GST notification on 03-04-2020 list by team RPAG & Co.

NOTIFICATIONS ISSUED BY CBIC ON 03 APRIL 2020 – COVID19

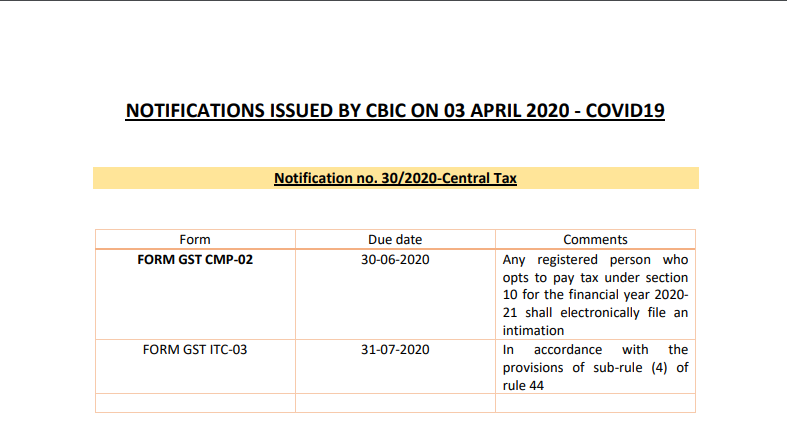

Notification no. 30/2020-Central Tax

| Form | Due date | Comments |

| FORM GST CMP-02 | 30-06-2020 | Any registered person who opts to pay tax under section 10 for the financial year 2020- 21 shall electronically file an intimation |

| FORM GST ITC-03 | 31-07-2020 | In accordance with the provisions of sub-rule (4) of rule 44 |

A proviso has been inserted to sub-rule (4) to rule 36,

Download the original notification 30/2020-CT dated 3-4-2020

“Provided that the said condition shall apply cumulatively for the period February, March, April, May, June, July and August 2020 and the return in FORM GSTR-3B for the tax period September 2020 shall be furnished with the cumulative adjustment of the input tax credit for the said months in accordance with the condition above.”

This amendment is a relaxation to claim ITC. With effect from 09-10-2019, the rule 36(4) provides that the ITC shall be claimed by the taxpayer in monthly GSTR 3B if the same is appearing in GSTR 2A. However, for February 2020 to August 2020, the taxpayer shall be allowed to claim the provisional ITC based on a self-assessment basis. However, the same shall be reconciled in September 2020 and necessary impacts shall be taken in the GSTR 3B for September 2020.

Notification no. 31/2020-Central Tax

No Interest on late payment of taxes if GSTR 3B has been filed on or before the below due dates:

Aggregate Turnover

| More than Rs. 5 Crs. | Less than Rs. 5 Crs. but more than Rs. 1.5 Crs. | Less than Rs. 1.5 Crs. | |

| February 2020 | 24-Jun-20 | 29-Jun-20 | 30-Jun-20 |

| March 2020 | 24-Jun-20 | 29-Jun-20 | 03-Jul-20 |

| April 2020 | 24-Jun-20 | 30-Jun-20 | 06-Jul-20 |

*Interest @ 9% p.a. shall be payable if the payment is not made within 15 days from the regular due date.

Download copy of Notification no. 31/2020-Central Tax

Please note that any person, having aggregate turnover more than Rs. 5 Crores shall be required to pay the taxes and file GSTR 3B on or before 04-04-2020, 05-05-2020 and 04-05-2020 for February, March and April 2020 month respectively to get the benefit of Nil rate of interest. Else, the interest shall be charged at the rate of 9% p.a. provided the payment and GSTR 3B is filed till 24-06-2020.

Notification no. 32/2020-Central Tax

No LATE FEES u/s 47 due to delay in submission of GSTR 3B if the return is filed on or before the below due dates:

Turnover

| More than Rs. 5 Crs. | Less than Rs. 5 Crs. but more than Rs. 1.5 Crs. | Less than Rs. 1.5 Crs. | |

| February 2020 | 24-Jun-20 | 29-Jun-20 | 30-Jun-20 |

| March 2020 | 24-Jun-20 | 29-Jun-20 | 03-Jul-20 |

| April 2020 | 24-Jun-20 | 30-Jun-20 | 06-Jul-20 |

Download notifications no. 32/2020 CT

Notification no. 33/2020-Central Tax

No LATE FEES u/s 47 due to delay in submission of GSTR 1, if the statement for March 2020 to May 2020 and for the Quarter ended 31 March 2020 has been filed on or before 30-06-2020.

Download notification no. 33/2020 CT

Notification no. 34/2020-Central Tax

Extension of filing CMP-08 for Q4-FY 2019-20 till 07-07-2020:

The due date for payment of taxes by Composition dealer for the Quarter ended 31 March 2020 has been extended to 07-07-2020 to be furnished under Form GST CMP-08.

Extension of filing of GSTR 4 for FY 2019-20 till 15-07-2020:

Also, the return shall be furnished under Form GSTR 4 for the FY 2019-20 till 15-07-2020.

Download notification no. 34/2020

Notification no. 35/2020-Central Tax

Where an e-way bill has been generated under rule 138 of the Central Goods and Services Tax Rules, 2017 and its period of validity expires during the period 20th day of March 2020 to 15th day of April 2020, the validity period of such e-way bill shall be deemed to have been extended till the 30th day of April 2020.

Notification no. 36/2020-Central Tax

Aggregate Turnover

| More than Rs. 5 Crs. |

Less than Rs. 5 Crs. Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, UTs of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman, and the Nicobar Islands or Lakshadweep |

Less than Rs. 5 Crs. Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi |

|

| May 2020 | 27-Jun-20 | 12-Jul-20 | 14-Jul-20 |

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.