Format and salient features of GST Sugam

Format and salient features of GST Sugam:

Applicability of GSTR Sugam: GST Sugam can be filed by the taxpayers having B2B and B2C supplies other than the following:

a) Composition Dealer

b) ISD

c) TDS deductor u/s 51

d) TCS deductor u/s 52

e) Non-resident taxable persons

Sugam is the new return under GST. This is introduced by the CBIC under their process of simplification of GST returns. Sugam is required to be filed quarterly by the taxpayers having the BtoC and BtoB supply. Here BtoC means business to customer. When our customer is not registered in GST we call it a BtoC supply. On the other hand, when my buyer is registered under GST it is called BtoB supply. GSTR Sugam will be filed by the taxpayer having both of these supplies. It is important to note that the payment of tax will be monthly. Tax payment will be made on the basis of the declaration of the taxpayer. Although return can be filed quarterly when the annual turnover is up to Rs. 5 Crore.

Information in GSTR Sugam:

Main data required to be disclosed in GSTR Sugam is as follows.

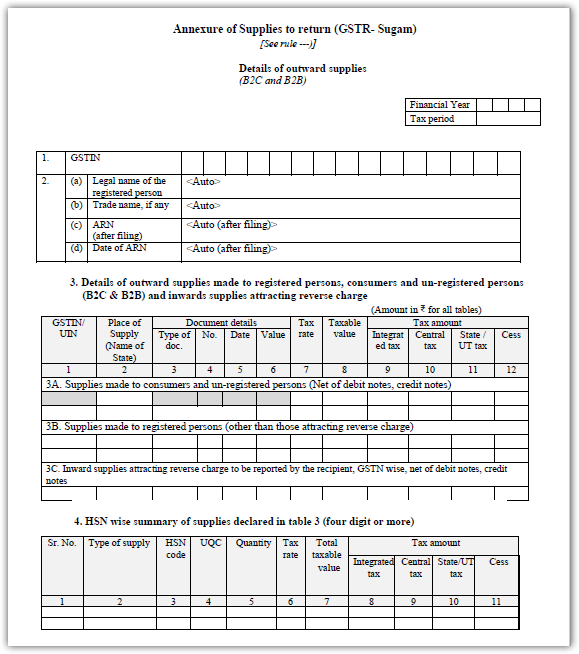

Details of outward supplies: Details of outward supplies made to registered persons, consumers and un-registered persons (B2C & B2B) and inwards supplies attracting a reverse charge. Following three data will be there in Annexure to GSTR Sugam.

- Supplies made to consumers and un-registered persons (Net of debit notes, credit notes). Table 3A

- Supplies made to registered persons (other than those attracting reverse charge) Table 3B.

- Inward supplies attracting a reverse charge to be reported by the recipient, GSTN wise, net of debit notes, credit notes. Table 3C.

- HSN wise summary of supplies declared in table 3 (four digits or more)

The format of this annexure is attached here.

Annexure to GSTR Sugam

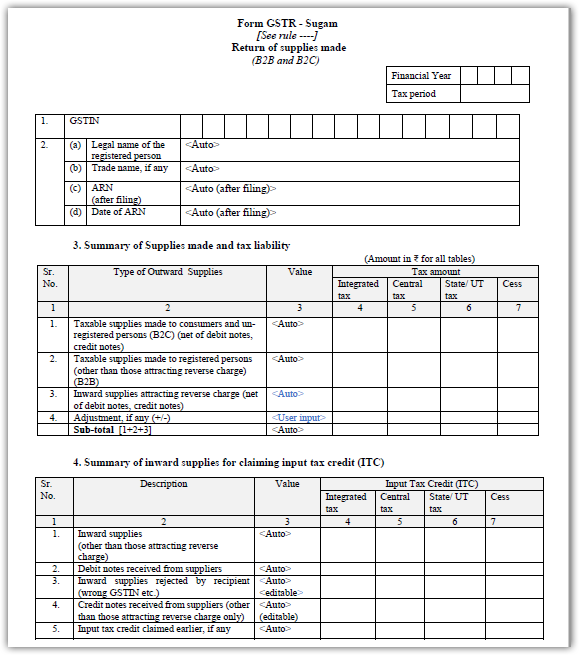

Data to be disclosed in GSTR Sugam:

- Summary of Supplies made and tax liability, Table No. 3.

- Summary of inward supplies for claiming input tax credit (ITC), Table no. 4.

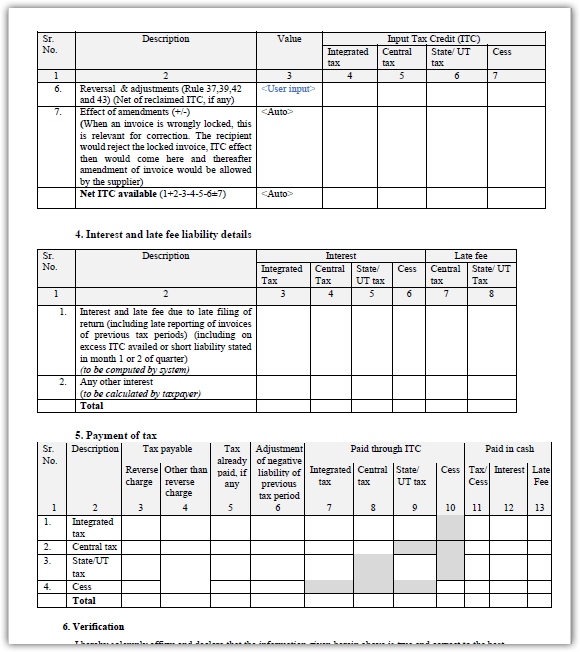

- Interest and late fee liability details.

- Payment of tax, Table no. 5.

Instructions (GSTR-Sugam) –

1. The return can be filed by the taxpayer who has made supplies to consumers and un-registered persons (B2C) and to registered persons (B2B) only.

2. Input tax credit availed earlier during first two months of the quarter will be adjusted from the claim. If balance becomes negative, then it will be added into the liability for the same quarter.

3. Tax paid during the first two months of the quarter will be adjusted against the total liability of the quarter.

4. Payment can be made out of cash or credit as per rules.

5. Reversal of credit under rule 37, 39, 42 & 43 shall be reported as net of reclaimed ITC if any. Ineligible credit shall also be reported under reversal.

6. Adjustment in ITC, if any due to transition from the composition or otherwise shall be reported in table 4 for accounting into ITC.

Thus now a taxpayer will have to see their nature of supply.

The format of the same is attached here.

The author can be reached at info@consultease.com

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.