Notification No. 66/2018 – Central Tax

Notification No. 66/2018 – Central Tax

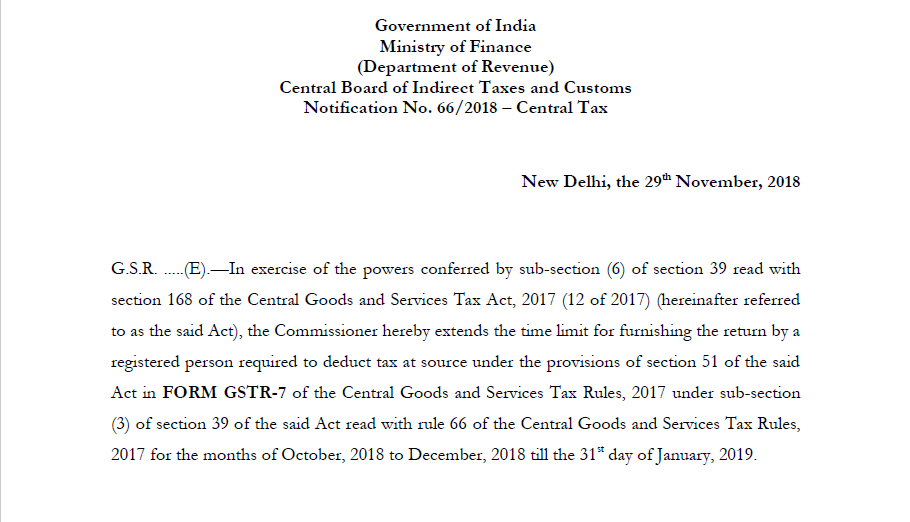

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 66/2018 – Central Tax

New Delhi, the 29th November 2018

G.S.R. …..(E).—In exercise of the powers conferred by sub-section (6) of section 39 read with section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereinafter referred to as the said Act), the Commissioner hereby extends the time limit for furnishing the return by a registered person required to deduct tax at source under the provisions of section 51 of the said Act in FORM GSTR-7 of the Central Goods and Services Tax Rules, 2017 under sub-section (3) of section 39 of the said Act read with rule 66 of the Central Goods and Services Tax Rules, 2017 for the months of October, 2018 to December, 2018 till the 31st day of January, 2019.

[F. No. 20/06/17/2018-GST (Pt. I)]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India

Download the Notification No. 66/2018 – Central Tax, by clicking the below Image:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.