Brief on Recommendations of 43rd GST Council Meeting Held On 28th MAY, 2021

- Measures for Trade Facilitation

- What Pawan Arora, Partner @ Athena Law Associates has to say about measures

- 1. Easing compliance of Annual Return for FY 2020-21

- 2. Burden of Late fees reduced from prospective tax periods

- 3. Some more relaxations recommended as so-called Covid-19 relief

- 4. Amnesty Scheme regarding late fees for pending GST returns

- 5. Clarifications/ Amendments recommended in relation to GST rates

- 6. IGST/Custom Duty exemption on various Medical products related to Covid-19

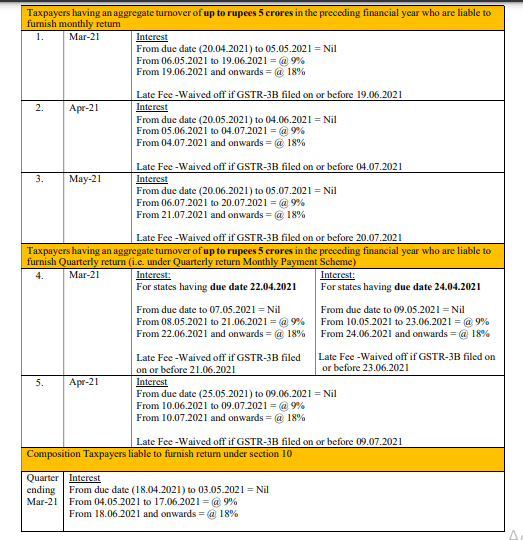

- Relaxation in interest rates and Late fees Waiver for Other taxpayers

Measures for Trade Facilitation

1. Easing compliance of Annual Return for FY 2020-21

Taxpayers having aggregate turnover above 5 crores are required to file GSTR-9C for FY 2020-21 and can self-certify the same. However, Team Athena understands the complexity involved in certifying GSTR-9C and is pleased to provide its review services prior to SelfCertification by Management.

2. Burden of Late fees reduced from prospective tax periods

3. Some more relaxations recommended as Covid-19 relief

The government has recommended a reduction in interest rates, waiver of late fees, extension in due dates of returns, and cumulative application of Rule 36(4) relating to tax periods March 2021 to June 2021.

4. Amnesty Scheme regarding late fees for pending GST returns

Late Fees for pending GSTR-3B from July 2017 to April 2021 are reduced if filed between 01.06.2021 to 31.08.2021.

5. Certain clarifications/amendments have been approved by Council for specific goods/services.

6. IGST/Custom Duty exemption on various Medical products related to Covid-19.

What Pawan Arora, Partner @ Athena Law Associates has to say about measures

“Self-Certification of GSTR-9C instead of GST Audit from CA/CMA got approval from Council. In my view, despite this taxpayers should get review their annual compliances to ensure proper compliance.

Despite the fact that the petition is pending before the Hon’ble Delhi High Court, no extension in due dates of filing returns and therefore no relaxation on Interest for delay in payment of taxes. Considering the ongoing proceedings, the Court is more inclined towards giving relaxation by extending due dates or waiving interest directly.

However, definitely, Amnesty Scheme for small taxpayers may give some relief to them regarding late fees on their previously pending returns.

Set-back for industries like Footwear and Textile as no resolution to the issue of inverted duty structure in the present meeting.

During the press conference, the judgment of Hon’ble Delhi High Court on import of Oxygen Concentrators for personal use (free of Cost) is accepted as effective and further confirmed that Committee is constituted for rationalization of the tax rate on some Covid items which are presently taxable like Vaccine.

The state may be benefited if sun-set of 5 years of compensation cess will be extended.”

1. Easing compliance of Annual Return for FY 2020-21

i. Filing of annual return in FORM GSTR-9 / 9A for FY 2020-21 to be optional for taxpayers having aggregate annual turnover up to Rs 2 Crore;

ii. The reconciliation statement in FORM GSTR-9C for the FY 2020-21 will be required to be filed by taxpayers with an annual aggregate turnover above Rs 5 Crore.

iii. Amendments in sections 35 and 44 of CGST Act made through Finance Act, 2021 to be notified. Thereafter, taxpayers would be able to self-certify the reconciliation statement, instead of getting it certified by chartered accountants. This change will apply for Annual Return for FY 2020-21.

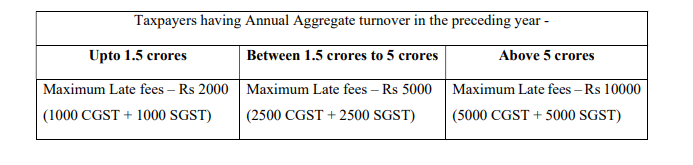

2. Burden of Late fees reduced from prospective tax periods

A. Late Fees for the delay in furnishing Form GSTR-3B and GSTR-1

a) For taxpayers having nil tax liability/nil outward supplies

Maximum Late fees per return – Rs 500 (Rs 250 CGST + Rs 250 SGST)

b) For other taxpayers:

The below-mentioned amount of maximum late fees is per return.

B. Late fees for delay in furnishing Form GSTR-4 by composition taxpayers

c) For taxpayers having Nil liability – Maximum Late fees per return: Rs. 500 (250 CGST + 250 SGST)

d) For other taxpayers – Maximum Late fees per return: Rs. 2000 (1000 CGST + 1000 SGST)

C. Late fees for delay in furnishing Form GSTR-7

The late fee is reduced to Rs. 50 per day (25 CGST + 25 SGST) and capped at a maximum amount of Rs. 2000 (1000 CGST + 1000 SGST) per return.

It is reiterated that the above-mentioned proposals of reducing the burden of late fees are applicable for prospective tax periods.

