Original order of GST AAR of M/s Indian Institute of Management

Original order of GST AAR of M/s Indian Institute of Management

Following is the original order of GST AAR of M/s Indian Institute of Management. In which the question tax liability of the services provided by the applicant is raised.

ORDER UNDER SUB-SECTION (4) OF SECTION 98 OF CENTRAL GOODS AND SERVICE TAX ACT, 2017 AND UNDER SUB-SECTION (4) OF SECTION 98 OF KARNATAKA GOODS AND SERVICES TAX ACT, 2017

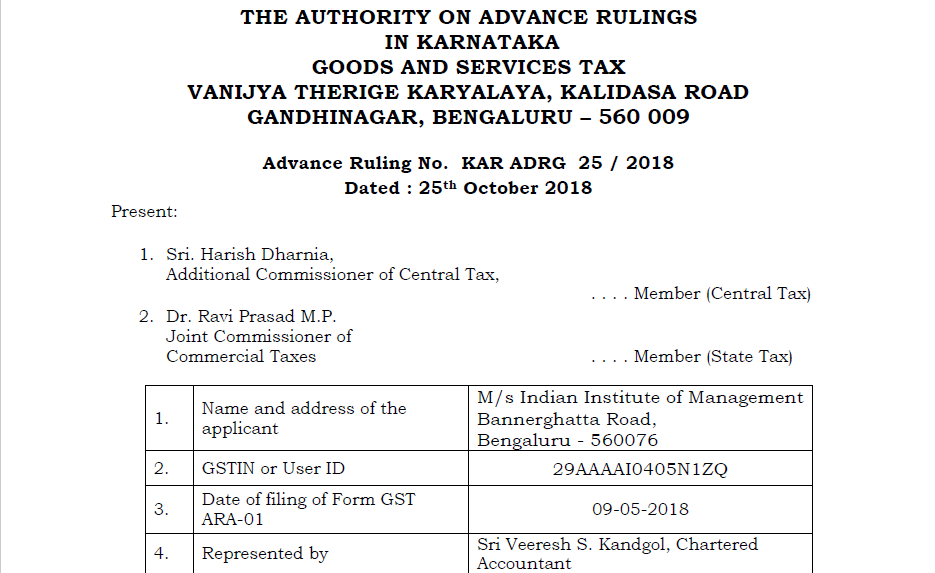

1. M/s Indian Institute of Management, Bangalore (called as the „Applicant‟ hereinafter), No.12, Bannerghatta Road, Bengaluru – 560076, having GSTIN number 29AAAAAI0405N1ZQ, has filed an application for Advance Ruling under Section 97 of CGST Act, 2017 and KGST Act, 2017 read with Rule 104 of CGST Rules 2017 & KGST Rules 2017, in form GST ARA-01 discharging the fee of Rs.5,000-00 each under the CGST Act and the KGST Act.

2. The Applicant is an Association of Persons and is registered under the Goods and Services Act, 2017. The applicant has sought advance ruling in respect of the following questions:

a) Whether the long duration post graduate diploma/ degree granting programmes offered by the Indian Institute of Management, Bengaluru other than specifically mentioned in Sl.No.67 of Notification No.12/ 2017 – Central Tax (Rate) dated 28th June 2017 as amended by Notification No.2 /2018 dated 25th January 2018 are exempted from the GST output liability on education as a part of a curriculum for obtaining a qualification recognized by any law for the time being in force in the light of enactment of the Indian Institute of Management Act, 2017?

b) Whether supply of online educational journals or periodicals to the Indian Institute of Management, Bengaluru is exempted from reverse charge liability of GST under Sl. No.66 of Notification No.12 / 2017 – Central Tax (Rate) dated 28th June 2017 as amended by Notification No. 2/2018 dated 25th January 2018 being education provided as a part of a curriculum for obtaining a qualification recognized by any law for the time being in force in the light of enactment of the Indian Institute of Management Act, 2017?

