How to download the TDS Certificate in GST?

How to download the TDS Certificate in GST?

The applicability of the TDS provisions as per the section 52 of CGST Act, 2017. The provision was applied from the 1st October 2018 by the notification no. 51 dated 13th September 2018. After the applicability, the date of filing of the TDS return in GSTR-7 was 10th of the next month. The first GSTR-7 was filed on 10th of November 2018. So, how to download the TDS certificate in GST?

As per the provisions of TDS law, the TDS certificates should be issued within 5 days of filing the TDS return. Which implies that the date of generating the TDS certificates are 15th of the next month. The taxpayers are having problems while generating the TDS certificates. So, let us discuss the procedure of generating the TDS certificate in the GST regime.

Following is the process generating the TDS certificate in GST regime:

There are three basic steps for generation of the TDS certificate in GST:

- The deductor file the details of the TDS deducted in Form GSTR-7.

- After the filing of the GSTR-7 by the deductor, the amount will be reflected in the account of the deductee to accept. He has to accept the transactions to take the benefits of the TDS.

- When the deductee accepts the transactions in his account under TDS. The TDS certificated are available to the deductor to be downloaded.

The major problem lies with the deductees, they are unaware of the process of the of accepting the transactions. So, let us discuss the process of accepting the transactions by the deductee:

In GST portal of deductee:

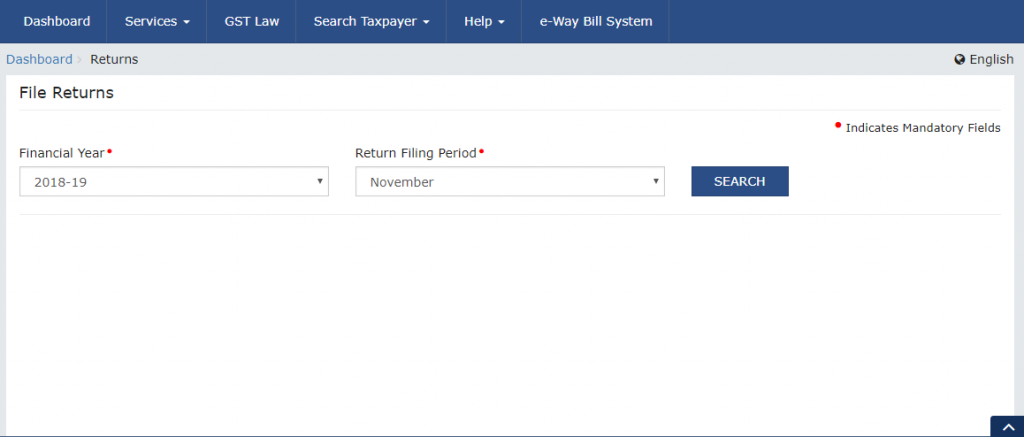

- Log in and go to the return dashboard.

- Select the period for which the TDS has been deducted:

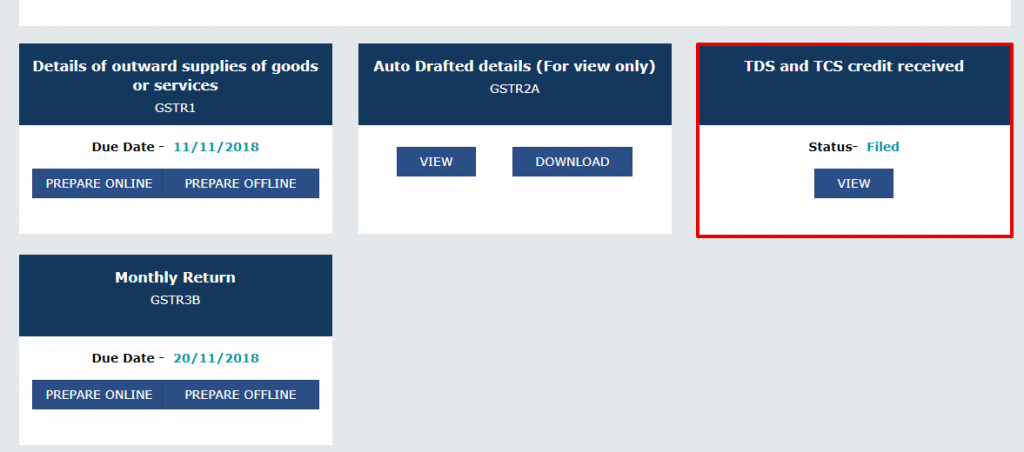

3. The portal will take you to the returns where the returns are to be filed. There will be an option or table in which the TDS and TCS credit received will be showing. Click on the table to view the details of the TDS deducted.

4. A new window will open in which the details may or may not reflect. Click on the table of TDS credit received.

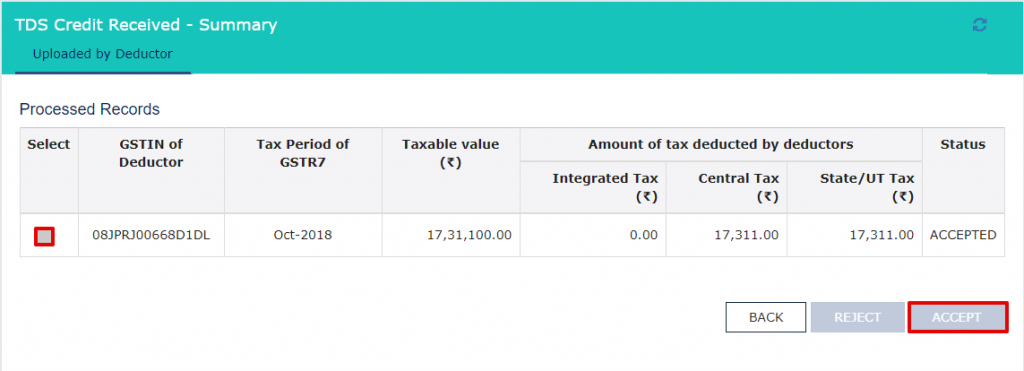

5. The details will be shown in the summary. You have to select the transaction which is accurate as per your data. Then mark the transaction which is accurate as per your data and accept them.

After accepting the data by the deductee the TDS certificates will be available to the deductor to download.

So, the deductor has to keep the deductee updated to issue the TDS certificate. Because the TDS certificates can’t be generated without the acceptance of the deductee. Also, the deductee will get the benefits of the TDS as soon as he accepts the transaction under the TDS received table.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.