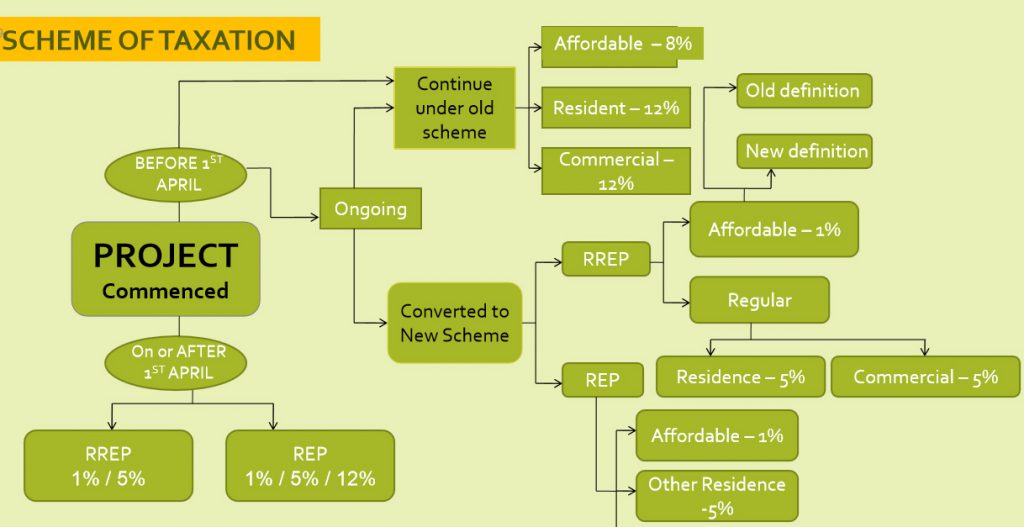

PPT on Real Estate Taxation Scheme From April 2019

Download the full PPT on Real Estate Taxation Scheme From April 2019 by clicking the image below:

CBIC issues notifications in March 2019 which related to a Real Estate Taxation Scheme.

Important Terminologies

- Ongoing Project – Project started before 1st April 2019 subject to conditions

- New Project – Project started on or after 1st April 2019

- What is the Project – Project means a project as defined under the Real Estate (Regulation and Development) Act, 2016 (RERA). It means every separate registration under RERA (even phase wise registrations) will be treated as a separate project for GST purposes.

- Issue: Whether an old project gets registration of a phase after 01st April 2019 will be considered as a new project??

Ongoing Project

If all the below conditions are getting satisfied as on 31st March 2019:

- Commencement certificate for the project has been issued &

- b) Construction for the project has started (earthwork for site preparation is completed and excavation for the foundation has started) and the same is certified by Architect or chartered engineer or licensed surveyor

- c) Completion certificate has not been issued or the first occupation for the project has not taken place

- d) Apartments being constructed under the project have been booked (wherein at least one installment is credited to the bank account) partly or wholly

A Project which does not qualify as the ongoing project will qualify as “New Project” which commences on or after 1st April 2019.

Types of projects:

- As per definitions, a project with commercial units up to 15% area of the total area of the project will be treated a Residential Real Estate Project (RREP). In other words, these commercial units will be treated as residential units.

- A project wherein the commercial unit’s area is more than 15% of the total area of the project will be known as the Real Estate Project (REP).

Affordable Residential Apartment

Two types of apartments qualify as Affordable Residential Apartment

- Residential unit fulfilling both the conditions:

- Having RERA Carpet area up to 60 sq meters in metro cities (Bengaluru, Chennai, Delhi NCR, Hyderabad, Kolkata, and Mumbai) or up to 90 sq meters in non-metro cities AND

- Gross amount charged for such unit is up to INR 45 Lakhs

- A unit which was qualifying as affordable housing unit under the earlier scheme (effective up to 31st March 2019). This is only for an ongoing project

You can find another article related to GST on Real Estate Amendments by clicking here.

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.