Provisions of E-Invoicing to be applicable from 1st October 2020

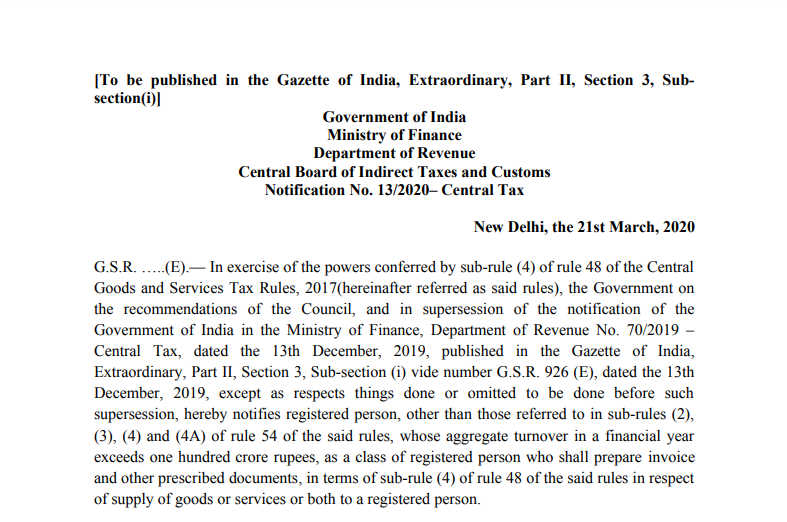

Notification No. 13/2020– Central Tax

G.S.R. …..(E).— In exercise of the powers conferred by sub-rule (4) of rule 48 of the Central Goods and Services Tax Rules, 2017(hereinafter referred as said rules), the Government on the recommendations of the Council, and in supersession of the notification of the Government of India in the Ministry of Finance, Department of Revenue No. 70/2019 – Central Tax, dated the 13th December 2019, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 926 (E), dated the 13th December 2019, except as respects things done or omitted to be done before such supersession, hereby notifies registered person, other than those referred to in sub-rules (2), (3), (4) and (4A) of rule 54 of the said rules, whose aggregate turnover in a financial year exceeds one hundred crore rupees, as a class of registered person who shall prepare the invoice and other prescribed documents, in terms of sub-rule (4) of rule 48 of the said rules in respect of the supply of goods or services or both to a registered person.

2. This notification shall come into force from the 1st of October, 2020.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.