Circular No. 75/49/2018-GST

Circular No. 75/49/2018-GST

Circular No. 75/49/2018-GST

F. No. CBEC-20/16/05/2018 – GST

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

GST Policy Wing

New Delhi, Dated the 27th December 2018

To,

The Principal Chief Commissioners / The Principal Directors General / Chief Commissioners / Directors General (All) / Principal Commissioners / Commissioners of Central Tax (All) / The Principal Chief Controller of Accounts, CBIC

Madam/Sir,

Subject: Guidelines for processing of applications for financial assistance under the Central Sector scheme named ‘Seva Bhoj Yojna’ of the Ministry of Culture – Reg.

I. Background

1.1 The Ministry of Culture has introduced a Central Sector Scheme called the „Seva Bhoj Yojna‟ (hereinafter referred to as “the Scheme”) for the reimbursement of central tax and the Central Government‟s share of integrated tax paid (hereinafter referred to as “the said taxes”) on the purchase of certain raw food items namely, ghee, edible oil, sugar/ Burra/ jaggery, rice, atta/ maida/rava/flour and pulses (hereinafter referred to as the “specified items”) used for distributing free food to general public/devotees (hereinafter referred to as the “specified activity”) by charitable/religious institutions like Gurudwaras, temples, Dharmik Ashrams, Mosques, Dargahs, Churches, Math, Monasteries, etc(hereinafter referred to as the “institutions”).

1.2 The Scheme has been made operational with effect from the 1st of August, 2018. The detailed guidelines issued in this regard by the Ministry of Culture vide F. No. 13- 1/2018-US (S&F) dated 01.08.2018 is enclosed as Annexure A. The applications for reimbursement of the said taxes shall be processed by a designated nodal central tax officer of each State or Union territory. The officers who have been designated as nodal officers for the purpose of facilitating the processing of refund applications for UIN entities as per Circular No. 36/10/2018-GST, dated 13th March 2018 issued vide F. No. 349/48/2017-GST shall act as nodal officers for the purposes of this Scheme as well. The details of the nodal officers is enclosed as Annexure B to this Circular. The Directorate General of Goods and Services Tax (DGGST), 5thFloor, MTNL (Telephone Exchange) Building, 8, Bhikaji Kama Place, New Delhi-110066 shall be the central nodal agency for reporting and monitoring the reimbursement of the said taxes by the nodal officers under the Scheme.

II. Application for obtaining Seva Bhoj Yojana – Unique Identity Number (SBYUIN)

2.1 The institutions opting to avail of the Scheme must first register with the Darpan Portal of NITI Aayog to obtain a Unique ID from the portal and thereafter, apply on the CSMS Portal on the Ministry of Culture‟s website www.indiaculture.nic.inin the prescribed format, and upload the requisite documents. The details are contained in paragraph 7 of the guidelines issued by the Ministry of Culture (Annexure A).

2.2 After enrolling with the Ministry of Culture, only the eligible institutions (hereinafter referred to as the “claimant”) shall be provided with a unique enrolment number by the Ministry of Culture for filing claims for the reimbursement of the said taxes. The details of the institutions enrolled under this scheme can be viewed online at https://indiaculture.nic.in/scheme-financial-assistance-under-seva-bhoj-yojna-new.

2.3 The claimant is then required to submit an application in FORMSBY-01 for obtaining a Seva Bhoj Yojana – Unique Identity Number (hereinafter called as the “SBY-UIN”), to the jurisdictional nodal officer of the State/Union Territory, in which the specified activity is undertaken. The claimant must indicate the details of all the locations/branches in a State/Union territory from where the specified activity is undertaken by them in FORM SBY-01. Since the reimbursement of the said taxes by the nodal officers shall be done State-wise or Union territory-wise, the claimant would be required to apply for a separate SBY-UIN for each State or Union territory in which they undertake the specified activity.

2.4 Upon receipt of the application in FORM SBY-01 and the information of allocation of a Unique Enrolment Number by the Ministry of Culture, a unique ten-digit SBYUIN, in the format of XX/YYYYY/ZZZ (where XX stands for the two digit State Code, YYYYY stands for the five-digit Unique Enrolment Number allotted by the Ministry of Culture and ZZZ stands for the three-digit running number assigned by the jurisdictional nodal officer) shall be communicated to the applicant in FORM SBY02 within seven days from the receipt of the complete application in FORM SBY-01 by the nodal officer.

