Notification No.25 /2018-Central Tax (Rate)

Notification No.25 /2018-Central Tax (Rate)

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(Department of Revenue)

Notification No.25 /2018-Central Tax (Rate)

New Delhi, the 31st December 2018

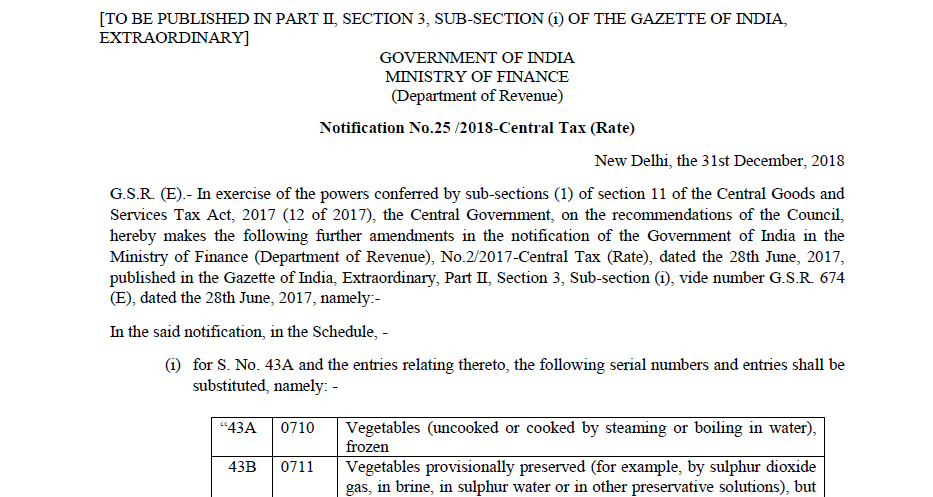

G.S.R. (E).- In exercise of the powers conferred by sub-sections (1) of section 11 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.2/2017-Central Tax (Rate), dated the 28th June, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 674 (E), dated the 28th June, 2017, namely:-

In the said notification, in the Schedule, –

(i) for S. No. 43A and the entries relating thereto, the following serial numbers and entries shall be substituted, namely: –

| “43A | 0710 | Vegetables (uncooked or cooked by steaming or boiling in water), frozen |

| 43B | 0711 | Vegetables provisionally preserved (for example, by sulphur dioxide gas, in brine, in sulphur water or in other preservative solutions), but unsuitable in that state for immediate consumption”; |

(ii) after S. No. 121 and the entries relating thereto, the following serial number and entries shall be inserted, namely: –

| “121A | 4904 00 00 | Music, printed or in manuscript, whether or not bound or illustrated”; |

(iii) after S. No. 152 and the entries relating thereto, the following serial number and entries shall be inserted, namely: –

| “153 | Any Chapter | Supply of gift items received by the President, Prime Minister, Governor or Chief Minister of any State or Union territory, or any public servant, by way of public auction by the Government, where auction proceeds are to be used for public or charitable cause”. |

2. This notification shall come into force on the 1st January 2019.

[F.No.354/432/2018-TRU]

(Gunjan Kumar Verma)

Under Secretary to the Government of India

Download the Notification No.25 /2018-Central Tax (Rate) by clicking the below image:

Note: – The principal notification No.2/2017-Central Tax (Rate), dated the 28th June 2017, was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 674(E), dated the 28th June, 2017 and last amended by notification No. 19/2018 – Central Tax(Rate), dated the 26th July 2018, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 693(E), dated the 26th July 2018.

Source: http://www.cbic.gov.in/resources//htdocs-cbec/gst/notfctn-25-2018-cgst-rate-english.pdf

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.