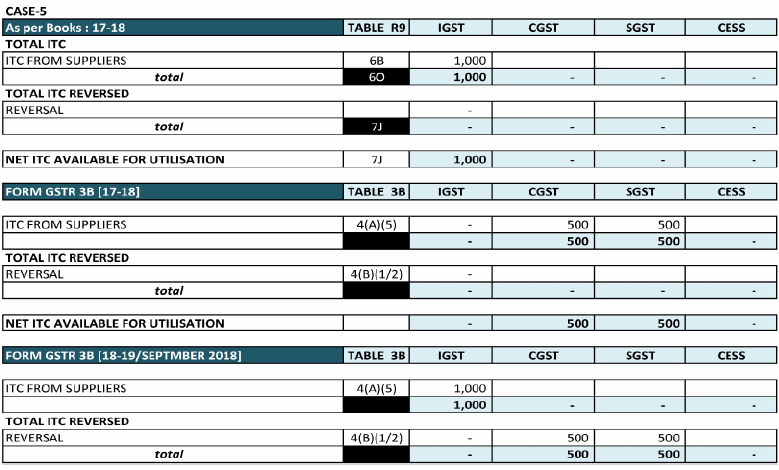

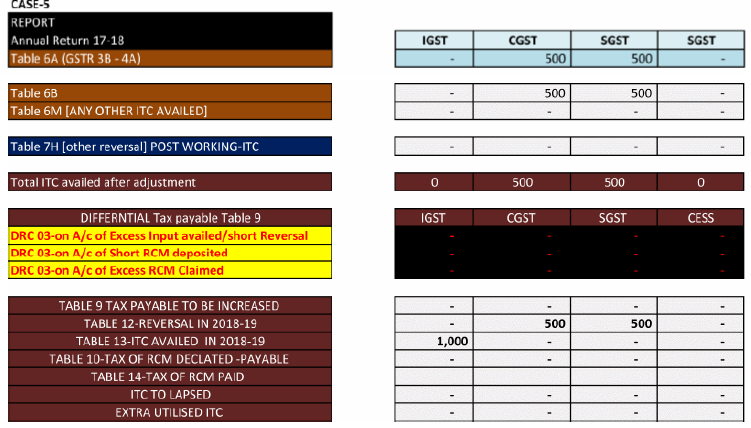

Case-5: How to declare the tax not paid in annual return?

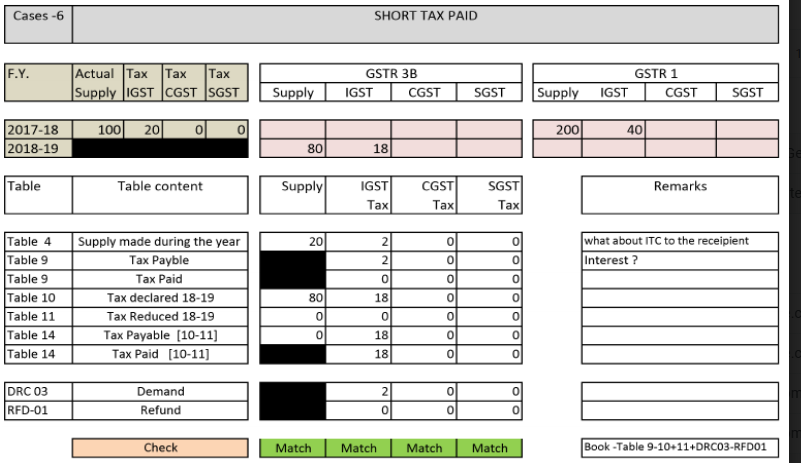

Case-6: How to report the short tax paid in annual return?

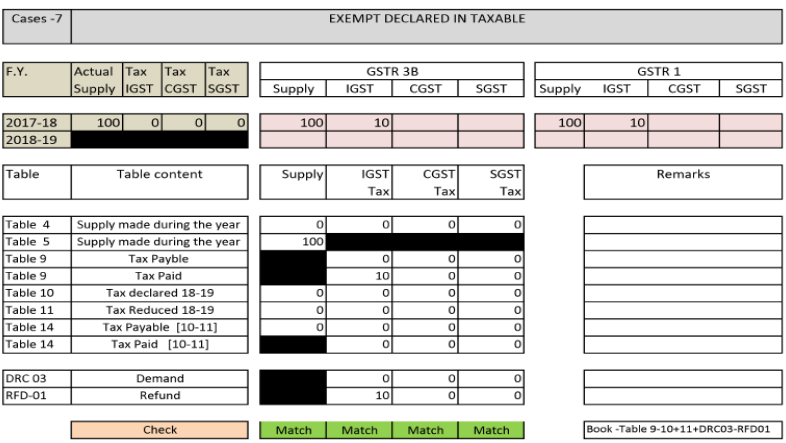

Case-7: How to report exempted supply declared as exempt?

