GSTR 1, When to file, who is liable to file, Due dates, late fees

Latest Update in GSTR-1

- As per the latest changes in GST, You cant file GSTR 1of the next month unless you file the GSTR 1 and 3b of the previous month. There is a history of ITC frauds behind this provision.

- The recipient will lose the input tax credit if the GSTR 1 is not filed by the supplier.

- The GSTR 1 can be amended but there is a time limit for that.

Related Topic:

Claim of ITC under wrong head in GSTR 3B due to wrong filing of GSTR-1 by the supplier

WHAT IS GSTR 1?

GSTR 1 is the first and the most important compliance to be done by a registered dealer. It is just a tabulated list of the outward supplies of Goods or Services or both made during a month or a quarter by a registered dealer. It has the following components;

- GST number of the recipient

- Place of supply i.e. location of recipient (state of the recipient)

- Invoice no and date

- HSN code

- Quantity

- Taxable value

- Rates of tax thereon

- Tax amount

- Cess if any,

- Type of supply

Related Topic:

How to File Gst Return Without Any Software

WHEN TO FILE GSTR 1?

- Every registered person (apart from some exceptions) has to file his GSTR1. It can be filed monthly or quarterly depending upon the previous year’s turnover of that person.

- ‘Small Taxpayer’ is a dealer whose previous year‘s turnover is up to 5 crores (1.5 crores till Dec 2020). Dealers having a turnover of more than 5 crores in the last financial year, have to mandatorily file monthly GSTR 1.

- A ‘Small Taxpayer’ has an option to choose between the monthly or quarterly filing of returns according to his business needs and capacity.

- The invoices reported by the supplier in his GSTR 1 reflect in the return 2A of the recipient. If the recipient insists the supplier file a monthly return, then it is in the business interest of the supplier to file monthly.

Related Topic:

Live Demo for the Filing of Gstr-1

Monthly Filing of Return

Every dealer (except ‘Small taxpayer’ who has chosen to file quarterly return) has to file monthly GSTR 1. It has to be filed by the 11th day of the ensuing month. For e.g. GSTR 1 for the month of April 21 had to be filed by 11 May 21 but owing to the pandemic it has been extended to 26 May 21.

Quarterly Filing of Return

(Situation prevailing before the introduction of QRMP and IFF)

Small Taxpayers have the option of filing Quarterly GSTR 1. They can choose their preference for filing returns per quarter.

The due date for filing the quarterly return is the 13th day of the ensuing month from the end of that quarter. For e.g. Due date of filing GSTR 1 for the quarter ending June 21 will be 13th July 21.

The quarterly filing also has an inherent drawback. The invoices of the first and second month will be reflected only after the return is filed i.e. after the completion of the quarter. The customers become irritated when they do not find their invoice in 2A of that month. It becomes problematic for them to take a full Input tax credit against that invoice.

Related Topic:

Live demo for the filing of GSTR-1

Also, it creates a mismatch in the amounts of inputs in their accounting software and actually adjusted by them. This forces them to move towards suppliers who file monthly returns. Sometimes they try to delay a part of the payment till the invoice is reflected on the portal.

If the customer has already paid and still is unable to use that credit, it causes friction in the business relations. The customer remains in a state of constant fear till the invoice is reflected on the portal.

This acts as a double whammy for the supplier. He loses his valuable customer. Also, his payment may be delayed by the customer.

Note– If the cumulative turnover for the current year of any ‘Small Taxpayer’ exceeds 5 crores in any quarter, then he has to mandatorily file the monthly return from the next quarter.

Related Topic:

Gst Return Filing System (Version 3.0) from 01-01-2021

QRMP (Quarterly Return and monthly payment) and IFF (Invoice furnishing facility)

QRMP

To prevent such problems faced both by the suppliers and recipients, the Department has brought two new facilities from 1st Jan 21. The CBIC has introduced a QRMP scheme that enables the taxpayer to file 3B quarterly and pay tax on a monthly basis. Now a ‘Small taxpayer’ can file both GSTR 1 and 3B quarterly (previously he could file only GSTR 1 Quarterly).

