Step by Step process for filing GSTR 9C

- Step 1 for filing GSTR 9C: Download Latest version 1.6 of the utility of GSTR 9C:

- Step 2: Filling the data into the utility to file GSTR 9C

- Fill the data from GSTR 9C PDF downloaded from GST portal:

- Table 5: Reconciliation of Turnover:

- Table 6: Reasons

- Table 7: Reconciliation of Taxable Turnover:

- Table 8: Reasons for mismatch in taxable turnover in table 7

- Table 9: Reconciliation of rate wise liability and amount payable thereon:

- Table 10: Reasons for mismatch in rate wise liability.

- Table 11: Additional amount payable but not paid: (Due to reasons specified in table no. 6,8 and 10)

- Table 12: Reconciliation of ITC:

- Table 13: Reasons for mismatch in table 12:

- Table14: Reconciliation of ITC:

- Table 15: Reason for unreconciled ITC:

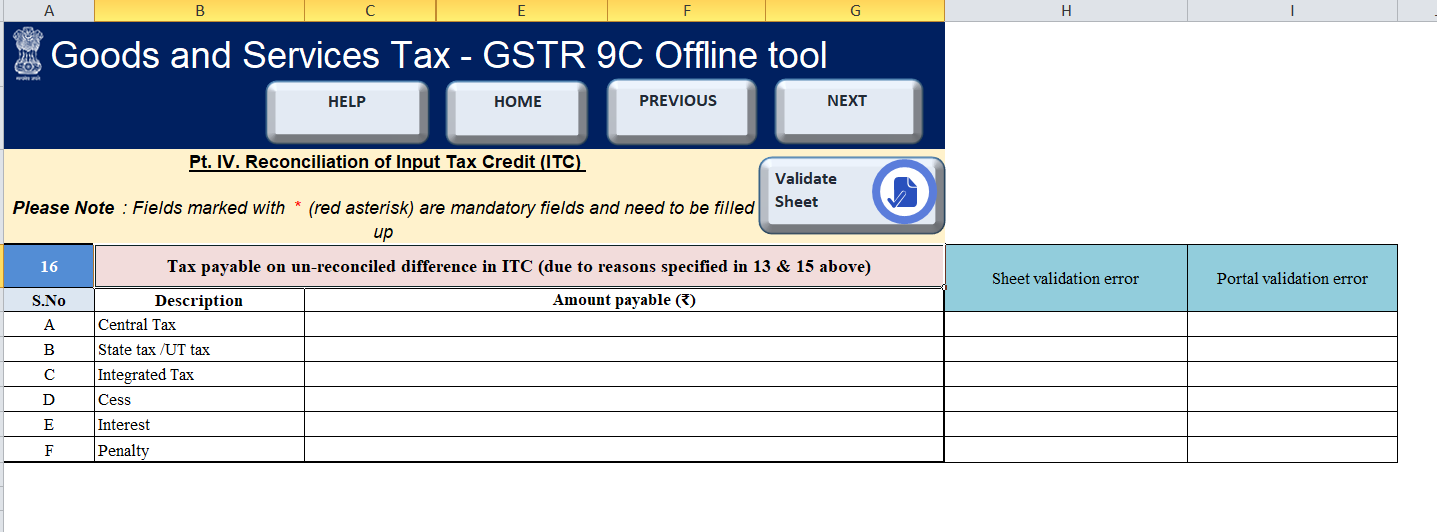

- Table 16: Tax Payable on the unreconciled difference in ITC:

- Part V: Auditor’s recommendation:

- Step 3: Create JSON from the utility:

- Step 4: Upload the JSON file created on the portal: Check errors and correct:

