Download List of GST Forms

- GST Forms

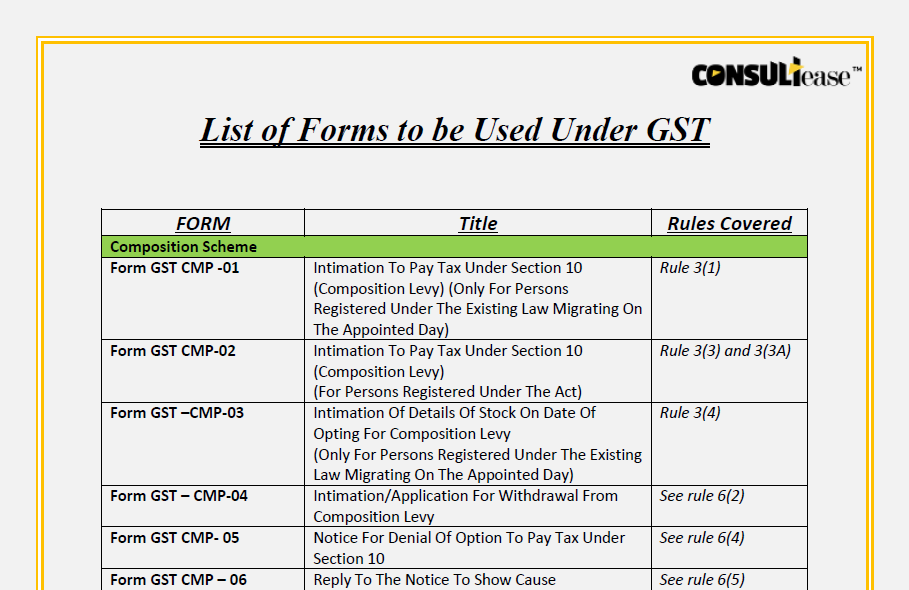

- List of the GST Forms:

- Composition Scheme

- Registration

- GST forms for Input tax credit

- GST forms for Enrolment under section 35

- GST forms for filing of Returns

- GST Practitioner Forms

- Electronic Ledgers

- Refund Forms

- Assessment Forms Under GST

- Audit Forms in GST

- Advance Ruling Forms in GST

- Appellate Authority of Advance Ruling Form

- Transitional Credit Forms

- E-Way Bill Forms

- Inspection Forms

- Payment for other reasons

- Compounding of Offence Forms

GST Forms

As we are getting used to the GST regime in our life. But still, we do not know the procedure and GST forms which are to be used. The GST forms are used for various purposes. We all know what we have to do, but do not know the GST forms for particular purposes. All the functions are to be done through GST Forms. So, we have organized the list of the GST forms and for what is the purpose of that GST forms. Following is the list of the GST Forms:

Download the list of the GST Forms by clicking the below image:

List of the GST Forms:

| FORM | Title | Rules Covered |

Composition Scheme |

||

| Form GST CMP -01 | Intimation To Pay Tax Under Section 10 (Composition Levy) (Only For Persons Registered Under The Existing Law Migrating On The Appointed Day) | Rule 3(1) |

| Form GST CMP-02 | Intimation To Pay Tax Under Section 10 (Composition Levy)

(For Persons Registered Under The Act) |

Rule 3(3) and 3(3A) |

| Form GST –CMP-03 | Intimation Of Details Of Stock On Date Of Opting For Composition Levy

(Only For Persons Registered Under The Existing Law Migrating On The Appointed Day) |