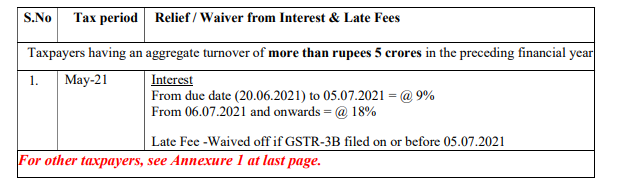

3. Some more relaxations recommended as so-called Covid-19 relief

A. Relaxation in interest rates and Late fees Waiver

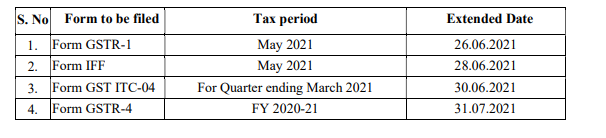

B. Extension of Due dates

C. Restriction of Input Tax Credit under Rule 36(4)

C. Restriction of Input Tax Credit under Rule 36(4)

The restriction laid in sub-rule (4) of Rule 36 relating to a maximum of 5% of eligible ITC is recommended to apply cumulatively for the months of April, May, and June 2021 in the return for the period June 2021.

D. Filing of returns by Companies using Electronic Verification Code (EVC)

The recommendation is to allow the filing of returns by Companies using Electronic Verification Code (EVC) instead of Digital Signature Certificate (DSC) till 31.08.2021

E. Relaxations under section 168A of the CGST Act

The time limit for completion of various actions, by any authority or by any person, under the GST Act, which falls during the period from 15th April 2021 to 29th June 2021, to be extended up to 30th June 2021, subject to some exceptions.

[Wherever the timelines for actions have been extended by the Hon’ble Supreme Court, the same would apply]

4. Amnesty Scheme regarding late fees for pending GST returns

i. Late fees for non-furnishing FORM GSTR-3B for the tax periods from July 2017 to April 2021 has been reduced/waived as under: –

- If taxpayers did not have any tax liability for said tax periods: Rs. 500 per return

- Other taxpayers: Rs. 1000 per return

ii. Such late fees would apply if the return for the said tax period is filed between 01.06.2021 to 31.08.2021.

5. Clarifications/ Amendments recommended in relation to GST rates

Goods:

a. Leviability of IGST on repair value of goods re-imported after repairs

b. GST rate of 12% to apply on parts of sprinklers/ drip irrigation systems falling under tariff heading 8424 (nozzle/laterals) to apply even if these goods are sold separately.

Services:

i. For Real Estate Sector: To make appropriate changes in the relevant notification for an explicit provision to make it clear that landowner promoters could utilize the credit of GST charged to them by developer promoters in respect of such apartments that are subsequently sold by the land promotor and on which GST is paid. The developer promotor shall be allowed to pay GST relating to such apartments any time before or at the time of issuance of the completion certificate.

ii. For Road Construction Contractors: To clarify that GST is payable on annuity payments received as deferred payment for construction of the road. The benefit of the exemption is for such annuities which are paid for the service by way of access to a road or a bridge.

iii. To clarify that supply of service by way of milling of wheat/paddy into flour (fortified with minerals etc. by millers or otherwise )/rice to Government/ local authority etc. for distribution of such flour or rice under PDS is exempt from GST if the value of goods in such composite supply does not exceed 25%. Otherwise, such services would attract GST at the rate of 5% if supplied to any person registered in GST, including a person registered for payment of TDS.

iv. To clarify those services supplied to an educational institution including Anganwadi (which provide pre-school education also), by way of serving of food including mid-day meals under any midday meals scheme, sponsored by Government is exempt from levy of GST irrespective of funding of such supplies from government grants or corporate donations.

v. To clarify these services provided by way of examination including entrance examination, where the fee is charged for such examinations, by National Board of Examination (NBE), or similar Central or State Educational Boards, and input services relating thereto are exempt from GST.

vi. To extend the same dispensation as provided to MRO units of the aviation sector to MRO units of ships/vessels so as to provide a level playing field to domestic shipping MROs vis a vis foreign MROs and accordingly, –

(a) GST on MRO services in respect of ships/vessels shall be reduced to 5% (from 18%).

(b) PoS of B2B supply of MRO Services in respect of ships/ vessels would be the location of the recipient of service

vii. To clarify those services supplied to a Government Entity by way of construction of a rope-way attract GST at the rate of 18%.

viii. To clarify that services supplied by Govt. to its undertaking/PSU by way of guaranteeing loans taken by such entity from banks and financial institutions are exempt from GST.

6. IGST/Custom Duty exemption on various Medical products related to Covid-19

- As a COVID-19 relief measure, a number of specified COVID-19 related goods such as medical oxygen, oxygen concentrators, and other oxygen storage and transportation equipment, certain diagnostic markers test kits and COVID-19 vaccines, etc., have been recommended for full exemption from IGST, even if imported on payment basis, for donating to the government or on the recommendation of state authority to any relief agency. This exemption shall be valid up to 31.08.2021.

- 2. A Group of Ministers (GoM) is constituted to go into the need for further relief to COVID-19 related individual items. The GOM shall give its report by 08.06.2021.

Please note that the above recommendations would be given effect through relevant Circulars/Notifications which alone shall have the force of law.

Relaxation in interest rates and Late fees Waiver for Other taxpayers

If you already have a premium membership, Sign In.

Adv. Pawan Arora

Adv. Pawan Arora

Adv. Pawan Arora, Partner at Athena Law Associates Experience of Advisory and Litigation of GST, VAT, and Service Tax to more than 25 Reputed Real Estate and Infrastructure Construction Companies. 10 Years of relentless and steady experience of Advisory and Litigation in GST and other Indirect Taxes and handled matters of clients from diverse industries and field of specialization is Indirect Taxes.