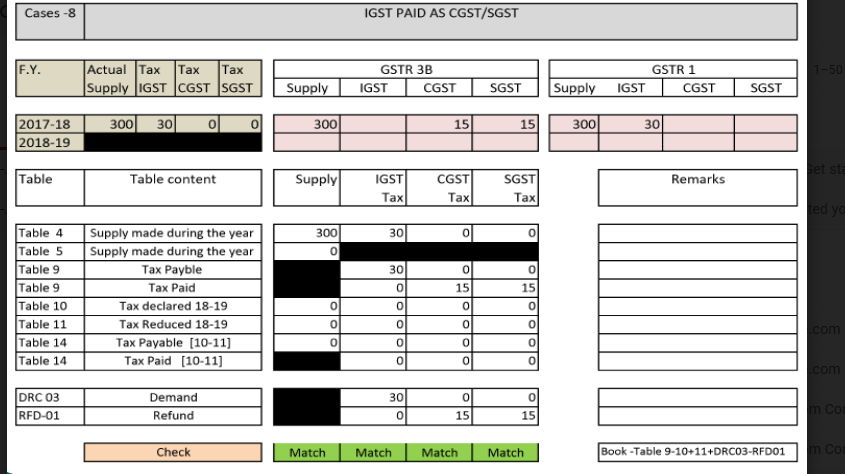

Case-8: How to declare IGST paid as CGST/SGST?

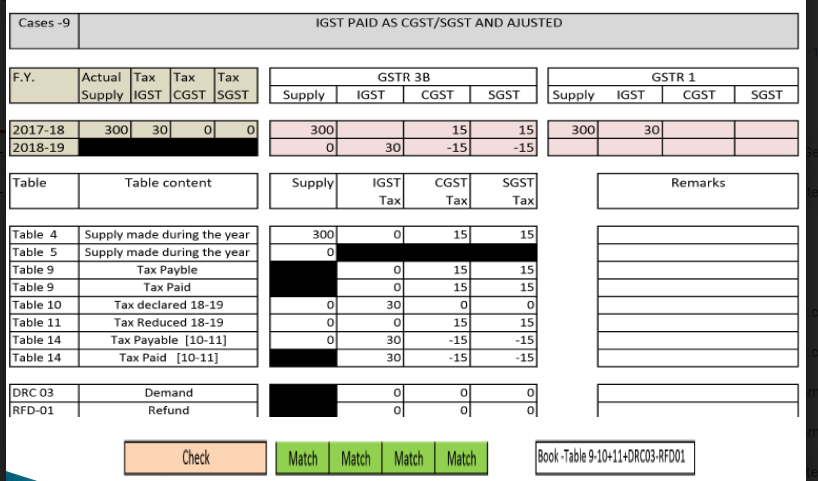

Case-9: How to report CGST/SGST paid as IGST and adjusted?

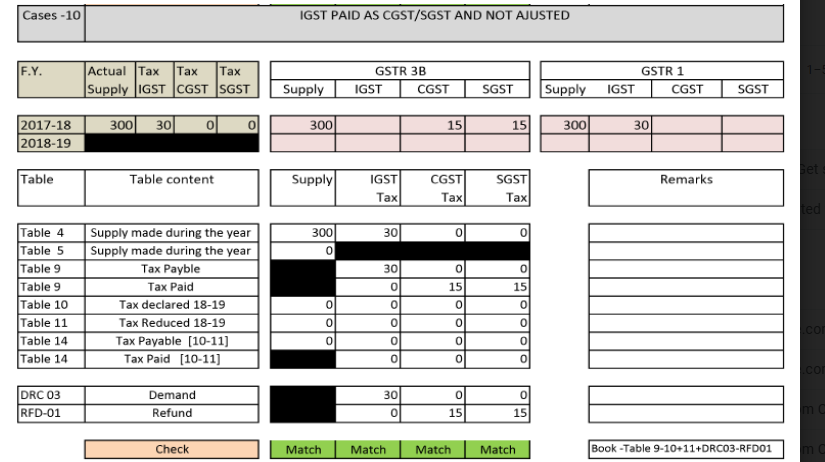

Case-10: How to report IGST paid as CGST/SGST and not adjusted?

