Circular No. 106/25/2019-GST

Circular No. 106/25/2019-GST

CBEC-20/16/04/2018-GST

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

GST Policy Wing

New Delhi, Dated the 29th June, 2019

To,

The Principal Chief Commissioners / Chief Commissioners / Principal Commissioners / Commissioners of Central Tax (All)

The Principal Chief Commissioners / Chief Commissioners / Principal Commissioners / Commissioners of Customs (All)

The Principal Director Generals / Director Generals (All)

The Principal CCA, CBIC

Madam / Sir,

Subject: – Refund of taxes paid on inward supply of indigenous goods by retail outlets established at departure area of the international airport beyond immigration counters when supplied to outgoing international tourist against foreign exchange -reg.

The Government vide notification no. 11/2019-Central Tax (Rate), 10/2019-Integrated Tax (Rate) and 11/2019-Union territory Tax (Rate) all dated 29.06.2019 issued in exercise of powers under section 55 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the „CGST Act‟) has notified that the retail outlets established at departure area of the international airport beyond immigration counters shall be entitled to claim refund of all applicable Central tax, Integrated tax, Union territory tax and Compensation cess paid by them on inward supplies of indigenous goods received by them for the purposes of subsequent supply of goods to outgoing international tourists i.e. to a person not normally resident in India, who enters India for a stay of not more than six months for legitimate non-immigrant purposes against foreign exchange (hereinafter referred to as the “eligible passengers”). Identical notifications have been issued by the State or Union territory Governments under the respective State Goods and Services Tax Acts (hereinafter referred to as the “SGST Act”) or Union Territory Goods and Services Tax Acts (hereinafter referred to as the “UTGST Act”) also to provide for refund of applicable State or Union territory tax.

2. With a view to ensuring expeditious processing of refund claims, the Board, in exercise of its powers conferred under section 168(1) of the CGST Act, hereby specifies the conditions, manner and procedure for filing and processing of such refund claims in succeeding paras.

3. Duty Free Shops and Duty Paid Shops: –

It has been recognized that international airports, house retail shops of two types – „Duty Free Shops‟ (hereinafter referred to as “DFS”) which are point of sale for goods sourced from a warehoused licensed under Section 58A of the Customs Act, 1962 (hereinafter referred to as the “Customs Act”) and duty paid indigenous goods and „Duty Paid Shops‟ (hereinafter referred to as “DPS”) retailing duty paid indigenous goods.

4. Procurement and supply of imported / warehoused goods: –

The procedure for procurement of imported / warehoused goods is governed by the provisions contained in Customs Act. The procedure and applicable rules as specified under the Customs Act are required to be followed for procurement and supply of such goods.

5. Procurement of indigenous goods: –

Under GST regime there is no special procedure for procurement of indigenous goods for sale by DFS or DPS. Therefore, all indigenous goods would have to be procured by DFS or DPS on payment of applicable tax when procured from the domestic market.

6. Supply of indigenous goods by DFS or DPS established at departure area of the international airport beyond immigration counters (hereinafter referred to as “the retail outlets”) to eligible passengers:

The sale of indigenous goods procured from domestic market by retail outlets to an eligible passenger is a “supply” under GST law and is subject to levy of Integrated tax but the same has been exempted vide notification No. 11/2019-Integrated Tax (Rate) and 01/2019-Compensation Cess (Rate) both dated 29.06.2019. Therefore, retail outlets will supply such indigenous goods without collecting any taxes from the eligible passenger and may apply for refund as per procedure explained in succeeding paragraphs.

7. Who is eligible for refund:

7.1 Registration under CGST Act: The retail outlets applying for refund shall be registered under the provisions of section 22 of the CGST Act read with the rules made thereunder and shall have a valid GSTIN.

7.2 Location of retail outlets: Such retail outlets shall be established at departure area of the international airport beyond immigration counters and shall be entitled to claim a refund of all applicable Central tax, State tax, Integrated tax, Union territory tax and Compensation cess paid by them on all inward supplies of indigenous goods received for the purposes of subsequent supply of such goods to the eligible passengers.

