FAQs On E-Invoicing in GST- How, when and who is liable

These FAQs On E-Invoicing in GST are drafted

- 1. What is ‘e-invoicing’?

- 2. Do I need to make an invoice on the government Portal?

- 3. What are the consequences of non-compliance with invoice provisions?

- 4. For which business e-invoicing is applicable?

- 5. is ‘e-invoicing’ different from the Current Invoicing system?

- 6. Is e-invoicing beneficial for businesses?

- 7. What changes are required to become E-invoicing ready?

- 8. What supplies are presently covered under e-invoice?

- 9. Does Business to Consumer (B2C) supplies are to be reported under E-invoicing?

- 10. What documents are presently covered under e-invoice?

- 11. Is e-invoicing applicable for invoices issued between two GSTINs under the same PANs?

- 12. Is E-invoicing applicable for supplies made by a notified class of registered persons to SEZ Units?

- 13. Is E-invoicing applicable where an SEZ and a DTA [ domestic tariff unit ].registered under the same PAN? Aggregate total turnover is more than Rs. 80 crores, in which turnover of DTA is less than 50 crores in FY 2020-21. As SEZ units are exempted from E-invoice, whether e-invoicing is applicable on the DTA unit?

- 14. Is E-invoicing applicable on Invoices issued by ISD?

- 15. Is E-invoicing applicable on Supplies attracting Reverse Charge?

- 16. What is the Invoice registration portal (IRP)?

- 17. Can a registered person having aggregate turnover below the prescribed limit report invoices to IRP?

- Relevant Notifications:-

1. What is ‘e-invoicing’?

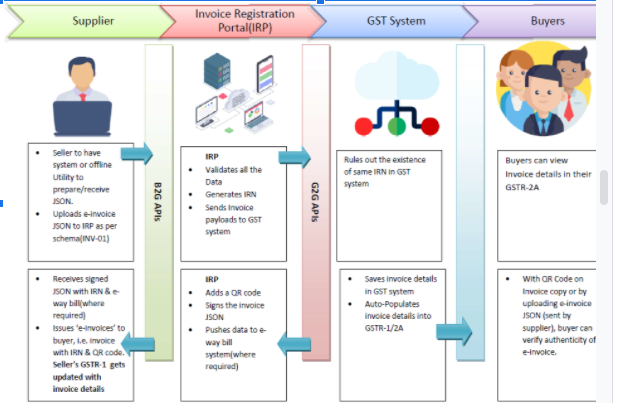

Ans. E-Invoicing means a system in which notified class of registered person uploads specified particulars of B2B Invoices on Invoice Registration Portal (IRP) [ in FORM GST INV -01] and obtain an Invoice Reference Number (IRN), such invoices gets authenticated by GSTN for further use on Common GST portal, this process (E-invoicing process) in which invoice copy containing the IRN (with QR code) issued by the notified supplier to a buyer is commonly referred to as E-Invoice in GST.

2. Do I need to make an invoice on the government Portal?

Ans. E-invoicing doesn’t mean that the invoice will be raised via the government portal. You just need to register every invoice. The process to raise the invoice is still the same. Normal software can be used to raise invoices. But the only difference is to generate IRN.

3. What are the consequences of non-compliance with invoice provisions?

Ans.

- From the buyer’s point of view

A tax invoice is a basic document to claim the input tax credit. Thus every buyer is required to check the E-invoicing requirements.

- From the supplier’s point of view

The supplier may also be liable for the penalty for non-compliance. If there is a difference in turnover as recorded in the e-invoices and as reported via GSTR 1.

4. For which business e-invoicing is applicable?

Ans.

| Aggregate Turnover | Date of Applicability |

| More than Rs. 500 crores | 1st October 2020 |

| More than Rs. 100 crores | 1st January 2021 |

| More than Rs. 50 crores | 1st April 2021 |

As per Notification 61/2020 central tax dated 30-07-2020 e-Invoicing has been made applicable from 1st October 2020 for businesses with a turnover of more than Rs.500 crores (in any financial year from FY 2017-18 onwards.

As per Notification 88/2020 central tax dated 10-11-2020 e-Invoicing has been made applicable from 1st January 2021 for businesses with a turnover of more than Rs.100 crores (in any financial year from FY 2017-18 onwards.

At present, As per Notification 05/2021 central tax dated 08-03-2021 e-Invoicing will be applicable from 1st April 2021 for businesses with a turnover of more than Rs.50 crores (in any financial year from FY 2017-18 onwards.

However irrespective of the turnover E-Invoicing shall not be applicable to the following class of taxpayers as notified in Notification 13/2020-Central Tax, dated. 21-03-2020.

- An insurer or a banking company or a financial institution, including an NBFC

- A Goods Transport Agency (GTA)

- A registered person supplying passenger transportation services

- A registered person supplying services by way of admission to the exhibition of cinematographic films in multiplex services

- An SEZ unit (excluded via Notification No. 61/2020 –Central Tax)

5. is ‘e-invoicing’ different from the Current Invoicing system?

Ans. We can say that there is barely any difference between both invoicing systems. Taxpayers will continue to generate their GST invoices through various software. Now, these invoices will have to be reported on the Invoice registration Portal (IRP) by ‘notified class of registered persons on which e-invoicing is applicable’. On reporting, IRP returns the e-invoice with a unique Invoice reference number (IRN) after digitally signing the e-invoice & adding a QR code. Then, the invoice can be issued to the receiver (along with QR Code).

6. Is e-invoicing beneficial for businesses?

Ans. E-invoice provides many benefits to businesses such as:-

- Auto-reporting of invoices into GST return.