- Step 5: File it finally

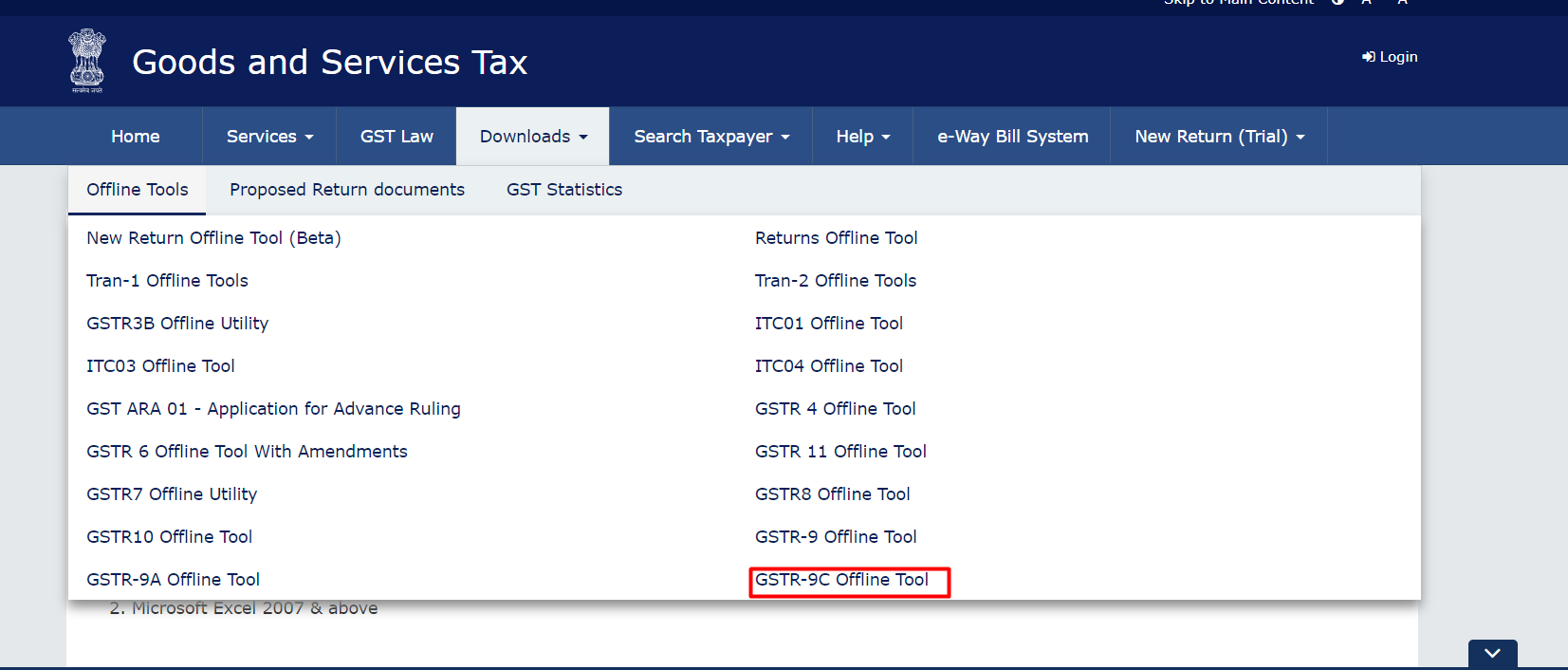

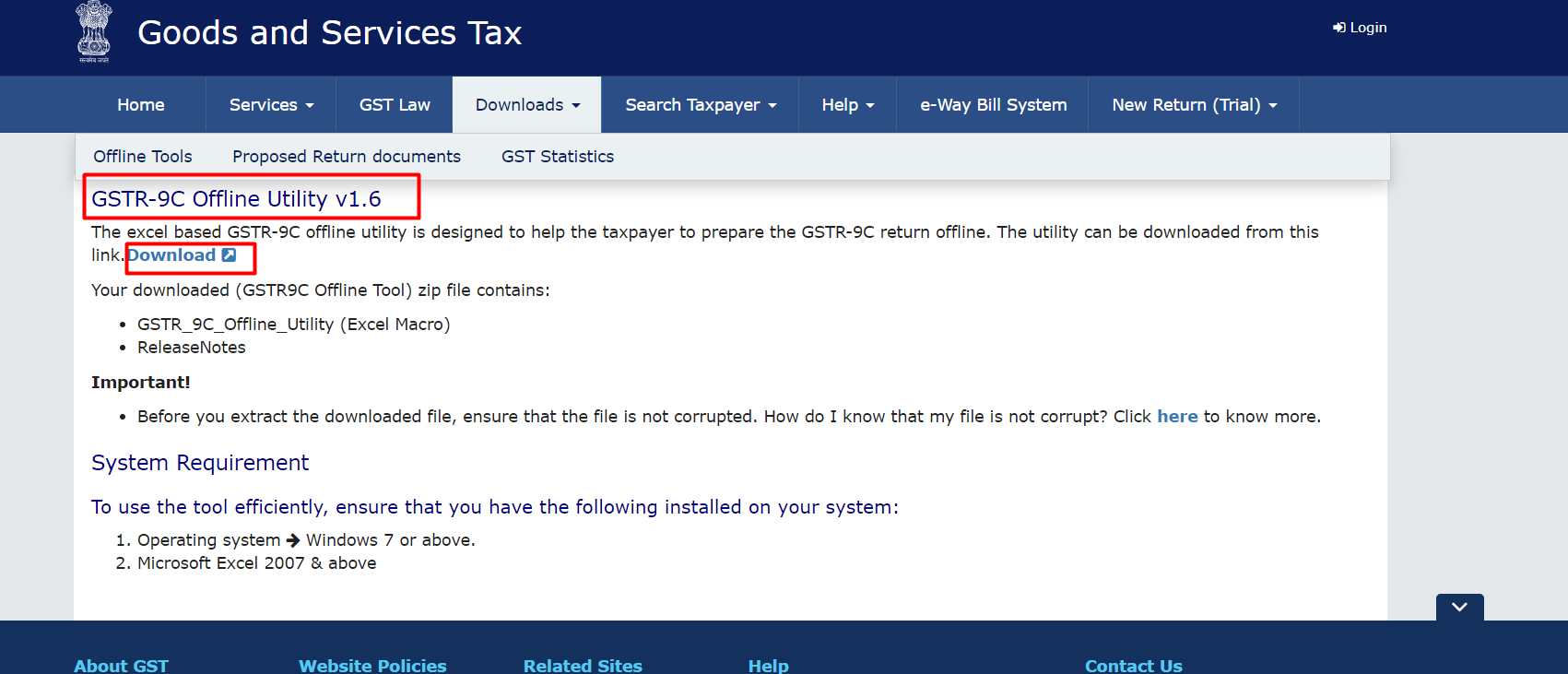

Step 1 for filing GSTR 9C: Download Latest version 1.6 of the utility of GSTR 9C:

First of all download the latest version of utility available on the portal. There were many versions of this tool. But they had many errors. Download the latest version 1.6 only.