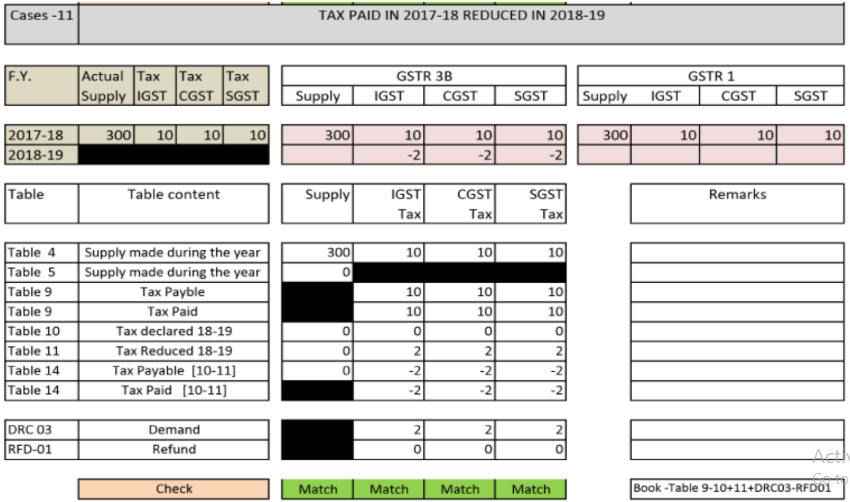

Case-11: How to report the tax paid in 17-18 and adjusted in 18-19?

