Changes as brought out Budget 2020 in GST

- Changes as brought out Budget 2020 in GST

- Amendments to the central goods and services tax act, 2017

- 1. The time limit of availing credit based on debit notes: Amendment of Section 16(4) of the CGST Act:

- 2. Levy of penalty even on person neither supplier nor recipient of Supply: Insertion of Section 1(A) in Section 122 of the CGST Act:

- 3. Punishment of offences-Amendment of Section 132:

- 4. Extension of time to file an application for ‘revocation of cancellation of registration’: Insertion of Proviso in Section 30(1) of the CGST Act:

- 5. Cancellation of Voluntary Registration: Amendment of Section 29(1) by substituting clause c:

- Download the copy:

Changes as brought out Budget 2020 in GST

Provisions Omitted

Provisions Inserted

Amendments to the central goods and services tax act, 2017

All amendments mentioned below are effective from the date to be notified.

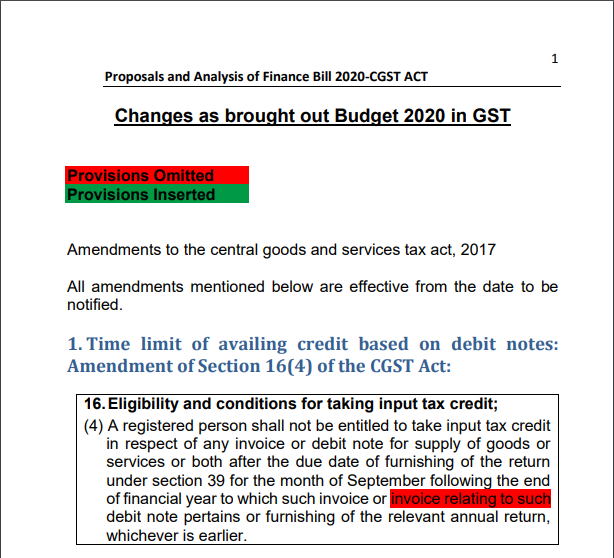

1. The time limit of availing credit based on debit notes: Amendment of Section 16(4) of the CGST Act:

16.Eligibility and conditions for taking input tax credit;

(4) A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the due date of furnishing of the return under section 39 for the month of September following the end of financial year to which such invoice or invoice relating to such debit note pertains or furnishing of the relevant annual return, whichever is earlier.

Section 16(4) of the CGST Act 2017 restricts the ITC beyond the due date of filing return for the month of September of the corresponding financial year. In this restriction credit pertaining to debit note is linked with date of invoice against which debit note is issued. Now it is proposed to delink the debit note with the date of invoice to avail ITC. Now the last date of taking the input tax credit will be the due date of the September return of the subsequent financial year to which the debit note pertains and it will not be linked with date of Invoice.

2. Levy of penalty even on person neither supplier nor recipient of Supply: Insertion of Section 1(A) in Section 122 of the CGST Act:

122. Penalty for certain offences;

(1A) Any person who retains the benefit of a transaction covered under clauses (i), (ii), (vii) or clause (ix) of sub-section (1) and at whose instance such transaction is conducted, shall be liable to a penalty of an amount equivalent to the tax evaded or input tax credit availed of or passed on.

Section 122(1) of the CGST Act contains clauses I to xxi to provide penalty for certain offences. Clause (i), (ii), (vii) and (ix) of Section 122(1) levy of penalty on ‘taxable person’ for following offences:

• Making supply without invoice or on false or incorrect invoice

• Issuing invoice without supply

• Taking or utilizing ITC without actual receipt of supply

• Taking or distributing ITC in contravention of ISD provisions.

Section 122(1A) has been proposed to penalize the beneficiary and such person whose instance such transactions covered in Clause (i), (ii), (vii) and (ix) of Section 122(1) are conducted, to the extent of the tax evaded or input tax credit availed.

