How to manage Tax payments on GSTIN

Tax payments on GSTIN:

The tax payments on GSTIN will be much simple and easy. In its first outlook of GSTIN the tax payments are also covered.

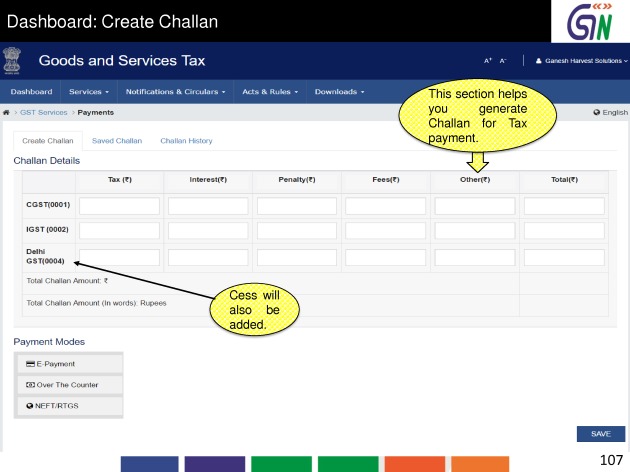

Create Challan for tax payment at GSTIN:

First thing we need to do is to create a challan for the payment of tax. You can see in the image below how to create a challan.

First of all choose the tax you need to pay. Then fill the amount of tax , fees, interest and penalty (if any).

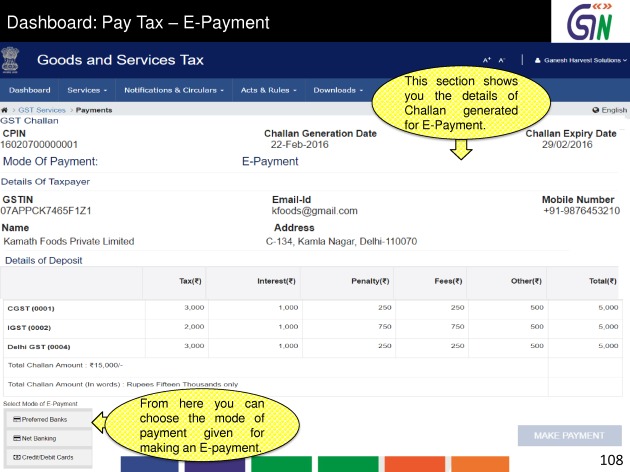

Make payment of challan generated:

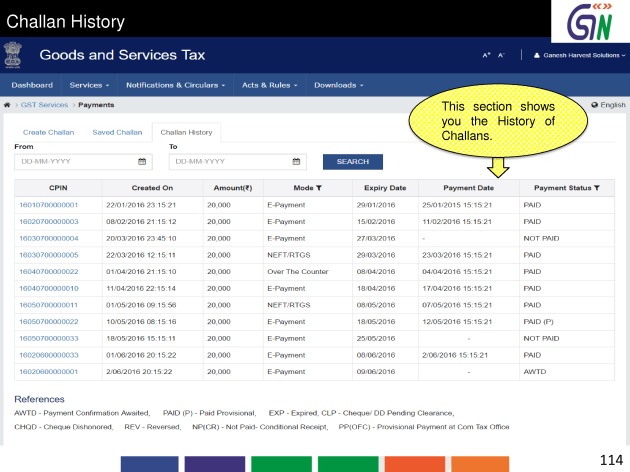

Now click on challan generated and it will show you the list of challans generated. Choose the mode of payment you want to opt.

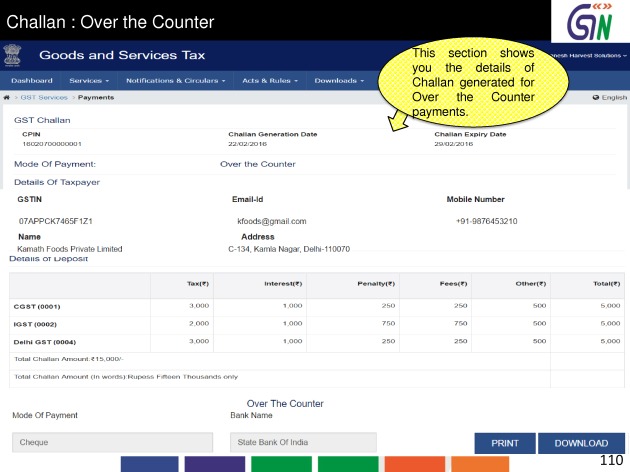

Over the counter payment of challans:

Tax payments on GSTIN can be over the counter also.You can create an over the counter challan. You can also see the list of challans generated for over the counter payments.