Rule 3(4) |

| Form GST – CMP-04 | Intimation/Application For Withdrawal From Composition Levy | See rule 6(2) |

| Form GST CMP- 05 | Notice For Denial Of Options To Pay Tax Under Section 10 | See rule 6(4) |

| Form GST CMP – 06 | Reply To The Notice To Show Cause | See rule 6(5) |

| Form GST CMP-07 | Order For Acceptance / Rejection Of Reply To Show Cause Notice | See rule 6(7) |

| Form GST CMP-08 | Statement for payment of self-assessed tax | See rule 62 |

Registration |

||

| Form GST REG-01 | Application For Registration | See rule 8(1) |

| Form GST REG-02 | Acknowledgment | See rule 8(5) |

| Form GST REG-03 | Notice For Seeking Additional Information / Clarification / Documents Relating To Application For <<Registration/Amendment/Cancellation>> | See rule 9(2) |

| Form GST REG-04 | Clarification/Additional Information/Document

For<<Registration/Amendment/Cancellation>> |

See rule 9(2) |

| Form GST REG-05 | Order Of Rejection Of Application For <Registration / Amendment / Cancellation> | Rule 9(4) |

| Form GST REG-06 | Registration Certificate | See rule 10(1) |

| Form GST REG-07 | Application For Registration As Tax Deductor At Source (U/S 51) Or Tax Collector At Source (U/S 52) | See rule 12(1) |

| Form GST REG-08 | Order Of Cancellation Of Registration As Tax Deductor At Source Or Tax Collector At Source | See rule 12(3) |

| Form GST REG-09 | Application For Registration Of Non-Resident Taxable Person | See rule 13(1) |

| Form GST REG-10 | Application For Registration Of Person Supplying OIDAR Service

From A Place Outside India To A Person In India, Other Than A Registered Person. |

Rule 14(1)] |

| Form GST REG-11 | Application For Extension Of Registration Period By Casual / Non-Resident Taxable Person | Rule 15(1)

|

| Form GST REG-12 | Order Of Grant Of Temporary Registration/ Suo Moto Registration | Rule 16(1) |

| Form GST REG-13 | Application/Form For Grant Of Unique Identity Number (UIN) To UN Bodies/

Embassies /Others |

Rule 17 |

| Form GST REG-14 | Application For Amendment In Registration Particulars | Rule 19(1) |

| Form GST REG-15 | Order Of Amendment | Rule 19(1) |

| Form GST REG-16 | Application For Cancellation Of Registration | See rule 20 |

| Form GST REG -17 | Show Cause Notice For Cancellation Of Registration | Rule 22(1) |

| Form GST REG- 18 | Reply To The Show Cause Notice Issued For Cancellation For Registration | Rule 22(2) |

| Form GST REG-19 | Order For Cancellation Of Registration | Rule 22(3) |

| Form GST REG-20 | Order For Dropping The Proceedings For Cancellation Of Registration | Rule 22(4) |

| Form GST REG-21 | Application For Revocation Of Cancellation Of Registration | Rule 23(1) |

| Form GST REG-22 | Order For Revocation Of Cancellation Of registration | Rule 23(2) |

| Form GST REG-23 | Show Cause Notice For Rejection Of Application For Revocation Of Cancellation Of Registration | Rule 23(3) |

| Form GST REG-24 | Reply To The Notice For Rejection Of Application For Revocation Of Cancellation Of Registration | Rule 23(3) |

| Form GST REG-25 | Certificate Of Provisional Registration | Rule 24(1) |

| Form GST REG-26 | Application For Enrolment Of Existing Taxpayer | Rule 24(2) |

| Form GST REG-27 | Show Cause Notice For Cancellation Of Provisional Registration | Rule 24(3) |

| Form GST REG-28 | Order For Cancellation Of Provisional Registration | Rule 24(3) |

| Form GST REG-29 | Application For Cancelation Of Registration Of Migrated

Taxpayers |

Rule 24(4) |

| Form GST REG-30 | Form For Field Visit Report | Rule 25 |

| Form GST REG – 31 | Intimation for suspension and notice for cancellation of registration | Rule 21A |

GST forms for Input tax credit |

||

| Form GST ITC – 01 | Declaration For Claim Of Input Tax Credit Under Sub-Section (1) Of Section 18 | Rule 40(1) |

| Form GST ITC -02 | Declaration For Transfer Of ITC In Case Of Sale, Merger, Demerger, Amalgamation, Lease Or Transfer Of A Business Under Sub-Section (3) Of Section 18 | Rule 41(1) |

| Form GST ITC – 02A | Declaration for transfer of ITC pursuant to registration under sub-section (2) of section 25 | Rule 41(A) |

| Form GST ITC -03 | Declaration For Intimation Of ITC Reversal/Payment Of Tax On Inputs Held In Stock, Inputs Contained In Semi-Finished And Finished Goods Held In Stock And Capital Goods Under Sub-Section (4) Of Section 18 | Rule44(4) |

| Form GST ITC-04 | Details Of Goods/Capital Goods Sent To Job Worker And Received Back | Rule 45(3) |