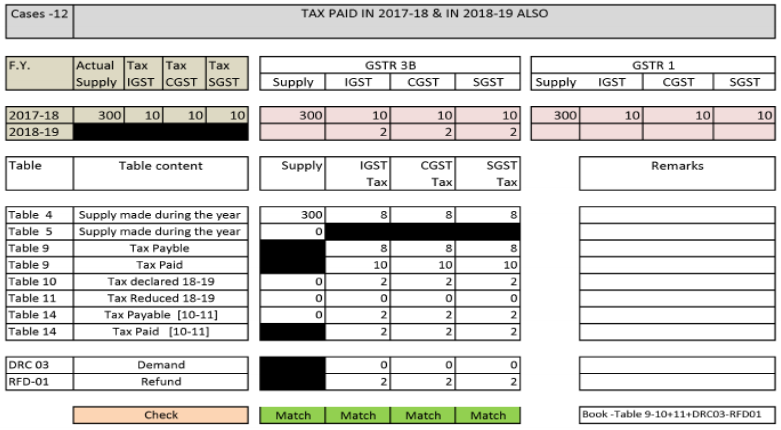

Case-12: How to report tax paid in 2017-18 in 18-19 also

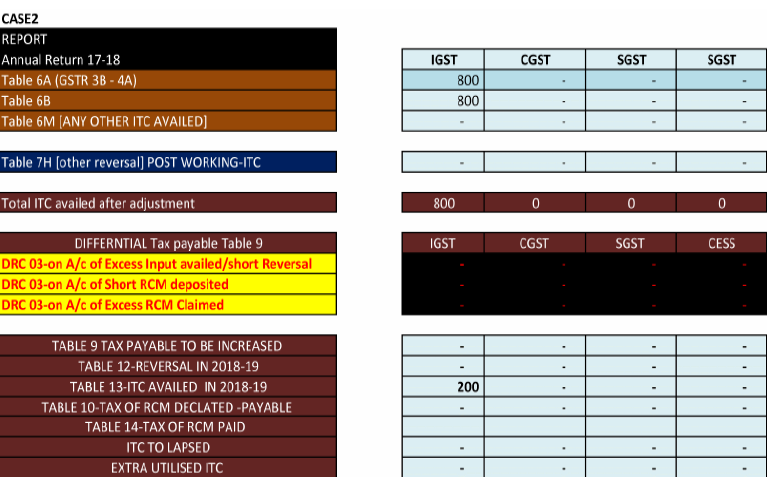

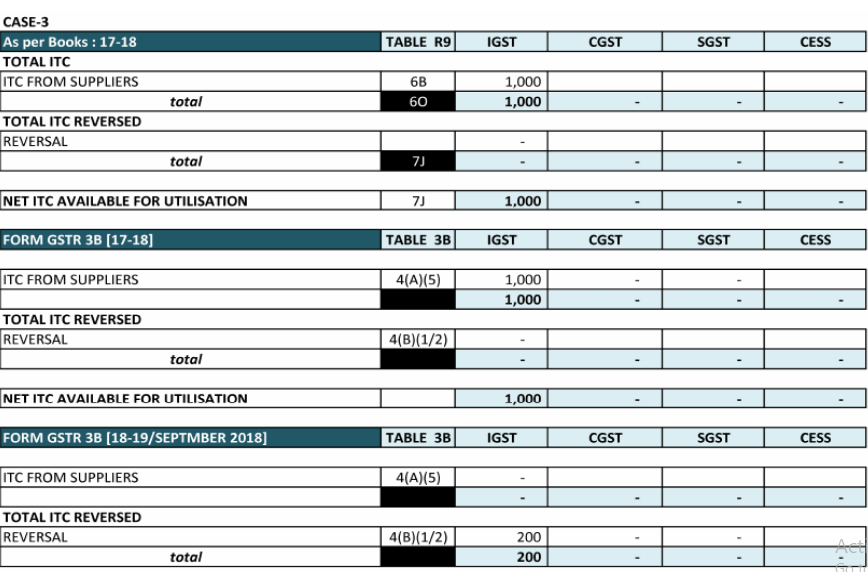

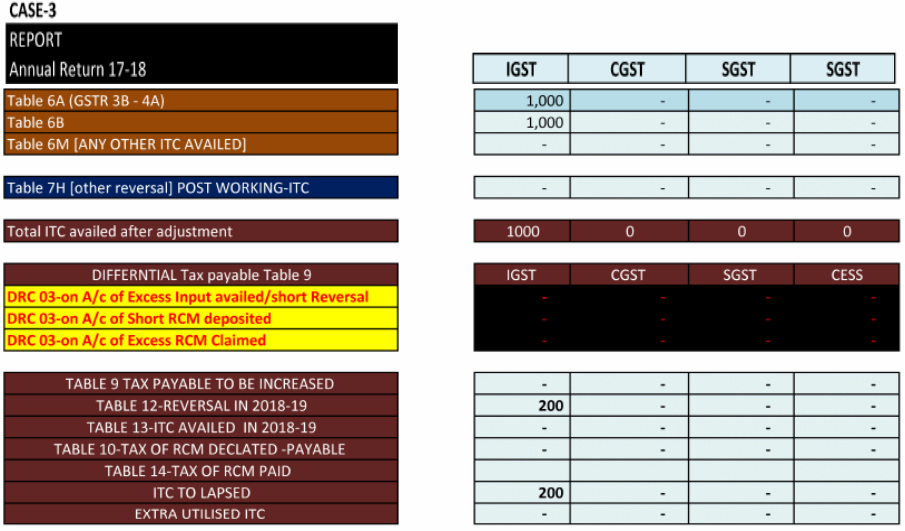

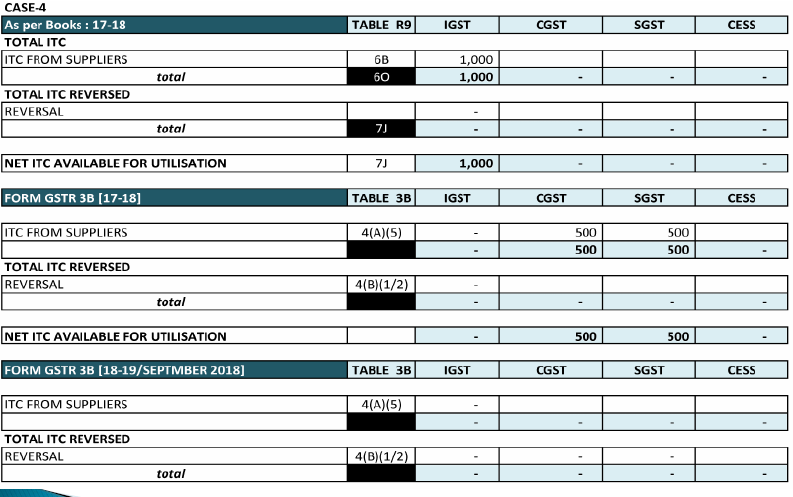

Reporting of Input tax credit in annual return:

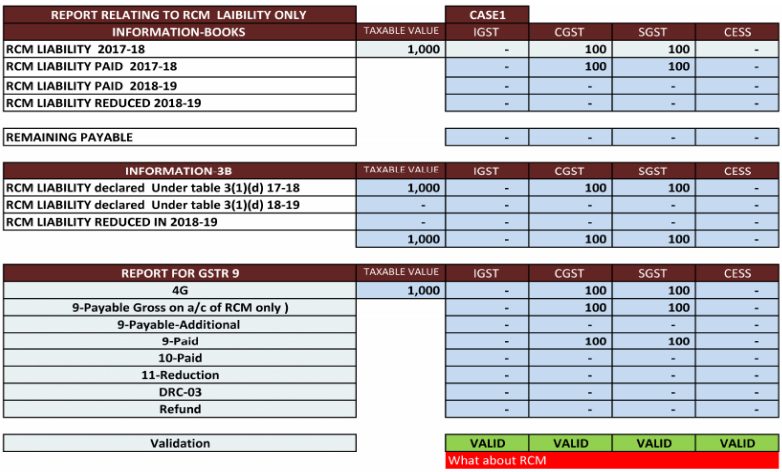

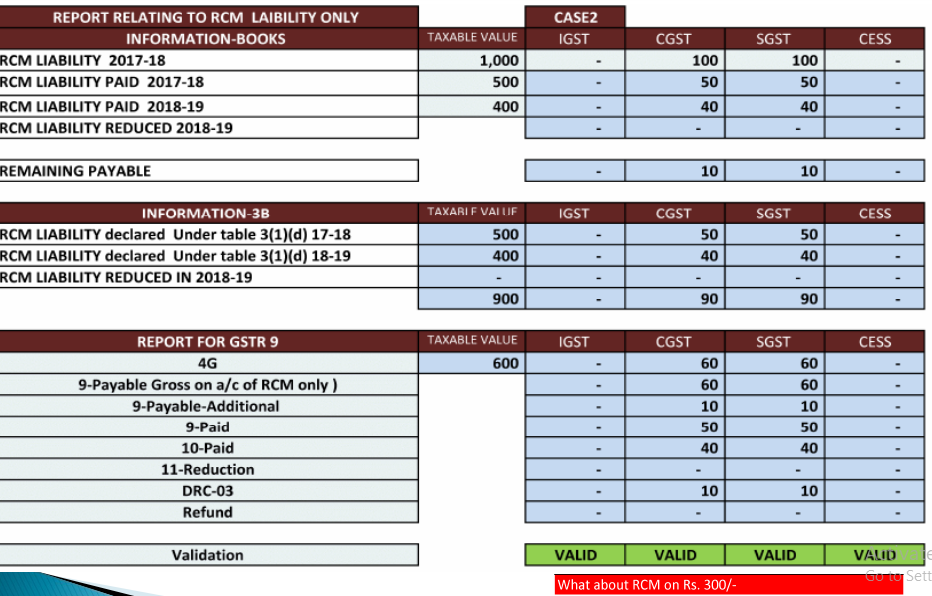

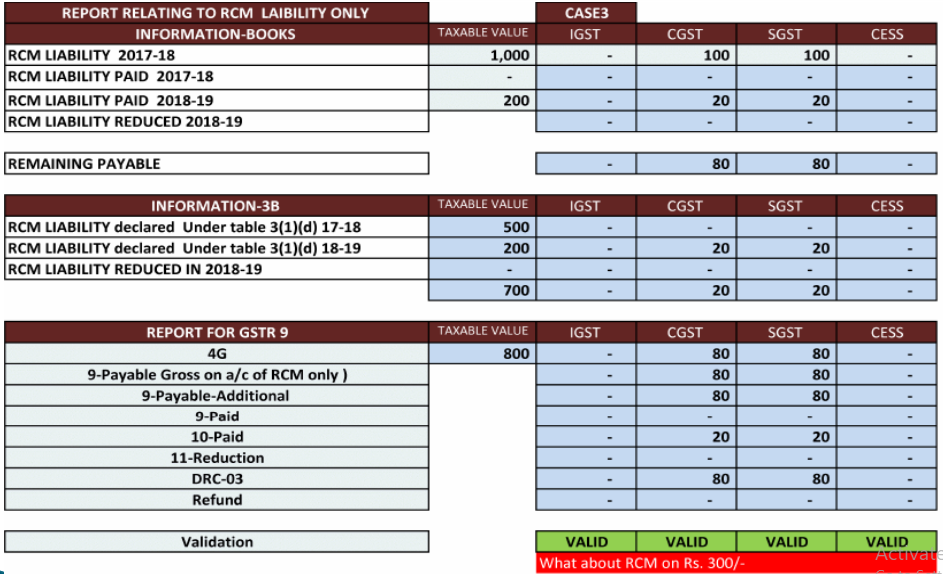

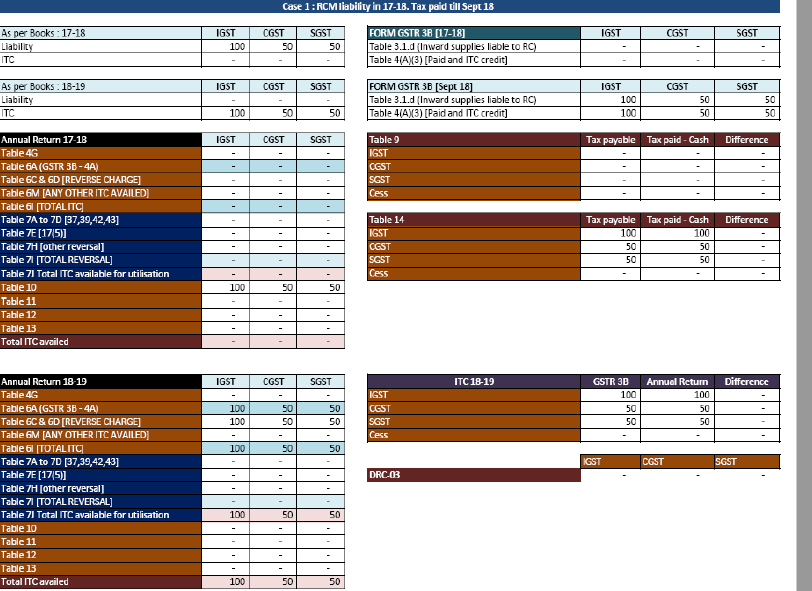

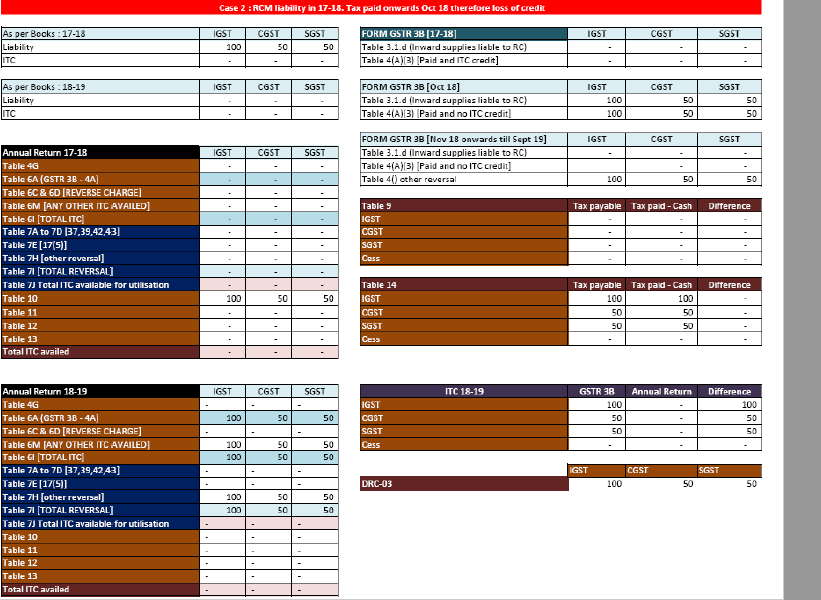

- Reporting of RCM liability

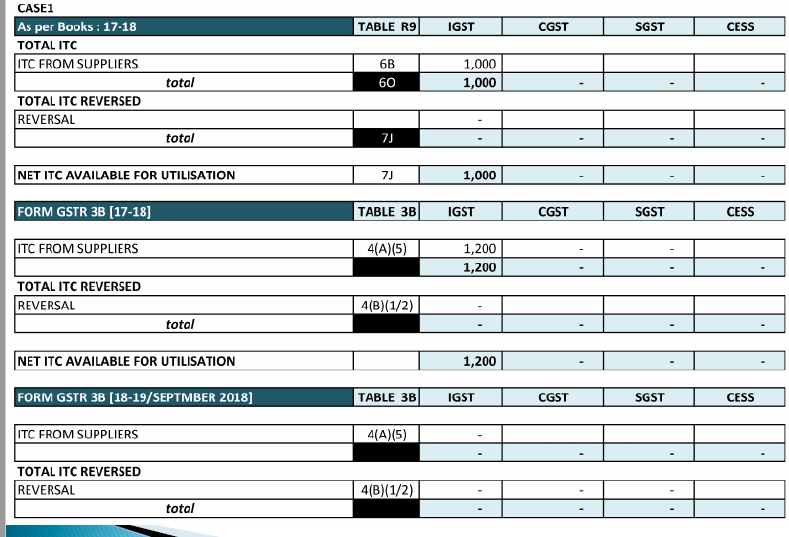