III. Application for claiming reimbursement of the said taxes in FORM SBY-03

3.1 All applications for reimbursement of the said taxes by a claimant shall be submitted to the nodal officer of the State/Union territory in whose jurisdiction the claimant undertakes the specified activity, on a quarterly basis in FORM SBY-03, before the expiry of six months from the last day of the quarter in which the purchases of the specified items have been made.

3.2 For the purposes of this Scheme, the term “quarter” refers to the three-month period in a calendar year from January to March, April to June, July to September and October to December. However, the claimant will be eligible for the reimbursement of the said taxes from the date of issue of the Unique Enrolment Number by the Ministry of Culture.

3.3 The application for reimbursement of the said taxes in FORM SBY-03shall be filed once for each quarter in respect of all the locations within the State/Union territory, which are specified in Column 6 of FORM SBY-02, from where the claimant undertakes the specified activity. In case the claimant undertakes the specified activity from different locations situated in more than one State or Union territory, separate applications would be required to be filed with respect to each SBY-UIN obtained in terms of para 2.3 above, to the jurisdictional nodal officers.

3.4 The application shall be signed by the authorized signatory of the claimant and shall be submitted along with the following documents:

a) Self-attested copies of the invoices issued by the suppliers for the purchases of the specified items mentioning the unique enrolment number allotted by the Ministry of Culture and SBY-UIN;

b) A Chartered Accountant‟s Certificate certifying the following:

(i) quantity, price and amount of central tax, State tax/Union territory tax or integrated tax paid on the purchase of the specified items during the quarter for which the claim is filed;

(ii) the claimant is involved in charitable/religious activities;

(iii) the reimbursement claimed in the current quarter/year is not more than the purchases in the previous corresponding quarter/year plus a maximum of 2.5%/10% for the current quarter/year, as the case may be;

(iv) the claimant is using the specified items for only distributing free food to the public/devotees etc. during the claim period; and

(v) the claimant fully satisfies the conditions laid down in para 6 of the guidelines issued by the Ministry of Culture (Annexure A).

3.5 The nodal officer shall, within a period of fifteen days from the date of receipt of FORM SBY-03, scrutinize the same for its completeness and where the application is found to be complete in all respects issue an acknowledgment in FORM SBY-04. The same shall be communicated to the claimant clearly indicating the date of receipt of the application in FORM SBY-03. In case of any deficiencies, the same shall be communicated to the claimant requiring him to file a fresh application after rectification of such deficiencies within a period of 15 days from the date of receipt of the said communication. IV. Processing of the application filed in FORM SBY-03.

Download the Circular No. 75/49/2018-GST, by clicking the image below:

4.1 While processing the application filed in FORM SBY-03, the nodal officer shall verify the following:

a) Invoices mentioning the unique enrolment number allotted by the Ministry of Culture and the SBY-UIN for the purchase of the specified items have been submitted;

b) The amount claimed as reimbursement is on account of the said taxes paid on the purchase of the specified items during the claim period;

c) The amount claimed does not exceed the limit specified in para 3.4(b)(iii) above.

4.2 The nodal officer may call for any document in case he has reason to believe that the information provided in the claim is incorrect or insufficient and further inquiry is required to be carried out before the sanction of the claim.

4.3 Where, upon examination of the application, the nodal officer is satisfied that the claimant is eligible for the reimbursement of the said taxes, he shall issue an order in FORM SBY-05 sanctioning the amount of reimbursement with full details of the Grant No. and the Functional Head (of Ministry of Culture) under which the amount is to be disbursed by the designated PAO. He shall also issue payment advice in FORM SBY-06 for the eligible amount based on the First-cum-First-serve basis with regard to the date of receipt of the complete application in FORM SBY-01. The Nodal Officer, in the capacity of Program Division, shall be able to view the available budget (DDO specific) which would get reduced to the extent of the uploaded sanction order immediately after uploading of the sanction order. He shall enter the details on the PFMS portal under his login access; scan the sanction order (FORM SBY05) and the payment Advise (FORM SBY06) and forward the same to the designated DDO. The designated DDO, on the basis of FORM SBY05 and FORM SBY06, shall generate the bill on the PFMS portal and forward the same to the concerned PAO under his digital signature. If a sanction order is uploaded exceeding the available budget, the PAO will prepare the Bill but not be able to pass the bill due to lack of funds, and the said sanction will remain as pending. The detailed procedure to be followed by all the stakeholders for disbursal of financial assistance under the Scheme as prepared by the O/o the Pr. Chief Controller of Accounts, CBIC is enclosed as Annexure C.