3. The applicant furnishes some facts relevant to the stated activity:

a. The applicant states that they are an educational institution of excellence established in the year 1973 with the objectives of imparting high-quality management education and training, conducting industrial and management research, etc. The applicant was established under the auspices of the Ministry of Human Resources Development (MHRD) Government of India as a premier educational institution and is renowned in India for its management education programs.

b. That the applicant was registered as a society with the Registrar of Societies, Mysore State (now Karnataka) vide No. 403/71-72 dated 27-03-1972 and is recognized world over as an institution of higher learning and seat of academic excellence in the field of management.

c. The Indian Institute of Management Act, 2017 was passed and it received the assent of the President on 31st December, 2017 with an object to declare certain Institutes of Management (IIMB is one among the schedule annexed to the Act) to be institutions of national importance with a view to empower these institutions to attain global excellence in management, management research and allied areas of knowledge and to provide for certain other matters connected therewith or incidental thereto.

d. The Government of India notified the Act in the Gazette of India on 31st January 2018. Now by the enactment of The Indian Institute of Management Act, 2017, IIMB is a body corporate as per Section 4 of the said Act.

e. IIMB‟s vision is to develop leaders and entrepreneurs through holistic, transformative and innovative education. Since the years of its existence, IIMB has developed a portfolio of programmes which cater to multiple sectors of society. The IIMB nurtures a teaching philosophy which encourages students to apply their learning in solving the real-life challenges around the world. IIMB currently offers 5 long duration programmes which collectively develop entry and middle-level management professionals for companies, government, and non-governmental organizations. IIMB also offers certificate programmes of short and long durations under Executive Education Programmes for mid and senior level Executives.

f. The applicant has provided the details of long duration programmes offered by it and its taxability is given in the table as below:

| Sl. No. | Programmes Offered | Period | Taxability under GST as per Notification No. 12/2017 –Central Tax (Rate) dtd 28-06-2017 |

1. |

Fellow Programme in Management (FPM) is a full time doctoral programme and is committed to train individual who will excel in their area of research through publication of high quality work of international standard | 5 Years | Exempted |

2. |

Post Graduate Programme in Management (PGP) is designed to equip student with skill and capabilities that will enable them to reach a responsible global position in management. The PGP revolves around the principle that world-class business leaders are not mass produced; they are nurtured and developed in a practical application-oriented, user-friendly environment. This is a flagship MBA degree equivalent programme where students are admitted through CAT | 2 Years | Exempted |

g. The applicant has also provided a table containing the programmes which they feel are exempted post enactment of IIM Act 2017

| Sl. No. | Programmes Offered | Period | Taxability under GST as per Notification No. 12/2017 –Central Tax (Rate) dtd 28-06-2017 |

1. |

Post Graduate Programme in Public Policy and Management (PGPPM) catalyzed by the Government of India and United Nations Development Program, the PGPPM is packed with path breaking inside about winning policy and making management strategies | 1 Year | Exempted |

2. |

Post Graduate Programme in Enterprise Management (PGPEM) is a weekend management program, designed for middle and senior level working professionals. Participants learn from World Class faculty, while strengthening their network through collaboration with peers during their on-campus long week-end session | 2 Years | Exempted |

3. |

Post Graduate Programme in Management (EPGP) is an intensive program designed to enhance skills and capabilities essential for responsible position at senior management level. Challenging widespread and globally oriented, the objective of this programme is to produce future leaders who can handle the dynamic corporate environment. | 1 Year | Exempted |

h. The applicant states that currently certain programmes offered by IIM are exempted as per the Notification No. 12/ 2017 – Central tax (Rate) dated 28th June, 2017. As per the applicant the relevant Heading 9992 vide Sl. No. 67 under which exemption to programmes offered by IIM. The said entry is reproduced as under:

| Sl. No. | Chapter, Section, Heading, Group or Service Code (Tariff) | Description of Services | Rate (percent.) | Condition |

| 67. | Heading 9992 | Services provided by the Indian Institutes of Management, as per the guidelines of the Central Government, to their students, by way of the following educational programmes, except the Executive Development Programme: (a) Two-year full-time Post Graduate Programmes in Management for the Post Graduate Diploma in Management, to which admissions are made on the basis of Common Admission Test (CAT) conducted by the Indian Institute of Management; (b) Fellow programme in Management; (c) Five-year integrated programme in management |