- Auto-generation of e-way bills (where required).

- It will help in data reconciliation under GST to reduce mismatch error.

- Facilitates Standardisation and Interoperability as E-invoices created on one software can be read by other software.

- It Will help in availing ITC much faster than in the current Invoicing system.

7. What changes are required to become E-invoicing ready?

Ans. Businesses will continue to issue invoices as they are doing now in the existing Invoicing system. Necessary changes on account of e-invoicing requirements (i.e. to enable reporting of invoices to IRP and obtain IRN), will be made by ERP/Accounting and Billing Software providers in their respective software. They need to get the updated version having this facility.

8. What supplies are presently covered under e-invoice?

Ans. Following supplies made by a notified class of registered persons are presently covered under E-invoice:-

- Supplies to registered persons (B2B)

- Supplies to SEZs (with/without payment of tax)

- Exports (with/without payment of tax)

- Deemed Export

9. Does Business to Consumer (B2C) supplies are to be reported under E-invoicing?

Ans. No, Currently it is not applicable/allowed to report B2C supplies. However, they will be brought under e-invoice in the next phase.

10. What documents are presently covered under e-invoice?

Ans. Following documents if issued by a notified class of registered persons are presently covered under E-invoicing:-

- Invoices

- Credit Notes

- Debit Notes

11. Is e-invoicing applicable for invoices issued between two GSTINs under the same PANs?

Ans. Yes, E-invoicing is Mandatory by notified persons for the supply of goods & services or both to a registered person.

12. Is E-invoicing applicable for supplies made by a notified class of registered persons to SEZ Units?

Ans. Yes, e-invoicing is applicable to supplies made to SEZ units.

13. Is E-invoicing applicable where an SEZ and a DTA [ domestic tariff unit ].registered under the same PAN? Aggregate total turnover is more than Rs. 80 crores, in which turnover of DTA is less than 50 crores in FY 2020-21. As SEZ units are exempted from E-invoice, whether e-invoicing is applicable on the DTA unit?

Ans. Yes, because the aggregate turnover, in this case, is more than Rs. 500 crores. The eligibility is based on an aggregate annual turnover on the common PAN.

14. Is E-invoicing applicable on Invoices issued by ISD?

Ans. No, e-invoicing is not applicable on invoices issued by ISD.

15. Is E-invoicing applicable on Supplies attracting Reverse Charge?

Ans. If a Notified registered person issues an Invoice on outward supply & such supply attracts Reverse charge under section 9(3), then E-invoicing is applicable.

For Example –

- XYZ Ltd. has Organized an Event, this Event is Sponsored by Mr. A who is a registered taxable person under GST. turnover of Mr. A is more than Rs. 50 crores. Mr.A Issues an Invoice for Sponsorship services provided by him to XYZ ltd, tax liability will be discharged by XYZ Ltd. under RCM. Such invoices have to be reported by the notified person to the IRP.

- On the other hand, where Supplies are received by notified persons from an unregistered person { attracting RCM under section 9(4) } or through the import of services, E-invoicing is not applicable.

16. What is the Invoice registration portal (IRP)?

Ans. Invoice Registration Portal (IRP) is the website for uploading/reporting invoices by the notified class of registered persons.

Notification no. 69/2019-Central Tax dated 13-12-2019 notified ten portals for the purpose of preparation of the invoice in terms of Rule 48(4).

17. Can a registered person having aggregate turnover below the prescribed limit report invoices to IRP?

Ans. No, Only the notified class of persons will be allowed to report invoices to IRP, E-invoicing is not Voluntary.

Relevant Notifications:-

| Notification & Date | Description |

| 68/2019-Central Tax,dt. 13-12-2019 | Seeks to carry out changes in the CGST Rules, 2017. |

| 69/2019-Central Tax ,dt. 13-12-2019 | Seeks to notify the common portal for the purpose of e-invoice. |

| 70/2019-Central Tax ,dt. 13-12-2019 | Seeks to notify the class of registered persons required to issue e-invoice. |

| 02/2020-Central Tax,dt. 01-01-2020 | Seeks to make amendment (2020) to CGST Rules. |

| 13/2020-Central Tax, dt. 21-03-2020 | Seeks to exempt certain class of registered persons from issuing e-invoices and the date for implementation of e-invoicing extended to 01.10.2020 |

| 60/2020-Central Tax Dt. 30-7-2020 | Seeks to make Ninth amendment (2020) to CGST Rules |

| 61/2020-Central Tax Dt. 30-7-2020 | Seeks to amend Notification no. 13/2020-Central Tax in order to amend the class of registered persons for the purpose of e-invoice |

| 70/2020-Central Tax Dt. 30-9-2020 | Seeks to amend notification no. 13/2020-Central Tax dt. 21.03.2020. |

| 72/2020-Central Tax Dt. 30-9-2020 | Seeks to make the Eleventh amendment (2020) to the CGST Rules. |

| 73/2020-Central Tax dated 01.10.2020 | Seeks to notify a special procedure for taxpayers for issuance of e-Invoices in the period 01.10.2020 – 31.10.2020. |

| 88/2020-Central Tax dated 10.11.2020 | Seeks to implement e-invoicing for the taxpayers having aggregate turnover exceeding Rs. 100 Cr from 01st January 2021. |

| 05/2021-Central Tax dated 08.03.2021 | Seeks to implement e-invoicing for the taxpayers having aggregate turnover exceeding Rs. 50 Cr from 01st April 2021. |

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.