4.4 Where the nodal officer is satisfied, for reasons to be recorded in writing, that the whole or any part of the amount claimed is not payable to the claimant, he shall issue a notice detailing the reasons thereof and requiring the claimant to furnish a reply within a period of fifteen days from the date of the receipt of such notice.

4.5 After receiving the reply, the nodal officer shall process the application and issue an order in FORM SBY-05 either sanctioning or rejecting the amount of reimbursement claimed.

4.6 No amount shall be rejected without giving the claimant a reasonable opportunity of being heard.

4.7 The order in FORM SBY-05 shall be issued within a period of sixty days from the date of issue of the acknowledgment in FORM SBY-04. V. Reporting of the reimbursement claims filed and processed

5.1 The details of all the applications for obtaining SBY-UIN in FORM SBY-01, and its issuance thereof in FORM SBY-02 shall be recorded in the format given in Table A below, along with its monthly summary in the format given in Table B below:

Table A – Details of applications for SBY-UIN and its grant thereof

| Sl. No. | Claimant’s name | Unique ID given by the Ministry of Culture | Date of receipt of application in FORM SBY-01 | SBY-UIN issued in FORM SBY-02 | Date of issue of FORM SBY-02 |

| 1 | 2 | 3 | 4 | 5 | 6 |

Table B –Monthly Summary of issuance of SBY-UIN

(For the month of ——–)

| No. of applications received in FORM SBY-01 | No. of SBY-UIN issued in FORM SBY-02 | ||

| For the month | Up to the month | For the month | Up to the month |

| 1 | 2 | 3 | 4 |

5.2 The details of all the applications for reimbursement of the said taxes received in FORM SBY-03 and its processing shall be recorded in the format given in Table C below along with its monthly summary in the format given in Table D below:

Table C – Details of claims for financial assistance under Seva Bhoj Yojna received and processed

(Rs. in Lakh)

| Sl. No. | Claimant ‘s name | SBYUIN | Date of receipt of application in FORM SBY-03 | Date of issue of acknowledgment in FORM SBY-04 | Date of issue of deficiency memo, if any | Period to which the claim pertains | Amount claimed | Date of issue of the order in FOR M SBY05 | Amoun t sanctio ned | Amou nt reject ed | Date of issue of Paymen t advice in FORM SBY06 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

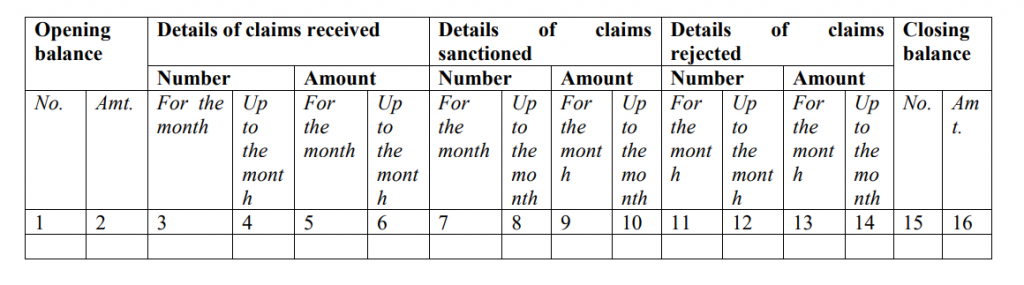

Table D–Monthly summary of Financial Assistance under Seva Bhoj Yojna

(For the month of ____)

(Rs. in Lakhs)

5.3 The nodal officers shall send a monthly statement in Tables B and D to the Additional Director General, DGGST by the 10th of the following month.

5.4 DGGST shall thereafter compile the information on an all-India basis, and communicate the same to the Under Secretary, S&F Section, Ministry of Culture, with a copy to the Commissioner (GST) in the Board, by the 15th of the following month.

6. It is requested that suitable trade notices may be issued to publicize the contents of this Circular.

7. The difficulty, if any, in the implementation of the above instructions may please be brought to the notice of the Board. Hindi version would follow.

(Upender Gupta)

Commissioner (GST)

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.