Reimbursement of electricity is a service: HC

Table of Contents

Introduction:

Reimbursement of electricity is a service for the purpose of service tax Act. In the present case the applicant was engaged in redistribution of electricity to its tenants. It is held that this redistribution is a supply of services. Reference from electricity Act was also drawn. The conditions in electricity Act prescribe a licensing for sale of electric energy. The nature of electric energy was also discussed. It is also clear that an electric energy is a goods and its sale will be the sale of goods only. The electricity Act prescribe a licensing requirement to trade electricity.

No other person is permitted the sale of electric energy. The argument of applicant was that sale of electricity without permission make it illegal but still the nature of transaction will still remain as sale of goods. Mere fact that requisite permission is not taken , it will not change the nature of transaction. It is held by honourable court that transmission of electricity from higher gauge cables to lower gauge is not a sale of goods but is a service.

What is decided in case of Srijan reality (p) limited for reimbursement of electricity

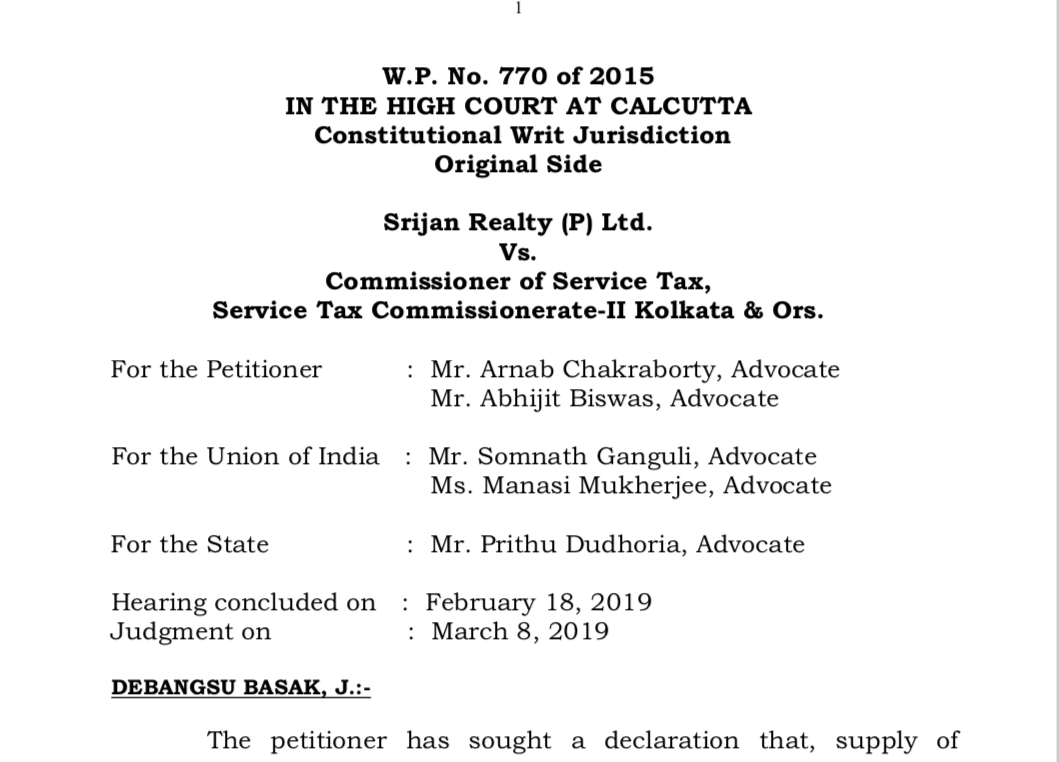

In case of Srijan realty (P) Ltd. Vs Commissioner of service Tax, It is held that redistribution of electricity will be a supply of service.

The applicant namely , Srijan Reality (P) Ltd. is having a mall in Asansol. The name of mall is galaxy mall. It let out the shops to the various tenants. The applicant has taken a electricity connection and has installed sub metres for the tenants. They raise invoice for electricity on tenants.

Facts of the case: The applicant argued that the supply of electricity is a supply of Goods. They provided various arguments for there stand. They also reproduced some provisions from the electricity Act which mentions that sale of electricity is a sale of goods. Some provisions from Finance Act were also reproduced. Relevant extracts from the previous judicial pronouncements was also made available.

After going through all those details honourable high court held that transaction of petitioner obtaining high-tension electric supply converting it to law -tension supply, and supplying it to the occupants, raising bills on such occupants and realizing the electricity consumption charges from such occupant is a service which the petitioner renders and such an activity is exigible to service tax under the Finance Act 1994.

What will be the Impact of Srijan reality decision on GST treatment of reimbursement of electricity expenses?

This is going to be a landmark case hitting many taxpayers. This is common practice in malls and other commercial complexes. Owner of property distribute the electricity and recover the expenses for it. But they are not authorised to sell electricity by the Electricity Act itself. It will make their activity a service.

In GST the landlords are following the same practice. Most of them are recovering GST as a pure agent. In this case two scenarios can be there:

- When the tenant have a separate metre from electricity department and pay the electricity bill directly: It will not be a part of valuation.

- Where the tenant have a separate connection but pays the bill to landlord and he make the payment of bill to electricity department: It will be a collection in capacity of a pure agent.

- Whether landlord have one connection and then instal the sub metres and recover electricity expenses from the tenants: It will be a supply leviable to GST.