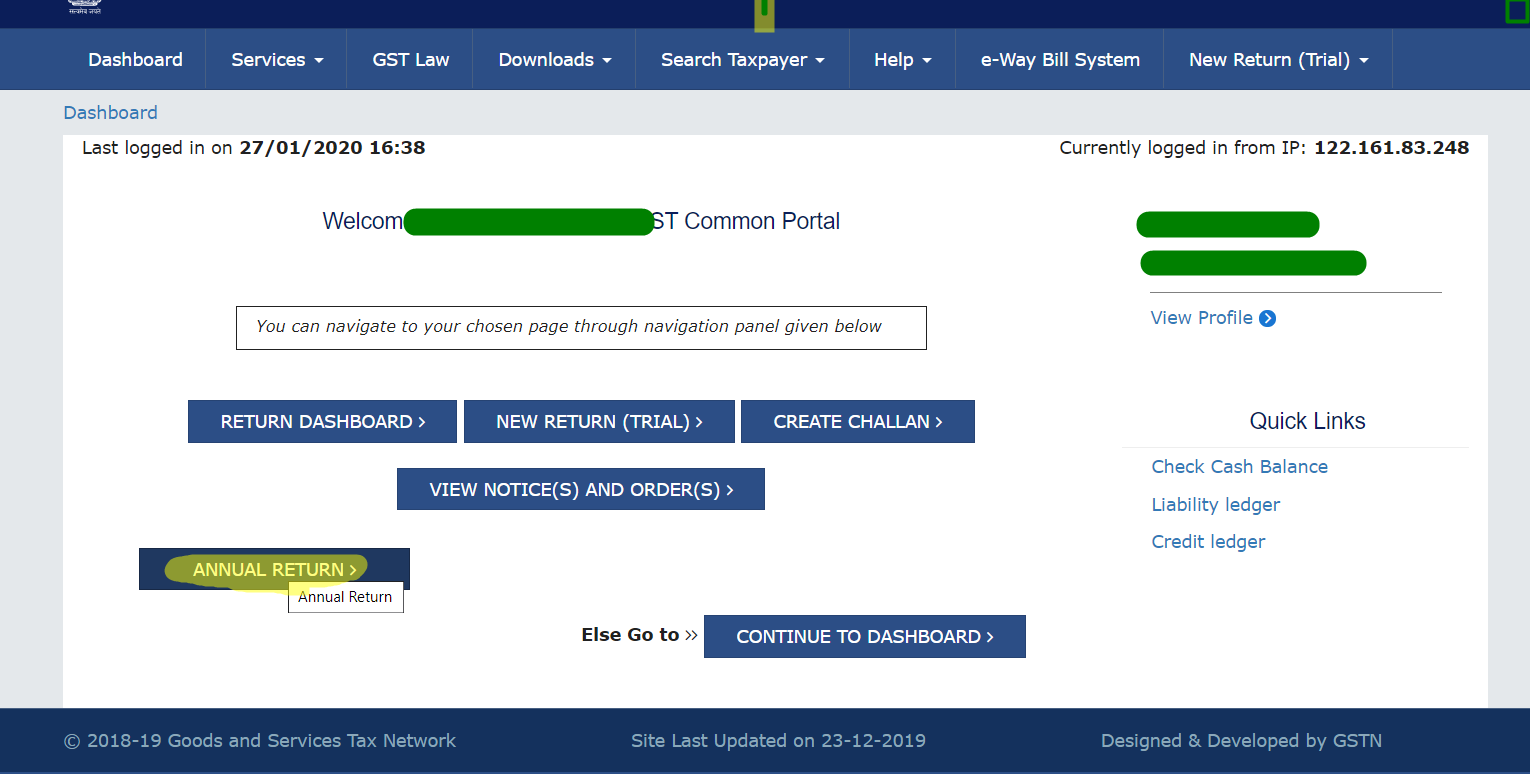

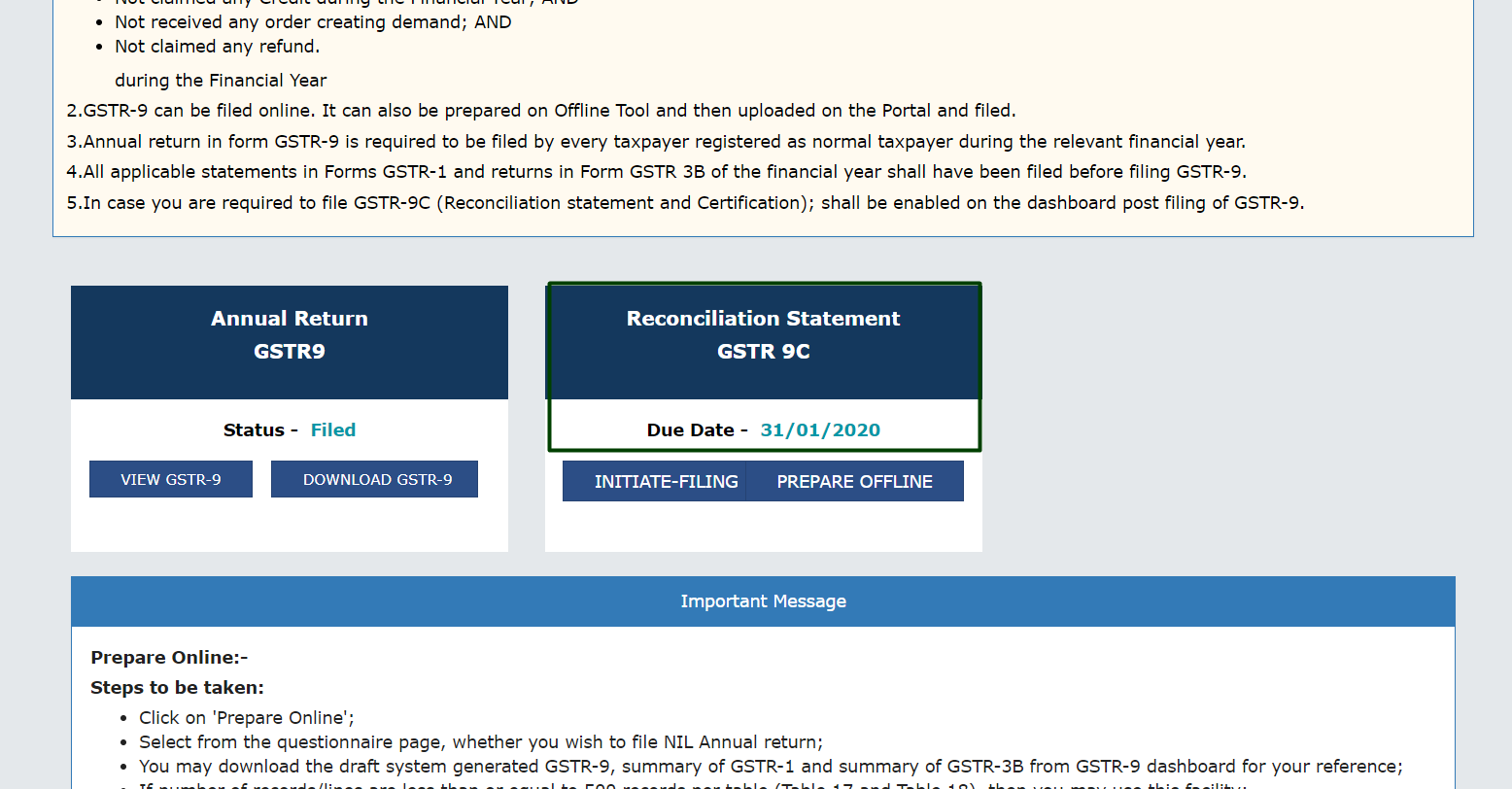

Do this and make separate files for all of your clients. You can file GSTR 9C only when you have already filed the GSTR 9 of the taxpayer.

Step 2: Filling the data into the utility to file GSTR 9C

This will contain two steps. Fill data from GSTR 9 already filed and then fill other data. GSTR 9C will compare the data in financials and data filed in GSTR 9. SO we need to fille both of these data from respective resources.