8. Procedure for applying for refunds:

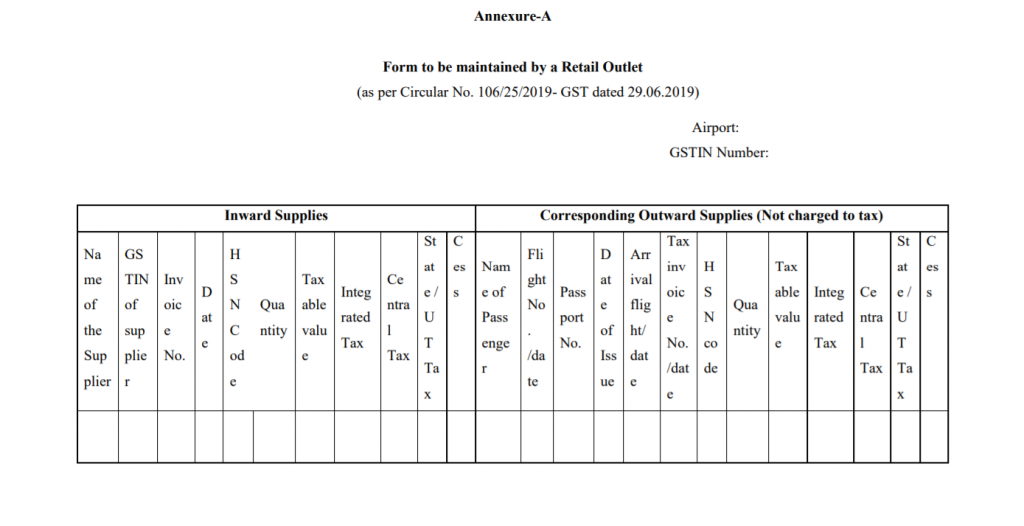

8.1. Maintenance of Records: The records with respect to duty paid indigenous goods being brought to the retail outlets and their supplies to eligible passengers shall be maintained as per Annexure A in electronic form. The data shall be kept updated, accurate and complete at all times by such retail outlets and shall be available for inspection/verification of the proper officer of central tax at any time. The electronic records must incorporate the feature of an audit trail, which means a secure, computer generated, time stamped record that allows for reconstruction of the course of events relating to the creation, modification or deletion of an electronic record and includes actions at the record or system level, such as, attempts to access the system or delete or modify a record.

8.2. Invoice-based refund: It is clarified that the refund to be granted to retail outlets is not on account of the accumulated input tax credit but is refund based on the invoices of the inward supplies of indigenous goods received by them. As stated in para 6 above, the supply made by such retail outlets to eligible passengers has been exempted vide notification No. 11/2019-Integrated Tax (Rate) and 01/2019-Compensation Cess (Rate) both dated 29.06.2019 and therefore such retail outlets will not be eligible for input tax credit of taxes paid on such inward supplies and the same will have to be reversed in accordance the provisions of the CGST Act read with the rules made thereunder. It is also clarified that no refund of tax paid on input services, if any, will be granted to the retail outlets.

8.3. Any supply made to an eligible passenger by the retail outlets without payment of taxes by such retail outlets shall require the following documents / declarations:

(a) Details of the Passport (via Passport Reading Machine);

(b) Details of the Boarding Pass (via a barcode scanning reading device);

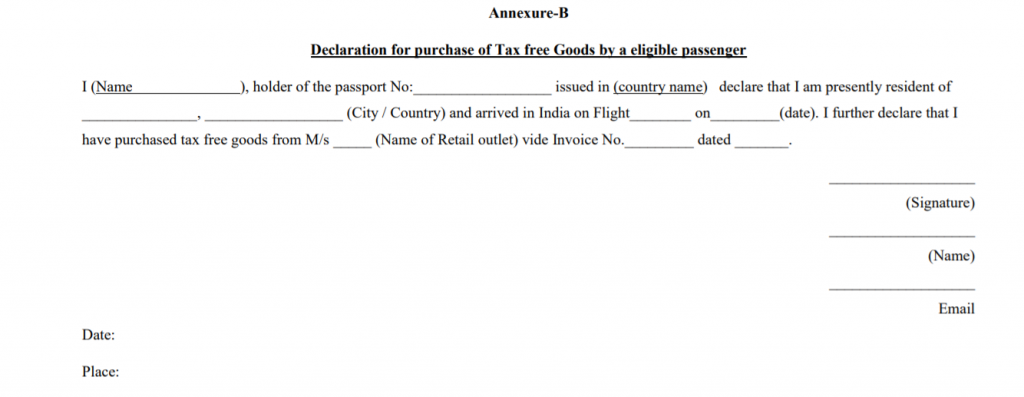

(c) A passenger declaration as per Annexure B;

(d) A copy of the invoice clearly evidencing that no tax was charged from the eligible passenger by the retail outlet.