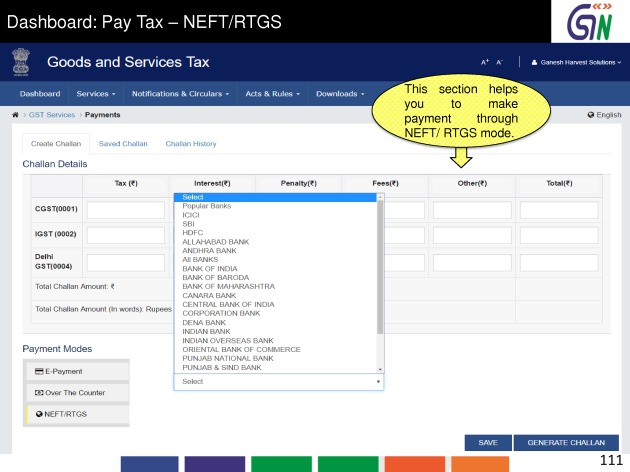

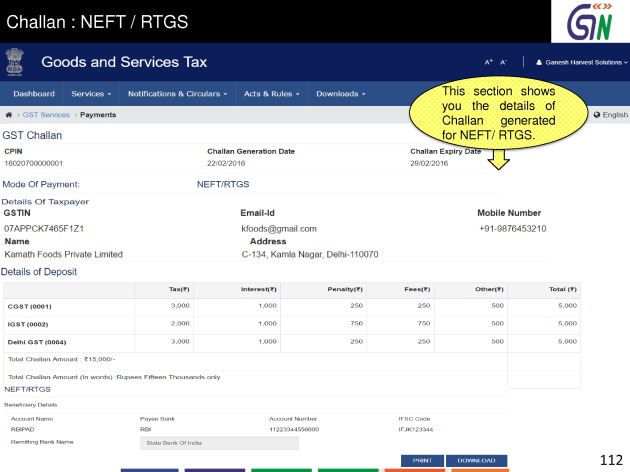

Payment of GST via NEFT/RTGS:

Here you will be able to make the online payment for GST. A list of banks will be there. You can simply make payment from any bank account.It is more or less same to the online payments we generally make. A list of saved challan will also be available on GSTIN portal.

Related Topic:

6 Free accounting softwares by GSTIN

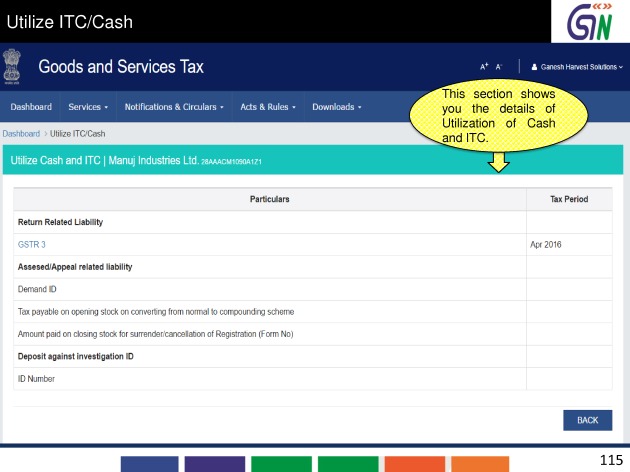

Utilization of Input tax credit or cash for GST payment:

In the end when you will file the GSTR 3 all your liability and credits available will be adjusted to each other. In the end you will be able to adjust your ITC with output tax liability. Then if any amount is left it will be adjusted against the cash deposited. If any amount of tax for last month is pending then first it will be adjusted against any payment.

This is the process for payment of GST available on the GSTIN dashboard of every taxpayer. This modules are open for any suggestion.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.