Nil | Nil |

In the light of the change in the constitution due to the enactment of the Indian Institute of Management Act, 2017, IIMB is now a body corporate governed by the said Act. Therefore, in the above background, IIMB has preferred this application for Advance Ruling in respect of the questions raised, since the Notification No. 12/2017–Central Tax (Rate) dated 28th June 2017 has not addressed the current change in Constitution in respect of IIMB.

i. The applicant has reproduced the provisions of the Indian Institute of Management Act, 2017 in support of awarding of educational qualification which is recognized by the said Act:

- Section 2 : Declaration of certain institutions as institutions of national importance.

“Whereas the objects of the Institutes mentioned in the Schedule are such as to make them institutions of national importance, it is hereby declared that each such institute is an institution of national importance.” - Section 3 (h) – “Institute” means any Institute mentioned in column (5) of the Schedule;

- Section 4: Incorporation of Institutes

(1) On and from the commencement of this Act. Every existing Institute shall be a body corporate by the same name as mentioned in column (5) of the Schedule. - Section 7: Powers and functions of Institute

Subject to the provisions of this Act, every institute shall exercise the following powers and perform the following functions, namely:

(f) to grant degrees, diplomas, and other academic distinctions or titles and to institute and award fellowships, scholarships, prizes and medals, honorary awards and other distinctions;

- Section 8: Institutes to be open to all irrespective of sex, race, creed, caste or class:

Provided further that every such institute shall be a Central Educational Institution for the purposes of the Central Educational Institutions (Reservation in Admission) Act, 2006. - Section 9: Institute to be not-for-profit legal entity.

(1) Every institute shall be a not-for-profit legal entity and no part of the surplus, if any, in revenue of such institute, after meeting all expenditure in regard to its operations under this Act, shall be invested for any purpose other than for the growth and development of such Institute or - Section 11. Power and functions of the Board

(d) to establish departments, faculties or schools of studies and initiate programmes or courses of study at the Institute;

(f) to grant degrees, diplomas, and other academic distinctions or titles, and to institute and award fellowships, scholarships, prizes and medals;

(g) to confer honorary degrees in such manner as may be specified by the regulations‟

(h) to grant honorary awards and other distinctions;

(o) to specify by regulations the institution of fellowships, scholarships, medals and prizes; - Section 15: Powers and functions of Academic Council.

(1) The Academic Council shall perform the following functions, namely:

(a) to specify the criteria and process for admission to courses or programmes of study offered by the institute;

(b) to specify the academic content of programmes and courses of study and undertake modifications therein;

(c) to specify the academic calendar, guidelines for conduct of examination and recommend grant of degrees, diplomas and other academic distinctions or titles. - Section 32: Returns and information to be provided to Central Government.

Every Institute shall furnish to the Central Government such returns or other information with respect to its policies or activities as the Central Government may, for the purpose of reporting to the Parliament or for the making of policy, from time to time, require. - Section 36: Ordinances how made.

(1) Save as otherwise provided in this section, Ordinance shall be made by the Academic Council.

(2) Subject to the provisions of this Act and the rules and regulations made thereunder, the Ordinances of every Institute may provide for all or any of the following matters, namely:

(b) the courses of study to be laid down for all degrees and diplomas of the Institute

Download the Copy of the Original order of GST AAR of M/s Indian Institute of Management. By clicking the below image:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.