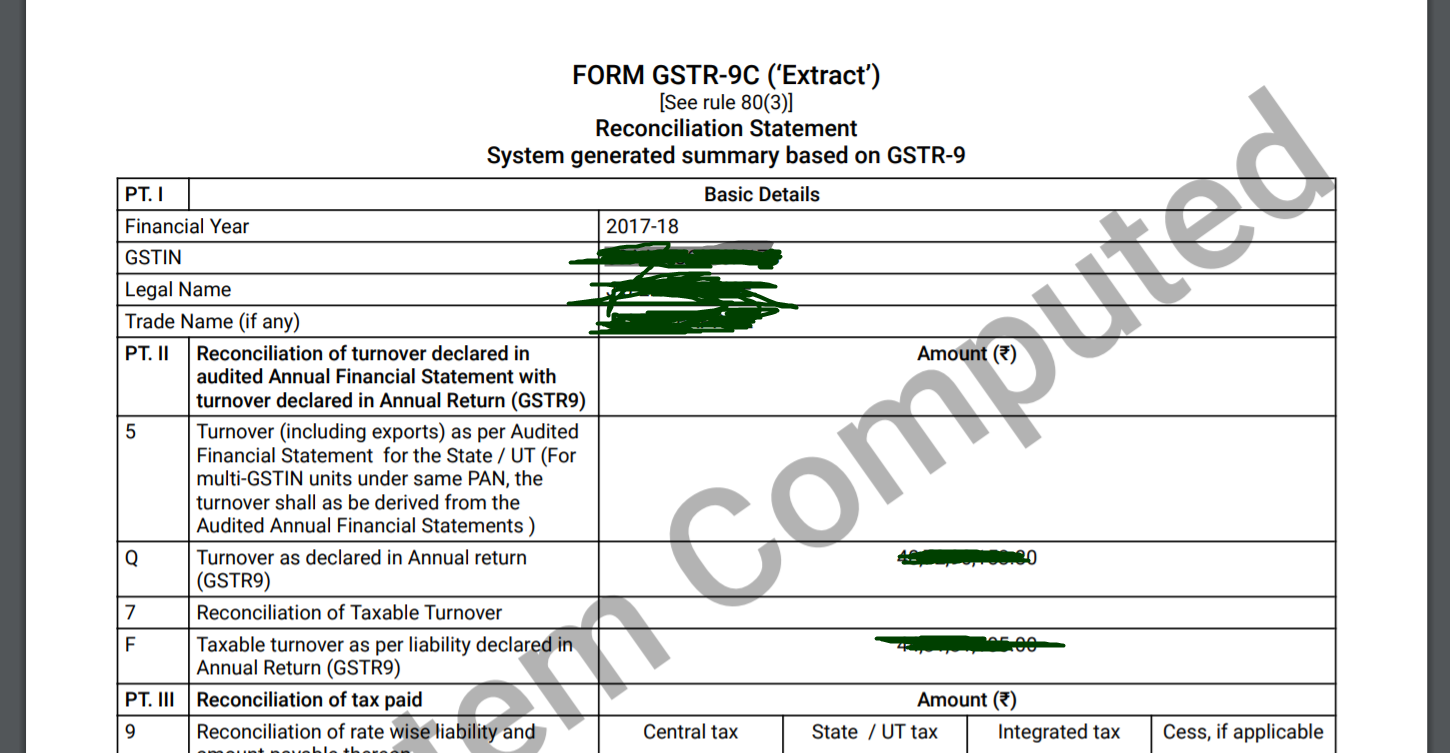

Fill the data from GSTR 9C PDF downloaded from GST portal:

