Master Guide on GST Annual Return and Audit

Master Guide on GST Annual Return and Audit

Most awaited GST Annual Return (Form GSTR 9) and Audit Reconciliation Statement (Form GSTR 9C) are notified by Government vide Notification 39/2018 CT dated 4th Sep 2018 and 49/2018 CT dated 13th Sep 2018. The due date for filing of the same for F.Y. 2017-18 is 31st Dec 2018. Enclosing herewith Master Guide on GST Annual Return and Audit, covering:

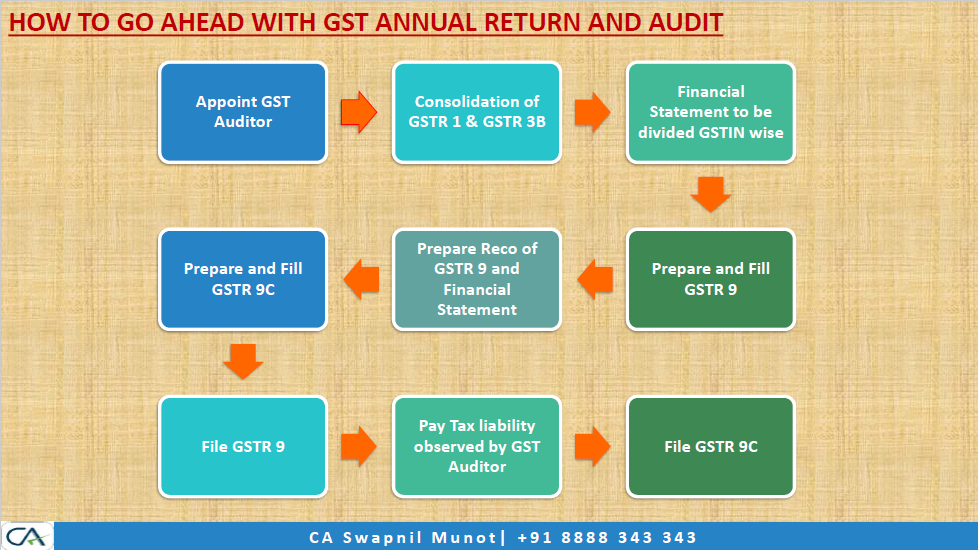

- How to Go Head with Annual Return and GST Audit

- Important Provisions

- Analysis of GSTR 9 Form and How to fill the same

- Analysis of GSTR 9C Form and How to fill the same

Professional should plan their work and ensure to file the said forms before the due date, without waiting for the extension.

Download the ppt on Master Guide on GST Annual Return and Audit by CA Swapnil Munot. By clicking the below image:

Swapnil Munot

Swapnil Munot

Delhi, India

CA Swapnil Munot is having keen interest & expertise in Indirect Tax and Foreign Trade policy. He has authored a book on GST, titled “HANDBOOK ON GST”. Also authored E-Book on “GST E Way Bill” and “GST Amendment Act”. He has conducted 290+ Seminars across India on GST for Government Officers, Commissioners, Professionals and Industries at the various forums – FIEO, ICAI, MCCIA, MSME, WMTPA, CII, NACIN, ICMA (Now ICAI), YASHADA, Various Associations, Institution, and Colleges, etc.