Original copy of GST AAR Of The Bengal Rowing Club

In the GST AAR OF The Bengal Rowing Club, the applicant has raised the query regarding the applicable rate on the services provided by them. Following is the order of GST AAR OF The Bengal Rowing Club:

Order:

1. Admissibility of the Application

1.1 The Applicant is stated to be a company limited by guarantee and registered with ROC as a nonprofit making company. It is engaged in providing its members privileges and amenities of a club such as swimming facility, gymnasium, indoor games, restaurant service etc. It seeks an advance ruling on the rate of GST applicable on the services it offers, like the restaurant service offered along with the supply of food, services like valet parking, music, decoration and other such services associated with organizing social gatherings etc. The Applicant also wants to know the admissible proportion of the input tax credit for services other than the supply of food.

1.2 The Applicant seeks an advance ruling on the applicable rate of tax. The concerned officer from the Revenue submits that the questions raised are not admissible for an advance ruling under section 97(2) of the GST Act. Clauses under section 97(2) do not cover the rate of tax as an issue on which advance ruling is admissible.

1.3 Section 97(2)(b) of the GST Act empowers this Authority to pronounce a ruling on the applicability of a notification issued under the GST Act. It includes questions to ascertain the applicability of any entry of the rate notifications issued, specifying the rate of tax or exemption from payment of tax. The Applicant’s questions are related to applicability of different entries of Notification No. 11/2017 – CT Page 2 of 4 (Rate) dated 28/06/2017 (corresponding State Notification No. 1135 – FT dated 28/06/2017), as amended from time to time, collectively called hereinafter the Rate Notification.

1.4 The questions raised by the Applicant are, therefore, admissible under section 97(2)(b) of the GST Act. The Applicant also declares that the issues raised in the application are not pending nor decided in any proceedings under any provisions of the GST Act. The officer concerned from the Revenue has raised no objection on that point.

1.5 The Application is, therefore, admitted.

Download the pdf of GST AAR OF The Bengal Rowing Club, by clicking the below image:

2. Submissions of the Applicant

2.1 In its written submission the Applicant provides in detail the rates at which it now charges GST on its various supplies. It also submits that input tax credit attributable to supplies other than food is apportioned following rules 42 and 43 of the CGST Rules, 2017 / WBGST Rules, 2017 (hereinafter collectively called ‘the GST Rules’).

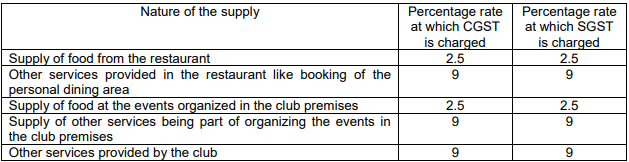

2.2 The rates at which the Applicant charges GST on various supplies are provided in the table below.

3. Observation & Findings of the Authority in AAR Of The Bengal Rowing Club

3.1 The Applicant’s services can broadly be classified into two categories: supply of food, by way of or as part of the services provided at its restaurant or at the social events organized in the club premises, and other services to the members and the guests that are not bundled with the supply of food and are charged separately.

3.2 Supply of food, by way of or as part of any service or in any other manner whatsoever, is a composite supply, which shall be treated as service in terms of Para 6(b) of Schedule II of the GST Act. It is classifiable under SAC 9963 and taxable under different clauses of Sl No. 7 of the Rate Notification. When the Applicant makes such a supply of food from its restaurant, along with eating facility and ambience and other amenities, whether or not the food is consumed at the restaurant or taken away, it is taxable under Sl No. 7(i) or 7(iii) of the Rate Notification, depending upon the criteria mentioned therein. If the Applicant provides no lodging service, such supplies of food will be taxable under Sl No. 7(i) of the Rate Notification, provided no credit of the input tax is taken.

3.3 If food is supplied by way of or as part of the services associated with organizing social events at the club premises, together with renting of such premises, it will be taxable under Sl No. 7(vii) of the Rate Notification. Supply of any other goods in such an event will also be taxable under Sl No. 7(vii) of the Rate Notification.

3.4 All other services offered by the Applicant, being services of a membership organization, are classifiable under SAC 9995 and taxable under Sl No. 33 of the Rate Notification. They include swimming and other facilities and services that are not bundled with the supply of food and charged separately, whether or not provided at the restaurant or at any other place.

3.5 If the Applicant charges GST under Sl No. 7(i) of the Rate Notification on his supplies from the restaurant, he will not be able to claim a credit of input tax on such supplies. Explanation 4(iv) to the Rate Notification clarifies that wherever a rate has been prescribed in the Rate Notification subject to the condition that credit of input tax charged on goods or services used in supplying the service has not been taken, it shall mean that (a) credit of input tax charged on goods or services used exclusively in supplying such service has not been taken, and (b) credit of input tax charged on goods or services used partly for supplying such service and partly for effecting other supplies eligible for input tax credits, is reversed as if supply of such service is an exempt supply and attracts provisions of section 17(2) of the GST Act. Section 17(2) & (6) of the GST Act read with rules 42 and 43 of the GST Rules provide the method and the manner in which input tax credit should be attributed for effecting taxable supplies when some are exempt supplies and the other ones are taxable supplies. The Applicant should, therefore, apply the provisions under section 17(2) & (6) for apportionment of the input tax credit, treating supplies, if any, taxable under Sl No. 7(i) of the Rate Notification, as exempt supplies.

In view of the foregoing, we rule as under

RULING in AAR Of The Bengal Rowing Club

Supply of food, by way of or as part of any service or in any other manner whatsoever, from the Applicant’s restaurant is classifiable under SAC 9963 and taxable under Sl No. 7(i) or 7(iii) of the Notification No. 11/2017-CT (Rate) dated 28/06/2017 (corresponding State Notification No. 1135-FT dated 28/06/2017), depending upon the criteria mentioned therein.

If food is supplied by way of or as part of the services associated with organizing social events at the club premises, together with renting of such premises, it will be classifiable under SAC 9963 and taxable under Sl No. 7(vii) of the above-mentioned rate notification. All other services offered by the Applicant are classifiable under SAC 9995 and taxable under Sl No. 33 of the above rate notification.

The Applicant should apply the provisions under section 17(2) & (6) of the GST Act, read with rules 42 and 43 of the GST Rules, for reversal of input tax credit, treating supplies, if any, taxable under Sl No. 7(i) of the above rate notification, as exempt supplies. Reference to food in this ruling includes the supply of other articles of human consumption and drink (whether or not alcoholic liquor).

This Ruling is valid subject to the provisions under Section 103 until and unless declared void under Section 104(1) of the GST Act

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.