Important directions issued by the Department on Interest Calculation

Table of Contents

Introduction

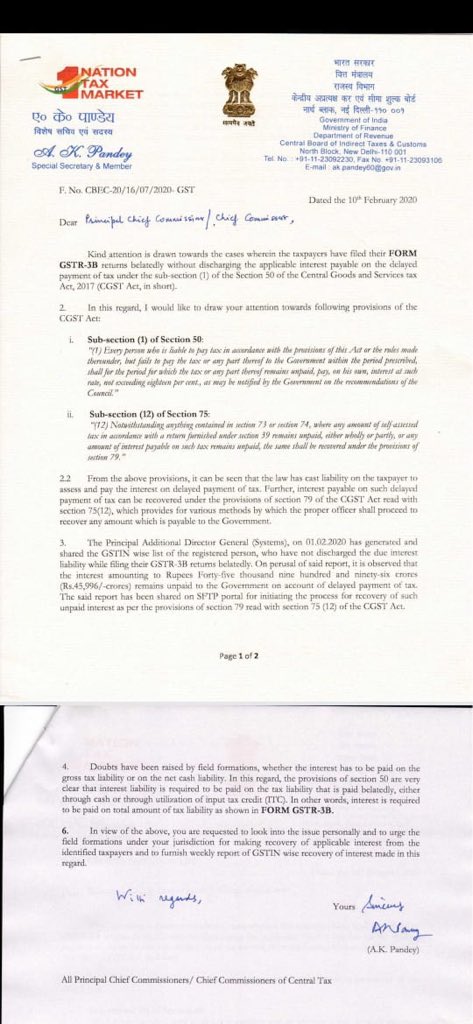

Kind attention is being drawn towards the cases wherein the taxpayers have filed their FORM GSTR-3B returns belatedly without discharging the applicable interest payable on the delayed payment of tax under sub-section (1) of section 50 of the Central Goods and Service Tax Act 2017(CGST Act, in short)

Provisions of CGST Act

i. Sub-section(1) of Section 50:

”(1) Every person who is liable to pay tax in accordance with the provisions of this Act or the rules made thereunder, but fails to pay the tax or any part thereof to the Government within the period prescribed, shall for the period for which the tax or any part thereof remains unpaid, pay, on his own, interest at such rate, not exceeding eighteen percent, as may be notified by the Government on the recommendations of the council.”

ii. Sub-section(12) of Section 75:

”(12) Notwithstanding anything contained in section 73 or section 74, where any amount of self-assessed tax in accordance with a return furnishes under section 39 remains unpaid, either wholly or partly or any amount of interest payable on such tax remains unpaid, the same shall be recovered under the provisions of section 79.”

From the above provisions, it can be seen that the law ha cast liability on the taxpayer to assess and pay the interest on delayed payment of tax. Further, interest payable on such delayed payment of tax can be recovered under the provisions of section 79 of the CGST Act read with section 75(12), which provides for various methods by which the proper officer shall proceed to recover any amount which is payable to the Government.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.