How to file GST new return?: Trial live

Introduction: GST new return

Trial for GST new return is live on the GST portal. This is only a trial version. It is expected that new GST return will resolve major issues related to GST. It is based on the matching concept. You can file it following the below process.

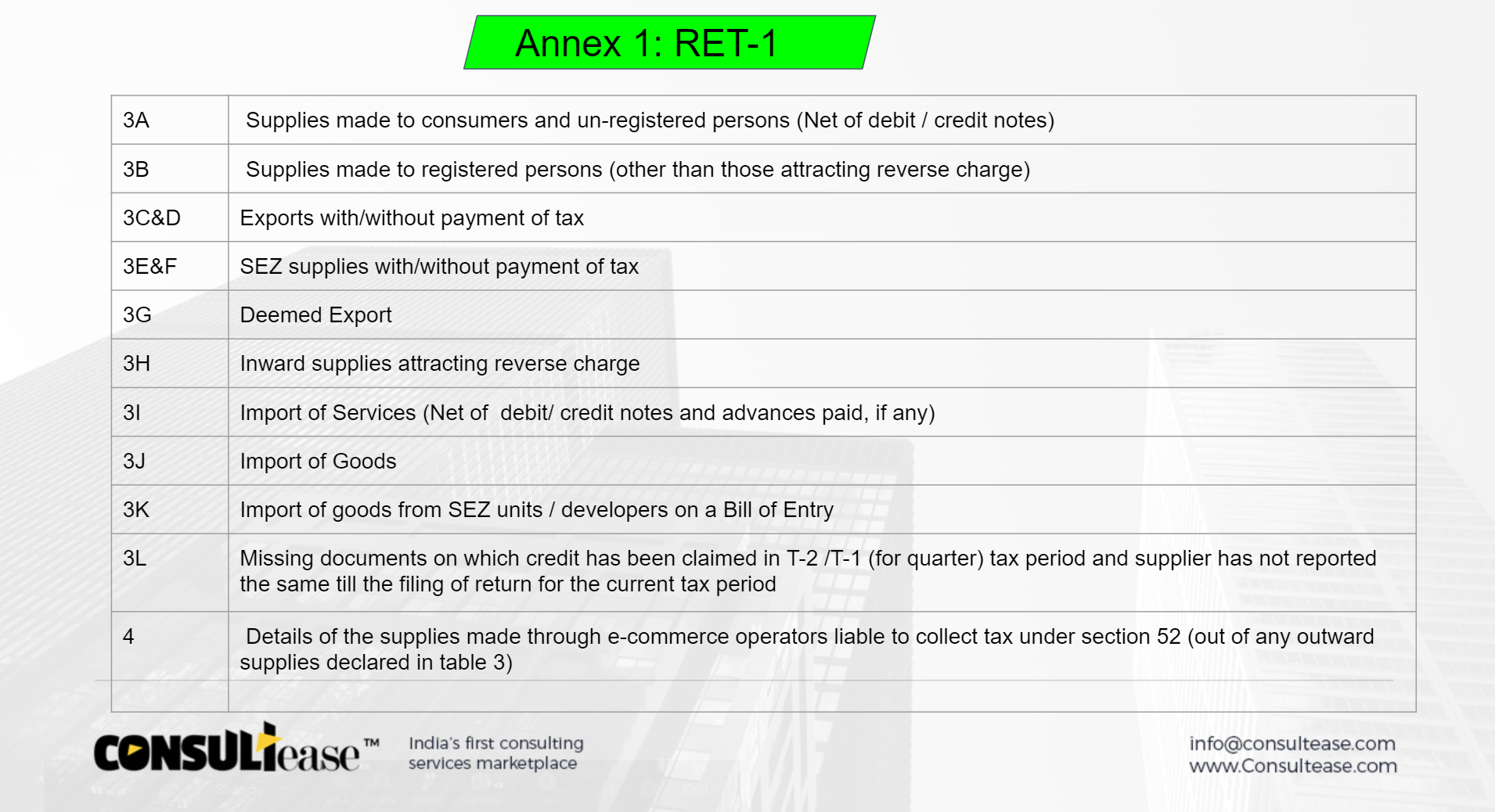

File annex I

It is detail of supplies and RCM. It is resembling to GSTR 1. But in GSTR 1 RCM and Import are not covered. In Annex 1 RCM is also required to be entered. You can have a look on items in Annex 1.