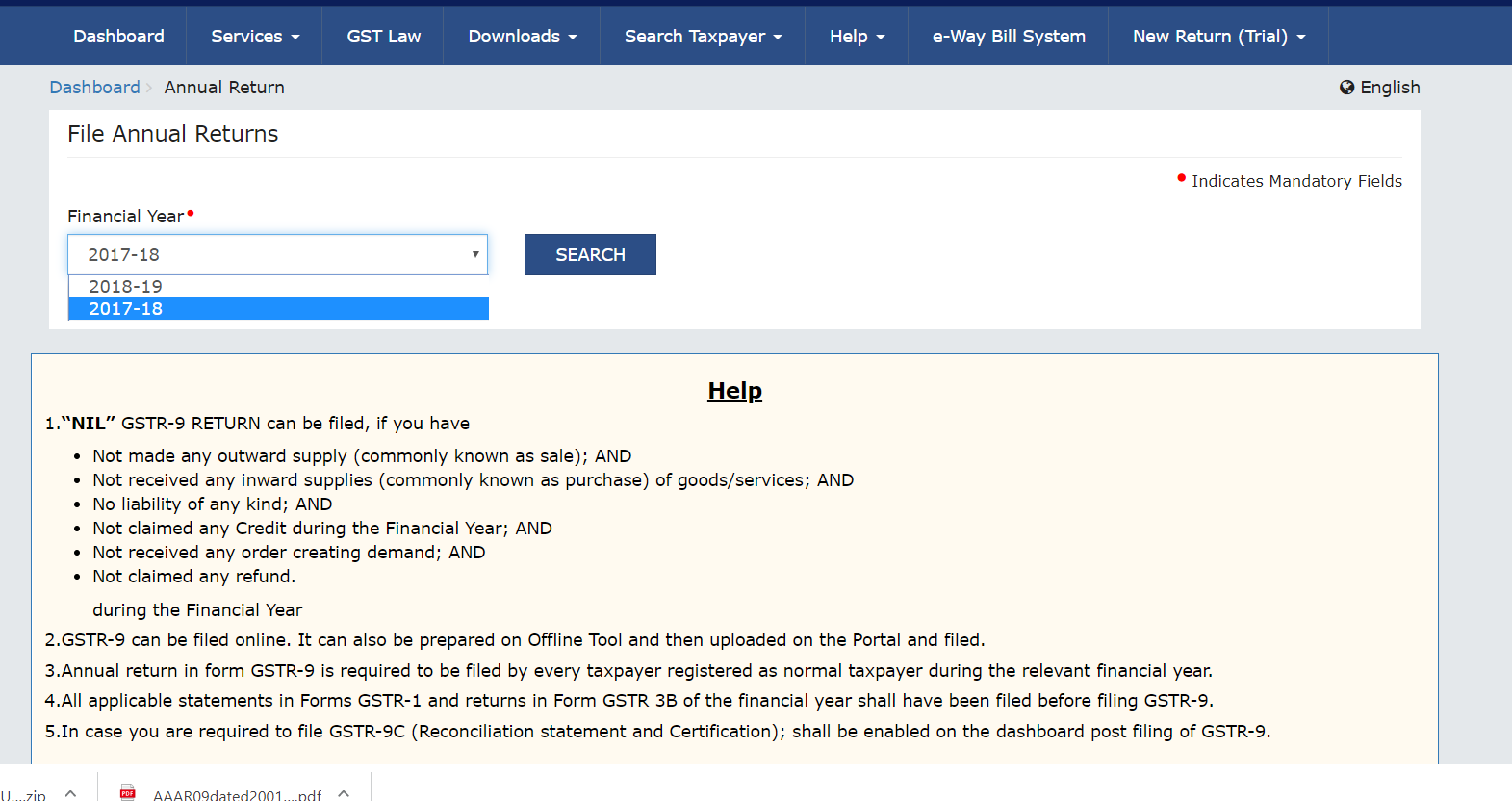

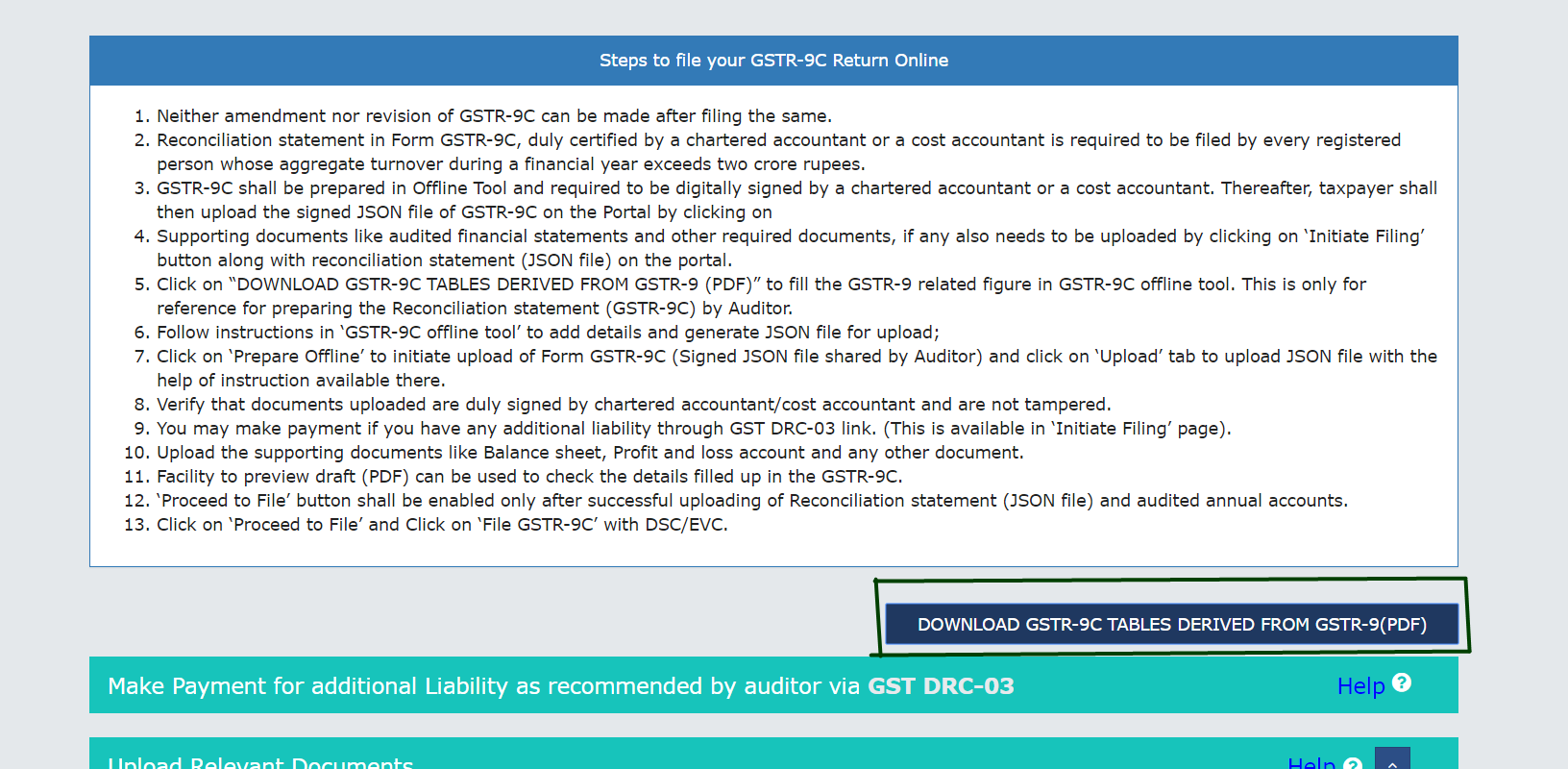

Now we need to fill the data already there in GSTR 9. You can download the PDF of GSTR 9 from the portal. Login into the account of the taxpayer and follow the following.

Step 1

You will get the PDF with details extracted from GSTR 9 auto-filled. You can use it to fill this data.

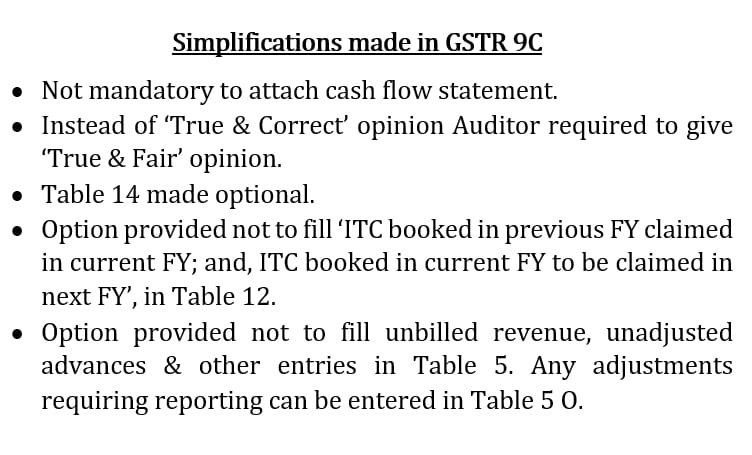

Now various tables of this utility are required to be filled with data from Financials. Some of these tables were made optional via circular no. Let us have a look at all tables with the part made optional.

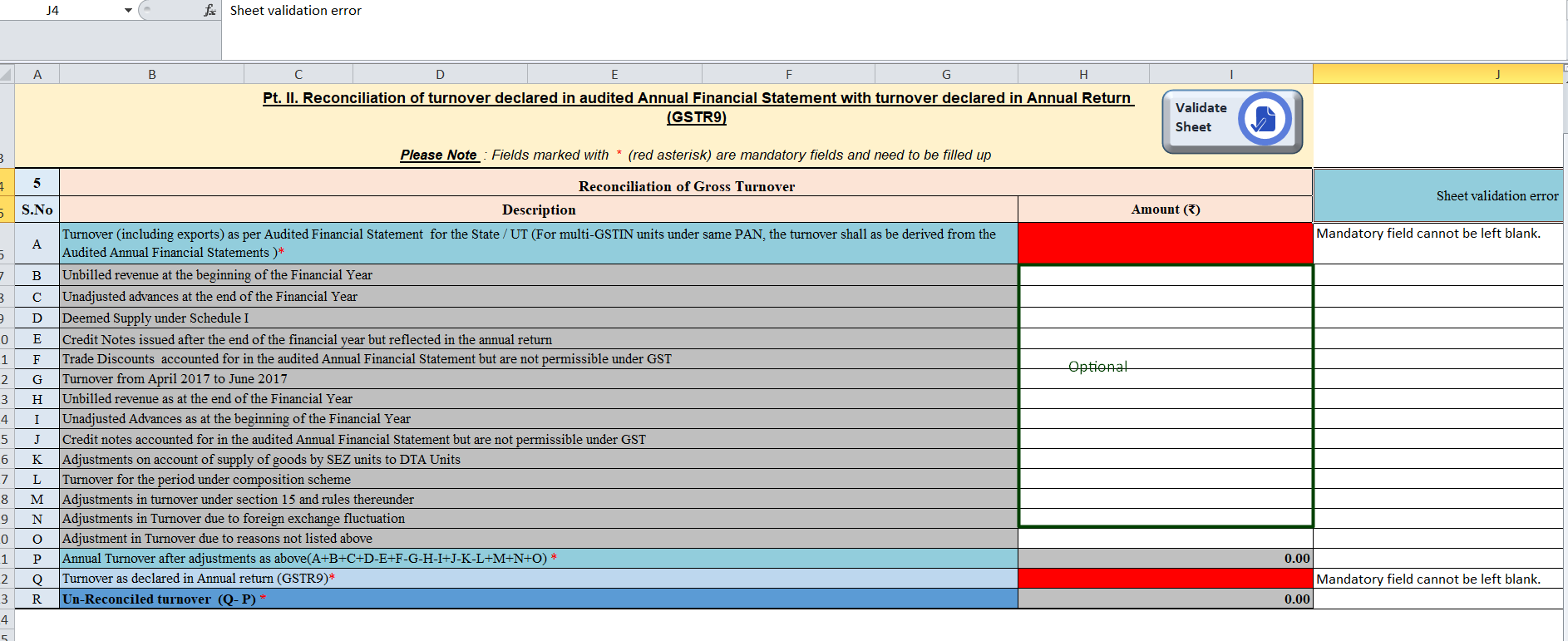

Table 5: Reconciliation of Turnover:

Table 6: Reasons

In this table reasons for mismatch in turnover are required to be mentioned.