GST forms for Enrolment under section 35 |

||

| FORM GST ENR-01 | Application For Enrolment Under Section 35(2)

[Only For Un-Registered Persons] |

Rule 58(1) |

| FORM GST ENR – 02 | Application for obtaining unique common enrolment number | Rule 58(1A) |

GST forms for filing of Returns |

||

| Form GSTR-1 | Details Of Outward Supplies Of Goods Or Services | Rule (59(1) |

| Form GSTR-1A | Details Of Auto Drafted Supplies | Rule 59(4) |

| Form GSTR-2 | Details Of Inward Supplies Of Goods Or Services | Rule 60(1) |

| FORM GSTR-2A | Details Of Auto Drafted Supplies | Rule 60(1) |

| FORM GSTR-2B | Auto-drafted ITC Statement | Rule 60(7) |

| Form GSTR-3 | Monthly Return | Rule 61(1) |

| Form GSTR – 3A | Notice To Return Defaulter U/S 46 For Not Filing Return | Rule 68 |

| FORM GSTR-3B | Monthly Return to claim ITC and pay Tax Liability | Rule 61(5) |

| Form GSTR-4 | Quarterly Return For Registered Person Opting For Composition Levy | Rule 62 |

| Form GSTR-4A | Auto-Drafted Details For Registered Person Opting For Composition

Levy |

Rules 59(3) & 66(2) |

| Form GSTR-5 | Return For Non-Resident Taxable Person | Rule 63 |

| Form GSTR-5A | Details Of Supplies Of Online Information And Database Access Or Retrieval Services By A Person Located Outside India Made To Non-Taxable Persons In India | Rule 64 |

| Form GSTR-6 | Return For Input Service Distributor | Rule 65 |

| Form GSTR-6A | Details Of Supplies Auto-Drafted Form | Rule 59(3) & 65 |

| Form GSTR-7 | Return For Tax Deducted At Source | Rule 66 (1) |

| Form GSTR 7A | Tax Deduction At Source Certificate | Rule 66(3) |

| Form GSTR – 8 | Statement For Tax Collection At Source | Rule 67(1) |

| Form GSTR – 9 | Annual Return | Rule 80 |

| Form GSTR – 9A | Annual Return (Composition Taxpayer) | Rule 80 |

| Form GSTR – 9C | Statement of audited annual accounts and a reconciliation (Reconciliation and Audit report) | Rule 80(3) |

| FORM GSTR-10 | Final Return | Rule 81 |

| Form GSTR -11 | Statement Of Inward Supplies By Persons Having Unique Identification Number (UIN) | Rule 82 |

GST Practitioner Forms |

||

| Form GST PCT – 1 | Application For Enrolment As Goods And Services Tax Practitioner | Rule 83(1) |

| Form GST PCT-02 | Enrolment Certificate Of Goods And Services Tax Practitioner | Rule 83(2) |

| Form GST PCT-03 | Show Cause Notice For Disqualification | Rule 83(4) |

| Form GST PCT-04 | Order Of Rejection Of Enrolment As GST Practitioner | Rule 83(4) |

| Form GST PCT-05 | Authorization/ Withdrawal Of Authorisation For Goods And Services Tax Practitioner | Rule 83(6) |

| FORM GST PCT-06 | APPLICATION FOR CANCELLATION OF ENROLMENT AS GOODS AND SERVICES TAX PRACTITIONER | Rule 83B |

| FORM GST PCT -07 | ORDER OF CANCELLATION OF ENROLMENT AS GOODS AND SERVICES TAX PRACTITIONER | Rule 83B |

Electronic Ledgers |

||

| Form GST PMT –01 | Electronic Liability Register Of Registered Person | Rule 85(1) |

