GST Insights – Relief Measures- COVID-19 2.0

In view of the challenges faced by taxpayers in meeting the statutory and regulatory compliances due to the outbreak of the second wave of COVID-19 pandemic, the Government has issued various notifications dated 01st May 2021 for providing various relief measures in terms of waiver of late fees and reduced rate of Interest for the period of March and April 2021. The relief measures and other updates are summarized below:

Table of Contents

- A. Relief in GSTR-3B & GSTR 1 (March 2021 to May 2021)

- B. Reduction in Interest rate for Composition Taxpayers (GST CMP-08)

- C. Extension in the filing of ITC-04 and GSTR 4.

- D. Cumulative application of Rule 36(4) for April 21 to May 21.

- E. Due date of some specified compliances extended to 31st May 2021.

- F. Extension of timelines for GST Registration and Refund claims.

- G. Due dates for Returns for TDS, TCS, Non-resident taxpayers, ISDs

- H. SC- Extension in limitation period due to COVID-19

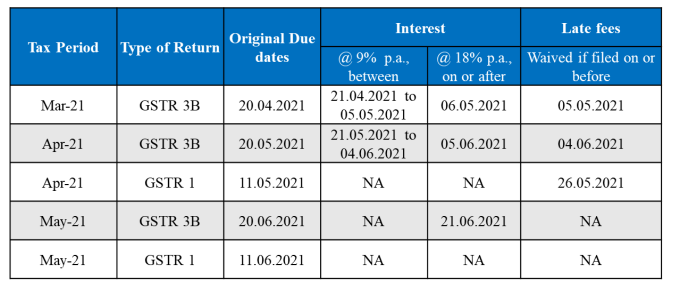

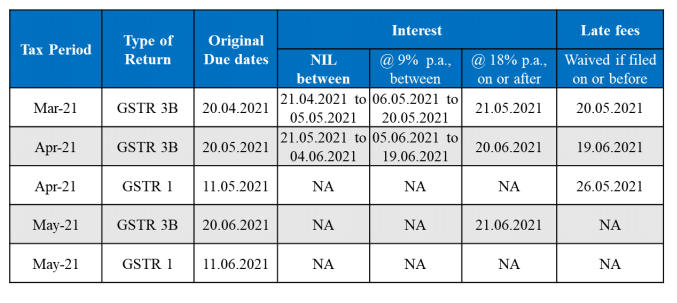

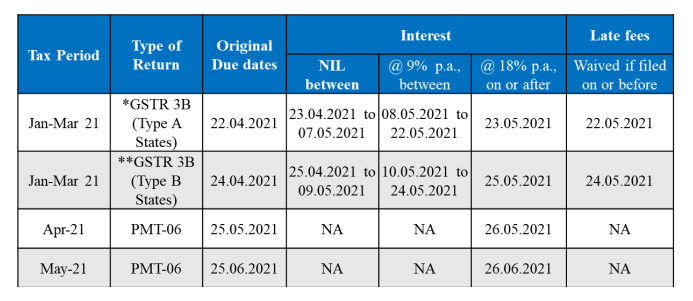

A. Relief in GSTR-3B & GSTR 1 (March 2021 to May 2021)

(1) Aggregate turnover of more than Rs. 5 Crores in preceding F.Y.

(2) Aggregate turnover below Rs. 5 Crores and have opted for Monthly Return Filing.

(3) Aggregate turnover below Rs. 5 Crores and have opted QRMP (Quarterly Return Monthly Payment) Scheme.

*Type A States: Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshadweep

**Type B States: Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi,

Related Topic:

Tax exemption to ameliorate stress due to COVID-19: PIB

The due date to file Invoice Furnishing Facility for April 2021 has been extended till 28th May 2021

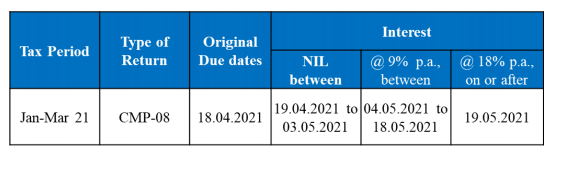

B. Reduction in Interest rate for Composition Taxpayers (GST CMP-08)

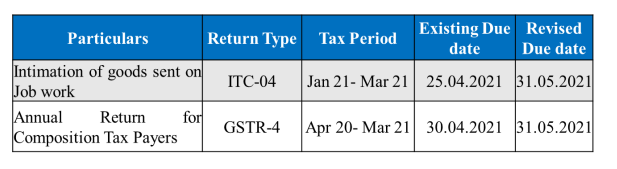

C. Extension in the filing of ITC-04 and GSTR 4.

D. Cumulative application of Rule 36(4) for April 21 to May 21.

Rule 36(4) of the CGST Rules, 2017, restricts availment of ITC to 105% of the ITC on Invoices/Debit Notes furnished by Suppliers in GSTR-1/IFF. With the relaxation in the filing of GSTR-1/IFF, it has been provided that the said restriction shall apply cumulatively for the period April ’21 to May ’21 while filing GSTR-3B of May’21.