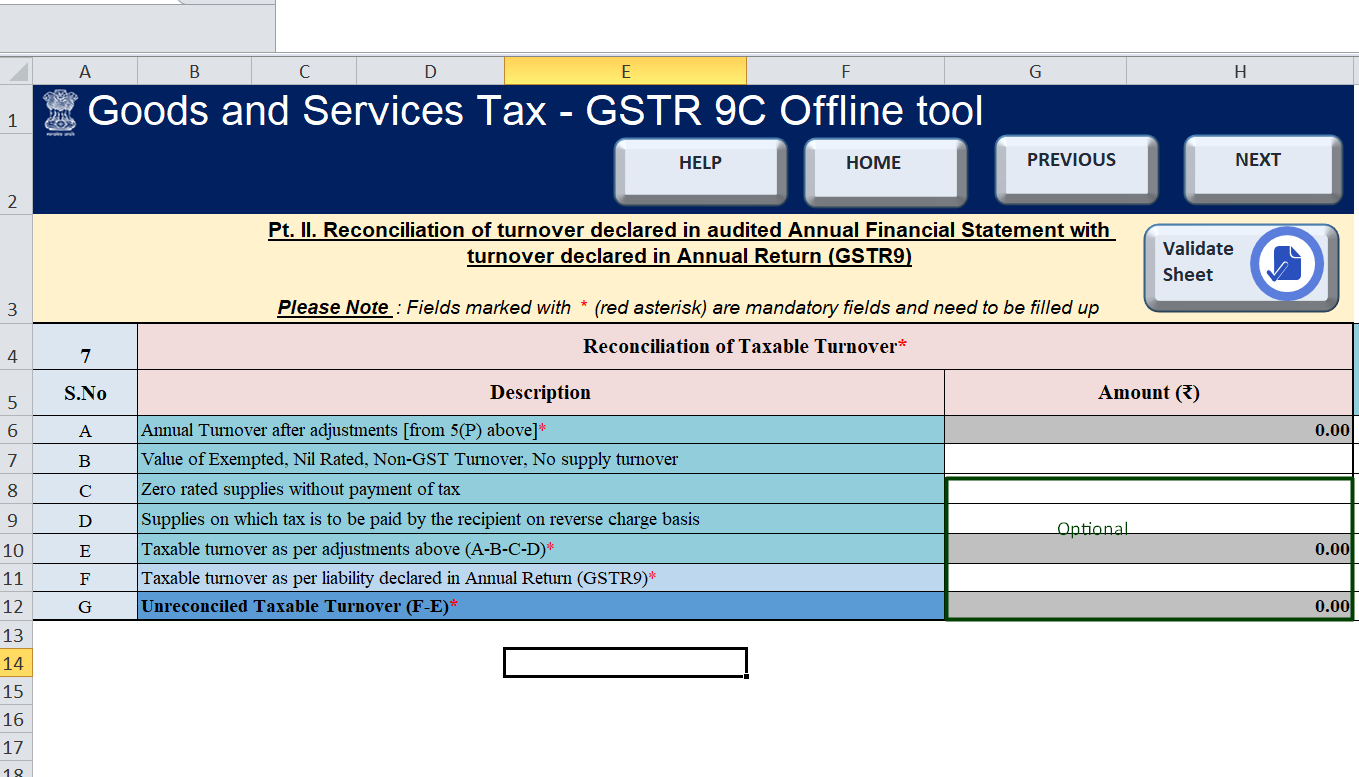

Table 7: Reconciliation of Taxable Turnover:

Table 8: Reasons for mismatch in taxable turnover in table 7

Reasons are required to be mentioned for mismatches in taxable turnover in this table.

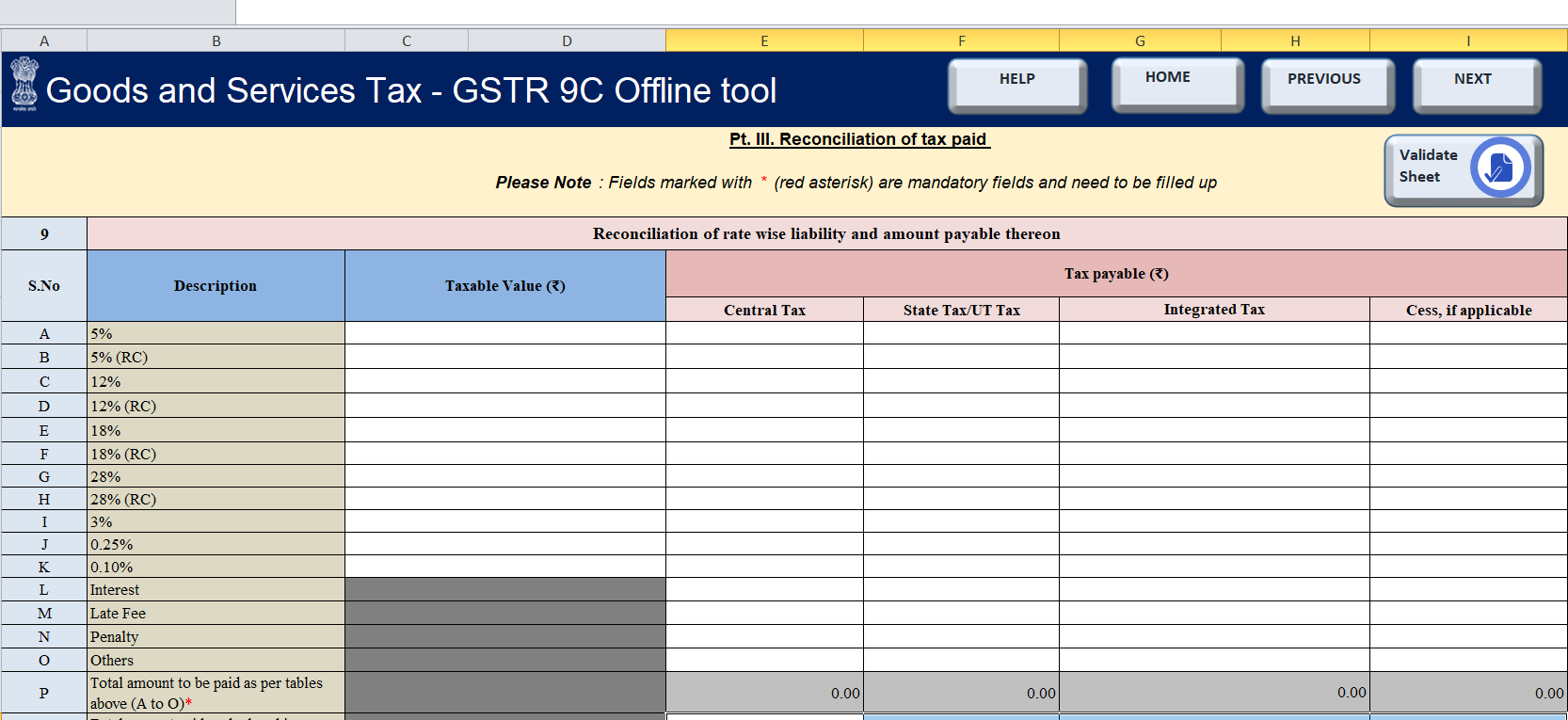

Table 9: Reconciliation of rate wise liability and amount payable thereon:

Data in this table can be filled from sales ledger. Tax payable under various tax rates will be covered here.

