[read notification]Due date for GSTR 9 and 9C for 2018-19 is extended

The due date for GSTR 9 and 9C for 2018-19

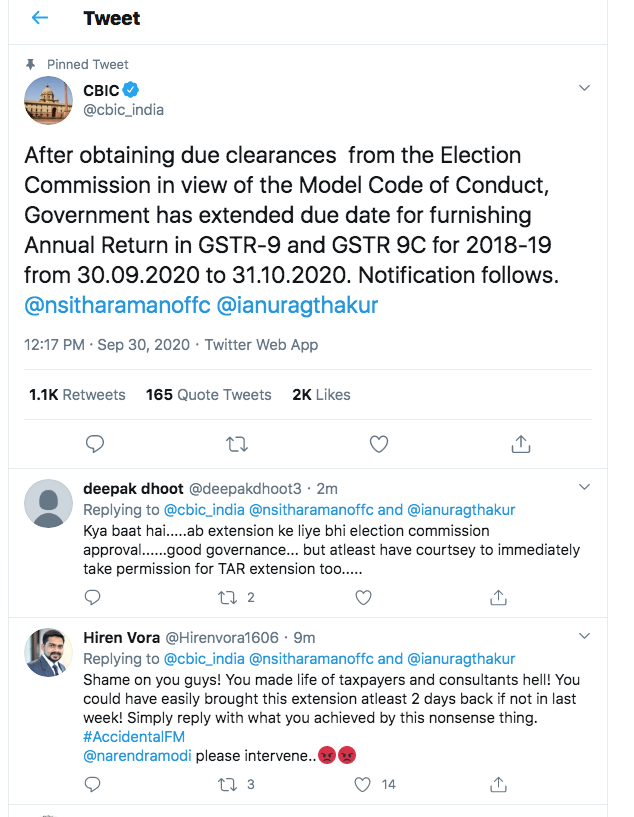

The due date for GSTR 9 and 9C for 2018-19is extended by CBIC. A tweet has been issued by CBIC. It confirms the extension of the GSTR 9 and 9C due date. Yesterday was the last date as per the last update. Huge demand from the taxpayers and consultants has raised to the extent it. GSTR 9 and 9C are required to be filed a taxpayer with more than 2 cr and 5 cr turnover respectively. Due to the COVID lockdown, the professionals were not being able to file it.

But the issues are still there. There are some issues in the format of GSTR 9. Some information related to previous has no place to declare. Taxpayers are also seeking clarification on GSTR 9. That is also a concern. With this extension once issues are addressed. But the issue of clarification is still there. Hope the finance ministry ill give it an ear soon. The CBIC also clarified that appropriate notification will follow.

Taxpayers are still concerned about the due date of the Tax audit report. Two days back an extension for various companies Act compliances was given. We hope that other compliances will also be extended soon.

Read Notification

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.