GST on Sale of Old Vehicles ( From 1.1.17 Till Date)

Introduction:

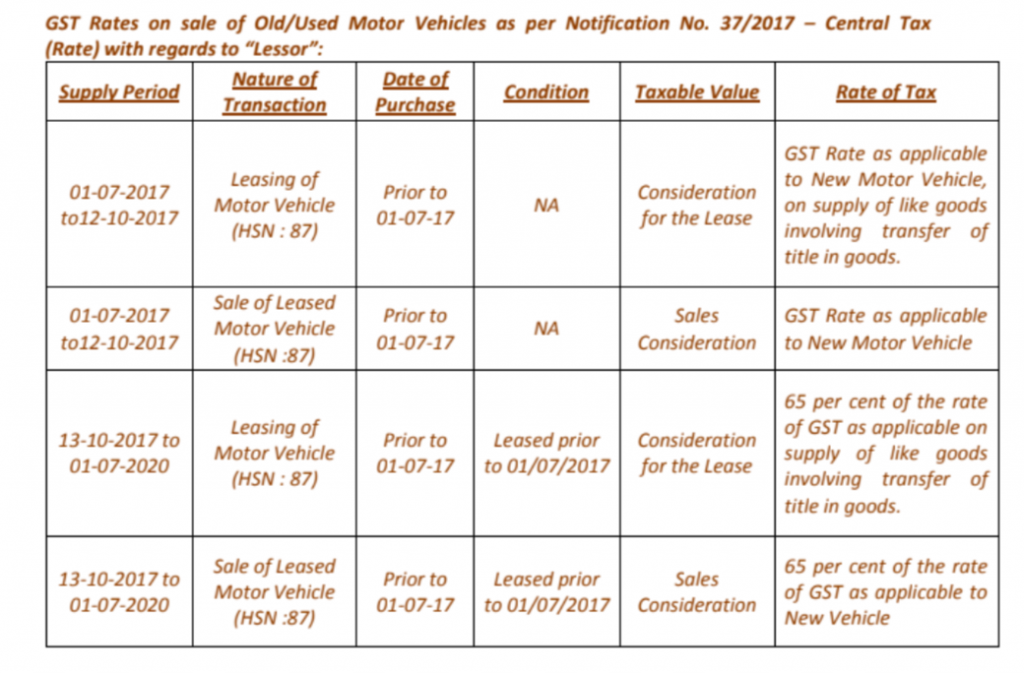

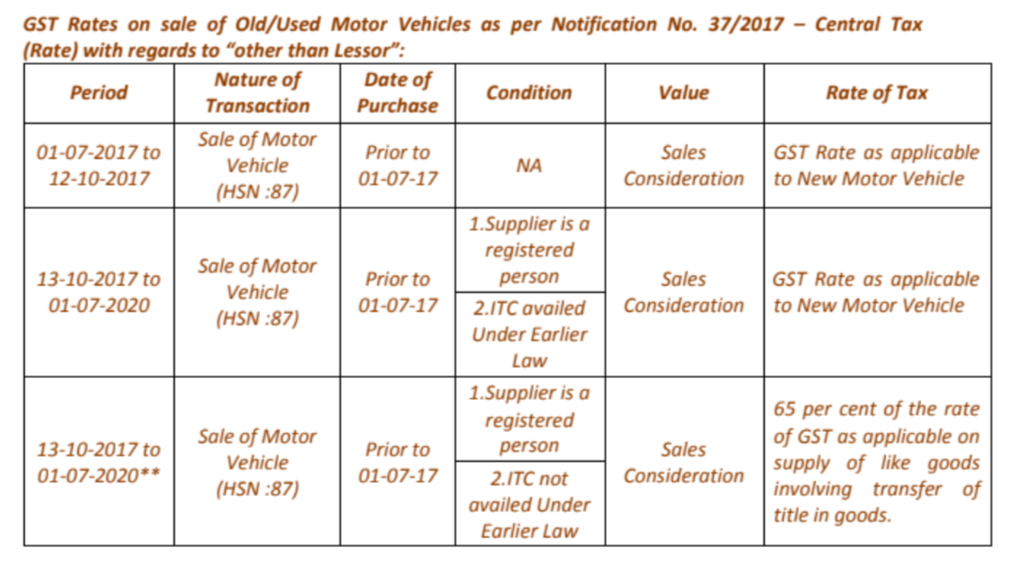

GST on sale of old vehicles/ cars is discussed at length from beginning to date. After the implementation of GST on sale of used and old vehicles was taxed at the same rate as applicable on new vehicles which were 28% + Applicable cess which was up to 15% and due to this, the effective tax on the sale of old vehicles was up to 43%. This higher rate of tax was causing the burden on trade and industry. On 13th Oct 2017, Some Relief on Sale of Old and Used Vehicles was provided to industries via Notification No. 37/2017 – Central Tax (Rate) dated 13th October 2017.

Notification No. 37/2017 gives big relief to the assessee who is in the business of leasing of an old vehicle. This notification provides the much-awaited abatement on the valuation of the lease of old motor vehicles. It gives abetment of 35% of value i.e. In other words, Applicable GST Tax Rate will be levied on only 65% of the consideration. But the benefits of this notification is only up to 1st July 2020 subject to fulfillment of the below conditions:

1. The Motor Vehicles was purchased by lessor prior to 1st July, 2017 and supplied on the lease before 1 st July 2017.

2. The supplier of the Motor Vehicle is a registered person.

3. Such Supplier had purchased the Motor Vehicle prior to 1st July, 2017 and has not availed input tax credit of Central Excise Duty, Value Added Tax or any other taxes paid on such vehicles.