| Form GST PMT –02 | Electronic Credit Ledger Of Registered Person | Rule 86(1) |

| Form GST PMT –03 | Order For Re-Credit Of The Amount To Cash Or Credit Ledger On Rejection Of Refund Claim | Rules86(4) & 87(11) |

| Form GST PMT –04 | Application For Intimation Of Discrepancy In Electronic Credit Ledger/Cash Ledger/ Liability Register | Rules85(7), 86(6) & 87(12) |

| Form GST PMT –05 | Electronic Cash Ledger | Rule 87(1) |

| Form GST PMT –06 | Challan For Deposit Of Goods And Services Tax | Rule 87(2) |

| Form GST PMT –07 | Application For Intimating Discrepancy Relating To Payment | Rule 87(8) |

| Form GST PMT – 09 | Transfer of amount from one account head to another in electronic cash ledger | Rule 87(13) |

Refund Forms |

||

| FORM-GST-RFD-01 | Application For Refund | Rule 89(1) |

| FORM-GST-RFD-01 A | Application For Refund (Manual) | Rules 89(1) and 97A |

| FORM-GST-RFD-01 B | Refund Order Details | Rules 91(2), 92(1), 92(3), 92(4), 92(5) and 97A |

| FORM-GST-RFD-02 | Acknowledgment | Rules90(1), 90(2) and 95(2) |

| FORM-GST-RFD-03 | Deficiency Memo | Rule 90(3) |

| FORM-GST-RFD-04 | Provisional Refund Order | Rule 91(2) |

| FORM-GST-RFD-05 | Payment Advice | Rule 91(3), 92(4), 92(5) & 94 |

| FORM-GST-RFD-06 | Refund Sanction/Rejection Order | Rule 92(1), 92(3), 92(4), 92(5) & 96(7) |

| FORM-GST-RFD-07 | Order For Complete Adjustment Of Sanctioned Refund | Rule 92(1), 92(2) & 96(6) |

| FORM-GST-RFD-08 | Notice For Rejection Of Application For Refund | Rule 92(3) |

| FORM-GST-RFD-09 | Reply To Show Cause Notice | Rule 92(3) |

| FORM GST RFD-10 | Application For Refund By Any Specialized Agency Of UN Or Any Multilateral Financial

Institution And Organization, Consulate Or Embassy Of Foreign Countries, Etc. |

Rule 95(1) |

| FORM GST RFD-10A | Application for refund by Canteen Stores Department (CSD) | Rule 95 |

| FORM GST RFD – 10B | Application for refund by Duty Free Shops/Duty Paid Shops (Retail outlets) | Rule 95A |

| FORM GST RFD-11 | Furnishing Of Bond Or Letter Of Undertaking For Export Of Goods Or Services | Rule 96A |

| Bond For Export Of Goods Or Services Without Payment Of Integrated Tax | Rule 96A | |

| Letter Of Undertaking For Export Of Goods Or Services Without Payment Of Integrated Tax | Rule 96A | |

| Form GST RFD – 01 W | Application for Withdrawal of Refund Application | Rule 90(5) |

Assessment Forms Under GST |

||

| Form GST ASMT – 01 | Application For Provisional Assessment Under Section60 | Rule 98(1) |

| Form GST ASMT – 02 | Notice For Seeking Additional Information / Clarification / Documents For Provisional