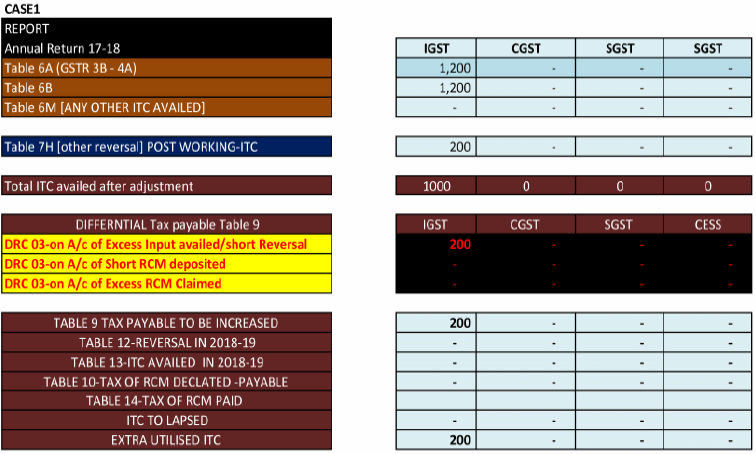

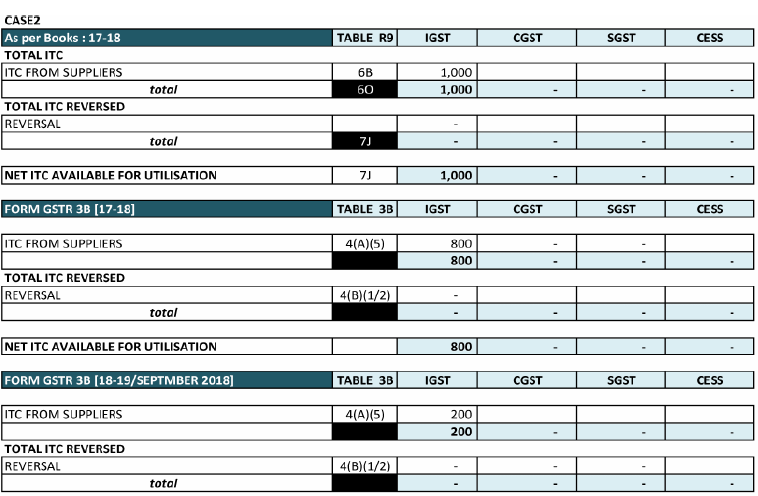

Case studies for reporting of Input tax credit:

If you already have a premium membership, Sign In.

CA Jatan Jain

CA Jatan Jain

Delhi, India

CA Jatan Jain is a partner of a firm M/s J P R M S & Co. and practicing in the field of direct and indirect taxes since 25 years. He is well versed with handling of assessment and litigation. He is known for his practical approach towards implementation of law harmoniously. He made various utilities to ease the working of professionals.