*In general the above table would be applicable to registered dealers like traders, manufacturers, etc. who sell Motor Vehicles used in their business which have been purchased in Pre GST Regime but sold during the GST Regime.

Big relief for GST on sale of old vehicles:

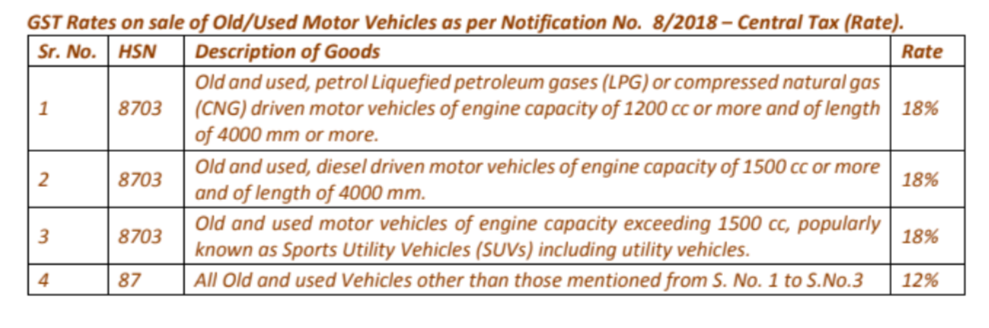

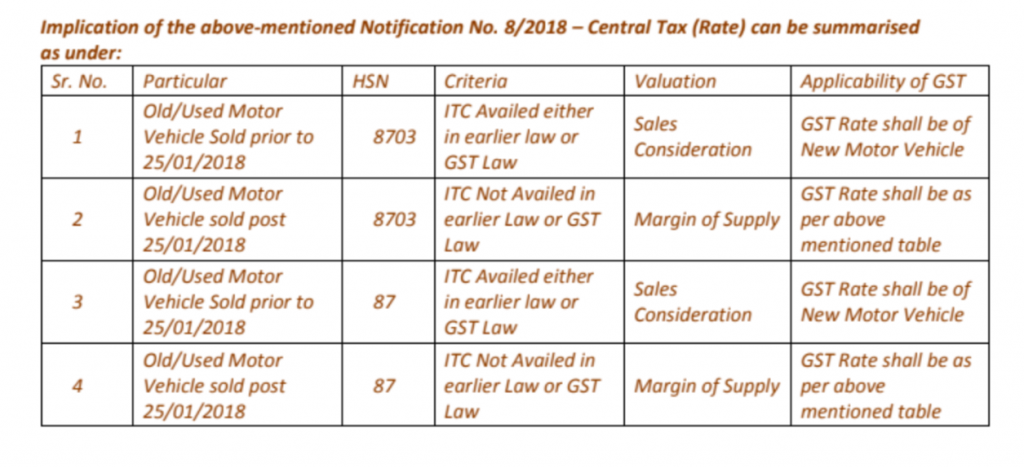

On 25th Jan 2018 Government gives Big Relief on Sale of Old and Used Vehicles via Notification No. 8/2018 – Central Tax (Rate) and Notification No. 1/2018 – Compensation Cess (Rate) dated 25th January 2018.

To make old/used Motor Vehicle more affordable, on the recommendation of the GST Council, Government has issued the above notifications on 25th January 2018. These notifications are in effect from 25th January 2018. These Notifications shall not apply, if the supplier of such goods has availed input tax credit as section 2(63) of the CGST Act, 2017, CENVAT as defined in CENVAT Credit Rules, 2004 or the input tax credit of VAT or any other taxes paid, on such goods.

Notification No. 1/2018 – Compensation Cess (Rate): The government exempt the cess on sale of old/used Motor Vehicles.

Notification No. 8/2018 – Central Tax (Rate): Government reduced the GST Tax Rate on sale of old/used Motor Vehicles.

What is the rate of GST on the sale of used motor vehicles/cars?

You can use this list for the rate of tax on the sale of used/old motor car/vehicles.

GST on sale of old vehicles

What is the valuation for levy of GST on sale of old/used motor car/vehicle?

Now the question will arise about valuation i.e. what shall be the value on which GST shall be applicable

As per the above notification, the Value of Supply shall be the “Margin of Supply”.

The margin of Supply means:-

1. If Depreciation Claimed u/s 32 of Income Tax Act 1961:-

Where the depreciation has been claimed under section 32 of Income Tax Act 1961 on the said goods, Margin of Supply shall be the difference between Sale consideration received for supply of such goods and the depreciated value of such goods on the date of supply, and where the margin of such supply is negative, it shall be ignored.

2. In Other Case: –

The margin of Supply shall be the difference between the selling price and the purchase price and where such margin is negative, it shall be ignored.

Example-

Mr. Z sold a motor vehicle for Rs. 2,00,000. It was bought for Rs. 7 lac 5 years back. Its depreciated value is Rs. 4 lac. The taxable value for GST is = 2lac-4lac=Negative figure= Nil.

In case Used vehicle is Sold by Government:-

In case the used vehicle’s Supplier is central government, State government, Union territory/Local authority & the recipient is –

- Registered person: The registered person will be liable to pay tax on reverse charge [Notif. no./ 04/2017-CT (Rate) dated 28-06-2017

- Unregistered person: The unregistered will have to obtain GST registration & pay GST-para 1 [circular No. 76/50/2018-GST dated 31-12-2018]

Supply of Used Business Assets under GST

Summarised provisions for GST on sale of old vehicles /cars

Here a summary of all provisions till now is compiled. It will be quite useful to you.

GST on sale of old vehicles

If you already have a premium membership, Sign In.

CA CA Himanshu Singhal

CA CA Himanshu Singhal