Mapping of Turnover in GST annual return

Mapping of Turnover in GST annual return:

Mapping of Turnover in GST annual return.Here we will see the link of data given in GSTR 1 or 3b into GST annual return.

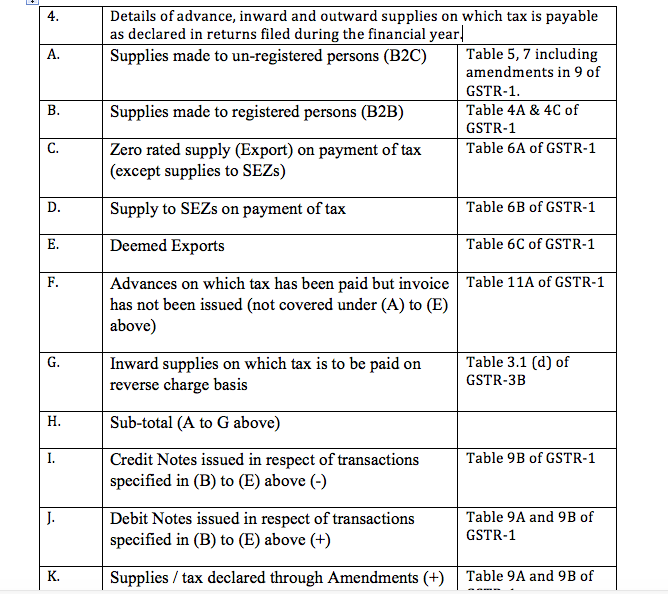

Details of advance, inward and outward supplies on which tax is payable as declared in returns filed during the financial year:

This particular table will include three items:

1- Advances liable for tax:

Advances related to services are liable for tax for the entire reporting period. Advances against supply of goods were liable for tax can be divided into two parts:

| Date | Notification No. | coverage |

| 15-11-2017 | 66/2017 CT | Tax on advance for goods will not be levied. |

| 13-10-2017 | 40/2017 CT | Tax on advance of goods will not be leviable when aggregate turnover in preceding financial year or in year in which he has taken registration (not likely ) didnt exceed Rs. 1.5 Cr. |

2- Inward supplies liable for tax:

| Section 9(4) RCM | Section 9(3) RCM | |

| Notification for coverage | NA | 13/2017 CTR & 4/2017 CTR (amended) |

|

Exemption 1 : 8/2017 CTR dated 28th June 2017. |

Upto Rs. 5000 exempted upto | No umbrella exemption was given. |

| Exemption 2: 38/2017 CTR dated 13th Oct 2017. | Totally exempted from | No umbrella exemption was given. |

3- Outward supplies liable for tax:

Supplies on which tax was payable by the taxpayer. This will also include the zero rated supplies on which tax was paid. Although it may have claimed as refund lateron.

Mapping of table 4 from GSTR 1 & 3b:

|

Table 4: |

|||

|

A. |

Supplies made to un-registered persons (B2C) |

Table 5, 7 including amendments in 9 of GSTR-1. |

|

|

B. |

Supplies made to registered persons (B2B) |

Table 4A & 4C of GSTR-1 |

|

|

C. |

Zero rated supply (Export) on payment of tax (except supplies to SEZs) |

Table 6A of GSTR-1 |

|

|

D. |

Supply to SEZs on payment of tax |

Table 6B of GSTR-1 |

|

|

E. |

Deemed Exports |

Table 6C of GSTR-1 |

|

|

F. |

Advances on which tax has been paid but invoice has not been issued (not covered under (A) to (E) above) |

Table 11A of GSTR-1 |

|

|

G. |

Inward supplies on which tax is to be paid on reverse charge basis |

Table 3.1 (d) of GSTR-3B |

|

|

H. |

Sub-total (A to G above) |

|

|

|

I. |

Credit Notes issued in respect of transactions specified in (B) to (E) above (-) |

Table 9B of GSTR-1 |

|

|

J. |

Debit Notes issued in respect of transactions specified in (B) to (E) above (+) |

Table 9A and 9B of GSTR-1 |

|

|

K. |

Supplies / tax declared through Amendments (+) |

Table 9A and 9B of GSTR-1 |

|

|

L. |

Supplies / tax reduced through Amendments (-) |

Table 9A and 9B of GSTR-1 |

|

|

M. |

Sub-total (I to L above) |

|

|

|

N. |

Supplies and advances on which tax is to be paid (H + M) above |

7F of GSTR 9C |

|

Details of Outward supplies on which tax is not payable as declared in returns filed during the financial year

|

Table 5: Outward supplies on which tax is not payable |

||

|

A. |

Zero rated supply (Export) without payment of tax |

Table 6A of GSTR-1 |

|

B. |

Supply to SEZs without payment of tax |

Table 6B of GSTR-1 |

|

C. |

Supplies on which tax is to be paid by the recipient on reverse charge basis |

Table 4B of GSTR-1 |

|

D. |

Exempted |

Table 8 of GSTR-1 |

|

E. |

Nil Rated |

Table 8 of GSTR-1 |

|

F. |

Non-GST supply |

Table 8 of GSTR-1 |

|

G. |

Sub-total (A to F above) |

|

|

H. |

Credit Notes issued in respect of transactions specified in A to F above (-)

|

Table 9B of GSTR-1 |

|

I. |

Debit Notes issued in respect of transactions specified in A to F above (+)

|

Table 9B of GSTR-1 |

|

J. |

Supplies declared through Amendments (+)

|

Table 9A and 9C of GSTR-1 |

|

K. |

Supplies reduced through Amendments (-)

|

Table 9A and 9C of GSTR-1 |

|

L. |

Sub-Total (H to K above)

|

|

|

M. |

Turnover on which tax is not to be paid (G + L above)

|

|

|

N. |

Total Turnover (including advances) (4N + 5M – 4G above)

|

5Q of GSTR 9C |

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.