Guidelines to be followed before authorizing for conducting Inspection, Search and Seizure Under Haryana GST Act.

From

Excise and Taxation Commissioner, Haryana

To

All the Joint Excise and Taxation Commissioner (Range/appeal)

All the Deputy Excise and Taxation Commissioner

Subject: Guidelines to be followed before authorizing for conducting Inspection, Search and Seizure Under Haryana GST Act.

I have been directed to invite your reference to the above-noted subject and to intimate you with the guidelines to be followed before authorizing for conducting the inspection, search and seizure under the Haryana GST Act. These are as under:-

GST Law provides for stringent measures to deal with the cases of tax evasion by bestowing upon the taxing authorities the powers to conduct the Inspection, Search and Seizure. It is expedient upon the department to frame certain guidelines for the assistance of the taxing authorities in due discharge of their duties so as to make these provisions more effective. These guidelines further strive to bring about uniformity during the process of exercising these powers and to bring about greater transparency.

The GST Law empowers the Proper Officers, not below the rank of Joint Commissioner, to authorize in writing any other officer working under his jurisdiction to inspect any place(s) of business of taxable person(s). Therefore, the Proper Officers, not below the rank of Joint Commissioner, should record in writing, either on his own or on the basis of the report submitted by the Officers working under his jurisdiction, mentioning the reasons for him to believe that there is a case for authorizing other officers of the State Tax to conduct inspection of any place(s) of any business entity in the State.

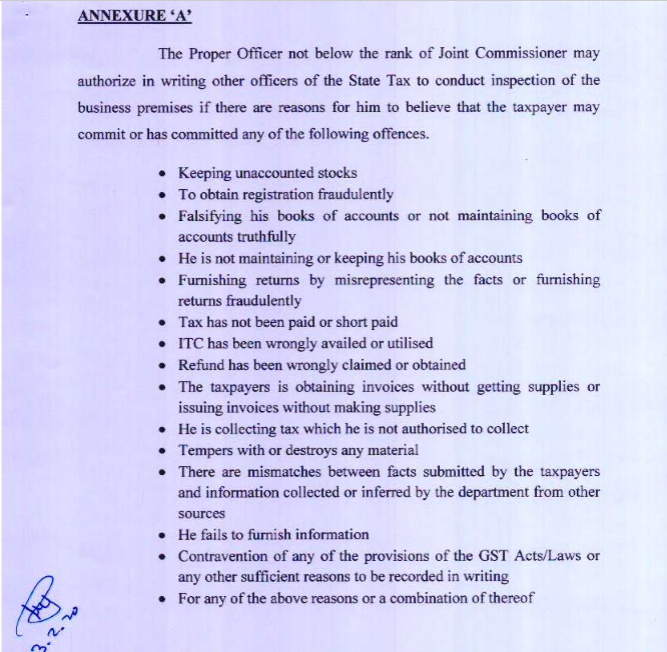

The inspection of the place of business of any business entity may be conducted for inspection of any of the offenses listed in Annexure appended to these guidelines or a combination thereof.

The Proper Officers authorizing such inspection may obtain, either on his own or through his subordinate officers, the information of the business entity. If the business entity is registered, the information, if available on portal, should contain the facts about his filing of returns, his turnovers, the credit availed and utilized, credit varified, details of his sales and purchases, tax deposited, e-way bills or any other relevant information for the relevant period.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.