The last due return (3B) of the previous taxable period on the date of exercising the option should have been filed mandatorily for exercising this option.

The period available for exercising their choice would be from the first day of the second month of the previous quarter to the last day of the first month of the current quarter. For e.g. for filing the return of the quarter ending 30 June (Apr- June), the taxpayer has to make his choice on the portal between 1 Feb to 30 April.

They do not have to necessarily make their choice every quarter but they can change their option after any quarter.

The Due dates for furnishing the return are as follows;

| Chhattisgarh, Madhya Pradesh, Gujarat, Dadra and Nagar Haveli, Daman and Diu, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman, and Nicobar Islands, Telangana, and Andhra Pradesh | 22nd day of the month succeeding such quarter |

| Jammu and Kashmir, Ladakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Mizoram, Manipur, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, and Odisha | 24th day of the month succeeding such quarter |

The tax has still to be paid on a monthly basis for the first two months of the quarter in Form no PMT-6 in the following ways;

FSM (Fixed sum Method) or

SAM (Self Assessment method)

IFF

Any taxpayer opting for QRMP has to necessarily furnish GSTR 1 on a quarterly basis. Therefore to help the recipient, IFF has been introduced. Now the supplier can report B2B sales ( raised to GST registered buyers ) in this new facility for the first two months of the quarter. These invoices would reflect in the 2A of the buyer and he can avail input tax credit on the strength of that invoice.

In the last month of the quarter, all the invoices (B2C invoices, Export invoices, exempt invoices, and nil invoices of the quarter along with B2B invoices of the last month) are reported by the supplier in his normal GSTR 1. Hence IFF facility is used only for the first two months of the quarter and only for B2B invoices.

The supplier can report B2B invoices of a month in IFF from the first to the thirteenth day of the next month. For e.g. reporting of B2B sales invoices in IFF by QRMP taxpayers for the month of May 2021 has been extended from 13th June 2021 to 28th June 2021.

Also, the taxable amount of the B2B invoices for a month should not exceed 50 lakhs to avail of this facility. Otherwise, the dealer has to go for monthly GSTR 1 only.

This facility helps in maintaining a continuous flow of input for the customer.

Related Topic:

GSTR-1: Who Is Required to File GSTR-1, Format, and Information to Be Provided

Who has to file GSTR 1?

Every registered person has to file GSTR 1 even if the turnover during the taxable period is zero. Then he has to file a nil return for that period. The following registered persons are exempt from filing GSTR 1;

- Input Service Distributors

- Composition Dealers

- Suppliers of online information and database access or retrieval services (OIDAR), who have to pay tax themselves (as per Section 14 of the IGST Act)

- Non-resident taxable person

- Taxpayer liable to collect TCS

- Taxpayer liable to deduct TDS

What are the various tables present in GSTR 1?

When we preview the return, we can see that,

it has a total of 13 sections, listed down as follows:

Tables 1, 2 & 3: GSTIN of the dealer, legal and trade names, and aggregate turnover in the previous year

Table 4: Taxable outward supplies to registered persons (including UIN-holders) excluding zero-rated supplies and deemed exports i.e. B2B sales (both inter and intrastate)

Table 5: Taxable outward inter-state supplies to unregistered persons where the invoice value is more than Rs.2.5 lakh (B2C sales to other states having a taxable value above 2.5 lakhs)

Table 6: Zero-rated supplies as well as deemed exports

Table 7: Taxable supplies to unregistered persons other than the supplies covered in table 5 (net of debit notes and credit notes) (B2C sales to other states having taxable value up to 2.5 lakhs.)

Table 8: Outward supplies that are nil rated, exempted, and non-GST in nature

Table 9: Amendments to outward supplies that are taxable and reported in table 4,5 & 6 of the earlier tax periods’ GSTR-1 return (including debit notes, credit notes, refund vouchers issued during the current period)

Table 10: Debit note and credit note issued to unregistered person

Table 11: Details of advances received or adjusted in the current tax period or amendments of the information reported in the earlier tax period.

