GSTR 9C: Reconciliation and certification

GSTR 9C: Reconciliation and certification:

This article is drafted to address the important issues related to GSTR 9C.

What is GSTR 9C?

GSTR 9C is the form for audit report by a Chartered Accountant and Cost accountant in GST. Section 35(5) of GST mandates for GST audit. Every registered person is required to get their GST accounts audited. Form GSTR 9C is prescribed form to be submitted by the person auditing the GST records. GST audit is similar to tax audit. In GST audit the auditor is required to verify the correctness of Turnover, Input tax credit, taxes paid and refunds.

Related Topic:

Amendment relating to GSTR 9C

Who is required to file GSTR 9C

Every registered person having a turnover of more than Rs. 2 crores is required to file form GSTR 9C. Turnover will be calculated for financial year. Financial year is not defined in GST Act. But as per general clauses Act, FY means an year starting from 1st April to 31st March 2018. Although GST was made applicable in India from 1st July 2018. It is a matter of debate that turnover from 1st July will be considered or from 1st April. Experts have different views on it. Aggregate turnover will be considered for this limit of Rs. 2 Crore. In GST aggregate turnover include both taxable and exempted turnover. It even include export turnover.

Example:

Mr. X have following turnover during relevant period. Pls check applicability of GST.

Sales of Scrap: 50lac

Sale of liquor: 50 lac

Services provided: 60 lac

Sale of land : 5 Cr

Sale of agricultural produce: 45 lac

Solution: Threshold turnover for GST audit is Rs. 2 Cr. The aggregate turnover for Mr. X will be:

Rs. 50 lac+ Rs. 50 lac+ 60 lac+ 45 Lac= 2.05 Cr.

Thus Mr. X is liable for GST audit.

What information is required in GSTR 9C?

GSTR 9C have two parts. First is reconciliation part and other is certification part.

GSTR 9C

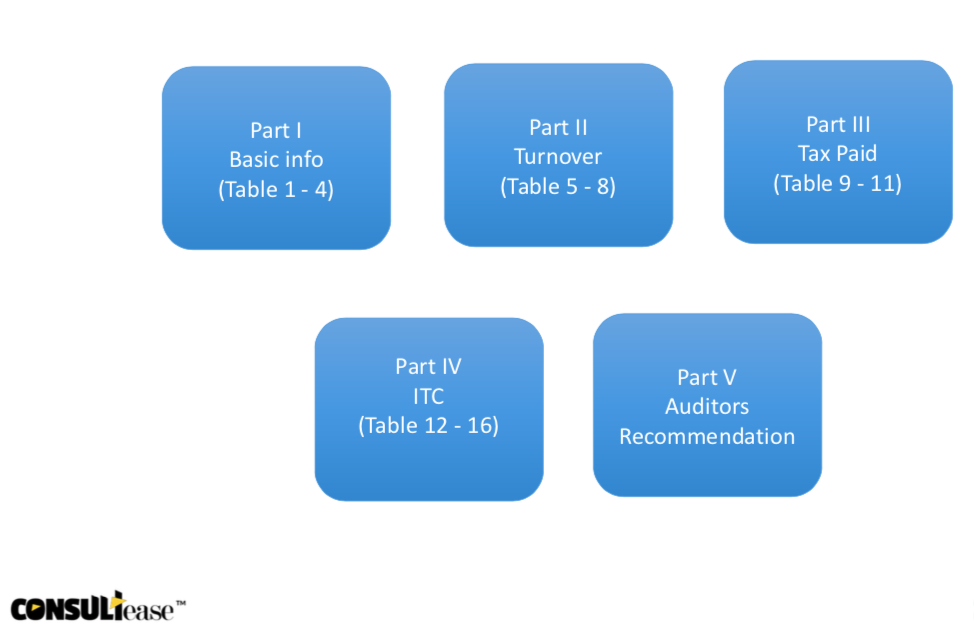

Reconciliation part consist of 5 parts and 16 Tables. Basically this part is a reconciliation between the data declared in annual return with data of financials. Mainly following data is required to be matched.

GSTR 9C

Turnover related data:

a. Turnover including RCM inward and advances on which tax was payable by taxpayer.

It will include:

- Outward supply

- advances liable for tax payment (In GST advances against services are liable for tax payment)

- Exports on which tax was payable (although refund of same was claimed lateron)

b. Gross turnover including turnover on which tax is not payable.

This turnover include the following:

- Exempt, nil rated and non GST supply

- Exports on which tax was not payable. In GST tax is not payable in case of exports against LUT.

- Outward supplies which were covered in RCM. On these supples tax was payable by the recipient of the supply.

- All other turnover covered in first point

Input tax credit related data:

Data related to input tax credit as declared in annual return and in financials will be matched in this part.

a. Input tax credit:

In this part Input tax credit as declared in annual return is matched with the input tax credit taken in financials. Reasons for any difference is also required to be mentioned. In case there is any tax liability due to mismatch it will also be mentioned here.

b. Expanse wise matching of input tax credit:

In this part the data of input tax credit will be matched expanse wise. P&L account will be matched here. The ITC corresponding to various expanse will be displayed.

a. Purchases

b. Freight / Carriage

c. Power and Fuel

d. Imported goods (Including received from SEZs)

e. Rent and Insurance

f. Goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples

g. Royalties

h. Employees’ Cost (Salaries, wages, Bonus etc.)

I. Conveyance charges

J. Bank Charges

K. Entertainment charges

L. Stationery Expenses (including postage etc.)

M. Repair and Maintenance

N. Other Miscellaneous expenses

O. Capital goods

P. Any other expense 1

Q. Any other expense 1

3. Certification part of GSTR 9C:

In this part auditor is required to comment upon the correctness of various data. This part is divided into two parts. First is when reconciliation is made by same person who has conducted the audit.

The second part is required to be certified in case reconciliation is filed by someone else. Some clauses of this part is changed accordingly.

Author can be contacted at info@consultease.com

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.