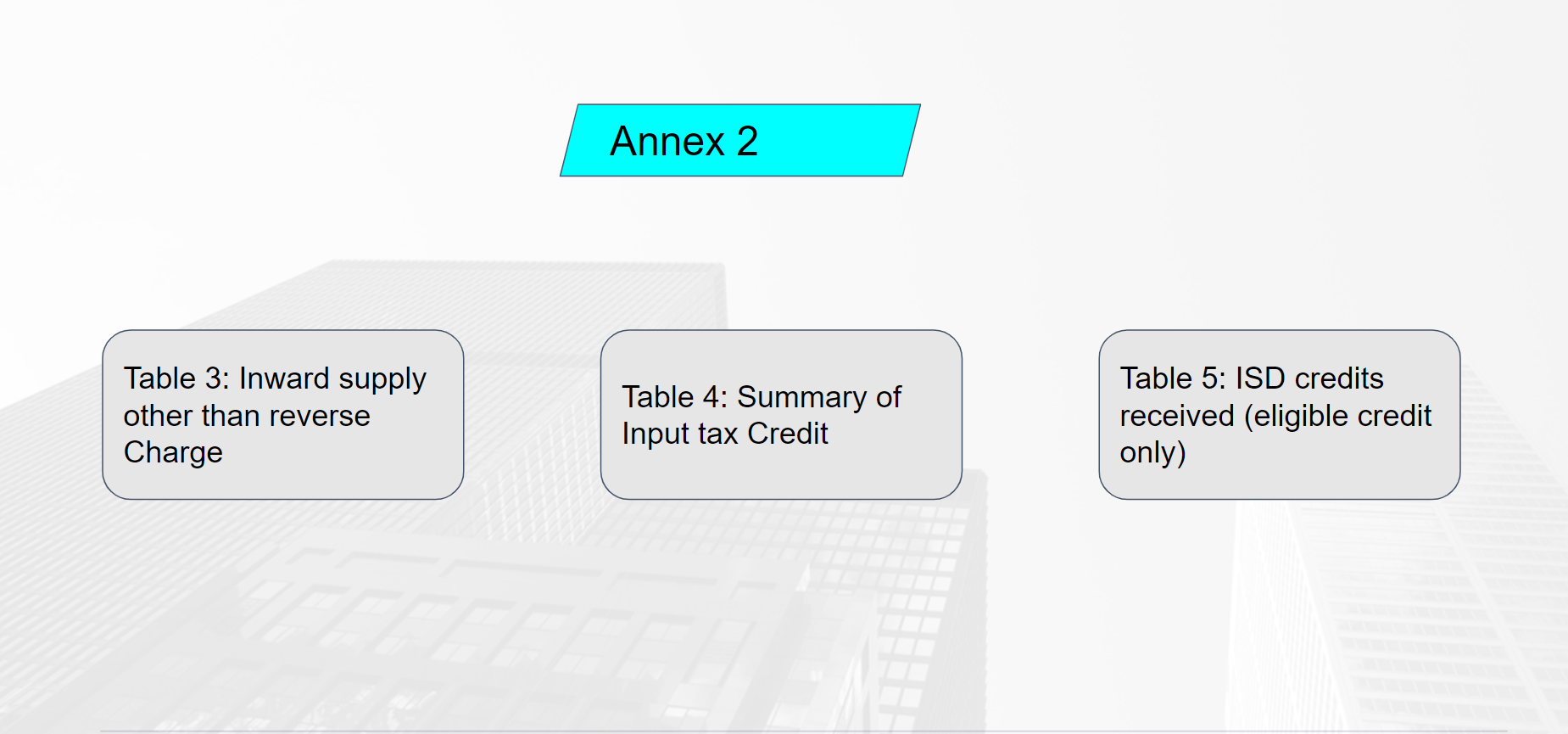

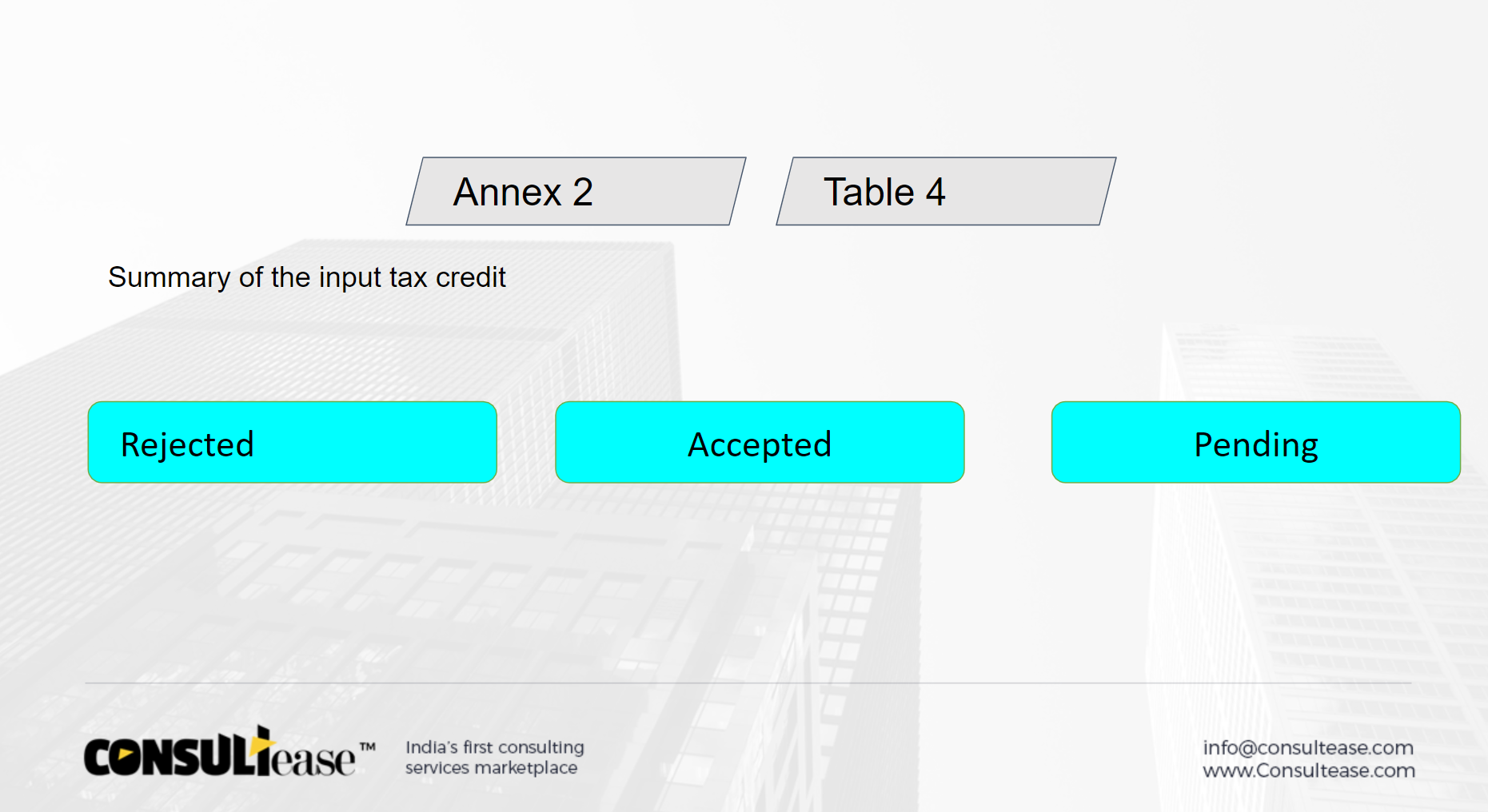

Match Annex II

The data filed in Annex I will get auto-populated in Annex II. This can be matched with the inward supplies or purchase register. There is a templet provided by GSTN for this purpose. This can be done online as well as offline using the templet.

File RET 01:

Once the matching is done the return of GST RET 01 can be filed. The taxpayer can take ITC on a self-assessment basis also. The latest restrictions by CBIC are also required to be taken care of. Like we can’t claim more than 110% of ITC of invoices uploaded by our suppliers. Entire data from Annex 1 and 2 will auto-populate in RET 01. You can make the final payment and file a GST return.

Amendments in GST new return

Annex 1 can be amended in the future. Annex 2 is auto-populated so amendments are not possible. An accepted invoice cant be amended. It is required to be unlocked by the recipient. Only then it can be amended by the supplier.

You will also be able to create the master. In this master, you can enter details of all your vendors and clients. It will help in the correct filing of return. But if there is a mistake it will be hard to rectify in case of wrong acceptance by the recipient.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.