Table 12: Outward supplies summary based on HSN codes ( HSN summary of total sales)

Table 13: Documents issued during the period. ( number of invoices)

How to revise GSTR 1?

The return once filed can not be revised. Any mistake made in the return of the current taxable period can be rectified in the GSTR-1 to be filed for the next period (month/quarter). It means that if a mistake is made in GSTR-1 of April 21, it can be rectified in the GSTR-1 of May 2021.(similarly for the Quarterly return)

What are the various methods of filing GSTR 1?

The return can be filed in the following ways;

1) On the GST portal

- a) online or

b) offline with the help of utility

2) With the help of any software

How to file GSTR 1?

Online Method

Directly on GST portal -The following challenges are faced by the dealer in filing the return directly on the portal (online method)

- The number of invoices per taxable period can not be more than 500.

- There is no option to perform bulk action on invoices.

- The HSN-wise summary has to be entered manually.

Step by step guide to file GSTR 1

Logging into the GST portal by the registered dealer

- Login to the GST Portal (wwwdotgstdotgovdotin)

- Enter the I.d. and the password of the dealer.

- Then enter the Captcha

- The I.d . is not case-specific but the password is case-specific.

- Be careful not to enter the password wrong three times. Then the I.d will be blocked and you need to get the E.V.C from the authorized person.

Selection of Turnover of previous year and frequency of return

- Select the turnover of the previous year.

- If you select less than 5 crores then you are eligible for Quarterly filing of returns. Otherwise, you have to file monthly.

- Then select your choice for the Quarter. Quarterly or monthly.

- Then go to SERVICES >RETURNS > RETURN DASHBOARD

- This will take you to the main return filing page.

- Then you select the Financial year and the month /Quarter whose return you want to file.

- Then click on the SEARCH button.

Editing the return filing frequency

- If a taxpayer wants to change the preference for return filing, then he should click the EDIT button.

- After choosing your preference, click SUBMIT.

Reach the return filing page

- A message will be displayed stating that the return filing frequency has been changed. Click on ‘Close’.

- Select the return you want to file. (GSTR 1 or 3B). Select GSTR 1

- Then, on the GSTR-1 return page, the return filer has two options– Prepare the return online or offline.

- Click on ‘Prepare online’.

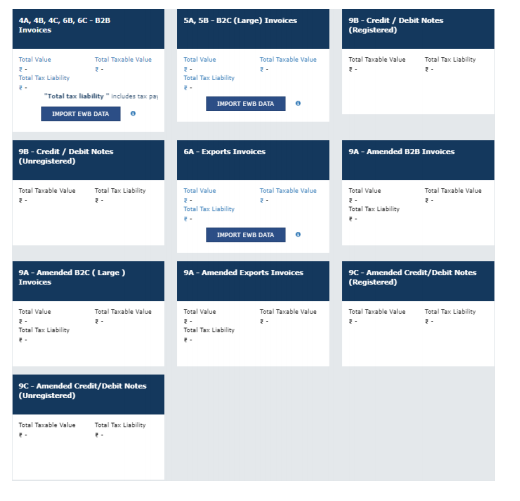

Various tiles of GSTR 1

This page will be showing a number of tiles having different nomenclature. Now we shall learn about the most frequently used tiles by the taxpayers.

GSTR-1 – Invoice Details

4A, 4B, 4C, 6B, 6C – These are all to report B2B invoices, made to registered persons. Upon clicking this tile, the next page will ask you to enter your invoices along with the necessary details (which we told you in the starting in the definition of GSTR 1). Click ADD button. Then you can enter the details of each invoice.

There is also a row for invoices on which reverse charge is applicable.

5A, 5B- B2C large invoices (whose taxable value is more than 2.5 lakhs) to unregistered persons. You can enter the invoices in the same manner by clicking on the ADD button.

