Goods and Services Tax (Compensation to State) Amendment Act, 2018

The Goods and Services Tax (Compensation to State) Amendment Act, 2018

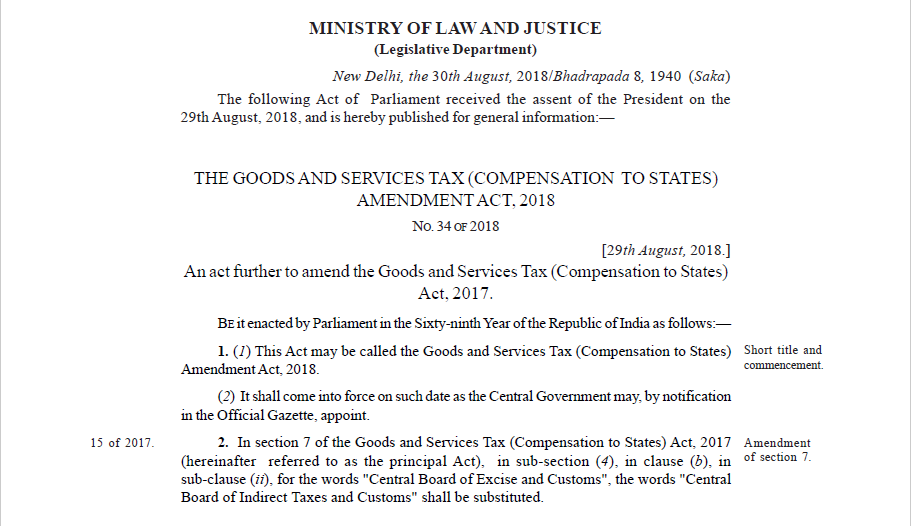

Goods and Services Tax (Compensation to State) Amendment Act, 2018 was pus published in The Gazette of India. The Goods and Services Tax (Compensation to State) Amendment Act, 2018 of Parliament received the assent of the President on the 29th August 2018. After the assent, the act was published for the public.

The text of the Act:

1. (1) This Act may be called the Goods and Services Tax (Compensation to States) Amendment Act, 2018.

(2) It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint.

2. In section 7 of the Goods and Services Tax (Compensation to States) Act, 2017 (hereinafter referred to as the principal Act), in sub-section (4), in clause (b), in sub-clause (ii), for the words “Central Board of Excise and Customs”, the words “Central Board of Indirect Taxes and Customs” shall be substituted.

3. In section 10 of the principal Act, after sub-section (3), the following sub-section shall be inserted, namely:––

“(3A) Notwithstanding anything contained in sub-section (3), fifty percent. of such amount, as may be recommended by the Council, which remains unutilized in the Fund, at any point of time in any financial year during the transition period shall be transferred to the Consolidated Fund of India as the share of Centre, and the balance fifty percent. shall be distributed amongst the States in the ratio of their base year revenue determined in accordance with the provisions of section 5:

Provided that in case of shortfall in the amount collected in the Fund against the requirement of compensation to be released under section 7 for any two months’ period, fifty percent. of the same, but not exceeding the total amount transferred to the Centre and the States as recommended by the Council, shall be recovered from the Centre and the balance fifty percent. from the States in the ratio of their base year revenue determined in accordance with the provisions of section 5.”.

Download the full GST(Compensation to state) Amendment Act, 2018 by clicking the below image:

Source: The Gazette of India

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.