Notification No. 62/2018 – Central Tax

Notification No. 62/2018 – Central Tax

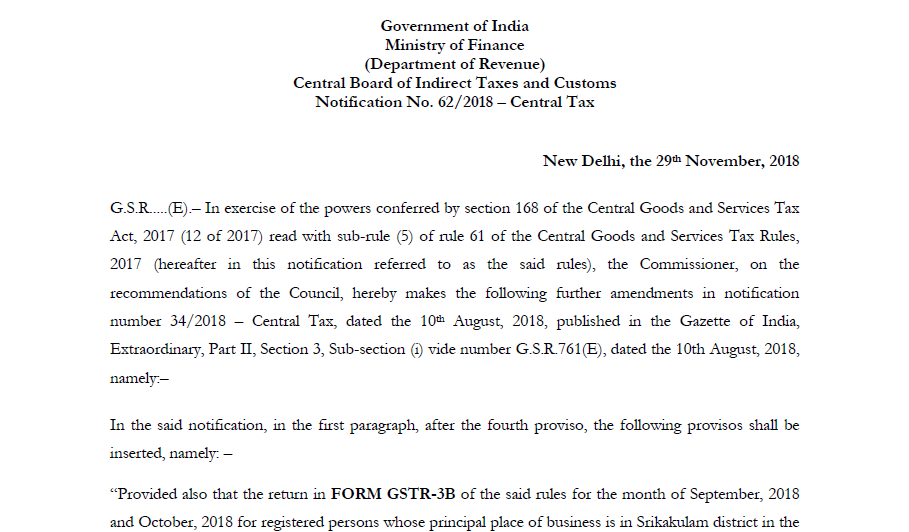

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 62/2018 – Central Tax

New Delhi, the 29th November 2018

G.S.R…..(E).– In exercise of the powers conferred by section 168 of the Central Goods and Services Tax Act, 2017 (12 of 2017) read with sub-rule (5) of rule 61 of the Central Goods and Services Tax Rules, 2017 (hereafter in this notification referred to as the said rules), the Commissioner, on the recommendations of the Council, hereby makes the following further amendments in notification number 34/2018 – Central Tax, dated the 10th August, 2018, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.761(E), dated the 10th August, 2018, namely:–

In the said notification, in the first paragraph, after the fourth proviso, the following provisos shall be inserted, namely: –

“Provided also that the return in FORM GSTR-3B of the said rules for the month of September, 2018 and October 2018 for registered persons whose principal place of business is in Srikakulam district in the State of Andhra Pradesh shall be furnished electronically through the common portal, on or before the 30th November 2018:

Provided also that the return in FORM GSTR-3B of the said rules for the month of October, 2018 for registered persons whose principal place of business is in Cuddalore, Thiruvarur, Puddukottai, Dindigul, Nagapattinam, Theni, Thanjavur, Sivagangai, Tiruchirappalli, Karur and Ramanathapuram in the State of Tamil Nadu shall be furnished electronically through the common portal, on or before the 20th December, 2018.”.

[F. No. 20/06/17/2018-GST (Pt. I)]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India

Download the Notification No. 62/2018 – Central Tax, by clicking the below image:

Note:- The principal notification number 34/2018 was published in the Gazette of India, vide number G.S.R. 761(E), dated the 10th August, 2018 and was last amended by notification no. 55/2018, dated the 21st October, 2018, published in the Gazette of India, Extraordinary, vide number G.S.R. 1050(E), dated the 22nd October, 2018.

Source: http://www.cbic.gov.in/resources//htdocs-cbec/gst/notfctn-62-central-tax-english-2018.pdf <rel=”nofollow”>

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.