9B- Credit/ Debit notes issued by you to registered Persons (on B2B invoices)

9B- Credit/ Debit notes issued by you to unregistered Persons (on B2C invoices)

6A- Export invoices

Amendments

9A-Amended B2B invoices

9A-Amended B2C large invoices

9A-Amended export invoices

9C- Amended Credit/ Debit notes (registered)

9C- Amended Credit/ Debit notes (unregistered)

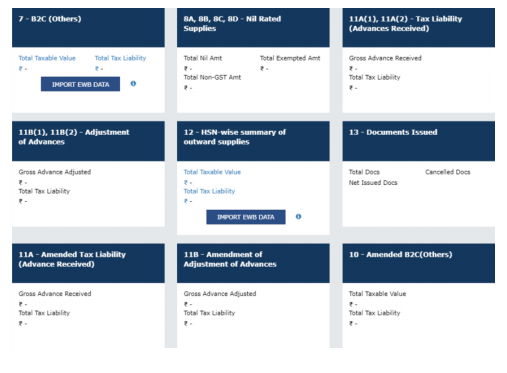

GSTR 1 (other details)

7– B2C Others (invoices to unregistered persons whose taxable value is less than 2.5 lakhs)

8A, 8B, 8C, 8D – Nil Rated Supplies (invoices whose tax rate is nil)

11A(1), 11A(2) – Tax Liability (Advances Received)

11B(1), 11B(2) – Adjustment of Advances

12 – HSN-wise-summary of outward supplies

13 – Documents Issued (total number of invoices issued during the taxable period)

11A – Amended tax liability (Advance received)

11B Amended of Adjustment of Advances

10– Amended B2C (Others)

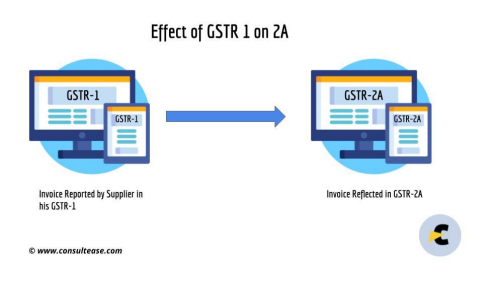

Effect of GSTR 1 on 2A

The invoices reported by the supplier in his GSTR 1 are reflected in the 2A of the recipient. On the strength of those invoices only he can claim the input tax credit. We shall discuss certain scenarios which can create problems for the recipient.

If the supplier furnishes his GSTR 1 of a certain month late – for e.g. GSTR 1 of Jan is filed in May, then those invoices will be reflected in Jan 2A of the recipient but in the month of May. Hence he has to check previous all the 2As for some pending bills.

If the supplier reports a particular bill pertaining to a certain month in the GSTR1 of a different month-for e.g.invoice of Jan is reported by the supplier in the GSTR 1 of May, then it will be reflected in the 2A of May. This creates a mismatch in the amounts of input in the accounting software and the portal.

Some important points to remember

1) GSTR-1 is a return where details of outward sales are filed with the government. No tax has to be paid after filing this return. The tax has to be paid at the time of filing GSTR-3B.

2)With effect from 1st January 2021, GSTR-1 has to be filed before filing the GSTR-3B return.

3)The frequency of filing of GSTR 1 and 3B for a taxable period has to be the same in all the cases.

a)Turnover above 5 crores – both monthly mandatorily

b) Turnover up to 5 crores – (i) opted for QRMP – both Quarterly (ii) not opted for QRMP – both monthly.

4) The GSTR-1 for the current tax period cannot be filed or the IFF cannot be used if

(i) the GSTR-3B was not filed for the preceding two months in the case of monthly GSTR-1 filers

(ii) the GSTR 3B of the previous quarter has not been filed by quarterly filers.

5) Invoices can be uploaded anytime. It is preferable to load invoices at regular intervals to prevent bulk upload at the time of filing returns.

6) You can make changes in the invoices even after loading multiple times. But nothing can be changed after the submission of the return.

7) While making entries of the invoice make sure that items having different HSN codes and tax rates are entered separately under the same invoice. Also do not enter a quantity in case of a supply of service.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.