Legislative Competence of Rule 36(4) of CGST Rules 2017

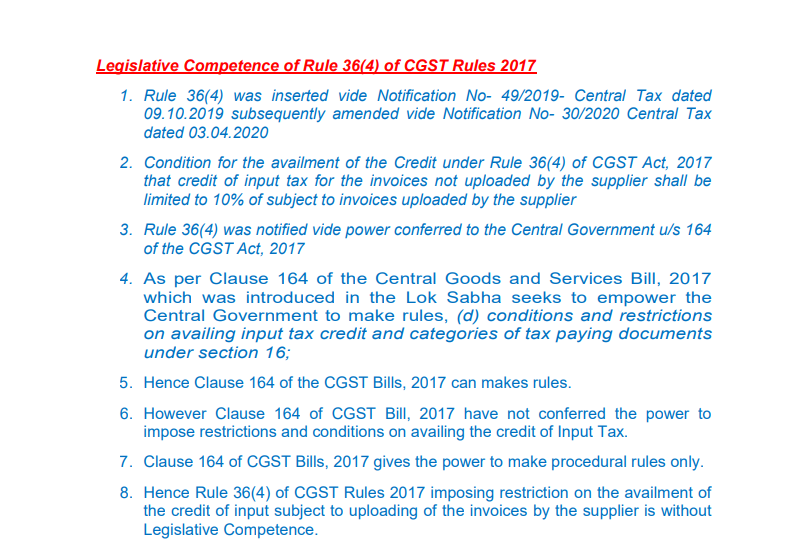

Legislative Competence of Rule 36(4) of CGST Rules 2017

1. Rule 36(4) was inserted vide Notification No- 49/2019- Central Tax dated 09.10.2019 subsequently amended vide Notification No- 30/2020 Central Tax dated 03.04.2020

2. Condition for the availment of the Credit under Rule 36(4) of CGST Act, 2017 that credit of input tax for the invoices not uploaded by the supplier shall be limited to 10% of subject to invoices uploaded by the supplier

3. Rule 36(4) was notified vide power conferred to the Central Government u/s 164 of the CGST Act, 2017

4. As per Clause 164 of the Central Goods and Services Bill, 2017 which was introduced in the Lok Sabha seeks to empower the Central Government to make rules, (d) conditions and restrictions on availing input tax credit and categories of tax-paying documents under section 16;

5. Hence Clause 164 of the CGST Bills, 2017 can makes rules.

6. However Clause 164 of CGST Bill, 2017 has not conferred the power to impose restrictions and conditions on availing the credit of Input Tax.

7. Clause 164 of CGST Bills, 2017 gives the power to make procedural rules only.

8. Hence Rule 36(4) of CGST Rules 2017 imposing restriction on the availment of the credit of input subject to uploading of the invoices by the supplier is without Legislative Competence.

9. Rule 36(4) being the procedural provision and hence the substantive right cannot be denied due to procedural lapses.

Read the copy:

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal