Intermediary service in GST with relevant cases

Latest update

The Government has Clarified via Circular No. 159/15/2021-GST dated 20th September 2021 that

- an intermediary service provider is a person who arranges or facilitates (Ancillary supply) the main supply &

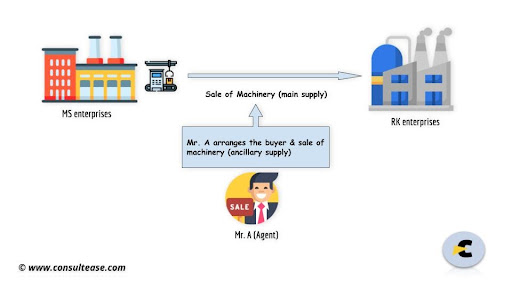

For Example – MS enterprises want to sell their Machinery for this purpose they hire a Mr. A & give him the task to find a suitable buyer. Mr. A finds & brings RK enterprises a suitable buyer that is looking to buy machinery. Mr. A facilitates the whole transaction and charges commission for his services.

In this case, there are three Parties involved MS enterprises, RK enterprises & Mr. A.

The main supply is the Sale of Machinery. Supply of service provided Mr. A is providing intermediary services as he was merely arranging or facilitating the supply of Machinery.

- Sub-contracting or Outsourcing service is not an intermediary service: sub-contracting a service or Outsourcing service are excluded from an intermediary. As the main supplier may outsource the supply of the main service Either fully or partly to one or more subcontractors.

For example – Mr. Xyz wants to create a website for his business. He hires Mokso Technologies Pvt. Ltd a web designing. Now Mokso technologies outsource the work to another web design company that is Trappinity Technologies Pvt Ltd. Trappinity technologies will interact with Mr. Xyz to know if he has specific requirements regarding the designs of the website. Here supply provided by Trappinity will not qualify as Intermediary services as in this case they are providing the main service i.e. Design & Development of the Website.

This clarification by govt. has resulted in a big relief to BPO & KPO sectors. Previously services outsourced to these sectors in India by foreign entities were treated as intermediary services.

Now, this clarification by the government will free up the GST refunds to companies in IT services, financial services, and R&D.

Meaning of intermediary service in GST Regime:

The term intermediary service is not new in the GST regime. This concept was already there in the pre-GST era. It is borrowed into GST from there. Let us try to understand from basics of it. The term intermediary is defined in section 2(13) OF IGST Act as:

“intermediary” means a broker, an agent or any other person, by whatever name called, who arranges or facilitates the supply of goods or services or both, or securities, between two or more persons, but does not include a person who supplies such goods or services or both or securities on his own account” (Quoted from IGST Act)

On the basis of the above definition we can say that:

- Intermediary may be a broker, agent, or any other person. It means that his nomenclature is irrelevant. No matter what we call him he will be an intermediary based on his activities.

- The intermediary is the person who “arranges” or “Facilitates’ the supply of

i) Goods,

ii) Services,

iii) both

iv) Securities.

It is important to note that securities are excluded from the definition of both goods and services. But for the purpose of intermediary facilitating a supply in securities is also covered.

- That activity of facilitating the supply can be between two people or more than two person.

Exclusion:

An intermediary will not include a person who made such supply at his own account.

So these are the basic fundamental laid down by the definition of intermediary.

Impact on transaction if a service is an intermediary supply:

Now the most important part of the issue. Why we are scared of intermediary supply? In case my supply turns into an intermediary supply it can convert my export into a domestic supply. I am liable to pay tax but will lose refund. Section 13(8) of IGST Act provide for the place of supply in following cases:

“The place of supply of the following services shall be the location of the supplier of services, namely:––

(a) services supplied by a banking company, or a financial institution, or a non-banking financial company, to account holders;

(b) intermediary services;

(c) services consisting of hiring of means of transport, including yachts but excluding aircrafts and vessels, up to a period of one month.”

How to determine the nature of intermediary service:

There are many legal precedents to understand this term. It is quite important from an exporter’s point of view. Because falling an activity in intermediary services in itself a loss of 18%. (or relevant rate of tax leviable on such supply.)

Legal Jurisprudence on intermediary service in pre and post GST era:

There are many legal precedents explaining the intermediary service in GST. These rulings will help readers in understanding the meaning of intermediary service in GST.

Five Star Shipping AAAR Maharashtra:

In this case the supplier was providing the consultancy services to the FSO’s which are located outside India. The services provided by the applicant is a composite supply with consulting is the principal supply.The support services are also provided by the applicant. The AAAR observed that the supply in this case is not an export.Thus it will be taxable in India. The activities done by applicant will fall in intermediary supply and thus will not be eligible for benefits of export.It will fall under SAC code 999799 which is other misc services and SAC 998222 which is accounting services with intermediary supply as a principal supply.

Global reach education services (P) Ltd.(AAAR West Bengal):

In this case the applicant was engaged in sales of courses of foreign universities.The appellant argued that the function of an intermediary is to facilitate or to arrange the supply of goods or services between two or more persons. The appellant is providing the services at his own. The appellant also provided his agreement with ACU( Australian catholic university).

It was held by the authority that by activities mentioned in the contract will fall in intermediary. Applicant also referred the case of M/s sunrise immigration consultants pvt ltd Vs. CCE. The AAAR denied and said that the provisions for intermediary are not same in GST and earlier tax laws. The activities of the taxpayer will fall in intermediary and will be taxable without any export benefits.

Mrs Vishakhar Prashant Bhave(AAR Maharastra):

The applicant was engaged in trading business of laboratory equipments. They are also engaged in other related activities such as servicing, repairs and maintenance of laboratory equipments. One of the activity of micro relates to providing services to its principals in Germany. They procure the purchase orders from the parties desirous of purchasing advance type of laboratory equipments.

It was held by the authority that in simple terms “intermediary” can be explained as a firm or a person etc. who acts as a link between parties for the conduction of business, etc. We find from the question posed that applicant is of opinion that they are providing services as an intermediary. The facts also reveals the likewise.

Sabre Travel Network India (P) Ltd. (AAR Maharashtra):

In this case the applicant was having an agreement with Sabre APAC to market their CRS software. The sales team of the applicant approaches potential subscribers in India to whom the features of CRS software and the flexibility of the same to integrate with the potential subscriber’s system for smooth functioning.

It was held that these activities will fall in ambit of intermediary.

Toshniwal Brothers(SR) (P) ltd. (AAR Karnataka):

Three important issues were raised by the applicant.

- Whether the promotion and marketing services will fall under the intermediary services.

- If after sale support services are also provided in a composite contract, will it fall under the composite supply?

- Whether that contract will be an export?

If those supply will be an intermediary supply, it will not be an export. That is sure because then place of supply will be the location of supplier. In this case the supplier was mainly engaged in three activities namely, Promotion and marketing, After sale service and submission of reports.

It was observed by the authority that the services of applicant are not purely of promotion and marketing but they are intermediary in nature. The after-sale services provided are not in the nature of a composite contract and they are independent from the other services provided and hence there is no question of determination of what will the principal supply.

Vserve Global (P) Ltd. (AAR Maharashtra):

The applicant Vserve Global Pvt. Ltd. is an Indian company having its office in Mumbai.The company is incorporated to provide back office support services to overseas companies. Vserve will come in picture after the sale purchase transaction take place. They were primarily doing the following activities.

- Get SDF(Sales Detail Form) & PDF (Purchase detail form)

- Generate order no. in VOSS.

- Create purchase order and Sales contract.

- Send PO and performa Invoice.

- liaise with supplier of Cargo.

and other relevant activities.

A sum of activities mentioned above indicate applicant as a person who arranges or facilitate the supply between the overseas client and customer of the overseas client.

Therefore applicant is clearly falling under the definition of intermediary

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.