Table 10: Reasons for mismatch in rate wise liability.

Table 11: Additional amount payable but not paid: (Due to reasons specified in table no. 6,8 and 10)

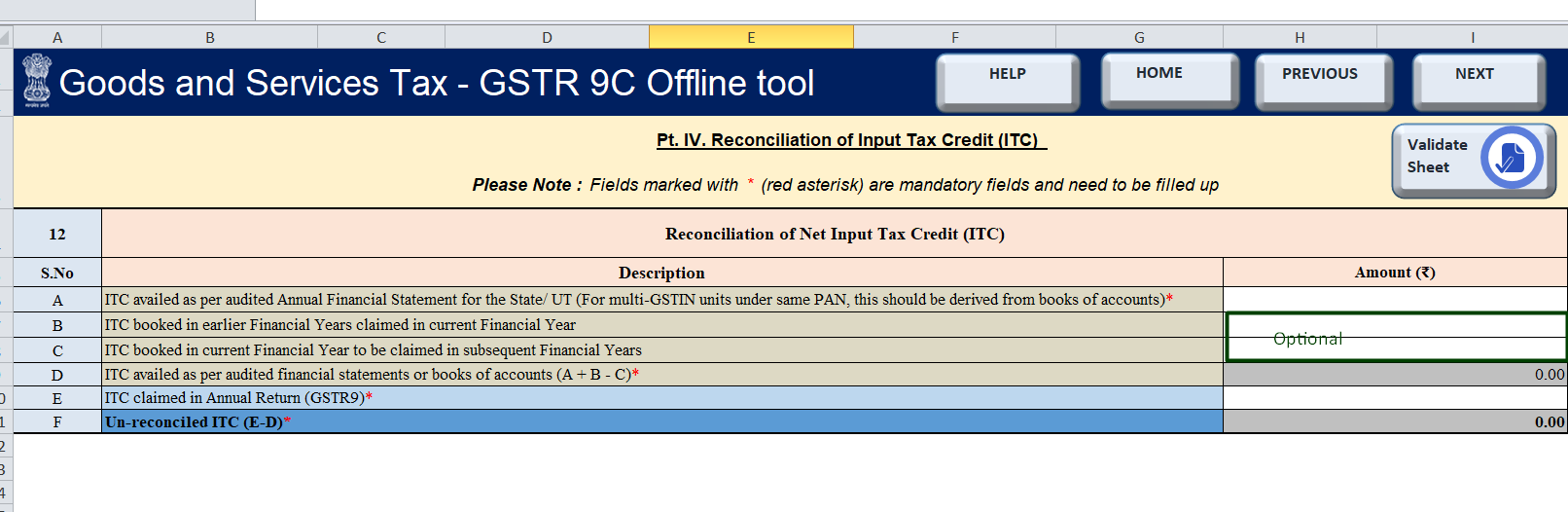

Table 12: Reconciliation of ITC:

ITC availed as per the financial statements and in annual return will be reconciled here.

Table 13: Reasons for mismatch in table 12:

In this table reasons for mismatch in table 12 are required to be mentioned.

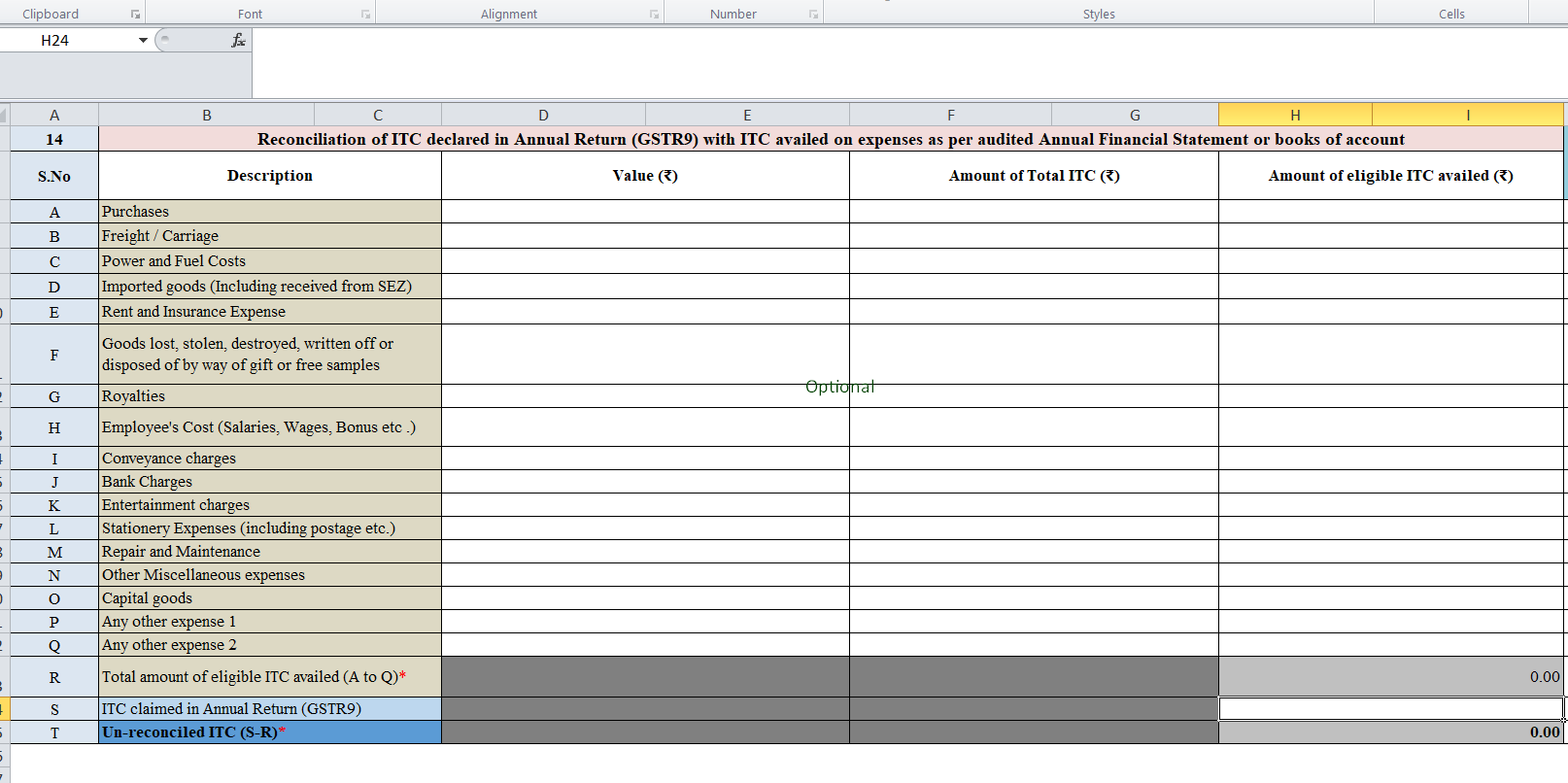

Table14: Reconciliation of ITC:

Table 15: Reason for unreconciled ITC:

In this table reasons for unreconciled ITC are required to be mentioned.

