What is Form GST ITC 03

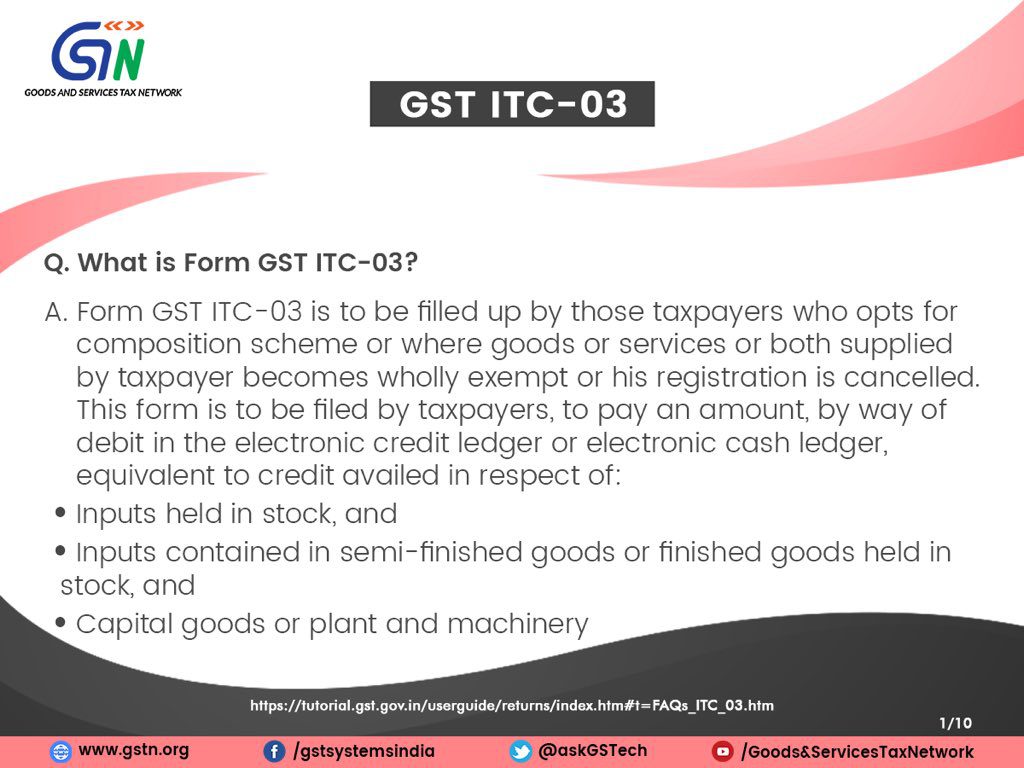

What is Form GST ITC 03?

Following taxpayers need to fill Form GST ITC 03.

- who opt for composition scheme or

- where goods or services or both supplied by taxpayer becomes wholly exempt or

- his registration is canceled u/s 29(2) of CGST Act.

In all the above situations the taxpayer is required to file FORM GST ITC03. It is filled to pay an amount equivalent to the closing credit. To pay this amount taxpayer to make a debit in the electronic credit ledger or electronic cash ledger, equivalent to credit availed in respect of:

- Inputs held in stock, and

- Inputs contained in semi-finished goods or finished goods held in stock, and

- Capital goods or plant and machinery

It is interesting to see that at the time of entry into GST ITC of CG is not available.

You can access this Form on GSTIN website. You need to login at GSTN portal and find it at your dashboard.Thus take care to calculate and pay closing ITC.

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.