Exemptions related to E way Bill

Exemptions related to E way Bill

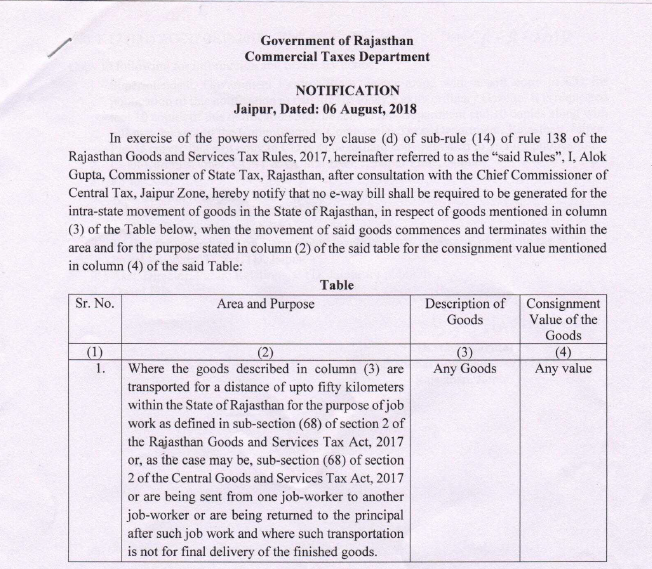

There is some Exemptions related to E way Bill is issued by the Rajasthan government through the Notification issued on 6 August 2018. So, Let us have a Look on the Exemptions related to E way Bill.

Here is brief advisory in relation to the notification issued by Rajasthan government on 6th August 2018. Following exemption/relaxation has been given to be effective from 6 Aug 2018:

- E waybill shall not be required to be made for material sent for job work within a distance of 50 km from the place of business.

- E waybill shall be required if the distance of your place of business and job worker’s place of business is more than 50 km.

- The exemption is also available when the material is sent from one job worker’s place to another job worker. The distance between those two is less than 50 km

- E waybill will have to be prepared when the material is sent from final supply from job worker’s place of business. E.g inspection house to direct export.

- Kindly ensure that e waybill is prepared in all cases of movement of goods other than job work invariably. In case of any failure, the penalty may be levied.

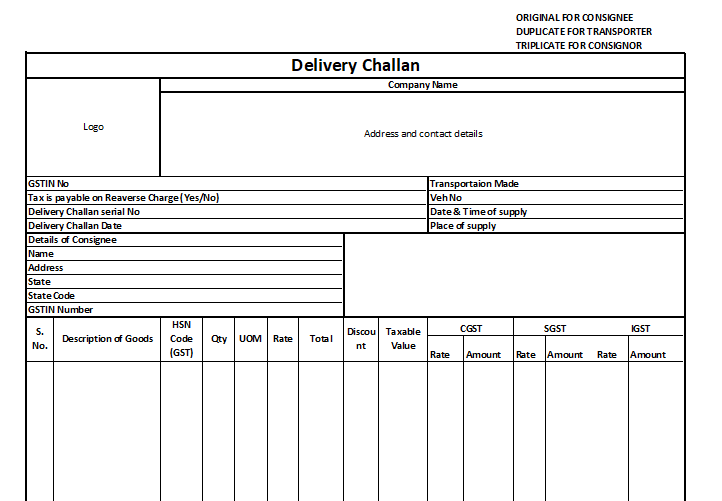

Download the Format of Delivery challan by Clicking The Below Image:

Click the below image to download the Full Notification:

Note: it is always mandatory to send the material to the job worker, under the cover of delivery challan. A sample format attached herewith. Please make sure that the value and quantity and other details in the delivery challan are filed properly. Since in any case of checking on the way delivery challan will be verified. Also Checked in the case of discrepancy, penalties may be levied.

If you already have a premium membership, Sign In.

CA Ranjan Mehta

CA Ranjan Mehta

CA Ranjan Mehta is a Fellow Chartered Accountant of Institute of Chartered Accountants of India and currently proprietor of M/s Ranjan Mehta & Associates. His area of specialization includes Indirect taxes specially GST, Excise, VAT and Service Tax. He is a faculty for GST. He has presented more than 100 papers on GST at various levels of ICAI, trade bodies, corporate seminars.