FAQs and User Manual – GST New Return Offline Tool (Beta)

FAQs and User Manual of GST New Return Offline Tool (Beta)

Release by GSTIN this manual on GST New Return Offline Tool is very helpful. It contains all major provisions related to GST new return

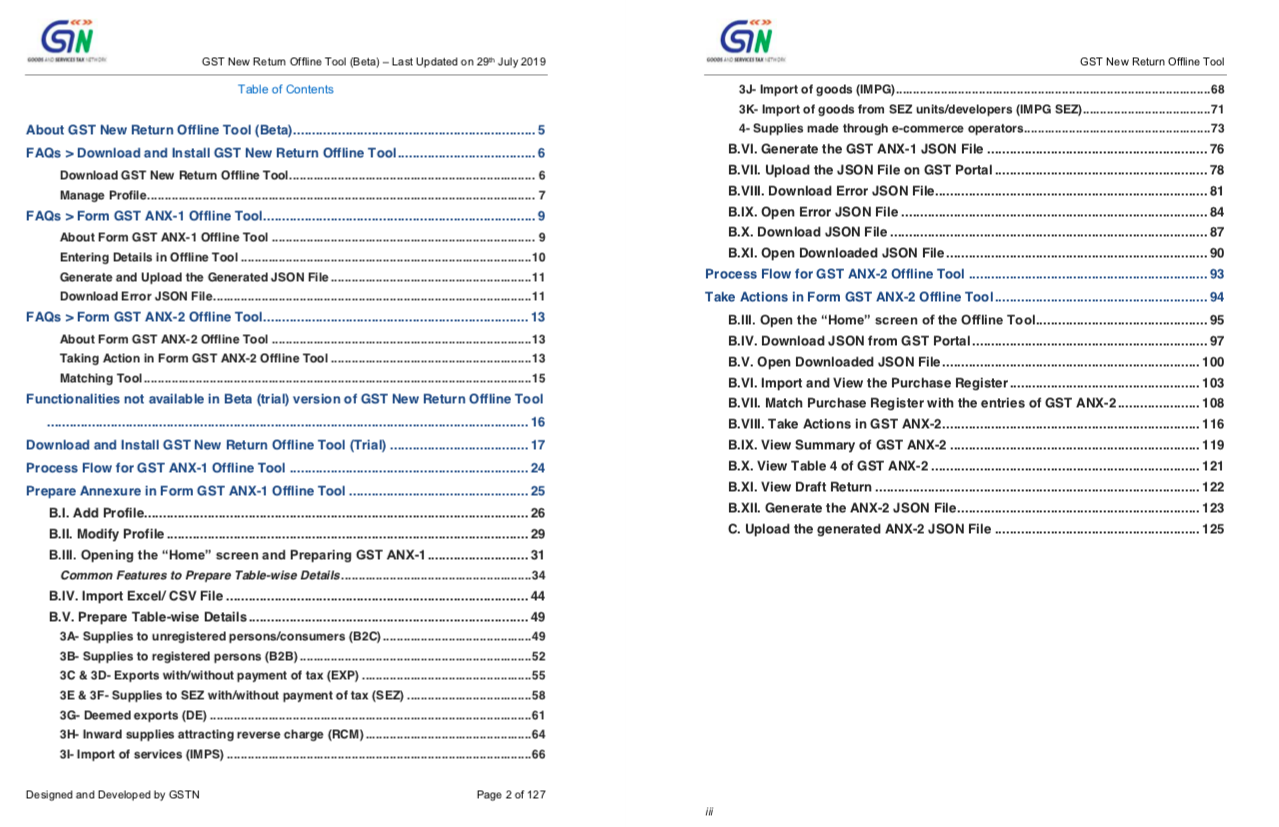

About GST New Return Offline Tool (Beta)……………………………………………………….. 5

FAQs > Download and Install GST New Return Offline Tool……………………………….6

Download GST New Return Offline Tool…………………………………………………………….. 6

Manage Profile…………………………………………………………………………………………………. 7

Annex 1:

FAQs > Form GST ANX-1 Offline Tool………………………………………………………………. 9

About Form GST ANX-1 Offline Tool …………………………………………………………………. 9

Entering Details in Offline Tool …………………………………………………………………………10

Generate and Upload the Generated JSON File ………………………………………………….11

Download Error JSON File………………………………………………………………………………..11

FAQs > Form GST ANX-2 Offline Tool…………………………………………………………….. 13

About Form GST ANX-2 Offline Tool …………………………………………………………………13

Taking Action in Form GST ANX-2 Offline Tool ………………………………………………….13

Matching Tool………………………………………………………………………………………………….15

Functionalities not available in Beta (trial) version of GST New Return Offline Tool………….. 16

Download and Install GST New Return Offline Tool (Trial) ………………………………. 17

Process Flow for GST ANX-1 Offline Tool ………………………………………………………. 24

Prepare Annexure in Form GST ANX-1 Offline Tool ………………………………………… 25 B.I. Add Profile…………………………………………………………………………………………. 26

B.II. Modify Profile ……………………………………………………………………………………. 29

B.III. Opening the “Home” screen and Preparing GST ANX-1……………………… 31 Common Features to Prepare Table-wise Details……………………………………………….34

B.IV. Import Excel/ CSV File ……………………………………………………………………… 44

B.V. Prepare Table-wise Details ………………………………………………………………… 49

3A- Supplies to unregistered persons/consumers (B2C)…………………………………….49

3B- Supplies to registered persons (B2B) ………………………………………………………….52

3C & 3D- Exports with/without payment of tax (EXP) ………………………………………….55 3E & 3F- Supplies to SEZ with/without payment of tax (SEZ) ………………………………58

3G- Deemed exports (DE) …………………………………………………………………………………61

3H- Inward supplies attracting reverse charge (RCM) …………………………………………64

3I- Import of services (IMPS) …………………………………………………………………………….66

3J- Import of goods (IMPG)……………………………………………………………………………….68

3K- Import of goods from SEZ units/developers (IMPG SEZ)……………………………….71

4- Supplies made through e-commerce operators………………………………………………73

B.VI. Generate the GST ANX-1 JSON File ………………………………………………….. 76

B.VII. Upload the JSON File on GST Portal ………………………………………………… 78

B.VIII. Download Error JSON File………………………………………………………………. 81

B.IX. Open Error JSON File ………………………………………………………………………. 84

B.X. Download JSON File …………………………………………………………………………. 87

B.XI. Open Downloaded JSON File ……………………………………………………………. 90

Annex 2

Process Flow for GST ANX-2 Offline Tool ………………………………………………………. 93

Take Actions in Form GST ANX-2 Offline Tool ………………………………………………… 94

B.III. Open the “Home” screen of the Offline Tool………………………………………. 95

B.IV. Download JSON from GST Portal ……………………………………………………… 97

B.V. Open Downloaded JSON File …………………………………………………………… 100

B.VI. Import and View the Purchase Register …………………………………………… 103

B.VII. Match Purchase Register with the entries of GST ANX-2 …………………. 108

B.VIII. Take Actions in GST ANX-2…………………………………………………………… 116

B.IX. View Summary of GST ANX-2 …………………………………………………………. 119

B.X. View Table 4 of GST ANX-2 ……………………………………………………………… 121

B.XI. View Draft Return …………………………………………………………………………… 122

B.XII. Generate the ANX-2 JSON File………………………………………………………..123

C. Upload the generated ANX-2 JSON File ………………………………………………. 125

.

Download PDF.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.