3. Punishment of offences-Amendment of Section 132:

132. Punishment for certain offences;

(1) Whoever commits any of the following offences, namely: –

Whoever commits, or causes to commit and retain the benefits arising out of, any of the following offences’’ namely: –

(c) avails input tax credit using such invoice or bill referred to in clause (b);

(c) avails input tax credit using the invoice or bill referred to in clause (b) or fraudulently avails input tax credit without any invoice or bill;

(d) evades tax, fraudulently avails input tax credit or fraudulently obtains refund and where such offence is not covered under clauses (a) to (d);

Section 132 provides for punishment for certain offences. Few offences are cognizable and non-bailable offence and others are non-cognizable and bailable offences. Earlier only input tax credit on fake bills were considered as cognizable and non-bailable. Now, the offence of fraudulent availment of input tax credit without invoice or bill cognizable and non-bailable

Section 132(1) is also being amended to expand the coverage of the offences thereunder to a person who causes the committing of the offences thereunder and retains the benefits thereof.

4. Extension of time to file an application for ‘revocation of cancellation of registration’: Insertion of Proviso in Section 30(1) of the CGST Act:

30. Revocation of cancellation of registration;

(1) Subject to such conditions as may be prescribed, any registered person, whose registration is cancelled by the proper officer on his own motion, may apply to such officer for revocation of cancellation of the registration in the prescribed manner within thirty days from the date of service of the cancellation order.

Provided that such period may, on sufficient cause being shown, and for reasons to be recorded in writing, be extended, – (a) by the Additional Commissioner or the Joint Commissioner, as the case may be, for a period not exceeding thirty days;

(b) by the Commissioner, for a further period not exceeding thirty days, beyond the period specified in clause (a).

Section 30 of the CGST Act provides to file an application to revoke the cancellation of registration by the proper officer. Such an application can be made within 30 days from the date of service of cancellation order. Now, these 30 days can be further extended for a period up to 30 days by AC/JC and further 30 days by the commissioner. Such an extension can be done only on sufficient cause being shown and reason to be recorded in writing.

5. Cancellation of Voluntary Registration: Amendment of Section 29(1) by substituting clause c:

29. Cancellation of registration;

(1) The proper officer may, either on his own motion or on an application filed by the registered person or by his legal heirs, in case of death of such person, cancel the registration, in such manner and within such period as may be prescribed, having regard to the circumstances where,–

(a) the business has been discontinued, transferred fully for any reason including death of the proprietor, amalgamated with other legal entity, demerged or otherwise disposed of; or

(b)there is any change in the constitution of the business; or

(c) the taxable person, other than the person registered under sub-section (3) of section 25, is no longer liable to be registered under section 22 or section 24.

(c) the taxable person is no longer liable to be registered under section 22 or section 24 or intends to opt-out of the registration voluntarily made under sub-section (3) of section 25:”.

Section 29(1) of the CGST Act provides the power to cancel the registration either on own motion or application by the registered person. Clause c of section 29(1) excludes the person registered under section 25(3) i.e. voluntary registration. The provisions of clause c of section 29(1) have now been modified to allow those cases wherein a person had obtained their registration voluntarily.

Download the copy:

If you already have a premium membership, Sign In.

Ashu Dalmia

Ashu Dalmia

New Delhi, India

Ashu Dalmia is Managing Partner of the firm AAP and Co., having office in Connaught Place Delhi. He is rank holder in CA Inter and also at graduation level from Lucknow university. He is has been working extensively in GST training, Consultancy and litigation in India and also handled VAT implementation projects for mid and large corporates in Saudi Arabia. He was special Invitee to Indirect Tax Committee of ICAI for year 2018-19. He is faculty in ICAI to train professionals for GST in India and VAT for UAE. He has authored books on GST: “GST A Practical Approach” published by Taxman, “Audit and Annual Return in GST” published by Wolters Kluwer-CCH GST Referencer and Manual published by LMP. He has taken more than 300 workshops and trainings on various forums: like ICAI, ASSOCHAM, CII, PHD Chamber of commerce, trade associations in India, UAE and KSA.