Key Amendments Notified by the Government between 4th – 13th September

Key Amendments Notified by the Government between 4th – 13th September

The latest Key Amendments Notified by the Government between 4th – 13th September is compiled in the article. To provide all the person with the amendments to see at one place.

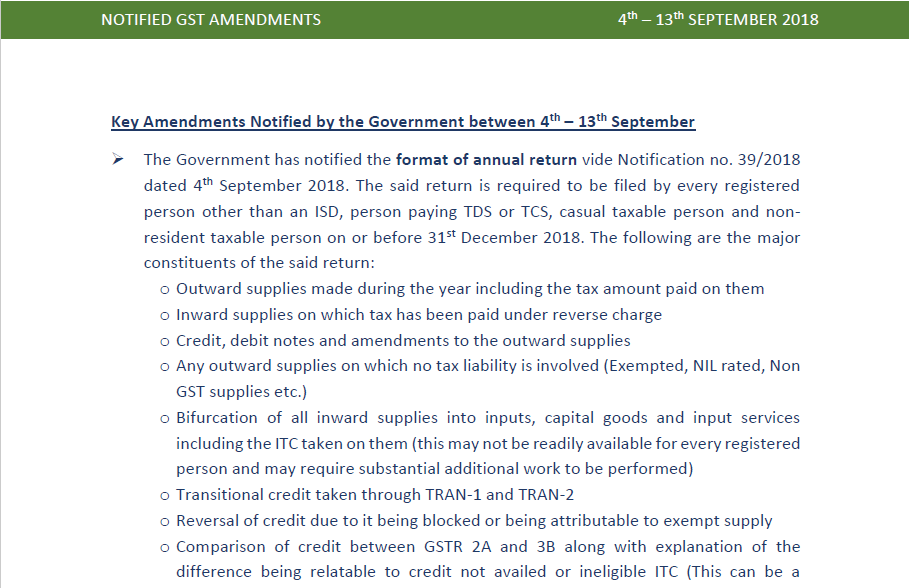

The Government has notified the format of annual return to vide Notification no. 39/2018 dated 4th September 2018. The said return is required to be filed by every registered person other than an ISD, the person paying TDS or TCS, casual taxable person and the non-resident taxable person on or before 31st December 2018. The following are the major constituents of the said return:

- Outward supplies made during the year including the tax amount paid on them o Inward supplies on which tax has been paid under reverse charge

- Credit, debit notes and amendments to the outward supplies o Any outward supplies on which no tax liability is involved (Exempted, NIL rated, Non-GST supplies etc.)

- Bifurcation of all inward supplies into inputs, capital goods and input services including the ITC taken on them (this may not be readily available for every registered person and may require substantial additional work to be performed)

- Transitional credit is taken through TRAN-1 and TRAN-2

- Reversal of credit due to it being blocked or being attributable to exempt supply

- Comparison of credit between GSTR 2A and 3B along with explanation of the difference being relatable to credit not availed or ineligible ITC (This can be a challenging task as the difference between 2A and 3B may be vitiated due to a number of reasons which are not specified in the form)

- Total credit lapsed during the year

- The details of actual tax paid during the year through Form GSTR 3B o Any amendments made in outward supplies along with tax amount or input tax credit made during the period April – September 2018 of the same belonging to the year 2017-18

- Particulars of demand and refund o Supplies received from composition dealers, deemed supplies for goods sent on job work and goods sent on the approval basis

- HSNwise summary of outward supplies and inward supplies (Finding HSNwise inward supplies can be a mammoth task as the data may not be readily available with a registered person)

(Notification no. 39/2018-Central tax dated 4th September 2018)

Download the full content of the Key Amendments Notified by the Government between 4th – 13th September. By Clicking the below image:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.