Advisory for Taxpayers to file Refund for Multiple Tax period

Advisory for Taxpayers to file Refund for Multiple Tax period

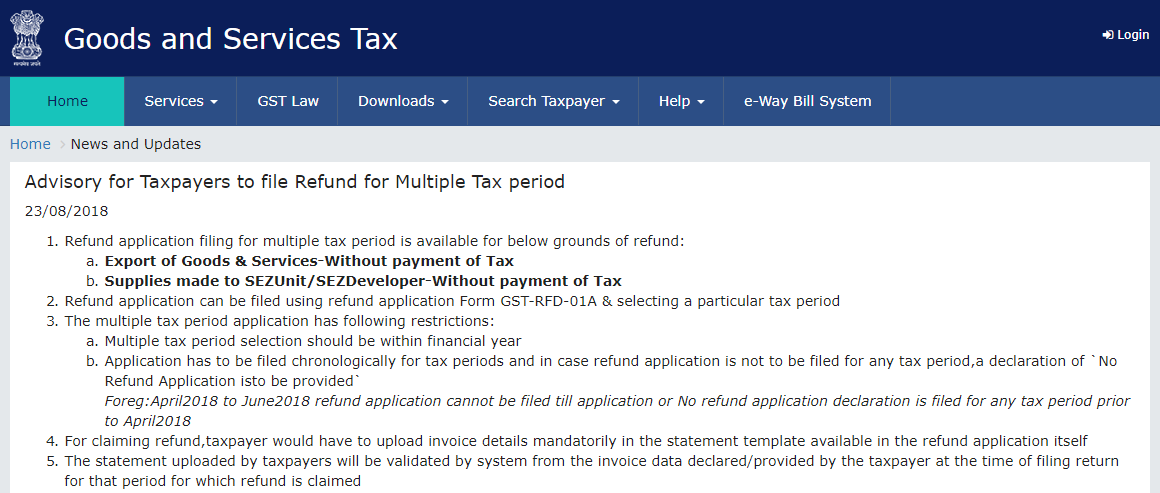

Following is the Advisory for Taxpayers to file Refund for Multiple Tax period by GSTN:

- Refund application filing for multiple tax period is available for below grounds of refund:

- Export of Goods & Services-Without payment of Tax

- Supplies made to SEZUnit/SEZDeveloper-Without payment of Tax

- Refund application can be filed using refund application Form GST-RFD-01A & selecting a particular tax period

- The multiple tax period application has following restrictions:

- Multiple tax period selection should be within the financial year

- The application has to be filed chronologically for tax periods and in case refund application is not to be filed for any tax period, a declaration of `No Refund Application is to be provided`

For eg: April 2018 to June 2018 refund application cannot be filed till application or No refund application declaration is filed for any tax period prior to April 2018.

- For claiming the refund, the taxpayer would have to upload invoice details mandatorily in the statement template available in the refund application itself.

- The statement uploaded by taxpayers will be validated by the system from the invoice data declared/provided by the taxpayer at the time of filing return for that period for which refund is claimed.

- Only after validating data from the system, the taxpayer would be able to file refund application.

- All the invoice details are to be provided in a single statement. The taxpayer is not required to upload multiple statements for different periods separately.

- After filing refund application, the taxpayer would not be able to claim the refund for that invoice again in some other refund application. As the system will lock the invoice for which refund is claimed in one application. Also, the taxpayer would not be able to amend invoice details after claiming the refund.

- The taxpayer can also attach any other supporting document if required 4 documents can be uploaded with a single refund application in pdf format. Max size allowed for a document is 5MB.

- After filing of refund application by the taxpayer, refund application Form GST-RFD-01A. Along with the statement and documents uploaded shall be available to tax officer for review and processing of the refund.

- As the functionality for multiple tax period has been made available, therefore to avoid duplication. The refund applications in the categories mentioned in point2 above, that were SAVED in the GST system will be purged and removed from the system.

Source: GST Portal

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.