E. Due date of some specified compliances extended to 31st May 2021.

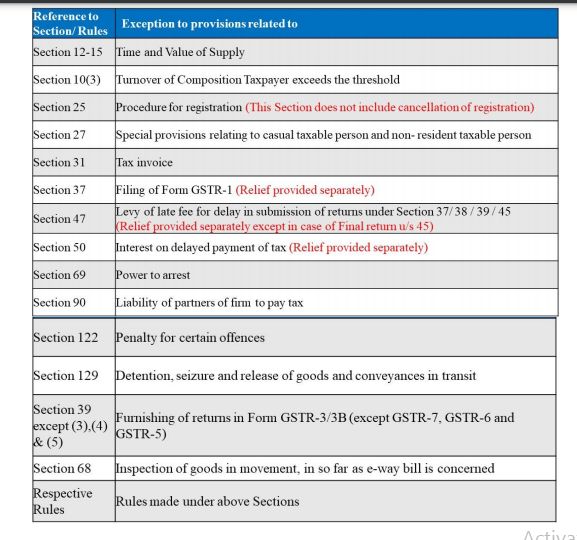

By way of CGST Notification No. 14/2021- dated 01.05.2021, where the time limit of any of the following actions falls between 15th April 2021 to 30th May 2021, the due date of the same would get extended to 31st May 2021:

- The due date for completion of any proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval or such other action by any authority, commission or tribunal, under the provisions of the Acts (Comment: From the perspective of the Department)

- Filing of any appeal, reply or application or furnishing of any report, the document, return, statement or such other record, by whatever name called, under the provisions of the Acts stated above; (Comment: From the perspective of the Taxpayer)

Related Topic:

GST Insights- Compliances before 31st March 21 and Changes w.e.f. 1st April 2021

Exclusions:

F. Extension of timelines for GST Registration and Refund claims.

By way of the CGST Notification No. 14/2021 – CT dated 01.05.2021,

- It has been notified that where the time limit for action by authorities relating to GST Registration in terms of issuance of notice in Form GST REG-03, rejection of order in Form GST REG-05 or grant of registration in Form GST REG-06 falls between 01st May 2021 to 31st May 2021, then such time limit shall be extended to 15th June 2021.

- Where an SCN for full or partial rejection of refund claim has been issued and the date of passing order to the same falls between 15th April to 30th May 2021, then the department can issue such order within

(i) 15 days from the date of reply or

(ii) 31st May 2021

Whichever is later.

G. Due dates for Returns for TDS, TCS, Non-resident taxpayers, ISDs

It is pertinent to note that there is no specific Notification extending the due dates to file other returns under GST like GSTR-5, GSTR-6, GSTR-7 & GSTR8. However, the same is very well covered by the general CGST Notification No. 14/2021-CGST dated 01.05.2021 extending timelines for various compliances and actions. Hence, the due dates for all the above returns for those periods whose due date fall between 15th April 2021 to 30th May 2021 have been extended till 31st May 2021

H. SC- Extension in limitation period due to COVID-19

Last year, the Hon’ble Supreme Court vide its order dated 23.03.2020 has granted an extension in respect of all proceedings w.e.f. 15th March 2020 onwards till further orders on account of challenges being faced due to the spread of the COVID19. Then, on 8th March 2021, the limitation period was brought to an end till 14th March 2021.

However, the Hon’ble Supreme Court on 27th March 2021 restored the Order to extend the aforesaid period of limitation of filing cases in various legal fora with effect from 14.03.2021 until further orders in view of hardships faced by litigants due to the alarming Covid-19 situation. Hence, the limitation period for filing any appeals/suits/applications before any appellate authority will exclude the period between 15th March 2020 till further orders by SC.

(CA Nikhil M. Jhanwar)

Disclaimer: The information in this document is for educational purposes only and nothing conveyed or provided should be considered as legal, accounting, or tax advice.