8.4. The retail outlets will be required to prominently display a notice that international tourists are eligible for purchase of goods without payment of domestic taxes.

8.5. Manual filing of refund claims: In terms of rule 95A of the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the „CGST Rules‟) as inserted vide notification No. 31/2019-Central Tax dated 28.06.2019, the retail outlets are required to apply for refund on a monthly or quarterly basis depending upon the frequency of furnishing of return in FORM GSTR-3B. Till the time the online utility for filing the refund claim is made available on the common portal, these retail outlets shall apply for refund by filing an application in FORM GST RFD-10B , as inserted vide notification No. 31/2019-Central Tax dated 28.06.2019 manually to the jurisdictional proper officer. The said refund application shall be accompanied with the following documents:

(i) An undertaking by the retail outlets stating that the indigenous goods on which refund is being claimed have been received by such retail outlets;

(ii) An undertaking by the retail outlets stating that the indigenous goods on which refund is being claimed have been sold to eligible passengers;

(iii)Copies of the valid return furnished in FORM GSTR – 3B by the retail outlets for the period covered in the refund claim;

(iv)Copies of FORM GSTR-2A for the period covered in the refund claim; and

(v) Copies of the attested hard copies of the invoices on which refund is claimed but which are not reflected in FORM GSTR-2A.

9. Processing and sanction of the refund claim :

9.1. Upon receipt of the complete application in FORM GST RFD-10B, an acknowledgement shall be issued manually by the proper officer within 15 days of the receipt of application in FORM GST RFD-02. In case of any deficiencies or any additional information is required, the same shall be communicated to the retail outlets by issuing a deficiency memo manually in FORM GST RFD-03 by the proper officer within 15 days of the receipt of the refund application. Only one deficiency memo should be issued against one refund application which is complete in all respects.

9.2. The proper officer shall validate the GSTIN details on the common portal to ascertain whether the return in FORM GSTR- 3B has been filed by the retail outlets. The proper officer may scrutinize the details contained in FORM RFD-10B, FORM GSTR-3B and FORM GSTR-2A. The proper officer may rely upon FORM GSTR-2A as an evidence of the accountal of the supply received by them in relation to which the refund has been claimed by the retail outlets. Normally, officers are advised not to call for hard copies of invoices or details contained in Annexure A. As clarified in clause (v) of Para 8.5 above, it is reiterated that the retail outlets would be required to submit hard copies of only those invoices of inward supplies that have not been reflected in FORM GSTR-2A.

9.3. The proper officer shall issue the refund order manually in FORM GST RFD-06 along with the manual payment advice in FORM GST RFD-05 for each head i.e., Central tax/State tax/Union territory tax/Integrated tax/Compensation Cess. The amount of sanctioned refund along with the bank account details of the retail outlets shall be manually submitted in the PFMS system by the jurisdictional Division‟s DDO and a signed copy of the sanction order shall be sent to the PAO for disbursal of the said amount.

9.4. Where any refund has been made in respect of an invoice without the tax having been paid to the Government or where the supply of such goods was not made to an eligible passenger, such amount refunded shall be recovered along with interest as per the provisions contained in the section 73 or section 74 of the CGST Act, as the case may be.

9.5. It is clarified that the retail outlets will apply for refund with the jurisdictional Central tax/State tax authority only, however, the payment of the sanctioned refund amount in relation to Central tax / Integrated tax / Compensation Cess shall be made by the Central tax authority while payment of the sanctioned refund amount in relation to State Tax / Union Territory Tax shall be made by the State tax/Union Territory tax authority. It therefore becomes necessary that the refund order issued by the proper officer of Central Tax is duly communicated to the concerned counter-part tax authority within seven days for the purpose of disbursal of the remaining sanctioned refund amount. The procedure outlined in para 6.0 of Circular No.24/24/2017-GST dated 21stDecember 2017 should be followed in this regard.

10. The scheme shall be effective from 01.07.2019 and would be applicable in respect of all supplies made to eligible passengers after the said date. In other words, retail outlets would be eligible to claim refund of taxes paid on inward supplies of indigenous goods received by them even prior to 01.07.2019 as long as all the conditions laid down in Rule 95A of the CGST Rules and this circular are fulfilled.

11. It is requested that suitable trade notices may be issued to publicize the contents of this circular.

12. Difficulty, if any, in implementation of the above instructions may please be brought to the notice of the Board. Hindi version would follow

(Upender Gupta)

Principal Commissioner (GST)

Source CBIC

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.