Table 16: Tax Payable on the unreconciled difference in ITC:

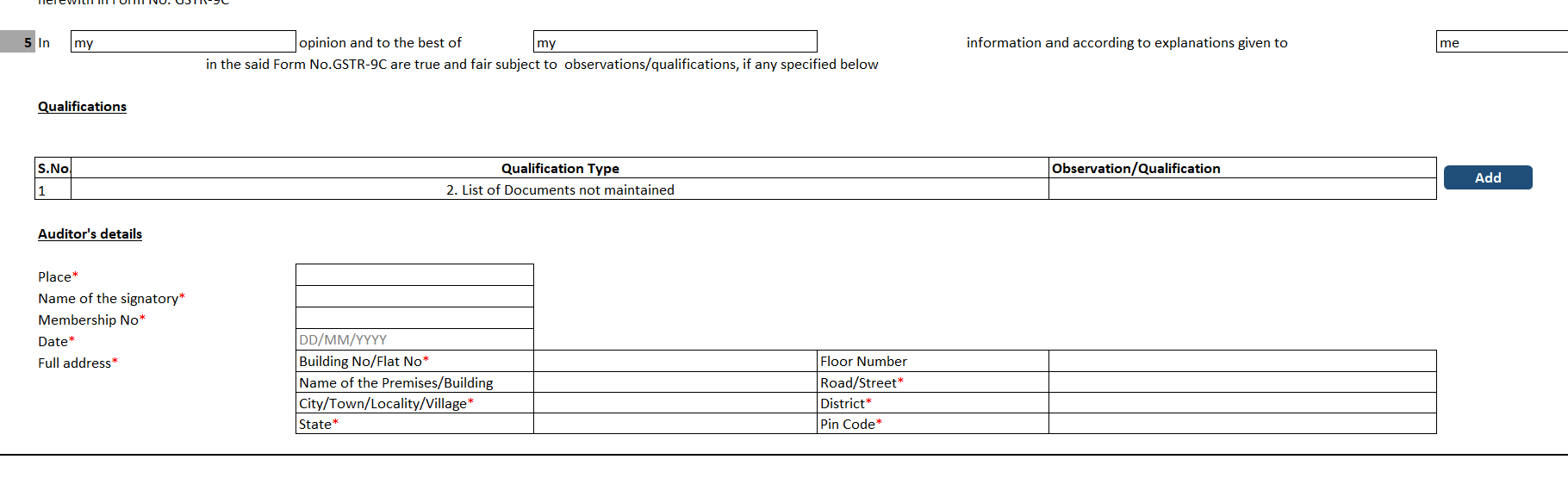

Part V: Auditor’s recommendation:

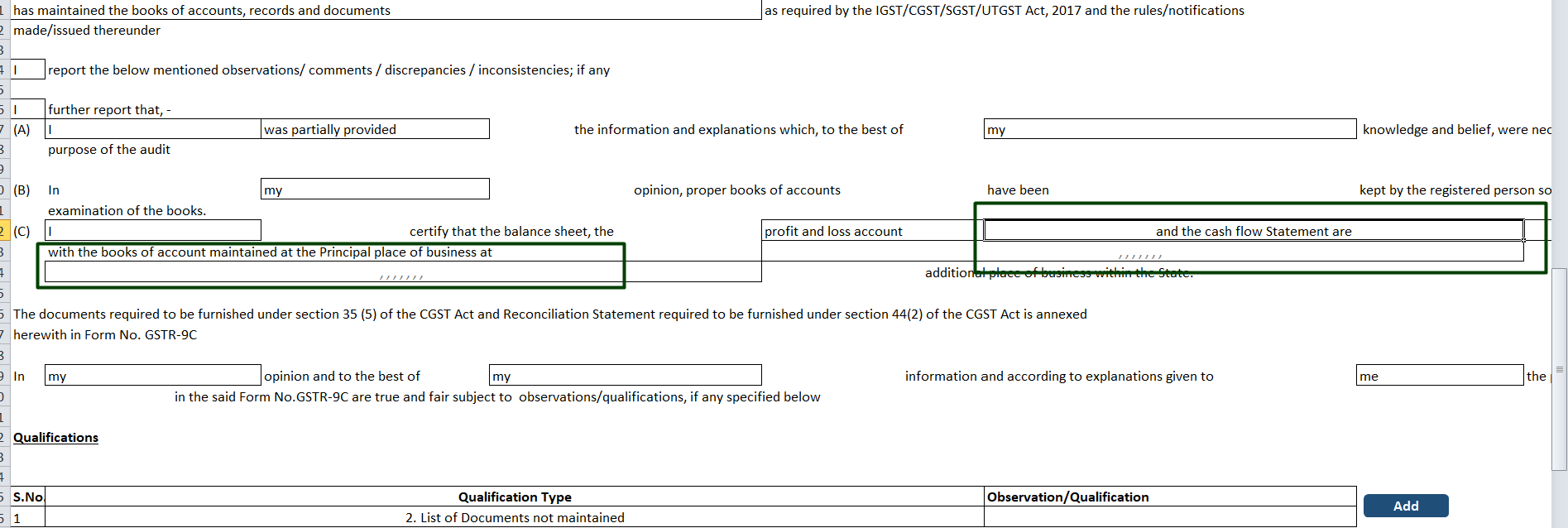

Part II: Certification:

In this part auditor’s certification will be provided. Earlier true and correct word was used. Now it is changed to true and fair.

Step 3: Create JSON from the utility:

After filling entire data in utility click on create JSON to create JSON file. See system requirements and other essentials for creating JSON.

Cash Flow Statement:

- This part requires to accept that cash flow statement is in agreement with books of accounts. In many cases cash flow statememt is not mandatory. Consultants were in dilemma to how to report in these cases. CBIC via there tweet clarified that in that it is not mandatory to upload cash flow statement.

Now it is clarified thus we can move forward accordingly.

-

Is the person making reconciliation statement (FORM GSTR-9C) is same person who had conducted the audit of mentioned GSTIN*

What is the meaning of audit here?

whether it means GST audit or Audit under other Law say Income Tax Act?

Qualifications:

Various qualifications are required to be mentioned here. In case of any default on the part of taxpayer is required to be noted here.

Step 4: Upload the JSON file created on the portal: Check errors and correct:

In the last step, you need to upload the JSON file created. There may be some errors while uploading it. You can read the following articles for various types of errors.

Resolution to Major issues of audit in GSTR 9C

Draft DIsclosures for Audit report

Step 5: File it finally

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.