Assessment |

Rule 98(2) |

| Form GST ASMT – 03 | Reply To The Notice Seeking Additional Information | Rule 98(2) |

| Form GST ASMT – 04 | Order Of Provisional Assessment | Rule 98(3) |

| Form GST ASMT – 05 | Furnishing Of Security | Rule 98(4) |

| Bond For Provisional Assessment | Rule 98(3) & 98(4) | |

| Form GST ASMT – 06 | Notice For Seeking Additional Information / Clarification / Documents For Final Assessment | Rule 98(5) |

| Form GST ASMT – 07 | Final Assessment Order | Rule 98(5) |

| Form GST ASMT – 08 | Application For Withdrawal Of Security | Rule 98(6) |

| Form GST ASMT – 09 | Order For Release Of Security Or Rejecting The Application | Rule 98(7) |

| Form GST ASMT – 10 | Notice For Intimating Discrepancies In The Return After Scrutiny | Rule 99(1) |

| Form GST ASMT – 11 | Reply To The Notice Issued Under Section61 Intimating Discrepancies In The Return | Rule 99(2) |

| Form GST ASMT–12 | Order Of Acceptance Of Reply Against The Notice Issued Under Section61 | Rule 99(3) |

| Form GST ASMT – 13 | Assessment Order Under Section 62 | Rule 100(1) |

| Form GST ASMT – 14 | Show Cause Notice For Assessment Under Section 63 | Rule 100(2) |

| Form GST ASMT – 15 | Assessment Order Under Section 63 | Rule 100(2) |

| Form GST ASMT – 16 | Assessment Order Under Section 64 | Rule 100(3) |

| Form GST ASMT – 17 | Application For Withdrawal Of Assessment Order Issued Under Section 64 | Rule 100(4) |

| Form GST ASMT – 18 | Acceptance Or Rejection Of Application Filed Under Section 64 (2) | Rule 100(5) |

Audit Forms in GST |

||

| Form GST ADT – 01 | Notice For Conducting Audit | Rule 101(2) |

| Form GST ADT – 02 | Audit Report Under Section 65(6) | Rule 101(5) |

| Form GST ADT – 03 | Communication to The Registered Person For Conduct Of Special Audit Under Section 66 | Rule 102(1) |

| Form GST ADT – 04 | Information Of Findings Upon Special Audit | Rule 102(2) |

Advance Ruling Forms in GST |

||

| Form GST ARA -01 | Application Form For Advance Ruling | Rule 104(1) |

| Form GST ARA -02 | Appeal To The Appellate Authority For Advance Ruling | Rule 106(1) |

| Form GST ARA -03 | Appeal To The Appellate Authority For Advance Ruling | Rule 106(2) |

Appellate Authority of Advance Ruling Form |

||

| Form GST APL – 01 | Appeal To Appellate Authority | Rule 108(1) |

| Form GST APL – 02 | Acknowledgment For Submission Of Appeal | Rule 108(3) |

| Form GST APL – 03 | Application To The Appellate Authority Under Sub-Section (2) Of Section 107 | Rule 109(1) |

| Form GST APL – 04 | Summary Of The Demand After Issue Of Order By The Appellate Authority, Tribunal Or

Court |

Rules113(1) & 115 |

| Form GST APL – 05 | Appeal To The Appellate Tribunal | Rule 110(1) |

| Form GST APL – 06 | Cross-Objections Before The Appellate Tribunal | Rule 110(2) |

| Form GST APL – 07 | Application To The Appellate Tribunal Under Sub Section (3) Of Section 112

1 |

Rule 111(1) |

| Form GST APL – 08 | Appeal To The High Court Under Section 117 | Rule 114(1) |

Transitional Credit Forms |

||

| Form GST TRAN – 1 | Transitional ITC / Stock Statement | Rule 117(1), 118, 119 & 120 |

| Form GST TRAN – 2 | Transitional ITC | Rule 117(4) |

E-Way Bill Forms |

||

| FORM GST EWB-01 | E-Way Bill | Rule 138 |

| FORM GST EWB-02 | Consolidated E-Way Bill | Rule 138 |

| FORM GST EWB-03 | Verification Report | Rule138c |

| FORM GST EWB-04 | Report Of Detention | Rule138d |

| Form GST EWB – 05 | Application for unblocking of the facility for generation of E-Way Bill | Rule 138E |

| Form GST EWB-06 | Order for permitting/rejecting the application for unblocking of the facility for the generation of E-Way Bill | Rule 138E |

Invoice Reference Number |

||

| FORM GST INV – 1 | Generation Of Invoice Reference Number | Rule 138A |

Inspection Forms |

||

| FORM GST INS-1 | Authorization For Inspection Or Search | Rule 139 (1) |

| FORM GST INS-02 | Order Of Seizure | Rule 139 (2) |

| FORM GST INS-03 | Order Of Prohibition | Rule 139(4) |

| FORM GST INS-04 | Bond For Release Of Goods Seized | Rule 140(1) |

| FORM GST INS-05 | Order Of Release Of Goods/ Things Of Perishable Or Hazardous Nature | Rule 141(1) |

Payment for other reasons |

||

| FORM GST DRC – 01 | Summary Of Show Cause Notice | Rule 142(1) |

| FORM GST DRC – 01A | Intimation of tax ascertained as being payable under section 73(5)/74(5) | Rule 142 (1A) |

| FORM GST DRC -02 | Summary Of Statement | Rule 142(1)(b) |

| FORM GST DRC- 03 | Intimation Of Payment Made Voluntarily Or Made Against The Show Cause Notice (SCN) Or Statement | Rule 142(2) & 142 (3) |

| FORM GST DRC – 04 | Acknowledgement Of Acceptance Of Payment Made Voluntarily | Rule 142(2) |

| FORM GST DRC- 05 | Intimation Of Conclusion Of Proceedings | Rule 142(3) |

| FORM GST DRC – 06 | Reply To The Show Cause Notice | Rule 142(4) |

| FORM GST DRC – 07 | Summary Of The Order | Rule 142(5) |

| FORM GST DRC – 07A | Summary of the order creating demand under existing laws | Rule 142A(1) |

| FORM GST DRC – 08 | Rectification Of Order | Rule 142(7) |

| FORM GST DRC – 08A | Amendment/Modification of summary of the order creating demand under existing laws | Rule 142A(2) |

| FORM GST DRC – 09 | Order For Recovery Through Specified Officer Under Section 79 | Rule 143 |

| FORM GST DRC – 10 | Notice For Auction Of Goods Under Section 79 (1) (B) Of The Act | Rule 144(2) |

| FORM GST DRC – 11 | Notice To Successful Bidder | Rule 144(5) & 147(12) |

| FORM GST DRC – 12 | Sale Certificate | Rule 144(5) & 147(12) |

| FORM GST DRC – 13 | Notice To A Third Person Under Section 79(1) (C) | Rule 145(1) |

| FORM GST DRC – 14 | Certificate Of Payment To A Third Person | Rule 145(2) |

| FORM GST DRC-15 | Application Before The Civil Court Requesting Execution For A Decree | Rule 146 |

| FORM GST DRC – 16 | Notice For Attachment And Sale Of Immovable/Movable Goods/Shares Under Section 79 | Rule 147(1) & 151(1) |

| FORM GST DRC – 17 | Notice For Auction Of Immovable/Movable Property Under Section 79(1) (D) | Rule 147(4) |

| FORM GST DRC – 18 | Certificate Action Under Clause (E) Of Sub-Section (1) Section 79 | Rule 155 |

| FORM GST DRC – 19 | Application To The Magistrate For Recovery As Fine | Rule 156 |

| FORM GST DRC – 20 | Application For Deferred Payment/ Payment In Instalments | Rule 158(1) |

| FORM GST DRC – 21 | Order For Acceptance/Rejection Of Application For Deferred Payment / Payment In Instalments | Rule 158(2) |

| FORM GST DRC – 22 | Provisional Attachment Of Property Under Section83 | Rule 159(1) |

| FORM GST DRC – 23 | Restoration Of Provisionally Attached Property / Bank Account Under Section83 | Rule 159(3), 159(5) & 159(6) |

| FORMGST DRC-24 | Intimation To Liquidator For Recovery Of Amount | Rule 160 |

| FORM GST DRC – 25 | Continuation Of Recovery Proceedings | Rule 161 |

Compounding of Offence Forms |

||

| FORM GST CPD-01 | Application For Compounding Of Offence | Rule 162(1) |

| FORM GST CPD-02 | Order For Rejection / Allowance Of Compounding Of Offence | Rule 162(3) |

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.